UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of January, 2021

(Commission File No. 1-35723 )

BRASILAGRO – COMPANHIA BRASILEIRA DE

PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural

Real Estate Company

(Translation of registrant’s name into

English)

Av. Brigadeiro Faria Lima, 1309, 5th

floor

São Paulo, São Paulo 01452-002

Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1):

_____

Indicate by check mark if the registrant is

submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7):

_____

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This report on Form 6-K may contain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are statements that are not historical

facts, and are based on our management’s current view and estimates of future economic circumstances, industry conditions,

company performance and financial results, including the projected impact of the COVID-19 pandemic on our business, financial condition

and results of operations. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting our financial condition,

liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of our

management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results

will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions,

industry conditions, and operating factors. Any changes in such assumptions or factors, including the unprecedented impact of the

COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders, could cause actual

results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the year ended June

30, 2020 filed with the U.S. Securities and Exchange Commission, or the SEC, as well as any subsequent filings made by us pursuant

to the Exchange Act of 1934, as amended, each of which is available on the SEC’s website (www.sec.gov), for a full

discussion of the risks and other factors that may impact any forward-looking statements in this presentation.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of the financial

condition and results of operations of BrasilAgro – Companhia Brasileira de Propriedades Agrícolas and its consolidated

subsidiaries as of September 30, 2020 and for the three-month periods ended September 30, 2020 and 2019 should be read in conjunction

with BrasilAgro’s unaudited interim condensed consolidated financial statements as of September 30, 2020 and for the three-month

periods ended September 30, 2020 and 2019 furnished to the U.S. Securities and Exchange Commission, or the SEC, on a Form 6-K on

January 25, 2021, or our unaudited interim consolidated financial statements, the information presented under the sections “Presentation

of Financial and Other Information” and “Key Information—Selected Financial Information,” “Operating

and Financial Review and Prospects,” “Quantitative and Qualitative Disclosures about Market Risk” and BrasilAgro’s

audited consolidated financial statements as of June 30, 2020 and 2019 and for each of the three years ended June 30, 2020, included

in BrasilAgro’s annual report on Form 20-F for the year ended June 30, 2020, which was filed with the SEC on October 30,

2020, or the 2020 Annual Report.

The following discussion contains

forward-looking statements that involve risks and uncertainties. BrasilAgro’s actual results may differ materially from those

discussed in the forward-looking statements as a result of various factors, including those set forth under “Forward-Looking

Statements” and in “Key Information—Risk Factors” in the 2020 Annual Report.

Recent Developments

Impact of the COVID-19 pandemic

In response to the effects of the COVID-19

pandemic, in March 2020 the Brazilian government created a crisis committee to monitor its impact. Since then, it has announced

several measures to address the effects of the COVID-19 pandemic. Brazilian health authorities, as well as several state and municipal

authorities, have adopted or recommended social distancing measures.

In order to guarantee the hygiene and

safety conditions established by the Brazilian Ministry of Health (Ministério da Saúde) and preserve the health

of our employees, we adopted a plan with several measures established specifically for this purpose. Following the guidelines established

by the Brazilian Ministry of Health, our main initiatives were: (i) the creation of a prevention and risk committee, (ii) the implementation

of remote work arrangements; and (iii) the adoption of various measures and protocols to preserve the safety of all persons involved

in our operations.

We also took measures to support

our operations and preserve cash, such as:

·

new credit lines, such as financing for agricultural costs, sugarcane and for working capital purposes;

·

early delivery of inputs; and

·

anticipating sales of agricultural products to ensure greater storage capacity.

In addition, as of September 30, 2020,

although we have not recorded any substantial gains or losses in our 2020 financial results directly related to the COVID-19 pandemic,

we continue to monitor possible future impacts due to:

·

exchange rate volatility, in connection with derivative transactions related to foreign exchange transactions and transactions

with commodities that we enter into to guarantee production margins in financial transactions;

·

volatility in sugar and ethanol prices and the consequent impact on demand and on sugarcane prices;

·

changes in the expected sugarcane payment cycle resulting from negotiations with our customers; as of September 30, 2020,

none of our customers had failed to make timely payments; and

·

volatility in other commodity prices.

Our operations in Brazil and Paraguay

continue without any substantial changes. We have not experienced any material disruptions in most of our business operations as

a consequence of the COVID-19 pandemic.

However, the COVID-19 pandemic could

affect our operations if a significant portion of our workforce is unable to work due to the spread of the virus, quarantines,

government actions, the shutdown of facilities or other restrictions are imposed. Part of our revenue is generated by the sale

of commodities to local customers, but the global market for such commodities relies on an extensive logistics and supply chain,

including ports, distribution centers and suppliers. In addition, the high volatility of the Brazilian real against the

U.S. dollar and the prices of commodities as a result of the impact of the COVID-19 pandemic could result in losses for us.

We have experienced strong demand for

exports because of the appreciation of the U.S. dollar against the Brazilian real. We have not experienced any significant

disruptions in our logistics and export operations as a result of the COVID-19 pandemic, as well as in inbound shipments of raw

materials and goods, most of which had been acquired prior to the imposition of quarantine restrictions in Brazil. We have also

not experienced any material changes in commitments for the 2019/2020 crop year. Our management believes that we are well positioned

to withstand the effects of the COVID-19 pandemic, aligned with our main concerns.

We have preserved our short-term and

long-term liquidity, and changes in inbound and outbound shipments were scaled not to materially affect our financial position.

As of the date hereof, we did not identify any significant risks with regard to our capacity to continue operating, and:

|

|

·

|

as of the date hereof, most of the harvest has already been shipped, with only cotton partially impacted by delays in the chain,

but without prejudice to revenue;

|

|

|

·

|

from a logistical point of view, the receipt of inputs is on schedule without prejudice to the start of planting and the rest

is scheduled to be received according to our need for the plantations of the next months;

|

|

|

·

|

sugarcane operations continue without impacts, as the mills did not interrupt their activities and prices recovered, despite

initial volatility; and

|

|

|

·

|

in Paraguay, slaughterhouses reopened and meat sales resumed.

|

Recent M&A transaction and bridge

loans

On December 22, 2020, we and our subsidiaries

Agrifirma Agro Ltda. and Imobiliária Engenho de Maracajú Ltda. approved the acquisition of all of the shares issued

by the following companies based in Bolivia: (i) Agropecuaria Acres del Sud S.A.; (ii) Ombu Agropecuaria S.A.; (iii) Yatay Agropecuaria

S.A.; and (iv) Yuchan Agropecuarian S.A., which are all indirectly controlled by Cresud S.A.C.I.F.Y.A., our parent company and

controlling shareholder.

