By Joe Flint | Photographs by Rozette Rago for The Wall Street Journal

On Scott Stuber's watch, Netflix has turned into the biggest

movie machine in Hollywood.

When the entertainment-industry veteran became the streaming

giant's film chief in 2017, Netflix had produced only a couple

dozen original movies. Most were acquisitions and many of them

projects abandoned by other studios. Since Mr. Stuber came aboard,

Netflix has made about 60 movies annually and is on pace to match

that output in 2021, even with the pandemic suspending many film

productions for stretches over the past year.

Quantity isn't Mr. Stuber's only goal. For the past two years,

Netflix has garnered more Oscar nominations than any other studio,

though last year's haul of 24 nominations translated into just two

wins. He is hoping for more this Sunday, when Netflix is up for 36

awards across 17 movies, including best-picture nominees "Mank" and

"The Trial of the Chicago 7."

The 52-year-old executive rose to co-head of production for

Universal Pictures and established his own production company

before joining Netflix in 2017. "Honestly, I probably

underestimated the job when someone said: 'Hey, come build a new

film studio,' " he said.

Mr. Stuber recently spoke to The Wall Street Journal from the

Pacific Palisades home he shares with his wife, actress Molly Sims,

and their three children about why Oscars matter to Netflix and how

the moviemaking landscape is changing. Here are edited

excerpts:

WSJ: How important is being the most Oscar-nominated movie

studio to Netflix as a business?

Mr. Stuber: It's very important because what you are saying to

the artistic community is: We can actually make those things happen

that you dream about. We all want to be recognized by our peers as

the best in class. When I started, we'd never been nominated. It's

a great accomplishment and it's hugely beneficial to the business

for not only recruiting artists, but also making sure our customer

knows that we try to achieve the best.

WSJ: Is it also bringing in more viewers and subscribers to the

service?

Mr. Stuber: We've seen it consistently this year, as well as in

the past with "Roma" and "Marriage Story" and other films that get

that bump the way that we traditionally see at the box office. You

see everyone recognizing that the community is saying: "These are

the 10 best films and let's watch them."

WSJ: You've been the most-nominated studio for two years in a

row. Are there still actors and directors reluctant to make a movie

for a streamer?

Mr. Stuber: I think there are aspects of global distribution in

the cinema that are still appealing. Chris Nolan [the director of

"Inception, " "Dunkirk" and several Batman movies] and I have

spoken quite a bit...and that's still something he wants deeply. If

we can't provide that, it will still be an issue for him.

WSJ: We're seeing studios negotiate with theaters for shorter

windows between a movie's theatrical release and its availability

on video platforms as the country reopens. Will Netflix possibly

offer longer theatrical windows for more of its movies or will that

remain a very limited option? Typically you've offered a range of

one to four weeks.

Mr. Stuber: I think we have a model that works and we've done

well with the theaters that have played us. As these things change,

we're all having these conversations to see where it all lands and

what the landscape on the other side of all of this is.

WSJ: You have a slate of roughly 60 movies a year. How do you

choose your movies and how do you try to strike a balance between

prestige and popular?

Mr. Stuber: Everybody's got different tastes. So you have to

recognize that with the [global streaming] distribution model that

we have, we can touch a lot of different people around the world

with what excites them and what they think is great.

We can make a big breadth of different films. The dream I always

hoped was that we could find that filmmaker and he or she could

make that $3 million film, and then we could build them in that $30

million film. And then from there, $100 million.

WSJ: How much does Netflix data factor into what films you

decide to make?

Mr. Stuber: You can read the numbers around the world and see

where audiences kind of lean in and lean out. But at the end of the

day, it's a human job. You have to love it. You've got to see in

that material something you believe is great. Is it a movie I

believe is going to be great and are these people going to be able

to achieve that? That's the job.

WSJ: Seeing movies in theaters was already on the wane before

the pandemic. What are your thoughts on how the theatrical business

will return?

Mr. Stuber: We're all ready to go back into the world and we all

recognize the things we took for granted. I think people will be

excited to go back and do it. And I think what we needed was an

adjustment in the window that can give all kinds of stories a

chance to be in that model. I'm an optimist and I believe the next

decade of the movie business...will be a really exciting time for

the new voices.

WSJ: Netflix doesn't have a big library of intellectual property

to mine and recently made some big deals to acquire movies from

Sony after their theatrical runs and a deal for two sequels for

"Knives Out." I gather acquired content is still a very important

part of Netflix's strategy?

Mr. Stuber: It's a unique and great opportunity to have access

to their movies, with all the Spider-Man films and the Brad Pitt

[action movie "Bullet Train"] they are making. And "Knives Out" was

just a great chance to come into something that is a great

franchise and has a great star in the middle of it with Daniel

Craig.

WSJ: It's a very competitive marketplace right now with the

emergence of Apple and HBO Max and Disney+ and others. How is that

affecting your ability to get the content you want?

Mr. Stuber: Competition is good. It makes you sharper as an

executive and it gives the artists a chance to find the right place

in the market for their idea and get what they deserve for it.

We're competing with everyone at the highest levels, which,

frankly, when I got here we weren't.

Write to Joe Flint at joe.flint@wsj.com

(END) Dow Jones Newswires

April 23, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

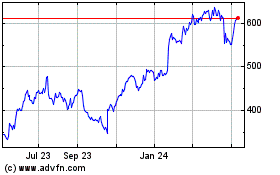

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Aug 2024 to Sep 2024

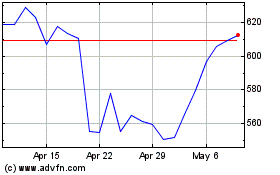

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Sep 2023 to Sep 2024