Additional Proxy Soliciting Materials (definitive) (defa14a)

May 23 2019 - 6:09AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the registrant

☒

Filed by a party other than the registrant

☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

Texas

Pacific Land Trust

(Name of registrant as specified in

its charter)

Payment of the filing fee (check the appropriate box):

|

|

|

|

☒

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities

to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which

transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value

of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state

how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement

No.:

|

|

|

(3)

|

Filing party:

|

|

|

(4)

|

Date filed:

|

On May 22, 2019, the Trust issued the following press release.

Texas Pacific Land Trust Responds to Dissident Group’s Actions

Disputes Validity of Mr. Oliver’s

“Meeting” and Purported Self-Election

DALLAS--(BUSINESS WIRE)--On May 21, 2019,

Texas

Pacific Land Trust (NYSE: TPL) (the “Trust”)

gave notice that the special meeting scheduled to be convened today

has been postponed to address Eric Oliver’s ongoing efforts to mislead the Trust’s shareholders by making materially

misleading statements and failing to disclose material information related to his record and potential conflicts of interest.

Over the past several months, the Trustees have made every effort

to resolve these issues amicably and to obtain the information necessary for all shareholders to evaluate Mr. Oliver’s fitness

to serve as Trustee. As recently as last Thursday, May 16, the Trust’s counsel reached out in writing to Mr. Oliver’s

personal attorney as part of these efforts. Mr. Oliver’s attorney never responded, forcing the Trust to take the step of

postponing the meeting and filing a lawsuit in the U.S. District Court for the Northern District of Texas. In its lawsuit, the

Trust has requested that the court compel Mr. Oliver to correct his misstatements and omissions as soon as possible so that all

shareholders can vote on a fully-informed basis on all the candidates.

Unfortunately, the dissident group continues to mislead shareholders.

This morning, Mr. Oliver and his attorneys purported to convene a “meeting” that they have attempted to pass off as

constituting a special meeting of the Trust’s shareholders. It was not. As the Declaration of Trust clearly provides, shareholder

meetings may only be called after certain requirements are met, including providing notice and following other procedures. Mr.

Oliver’s purported “meeting” was conducted in a secretly-booked conference room with no notice whatsoever provided

to the vast majority of the shareholders.

During his “meeting,” Mr. Oliver refused to take

questions from shareholders before purporting to hold a vote to elect himself as Trustee, even though fewer than half of the Trust’s

outstanding shares were represented at Mr. Oliver’s “meeting.” In light of the Trust’s earlier announcements

that the special meeting would be delayed, holders of millions of shares have not returned

any

proxies yet. It is disappointing

that Mr. Oliver intends to disenfranchise all these shareholders. Equally disconcerting, we believe the dissident group’s

disclosure of the highly confidential interim proxy tally constitutes another serious violation of federal securities laws.

The Trust will announce a new date for the special meeting once

the claims and issues raised in litigation are resolved. As previously announced, all three independent proxy advisory firms –

ISS, Glass Lewis and Egan-Jones – have recommended that shareholders vote FOR General Donald Cook.

Forward-Looking Statements

This release may contain statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements contained in this release, other than statements of historical fact, are “forward-looking

statements” for purposes of these provisions, including statements regarding Texas Pacific’s future operations and

prospects, the markets for real estate in the areas in which Texas Pacific owns real estate, applicable zoning regulations, the

markets for oil and gas, production limits on prorated oil and gas wells authorized by the Railroad Commission of Texas, expected

competitions, management’s intent, beliefs or current expectations with respect to Texas Pacific’s future financial

performance and other matters. Texas Pacific cautions readers that various factors could cause its actual financial and operational

results to differ materially from those indicated by forward-looking statements made from time-to-time in news releases, reports,

proxy statements and other written communications, as well as oral statements made from time to time by representatives of Texas

Pacific. The following factors, as well as any other cautionary language included in this release, provide examples of risks, uncertainties

and events beyond our control that may cause Texas Pacific’s actual results to differ materially from the expectations Texas

Pacific describes in such forward-looking statements: global economic conditions; market prices of oil and gas; the demand for

water services by operators in the Permian Basin; the impact of government regulation; the impact of competition; the continued

service of key management personnel; and other risks and uncertainties disclosed in Texas Pacific’s annual reports on Form

10-K and quarterly reports on Form 10-Q. We undertake no obligation to update publicly or otherwise revise any forward-looking

statements, whether as a result of new information, future events or other factors that affect the subject of these statements,

except where we are expressly required to do so by law.

Contacts:

Media:

Abernathy MacGregor

Sydney Isaacs / Jeremy Jacobs

(713) 343-0427 / (212) 371-5999

sri@abmac.com / jrj@abmac.com

Investor Relations:

MacKenzie Partners

Paul Schulman / David Whissel

(212) 929-5500 or (800) 322-2885

pschulman@mackenziepartners.com

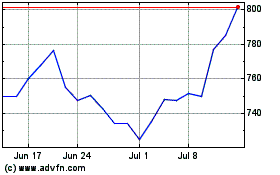

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

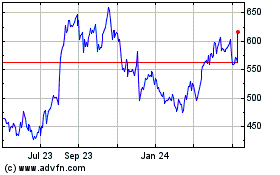

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Sep 2023 to Sep 2024