Closing of the acquisition is subject

to certain conditions precedent. The acquisition consists of a total area of approximately 9,900 hectares of the properties located

in the core region of Bolivia that are suitable for planting second crops. The aggregate acquisition value was approximately US$30.0

million (or approximately US$3.0 thousand per hectare). For the purposes of operationalizing the transaction, we expect to enter

into a bridge loan agreement in the amount of approximately R$160.0 million (or US$30.0 million), maturing in 15 days.

Preliminary

Results for the Six-Month Period Ended December 31, 2020

We continuously

monitor our results of operations, which allow us to anticipate, to a certain extent, but with limitations, the impacts of the

COVID-19 pandemic on our operations. Although our unaudited interim condensed consolidated financial statements for the six-month

period ended December 31, 2020 have not yet been finalized and reviewed by our independent auditors (and are, therefore, subject

to change), we set forth below certain financial information that reflects our preliminary results for this period.

Revenue for

the six-month period ended December 31, 2020 is expected to be between R$324.1 million and R$358.2 million, an increase of approximately

30.7% to 44.5% compared to the six-month period ended December 31, 2019, primarily due to an increase in the volume of corn sold

during the period and an increase in the prices of most of the commodities produced by us, mainly soybean, corn, and sugarcane.

Gross profit

for the six-month period ended December 31, 2020 is expected to be between R$130.2 million and R$143.9 million, an increase of

approximately 36.5% to 50.8% compared to the six-month period ended December 31, 2019, primarily due to the above-referenced increase

in revenue, which more than offset an increase in cost of goods sold.

Net financial

expenses for the six-month period ended December 31, 2020 are expected to be between R$58.4 million and R$64.6 million, an increase

of approximately 507.4% to 571.3% compared to the six-month period ended December 31, 2019, primarily due to the results of derivatives,

which reflect commodities hedge operations results and dollar foreign exchange operations. Due to the high volatility of the U.S.

dollar exchange rate against the Brazilian real in the six-month period ended December 31, 2020, we expect a negative impact

in derivative operations.

As a result

of the above, net profit for the six-month period ended December 31, 2020 is expected to be between R$49.9 million and R$55.1 million,

a decrease of approximately 9.6% to 18.2% compared to the six-month period ended December 31, 2019.

Adjusted EBITDA

for the six-month period ended December 31, 2020 is expected to be between R$110.9 million and R$112.6 million, an increase of

approximately to 93.1% to 113.4% compared to the six-month period ended December 31, 2019, primarily due to an increase in the

volume of corn sold during the period and an increase in the prices of most of the commodities produced by us, mainly soybean,

corn, and sugarcane.

The figures

in the paragraphs above are preliminary estimates based on our internal controls and are subject to material changes following

the final review by our auditors.

Cautionary

Statement Regarding Preliminary Results

While the preliminary

results described above have been prepared in good faith and based on information available at the time of preparation, no assurance

can be made that actual results will not change as a result of our management’s review of results and other factors. The

preliminary results presented above are subject to finalization and closing of our accounting books and records (which have yet

to be performed) and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with IFRS.

The preliminary results depend on several factors, including those relating to financial reporting processes, and our ability to

timely and accurately report our financial results. In addition, the estimates and assumptions underlying these preliminary results

include, among other things, economic, competitive, regulatory and financial market conditions and business decisions that may

not be accurately reflected and that are inherently subject to significant uncertainties and contingencies, including, among others,

risks and uncertainties described herein and in the section “Key Information—Risk Factors” in the 2020 Annual

Report, all of which are difficult to predict and may be beyond our control. There can be no assurance that the underlying assumptions

or estimates will be realized; in particular, while we do not expect that our estimated preliminary results will differ materially

from our actual results for six-month period ended December 31, 2020, we cannot assure you that our estimated preliminary

results for the six-month period ended December 31, 2020 will be indicative of our financial results for future interim periods

or for the full year ending June 30, 2021. As a result, the preliminary results cannot be considered predictive of actual operating

results for the periods described above, and this information should not be relied on as such. You should read this information

together with our audited consolidated financial statements and our unaudited interim condensed consolidated financial statements.

The preliminary

results presented above were prepared by and are the responsibility of our management. No independent registered public accounting

firm has examined, compiled or otherwise performed any procedures with respect to the financial information contained in these

preliminary results. Accordingly, no independent registered public accounting firm has expressed any opinion or given any other

form of assurance with respect thereto, and no independent registered public accounting firm assumes any responsibility for these

preliminary results. The reports of the independent registered public accounting firm relate to the historical financial information

of BrasilAgro. Such reports do not extend to the preliminary results and should not be read to do so.

By including

herein certain preliminary results regarding our financial and operating results, neither we nor any of our advisors or other

representatives has made or makes any representation to any person regarding the ultimate performance of BrasilAgro compared to

the information contained in the preliminary results, and actual results may materially differ from those described above, and

we do not undertake any obligation unless required by applicable law to update or otherwise revise the preliminary results set

forth herein to reflect circumstances existing since their preparation or to reflect the occurrence of unanticipated events or

to reflect changes in general economic or industry conditions, even in the event that any or all of the underlying assumptions

are shown to be in error.

Risks Relating to our Business and Industry

In

addition to the risk factors described under “Key Information—Risk Factors” in the 2020 Annual Report, we have

included the following risk factors in this report on Form 6-K:

We may lose ownership of certain

of our properties.

Certain of our properties are currently

pledged as collateral and subject to liens and mortgages. In the event of default of obligations with respect to such collaterals,

liens and mortgages, our creditors may execute the guarantees. In this case, our properties may be sold at auction and transferred

to third parties. If we do not have other assets to guarantee the payment of such debts, these properties may be acquired by third

parties at auction or transferred to creditors. In both cases, the continuity of the operation of such properties may require negotiation

with the new owners and payment of additional rent and other financial obligations, which may adversely affect our businesses,

results of operations and financial condition.

