Current Report Filing (8-k)

December 02 2020 - 4:14PM

Edgar (US Regulatory)

0000314808false00003148082020-11-302020-11-300000314808val:ClassAOrdinarySharesUS0.40ParValueMember2020-11-302020-11-300000314808val:FourPointSevenZeroPercentSeniorNotesDueTwoThousandTwentyOneMember2020-11-302020-11-300000314808val:A4.875SeniorNotesDue2022MemberMember2020-11-302020-11-300000314808val:FourPointFiveZeroPercentSeniorNotesDueTwoThousandTwentyFourMember2020-11-302020-11-300000314808val:A4.75SeniorNotesDue2024MemberMember2020-11-302020-11-300000314808val:EightPointZeroPercentSeniorNotesDueTwoThousandTwentyFourMember2020-11-302020-11-300000314808val:FivePointTwoPercentSeniorNotesMember2020-11-302020-11-300000314808val:A7.38SeniorNotesDue2025Member2020-11-302020-11-300000314808val:SevenPointSevenFivePercentSeniorNotesDueTwoThousandTwentySixMember2020-11-302020-11-300000314808val:A5.40SeniorNotesDue2042Member2020-11-302020-11-300000314808val:FivePointSevenFivePercentSeniorNotesMember2020-11-302020-11-300000314808val:A5.85SeniorNotesDue2044Member2020-11-302020-11-3000003148082020-04-152020-04-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): November 30, 2020

Valaris plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

England and Wales

|

1-8097

|

98-0635229

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

110 Cannon Street

London, England EC4N6EU

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: 44 (0) 20 7659 4660

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Class A ordinary shares, U.S. $0.40 par value

|

VAL*

|

|

New York Stock Exchange

|

|

4.70% Senior Notes due 2021

|

VAL21*

|

|

New York Stock Exchange

|

|

4.875% Senior Note due 2022

|

VAL/22*

|

|

New York Stock Exchange

|

|

4.50% Senior Notes due 2024

|

VAL24*

|

|

New York Stock Exchange

|

|

4.75% Senior Note due 2024

|

VAL/24*

|

|

New York Stock Exchange

|

|

8.00% Senior Notes due 2024

|

VAL24A*

|

|

New York Stock Exchange

|

|

5.20% Senior Notes due 2025

|

VAL25A*

|

|

New York Stock Exchange

|

|

7.375% Senior Note due 2025

|

VAL/25*

|

|

New York Stock Exchange

|

|

7.75% Senior Notes due 2026

|

VAL26*

|

|

New York Stock Exchange

|

|

5.4% Senior Note due 2042

|

VAL/42*

|

|

New York Stock Exchange

|

|

5.75% Senior Notes due 2044

|

VAL44*

|

|

New York Stock Exchange

|

|

5.85% Senior Note due 2044

|

VAL/44*

|

|

New York Stock Exchange

|

* On September 4, 2020, the New York Stock Exchange (“NYSE”) filed a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist the Class A ordinary shares of Valaris plc. (“Valaris”). The delisting became effective on September 14, 2020, 10 days after the Form 25 was filed with the SEC by the NYSE. The deregistration of Valaris’ Class A ordinary shares under Section 12(b) of the Exchange Act will be effective 90 days, or such shorter period as the SEC may determine, after filing of the Form 25. Upon deregistration of Valaris’ Class A ordinary shares under Section 12(b) of the Exchange Act, they will remain registered under Section 12(g) of the Exchange Act.

Indicate by check mark whether the registrant is an emerging growth company as defined by Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

|

|

|

|

|

|

|

|

Emerging Growth Company

|

☐

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

As previously disclosed on August 19, 2020, Valaris plc (the “Company”) and 89 of its subsidiaries filed voluntary petitions for reorganization (“Chapter 11 Cases”) under chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”).

The Company previously disclosed in a Form 8-K filed on May 6, 2020 the redesign of its overall compensation program as approved by the Company’s Board of Directors (the “Board”). Pursuant to the new compensation program, a portion of the target total direct compensation for 2020 (other than base salary) for each named executive officer currently employed by the Company will be earned pursuant to quarterly incentive bonuses under the Valaris Cash Incentive Plan during the period following April 1, 2020, based on personal safety, process safety, downtime and expense reductions or such other performance goals as may be approved by the Board.

On November 30, 2020, the Bankruptcy Court approved the Company’s incentive compensation program, which had been amended by the Board to provide for: (i) the extension of the terms of the program until the earlier of June 30, 2021 or the date a new incentive compensation program is established by the Company once it emerges from the Chapter 11 Cases, (ii) the addition of an adjusted EBITDA metric to its performance criteria and (iii) for the program metrics (personal safety, process safety, downtime, annualized expense reductions and adjusted EBITDA) to be measured on a quarterly basis beginning with the fourth quarter of 2020.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Valaris plc

|

|

|

|

|

Date: December 2, 2020

|

/s/ Michael T. McGuinty

|

|

|

Michael T. McGuinty

|

|

|

Senior Vice President and General Counsel

|

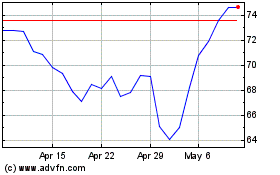

Valaris (NYSE:VAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

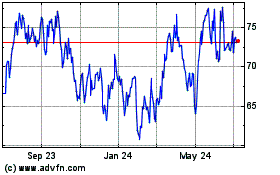

Valaris (NYSE:VAL)

Historical Stock Chart

From Sep 2023 to Sep 2024