Morganti & Co. Reminds Investors That Canada Goose Holdings, INC. Is the Target of Shareholder Litigation Over Alleged Unethi...

September 27 2019 - 1:00PM

Business Wire

Morganti & Co., P.C., a cross border shareholder’s rights

law firm, informs investors that purchased Canada Goose Holdings,

Inc. (NYSE and TSX: “GOOS”), that a shareholder class proceeding

seeking to recover money resulting from the drop in share price on

August 1, 2019, is going forward.

On June 17, 2019, the United States Federal Trade Commission

made public a letter it had sent to GOOS, which stated that GOOS

was under investigation for its advertising practices for possibly

making false or misleading representations about the treatment of

geese whose down is used in GOOS’ apparel. On August 1, 2019, the

New York Post released an article entitled “Canada Goose pulls

claims about its ‘ethical’ treatment of animals”. Upon the release

of these public corrective statements, the price of GOOS’ common

shares listed on the TSX dropped from $61.81 to $56.70 per

share.

Investors that purchased GOOS’ securities between March 1, 2017

and July 31, 2019, may have an opportunity to recover their

financial losses. Investors are encouraged to contact Morganti

& Co. to register their interest and determine their financial

losses, if any. Investors will not be charged for this service.

About Morganti & Co.

You may learn more about Morganti & Co. online at

www.morgantico.com. Since June 1999, Mr. Morganti has represented

investors and is licensed to provide legal opinions about the

Ontario Securities Act and the U.S. federal securities laws.

You may contact Morganti & Co. by email at

info@morgantilegal.com for further information. This press release

may be considered attorney advertising in some jurisdictions under

the applicable law and ethical rules.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190927005417/en/

Morganti & Co. Toronto + Detroit info@morgantilegal.com

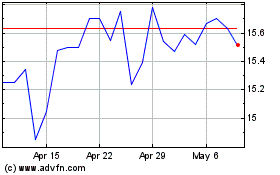

Canada Goose (TSX:GOOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

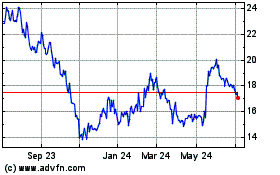

Canada Goose (TSX:GOOS)

Historical Stock Chart

From Sep 2023 to Sep 2024