In addition, our properties, as well

as the properties of our subsidiaries and affiliates, may be subject to eminent domain, by unilateral decision of the Brazilian

government, in order to fulfill the public interest or the social function of the property, pursuant to the Brazilian constitution.

The amount to be assessed in the event of eminent domain for payment of indemnities may be lower than the market value of the properties,

which may adversely affect our business, results of operations and financial condition.

Finally, there is an ongoing legal proceeding,

pending before the Civil Court of Correntina, in the State of Bahia, in which the plaintiffs seek the annulment of our acquisition

of the property registered under no. 6,413 in the real estate registry of Correntina, in the State of Bahia, which was filed by

former owners of such property. Considering that such property is part of our Chaparral farm, which is relevant to our agricultural

activities, the loss of the property would materially and adversely affect our business and results of operations.

The rural partnership agreements

that we have entered into for the use of third-party properties may not be considered rural leases.

We hold certain third-party properties

that we use for our activities through rural partnership agreements. According to article 96 of Law No. 4,504/1964, sharing of

risk between the parties is an essential requirement of rural partnership agreements. In case of an interpretation that our rural

partnership agreements do not contemplate the sharing of risk of production between the parties, such agreements may not be considered

as rural leases.

In this case, tax authorities may allege

fraud, and we may be held jointly and severally responsible in administrative and judicial proceedings for collection of unpaid

taxes and fines (which, in the event of fraud, can reach 150% of the unpaid tax), which may materially and adversely affect us.

In addition, in case of mischaracterization of the rural partnerships and the understanding that these are common lease agreements,

restrictions on the leasing of agricultural properties by Brazilian companies whose majority of the share capital is held by foreigners

may become applicable, which may materially and adversely affect our business, results of operations and financial condition.

We are subject to losses that

may not be covered by insurance policies and may face difficulties in contracting new policies, which may materially and adversely

affect us.

We are subject to the occurrence of uninsured

events (such as acts of god and force majeure events, or interruption of certain activities), or damage greater than the coverage

limits provided for in our insurance policies. In addition, the quantification of the risk exposure in existing policies may be

inadequate or insufficient.

In the event of the occurrence of an

event that is not covered or that exceeds the coverage provided for in our current policies, we may suffer financial losses to

rebuild or refurbish the assets affected by such events, which may compromise the investments we have made. Even in the event of

a claim covered by the policies, we cannot guarantee that the insurance payment will be made in a timely manner, or in an amount

sufficient to fully compensate us for the damages resulting from such claim, which may adversely affect our financial results.

In case of insured events, insurance policy coverage is conditional on the payment of the respective premium, and our failure to

pay these premiums, which could lead to a refusal by an insurer to cover a claim, could materially and adversely affect us.

In addition, we cannot guarantee that

we will be able to maintain insurance policies at reasonable commercial rates or on acceptable terms, or contracted with the same

or similar insurance companies in the future. In addition, we may be held liable for the payment of compensation to third parties

as a result of a claim. Should any of these factors occur, our business and financial condition and results of operations could

be adversely affected.

We may pursue new acquisitions

that may impact our indebtedness and adversely affect our financial condition if we are unable to successfully integrate the operations

of the acquired business.

Acquisitions are subject to certain risks,

such as: (i) the increase of our financial leverage; (ii) the combination of the business culture and facilities of two or more

companies; and (iii) failure to correctly and fully identify the acquired company’s liabilities. If any of such risks materialize,

they could adversely affect our results of operations. In addition, to complete such acquisitions, we may need to incur new debt

and raise equity capital.

Acquisitions may also expose us to liability

related to legal proceedings involving acquired entities, their respective management or contingent liabilities incurred prior

to the acquisition, as well as expose us to liabilities associated with ongoing operations, particularly if we are unable to adequately

manage the acquired operations. These transactions can also be structured to result in the assumption of obligations or unidentified

liabilities during the due diligence conducted before conclusion of the acquisition.

Any of these factors may adversely affect

our ability to achieve expected cash flows from operations acquired and obtain the synergies expected from an acquisition, which

may materially and adversely affect our business and results of operations.

We may be affected by new demarcations

of indigenous lands by Brazilian authorities, settlements, occupation by social movements and traditional communities.

Traditional communities (indigenous and

remnants of quilombos) and social movements, such as the Landless Rural Workers Movement (Movimento dos Trabalhadores

Rurais Sem Terra), are active in Brazil and seek to compel federal and state governments to carry out land demarcation procedures,

rural reforms and compulsory land redistribution, which may cover areas currently occupied by us, forcing us to stop operating

in such areas, which may adversely affect our agricultural production and consequently our results of operations, financial condition,

image and reputation. Invasions and occupations of rural lands by large numbers of people are common practices among members of

these communities and these movements and, in certain areas, police protection and legal procedures for maintaining or defending

the possession of such areas may not be available or sufficient to prevent invasions and occupations.

We are in the process of obtaining

and renewing operating licenses and authorizations from fire departments with respect to certain of our properties.

We are currently in the process of obtaining

and renewing operating licenses and authorizations from fire departments for some of our properties. The exercise of activities

without licenses, permits or authorizations may subject us to penalties in amounts defined by each of municipality and state where

our properties are located, including temporary or permanent closing of establishments, which may prevent us from operating such

properties. In addition, in the event of an accident or damage on the property, the absence of licenses, permits or authorizations,

or the existence of material irregularities in these licenses may subject us to civil and criminal liability. In addition, in

case of (i) changes to the property, (ii) changes of the activity performed on the properties, or (iii) changes in the holder

of the properties, the licenses, permits and authorizations may become null and void, and new licenses and authorizations may

need to be issued.

Business Drivers and Measures

The table below sets forth certain market

indices that affect our operating and financial results:

|

|

|

Three-month period ended September 30,

|

Year ended June 30,

|

|

|

|

|

|

|

2020

|

|

|

2020

|

|

|

2019

|

|

|

Source

|

|

Soybean Price (Paranaguá)

|

|

(R$/bag)

|

|

|

|

|

Closing

|

|

|

148.12

|

|

|

|

115.32

|

|

|

|

81.80

|

|

|

Bloomberg

|

|

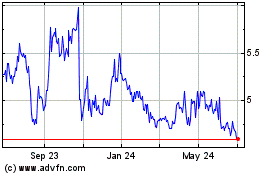

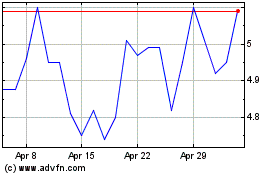

Exchange rate

|

|

(R$ per US$ 1.00)

|

|

|

|

|

Beginning

|

|

|

5.3651

|

|

|

|

3.82

|

|

|

|

3.90

|

|

|

Bloomberg

|

|

Closing

|

|

|

5.6407

|

|

|

|

5.48

|

|

|

|

3.83

|

|

|

Bloomberg

|

|

Average

|

|

|

5.3772

|

|

|

|

4.47

|

|

|

|

3.86

|

|

|

Bloomberg

|

|

ATR (R$/Kg of ATR)(1)

|

|

|

—

|

|

|

|

0.68

|

|

|

|

0.62

|

|

|

http://www.udop.com.br

|

|

Closing IGP-M (%)(2)

|

|

|

9.59%

|

|

|

|

7.31

|

%

|

|

|

6.51

|

%

|

|

Bloomberg

|

|

IPCA(3)

|

|

|

1.2%

|

|

|

|

2.13

|

%

|

|

|

3.37

|

%

|

|

Bloomberg

|

|

CDI(4)

|

|

|

0.5%

|

|

|

|

4.59

|

%

|

|

|

6.32

|

%

|

|

B3

|

|

NPK(5) (R$/ton)

|

|

|

1,791.14

|

|

|

|

1,362.73

|

|

|

|

1,150.28

|

|

|

Bloomberg

|

|

|

(1)

|

ATR corresponds to the quantity of sugar available in the raw material subtracted from the losses in the industrial process.

|

|

|

(2)

|

IGP-M is published monthly by FGV.

|

|

|

(3)

|

IPCA is published monthly by IBGE.

|

|

|

(4)

|

The CDI rate is the average of the rates of inter-bank deposits charged during the day in Brazil (accumulated in the period).

|

|

|

(5)

|

NPK is the chemical compound of farming fertilizers made up of nitrogen, phosphorus and potassium combined at a ratio of 2:20:20.

|

Results of Operations

The following discussion of our results

of operations is based on our unaudited interim condensed consolidated financial statements. The discussion of the results of our

business segments is based upon financial information reported for each of the segments of our business, as presented in the table

below.

The following tables set forth operating

results of each of our segments and the reconciliation of these results to our unaudited interim condensed consolidated financial

statements.

|

|

|

Three-month period ended September 30, 2020

|

|

|

|

|

(in R$ thousands)

|

|

|

|

|

|

|

|

|

|

|

Agricultural activity

|

|

|

|

|

Total

|

|

|

Real estate

|

|

|

Grains

|

|

|

Cotton

|

|

|

Sugarcane

|

|

|

Cattle raising

|

|

|

Other

|

|

|

Not allocated

|

|

|

Revenue

|

|

|

222,214

|

|

|

|

(575)

|

|

|

|

110,128

|

|

|

|

1,629

|

|

|

|

97,723

|

|

|

|

13,426

|

|

|

|

(117)

|

|

|

|

—

|

|

|

Gain from sale of farm

|

|

|

5,752

|

|

|

|

5,752

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Changes in fair value of biological assets and agricultural products

|

|

|

50,599

|

|

|

|

—

|

|

|

|

7,665

|

|

|

|

3,031

|

|

|

|

37,016

|

|

|

|

2,918

|

|

|

|

(31)

|

|

|

|

—

|

|

|

Adjustment to net realizable value of agricultural products after harvest, net

|

|

|

2,269

|

|

|

|

—

|

|

|

|

2,269

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Cost of sales

|

|

|

(207,539)

|

|

|

|

(530)

|

|

|

|

(100,866)

|

|

|

|

(1,969)

|

|

|

|

(88,751)

|

|

|

|

(12,101)

|

|

|

|

(3,322)

|

|

|

|

—

|

|

|

Gross profit (loss)

|

|

|

73,295

|

|

|

|

4,647

|

|

|

|

19,196

|

|

|

|

2,691

|

|

|

|

45,988

|

|

|

|

4,243

|

|

|

|

(3,470)

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

(5,437)

|

|

|

|

—

|

|

|

|

(5,280)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(157)

|

|

|

|

—

|

|

|

|

—

|

|

|

General and administrative expenses

|

|

|

(7,908)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(7,908)

|

|

|

Other operating income

|

|

|

(2,813)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(2,813)

|

|

|

Share of loss of a joint venture

|

|

|

(44)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(44)

|

|

|

Operating income (loss)

|

|

|

57,093

|

|

|

|

4,647

|

|

|

|

13,916

|

|

|

|

2,691

|

|

|

|

45,988

|

|

|

|

4,086

|

|

|

|

(3,470)

|

|

|

|

(10,765)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net financial income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

|

187,273

|

|

|

|

106,874

|

|

|

|

29,145

|

|

|

|

—

|

|

|

|

5,654

|

|

|

|

3,601

|

|

|

|

6,154

|

|

|

|

35,845

|

|

|

Financial expenses

|

|

|

(171,806)

|

|

|

|

(26,769)

|

|

|

|

(34,398)

|

|

|

|

—

|

|

|

|

(5,771)

|

|

|

|

(5,771)

|

|

|

|

(18,623)

|

|

|

|

(80,474)

|

|

|

Net income (loss) before income and social contribution taxes

|

|

|

72,560

|

|

|

|

84,752

|

|

|

|

8,663

|

|

|

|

2,691

|

|

|

|

45,871

|

|

|

|

1,916

|

|

|

|

(15,939)

|

|

|

|

(55,394)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income and social contribution taxes

|

|

|

3,094

|

|

|

|

(4,627)

|

|

|

|

(2,945)

|

|

|

|

(915)

|

|

|

|

(15,596)

|

|

|

|

(651)

|

|

|

|

5,419

|

|

|

|

22,409

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit (loss) for the period

|

|

|

75,654

|

|

|

|

80,125

|

|

|

|

5,718

|

|

|

|

1,776

|

|

|

|

30,275

|

|

|

|

1,265

|

|

|

|

(10,520)

|

|

|

|

(32,985)

|

|

|

|

|

Three-month period ended September 30, 2019

|

|

|

|

|

(in R$ thousands)

|

|

|

|

|

|

|

|

|

|

|

Agricultural activity

|

|

|

|

|

Total

|

|

|

Real estate

|

|

|

Grains

|

|

|

Cotton

|

|

|

Sugarcane

|

|

|

Cattle raising

|

|

|

Other

|

|

|

Not allocated

|

|

|

Revenue

|

|

|

166,006

|

|

|

|

2,061

|

|

|

|

60,825

|

|

|

|

5,226

|

|

|

|

91,936

|

|

|

|

5,980

|

|

|

|

(22)

|

|

|

|

—

|

|

|

Gain from sale of farm

|

|

|

16,572

|

|

|

|

16,572

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Changes in fair value of biological assets and agricultural products

|

|

|

38,218

|

|

|

|

(1,719)

|

|

|

|

692

|

|

|

|

485

|

|

|

|

39,326

|

|

|

|

(477)

|

|

|

|

(89)

|

|

|

|

—

|

|

|

Adjustment to net realizable value of agricultural products after harvest, net

|

|

|

(1,345)

|

|

|

|

—

|

|

|

|

(496)

|

|

|

|

(849)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Cost of sales

|

|

|

(158,808)

|

|

|

|

(351)

|

|

|

|

(55,740)

|

|

|

|

(5,939)

|

|

|

|

(90,862)

|

|

|

|

(6,203)

|

|

|

|

287

|

|

|

|

—

|

|

|

Gross profit (loss)

|

|

|

60,643

|

|

|

|

16,563

|

|

|

|

5,281

|

|

|

|

(1,077)

|

|

|

|

40,400

|

|

|

|

(700)

|

|

|

|

176

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

(3,873)

|

|

|

|

—

|

|

|

|

(3,816)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(57)

|

|

|

|

—

|

|

|

|

—

|

|

|

General and administrative expenses

|

|

|

(9,186)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(9,186)

|

|

|

Other operating income

|

|

|

446

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

446

|

|

|

Share of loss of a joint venture

|

|

|

(40)

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(40)

|

|

|

Operating income (loss)

|

|

|

47,990

|

|

|

|

16,563

|

|

|

|

1,465

|

|

|

|

(1,077)

|

|

|

|

40,400

|

|

|

|

(757)

|

|

|

|

176

|

|

|

|

(8,780)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net financial income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

|

71,605

|

|

|

|

39,775

|

|

|

|

5,244

|

|

|

|

—

|

|

|

|

834

|

|

|

|

—

|

|

|

|

365

|

|

|

|

25,387

|

|

|

Financial expenses

|

|

|

(70,370)

|

|

|

|

(29,557)

|

|

|

|

(265)

|

|

|

|

—

|

|

|

|

(3,386)

|

|

|

|

—

|

|

|

|

(8,086)

|

|

|

|

(29,076)

|

|

|

Net income (loss) before income and social contribution taxes

|

|

|

49,225

|

|

|

|

26,781

|

|

|

|

6,444

|

|

|

|

(1,077)

|

|

|

|

37,848

|

|

|

|

(757)

|

|

|

|

(7,545)

|

|

|

|

(12,469)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income and social contribution taxes

|

|

|

(8,649)

|

|

|

|

(1,433)

|

|

|

|

(2,191)

|

|

|

|

—

|

|

|

|

(12,868)

|

|

|

|

257

|

|

|

|

2,565

|

|

|

|

5,021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit (loss) for the period

|

|

|

40,576

|

|

|

|

25,348

|

|

|

|

4,253

|

|

|

|

(1,077)

|

|

|

|

24,980

|

|

|

|

(500)

|

|

|

|

(4,980)

|

|

|

|

(7,448)

|

|

The table below

shows a summary of our statement of operations for the periods indicated.

|

|

|

Three-Month Period ended September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

(in R$ thousands, except share and per share information)

|

|

|

CONSOLIDATED STATEMENT OF INCOME

|

|

|

|

|

|

|

|

Revenue

|

|

|

222,214

|

|

|

|

166,006

|

|

|

Gain from sale of farms

|

|

|

5,752

|

|

|

|

16,572

|

|

|

Changes in fair value of biological assets and agricultural products

|

|

|

50,599

|

|

|

|

38,218

|

|

|

Adjustment to net realizable value of agricultural products after harvest, net

|

|

|

2,269

|

|

|

|

(1,345

|

)

|

|

Cost of sales

|

|

|

(207,539

|

)

|

|

|

(158,808

|

)

|

|

Gross profit

|

|

|

73,295

|

|

|

|

60,643

|

|

|

Selling expenses

|

|

|

(5,437

|

)

|

|

|

(3,873

|

)

|

|

General and administrative expenses

|

|

|

(7,908

|

)

|

|

|

(9,186

|

)

|

|

Other operating (expenses) income net

|

|

|

(2,813

|

)

|

|

|

446

|

|

|

Share of loss of a joint venture

|

|

|

(44

|

)

|

|

|

(40

|

)

|

|

Operating income

|

|

|

57,093

|

|

|

|

47,990

|

|

|

Financial income

|

|

|

187,273

|

|

|

|

71,605

|

|

|

Financial expenses

|

|

|

(171,806

|

)

|

|

|

(70,370

|

)

|

|

Financial (expense) income, net

|

|

|

15,467

|

|

|

|

1,235

|

|

|

Profit before income and social contribution taxes

|

|

|

72,560

|

|

|

|

49,225

|

|

|

Income and social contribution taxes

|

|

|

3,094

|

|

|

|

(8,649

|

)

|

|

Net profit for the period

|

|

|

75,654

|

|

|

|

40,576

|

|

|

Basic earnings per share

|

|

|

1.2749

|

|

|

|

0.7542

|

|

|

Diluted earnings per share

|

|

|

1.2638

|

|

|

|

0.7495

|

|

In the following discussion, references

to increases or decreases in any period are made by comparison with the corresponding prior period, except as otherwise indicated.

Revenue

Revenue increased R$56.2 million, from

R$166.0 million in the three-month period ended September 30, 2019 to R$222.2 million in the three-month period ended September

30, 2020. This increase was mainly due to the following:

|

|

i.

|

Revenue from sugarcane sales: revenue from sugarcane sales increased R$5.8 million, from R$91.9 million (reflecting

sales of 992,110 tons at an average price of R$92.66 per ton) in the three-month period ended September 30, 2019 to R$97.7 million

(reflecting sales of 966,000 tons at an average price of R$101.16 per ton) in the three-month period ended September 30, 2020.

This represented an increase of 6.3% over the previous period, mainly resulting from the increase in average per-ton sugarcane

sales price. The increase in per-ton sugarcane sales price was due to the higher price of the TRS (total recoverable sugar) of

sugarcane sold. In the same period, there was also an increase in the price of the TRS per ton of harvested sugarcane, from R$0.671

per kg in the three-month period ended September 30, 2019 to R$0.683 per kg in the three-month period ended September 30, 2020.

|

|

|

ii.

|

Revenue from grain sales: revenue from grain sales increased R$49.3 million, from R$60.8 million in the three-month

period ended September 30, 2019 to R$110.1 million in the three-month period ended September 30, 2020. This represented an increase

of 81.1%, as explained below:

|

|

|

·

|

Revenue from soybean sales: revenue from soybean sales increased R$14.0 million, from R$52.0 million (reflecting sales

of 45,300 tons at an average price of R$1,146.67 per ton) in the three-month period ended September 30, 2019 to R$66.0 million

(reflecting sales of 43,300 tons at an average price of R$1,536.49 per ton) in the three-month period ended September 30, 2020.

This represented an increase of 26.9% over the previous period resulting from the variation in the amount of hectares being produced

and the maturity level of this crop area in each harvest year.

|

|

|

·

|

Revenue from corn sales: revenue from corn sales increased R$28.5 million, from R$8.9 million (reflecting sales of 24,400

tons at an average price of R$362.91 per ton) in the three-month period ended September 30, 2019 to R$37.4 million (reflecting

sales of 73,100 tons at an average price of R$511.56 per ton) in the three-month period ended September 30, 2020. This represented

an increase of 320.2% over the previous period resulting from the variation in the amount of hectares being produced and the maturity

level of this crop area in each harvest year.

|

|

|

iii.

|

Revenue from cattle sales: revenue from cattle sales increased R$7.4 million, from R$6.0 million (related to the sale

of 3,348 head of cattle at R$5.35 per kilo) in the three-month period ended September 30, 2019 to R$13.4 million (related to the

sale of 5,431 head of cattle at R$7.22 per kilo) in the three-month period ended September 30, 2020.

|

|

|

iv.

|

Revenue from cotton sales: revenue from cotton sales decreased R$3.6 million, from R$5.2 million (related to the sale

of 2,700 tons at an average price of R$1,926.00 per ton) in the three-month period ended September 30, 2019 to R$1.6 million (related

to the sale of 279 tons at an average price of R$5,735.00 per ton) in the three-month period ended September 30, 2020. The values

per ton are not comparable between periods due to the difference in the lint and seed sales mix. In the three-month period ended

September 30, 2019, 33.6% of volume sold referred to lint (average price of R$4.89 per kilo) and 66.4% of volume referred to seed

(average price of R$0.47 per kilo). In the three-month period ended September 30, 2020, 100.0% of volume sold referred to lint

(average price of R$5.93 per kilo). The increase in the price of sold lint reflects the variation in exchange rates during the

period.

|

The table below shows a summary of the

number of hectares harvested, productivity and revenues from grain, sugarcane and cotton production:

|

|

|

|

Gross operating revenue (in R$ thousands)

|

|

|

|

|

|

As of September 30,

|

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

Grain

|

|

|

|

112,099

|

|

|

|

61,744

|

|

|

|

Sugarcane

|

|

|

|

97,726

|

|

|

|

91,937

|

|

|

|

Cotton

|

|

|

|

1,656

|

|

|

|

5,260

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of farms

Gain on sale of farms decreased R$10.8

million, from a gain of R$16.6 million in the three-month period ended September 30, 2019 to a gain of R$5.8 million in the three-month

period ended September 30, 2020.

For the three-month period ended September

30, 2020, the fulfillment of certain obligations related to prior-year sales enabled the recognition of the portion of the revenue

that was deferred on the execution date related to the variable consideration concept provided for in IFRS 15 – Revenue

from contracts with customers. Of the total gross revenue from the sale of farms, we recognized the deferred revenue related to

the Jatobá III farm in the amount of R$3.9 million at a cost of R$0.6 million, including indirect taxes. In addition, with

respect to the Jatobá II farm, we recognized the deferred revenue in the amount of R$2.9 million at a cost of R$0.3 million.

For the three-month period ended September 30, 2019, we recognized revenue in the amount of R$19.0 million at cost of R$2.4 million,

including indirect taxes, related to the sale of 1,134 hectares of the Jatobá IV farm in the State of Bahia.

Changes in fair value of biological

assets and agricultural products

Changes in fair value of biological assets

and agricultural products increased R$12.4 million, from a gain of R$38.2 million in the three-month period ended September 30,

2019 to a gain of R$50.6 million in the three-month period ended September 30, 2020. Gains or losses from the variation in the

fair value of agricultural products are determined by the difference between their harvest volume at market value (net of selling

expenses and taxes and the production costs incurred (direct and indirect costs, leasing and depreciation). Harvested agricultural

products are measured at fair value at the time of harvest considering the market price of the area of each farm.

This variation resulted mainly from the

increase in the fair value of: (i) biological assets, from a gain of R$3.6 million in the three-month period ended September 30,

2019 to a gain of R$8.1 million in the three-month period ended September 30, 2020; and (ii) agricultural products, from a gain

of R$34.6 million in the three-month period ended September 30, 2019 to a gain of R$42.5 million in the three-month period ended

September 30, 2020.

Such variation was mainly due to an increase

in the fair value of: (a) grain, from a gain of R$0.7 million in the three-month period ended September 30, 2019 to a gain of R$7.6

million in the three-month period ended September 30, 2020; (b) cotton, from a gain of R$0.5 million in the three-month period

ended September 30, 2019 to a gain of R$3.0 million in the three-month period ended September 30, 2020; and (c) cattle-raising,

from a loss of R$1.2 million in the three-month period ended September 30, 2019 to a gain of R$2.9 million in the three-month period

ended September 30, 2020.

The variation described above was partially

offset by the decrease in the fair value of sugarcane, from a gain of R$38.3 million in the three-month period ended September

30, 2019 to a gain of R$37.0 million in the three-month period ended September 30, 2020.

Adjustment to net realizable value of

agricultural products after harvest, net

We recognized an impairment of net realizable

value of agricultural products after harvest equal to a loss of R$1.3 million in the three-month period ended September 30, 2019.

In the three-month period ended September 30, 2020, we reversed the previously recognized impairment of net realizable value of

agricultural products after harvest, which generated a gain of R$2.3 million, as a result of the increase in the price of commodities

in the three-month period ended September 30, 2020.

Cost of sales

Cost of sales increased R$48.7 million,

from R$158.8 million in the three-month period ended September 30, 2019 to R$207.5 million in the three-month period ended September

30, 2020.

Changes in costs year-over-year are directly

linked to the market prices of commodities at the time of harvest as well as the harvested volumes (tons), as explained below.

The description of each crop below excludes the effects of biological assets appropriated at cost.

|

|

i.

|

Cost of soybean sold: the cost of soybean sold decreased R$3.8 million, from R$47.1 million (corresponding to 45,300

tons at R$1,039.85 per ton) in the three-month period ended September 30, 2019 to R$43.4 million (corresponding to 43,300 tons

at R$1,000.55 per ton) in the three-month period ended September 30, 2020. Cost is impacted by variations in volumes sold, fertilizer

prices (which is impacted by freight costs and exchange rates) and the sale of farms, which decrease the annual cultivation in

mature areas and, consequently, reduce average productivity per hectare in the period.

|

|

|

ii.

|

Cost of corn sold: the cost of corn sold increased R$14.1 million, from R$7.6 million (corresponding to 8,600 tons at

R$313.34 per ton) in the three-month period ended September 30, 2019 to R$21.8 million (corresponding to 35,700 tons at R$297.79

per ton) in the three-month period ended September 30, 2020. The decrease in corn cost was due to the higher volume sold and dilution

of fixed cost.

|

|

|

iii.

|

Cost of sugarcane sold: the cost of sugarcane sold decreased R$2.1 million, from R$90.9 million (corresponding to 992,100

tons at R$60.05 per ton) in the three-month period ended September 30, 2019 to R$88.8 million (corresponding to 966,000 tons at

R$72.09 per ton) in the three-month period ended September 30, 2020. The decrease in sugarcane cost was due to lower volume sold

in the period, despite the increase in price per ton mainly due to the impact of the adoption of IFRS 16. For more information

about the impact of the adoption of IFRS 16, see: “Principal Components of Our Statement of Operations—Operating and

Financial Review and Prospect—New standards, amendments and interpretations of standards” in the 2020 Annual Report.

|

|

|

iv.

|

Cost of cattle-raising sold: the cost of cattle-raising sold increased R$5.9 million, from R$6.2 million (corresponding

to the sale of 3,348 head of cattle at R$1,900 per head) in the three-month period ended September 30, 2019 to R$12.1 million (corresponding

to the sale of 5,431 head of cattle at R$2,300 per head) in the three-month period ended September 30, 2020.

|

Gross profit

For the reasons mentioned above, our

gross profit for the three-month period ended September 30, 2020 was R$73.3 million, representing an increase of R$12.7 million,

compared to R$60.6 million for the three-month period ended September 30, 2019.

Selling expenses

Selling expenses increased R$1.5 million,

from R$3.9 million in the three-month period ended September 30, 2019 to R$5.4 million in the three-month period ended September

30, 2020, primarily as a result of the higher volumes of agricultural products sold.

General and administrative expenses

General and administrative expenses decreased

R$1.3 million, from R$9.2 million in the three-month period ended September 30, 2019 to R$7.9 million in the three-month period

ended September 30, 2020. This decrease was primarily a result of the compensation expenses related to our long-term stock-based

incentive plan settled in January 2020. Therefore, no compensation expense was recognized for the three-month period ended September

30, 2020. This decrease was offset by an increase in professional fees of service providers, related to the Agrifirma acquisition.

Other operating (expenses) income, net

For the three-month period ended September

30, 2019, other operating income, net, amounted to R$0.4 million. For the three-month period ended September 30, 2020, other operating

expenses, net, amounted to R$2.8 million. The balance of other operating expenses, net primarily relate to the variation in the

value of subscription warrants issued by us.

Financial income (expenses), net

Financial income increased R$115.7 million,

from R$71.6 million for the three-month period ended September 30, 2019 to R$187.3 million for the three-month period ended September

30, 2020, and financial expenses increased R$101.4 million, from R$70.4 million for the three-month period ended September 30,

2019 to R$171.8 million for the three-month period ended September 30, 2020.

The financial income (expenses), net

result is composed of: (i) interest on financing; (ii) exchange in variation on the offshore account; (iii) the present value of

sales receivables from the Araucária, Alto Taquari and Jatobá farms, fixes in soybean bags, and the leasing of sugarcane

areas; (iv) the result from hedge operations; and (v) bank fees and expenses and income from cash investments and cash equivalents.

The restatement of receivables from farm

value and leases, in the amount of R$80.1 million in the three-month period ended September 30, 2020 demonstrates the variation

in the amount to be received due to sales of the Araucária, Jatobá and Alto Taquari farms, fixed in soybeans bags,

and the variation of Consecana’s price in the lease of the Parceria IV farm.

The derivatives results reflect the commodities

hedge operations result of commodities and dollar foreign exchange operations, aiming to reduce the volatility of our exposure,

since our revenues, inventories, biological assets and farm receivables have a positive correlation with commodities prices and

the U.S. dollar. In the three-month period ended September 30, 2020, the derivatives result was an expense of R$54.9 million, of

which an expense of R$10.0 million was for currency operations and an expense of R$44.9 million for commodity operations. In the

three-month period ended September 30, 2019, the derivatives result was an expense of R$2.7 million, of which an expense of R$7.7

million was for currency operations and an income of R$5.0 million for commodity operations.

Income and social contribution taxes

We recognized income and social contribution

tax income of R$3.1 million for the three-month period ended September 30, 2020 compared to income and social contribution tax

expense of R$8.6 million for the three-month period ended September 30, 2019.

Net profit for the period

As a result of the above, net income

for the three-month period ended September 30, 2020 was R$75.7 million, compared to R$40.6 million for the three-month period ended

September 30, 2019.

Liquidity and Capital Resources

As of September 30, 2020, we held R$224.1

million in cash and cash equivalents and marketable securities. We usually hold cash and cash equivalents in Certificate of Deposits

and Repurchase Agreements issued by banks rated at least AA by Moody’s and Brazilian and American treasury bonds. Of the

total amount of cash and cash equivalents, approximately R$35.2 million was held in jurisdictions outside Brazil and, as a result,

there may be tax consequences if such amounts were moved out of these jurisdictions or repatriated to Brazil. We regularly review

the amount of cash and cash equivalents held outside of Brazil to determine the amounts necessary to fund the current operations

of our foreign operations and their growth initiatives and amounts needed to service our Brazilian indebtedness and related obligations.

We believe that our current capital resources,

together with our ability to obtain loans and credit facilities and, when appropriate, to raise equity in the capital markets,

are sufficient to meet our present cash flow needs.

Cash Flows

The following table sets forth certain

consolidated cash flow information for the periods indicated:

|

|

|

Three-month period ended September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

(in R$ thousands)

|

|

|

CONSOLIDATED CASH FLOW

|

|

|

|

|

|

|

|

|

|

Net cash flows (used in) from operating activities

|

|

|

129,631

|

|

|

|

48,321

|

|

|

Net cash flows (used in) from investing activities

|

|

|

(11,214

|

)

|

|

|

(9,721

|

)

|

|

Net cash flows from (used in) financing activities

|

|

|

(65,356

|

)

|

|

|

(34,215

|

)

|

|

Net increase in cash and cash equivalents

|

|

|

53.061

|

|

|

|

4,385

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities:

Net cash generated from operating activities was R$129.6 million for the three-month period ended September 30, 2020 compared

to R$48.3 million for the three-month period ended September 30, 2019. This increase was primarily due to: (i) adjustments to

reconcile the profit for the period in the amount of R$50.6 million related to the adjustment of the fair value of biological

assets and agricultural products not realized in the three-month period ended September 30, 2020, compared to R$38.2 million in

the three-month period ended September 30, 2019; (ii) adjustments to reconcile the profit for the period in the amount of R$90.0

million related to the change in the fair value of accounts receivable from the sale of farms and other financial liabilities,

compared to R$10.2 million in the three-month period ended September 30, 2019; (iii) an increase in the cash flow of biological

assets of R$72.5 million in the three-month period ended September 30, 2020, compared to an increase in the amount of R$56.6 million

in the three-month period ended September 30 2019; and (iv) an increase of R$19.5 million in the cash flow from customers in the

three-month period ended September 30, 2020, due to the increase in profitability and the improvement in sales prices, with a

positive impact on accounts receivable from customers and receivables from farm sales, compared to an increase of R$9.7 million

in the three-month period ended September 30, 2019.

Investing activities: Net cash

used in investing activities was R$11.2 million for the three-month period ended September 30, 2020 compared to R$9.7 million

for the three-month period ended September 30, 2019. This increase was primarily due to: (i) the acquisition of vehicles and agricultural

machinery in the amount of R$5.5 million; (ii) investments in the amount of R$9.8 million in the opening (cleaning and preparing

the soil for planting) of new cultivation areas on our farms; and (iii) the receipt of R$5.5 million from the sale of the Bananal

X farm in the three-month period ended September 30, 2020.

Financing activities: Net cash

used in financing activities was R$65.4 million for the three-month period ended September 30, 2020 compared to R$34.2 million

for the three-month period ended September 30, 2019. This increase was primarily due to the repayment of debentures in the amount

of R$42.6 million in the three-month period ended September 30, 2020.

Indebtedness and Cash and Cash Equivalents

Our total consolidated indebtedness (current

and non-current loans, financing and debentures) was R$455.2 million as of September 30, 2020, compared to R$514.1 million as of

June 30, 2020. Our short-term indebtedness as of September 30, 2020 amounted to R$208.1 million, compared to R$217.3 million as

of June 30, 2020. Our long- term indebtedness as of September 30, 2020 was R$247.2 million, compared to R$296.8 million as of June

30, 2020. Of the total indebtedness outstanding as of September 30, 2020, 54.3% consisted of long-term debt, compared to 57.7%

as of June 30, 2020.

The table below summarizes our material

outstanding loans and financing agreements as of September 30, 2020.

|

|

|

|

|

Annual interest rates and charges (%)

|

|

|

|

|

|

|

|

Index

|

|

2020

|

|

|

As of September 30, 2020

|

|

|

As of June 30, 2020

|

|

|

|

|

|

|

|

(in R$ thousands)

|

|

|

Financing for agricultural costs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed rate + CDI

|

|

|

1.80% + 100

|

|

|

|

40,053

|

|

|

|

40,568

|

|

|

|

|

Fixed rate

|

|

|

3.24

|

|

|

|

7,865

|

|

|

|

—

|

|

|

|

|

Fixed rate

|

|

|

3.90

|

|

|

|

9,162

|

|

|

|

9,072

|

|

|

|

|

Fixed rate

|

|

|

6.30

|

|

|

|

106,539

|

|

|

|

108,057

|

|

|

|

|

Fixed rate

|

|

|

6.34

|

|

|

|

3,055

|

|

|

|

3,251

|

|

|

|

|

Fixed rate

|

|

|

7.64

|

|

|

|

9,248

|

|

|

|

9,076

|

|

|

|

|

|

|

|

|

|

|

|

175,922

|

|

|

|

170,024

|

|

|

Financing for agricultural costs (USD)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed rate

|

|

|

7.00

|

|

|

|

2,870

|

|

|

|

2,787

|

|

|

|

|

Fixed rate

|

|

|

8.50

|

|

|

|

5,861

|

|

|

|

5,573

|

|

|

|

|

|

|

|

|

|

|

|

8,731

|

|

|

|

8,360

|

|

|

Financing for agricultural costs (Paraguayan guarani)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed rate

|

|

|

8.00

|

|

|

|

7,795

|

|

|

|

7,940

|

|

|

|

|

Fixed rate

|

|

|

8.25

|

%

|

|

|

19,439

|

|

|

|

19,749

|

|

|

|

|

|

|

|

|

|

|

|

27,234

|

|

|

|

27,689

|

|

|

Bahia Project Financing(*)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed rate

|

|

|

3.50

|

%

|

|

|