Revenue Growth and Strong Gross Margin

Expansion Lead to Narrowed Net Loss per Share

Today Phunware, Inc. (NASDAQ: PHUN), a fully-integrated

enterprise cloud platform for mobile that provides products,

solutions, data and services for brands worldwide, announced

financial results for its first quarter ended March 31, 2019, and

provided an update on recent business developments.

First Quarter 2019 Financial

Highlights

- Net revenues

increased 6.7% year-over-year to

$5.3 million

- Platform subscriptions and services

revenue increased 20.4% year-over-year to $4.8 million

- Gross profit margin was 50.8%,

representing 8.4 percentage points higher than the prior

year

- Non-GAAP Adjusted EBITDA improved by

$3.5 million to ($3.2) million, or 52.1% improvement over the prior

year

- Net loss per share improved $0.17

per share to ($0.12) compared to ($0.29), or 58.6%

improvement year-over-year

“We are very excited with the financial performance

underlying our first full quarter as a public company,” said

Alan S. Knitowski, CEO and Co-Founder of Phunware. “Not

only did we achieve continued revenue growth alongside strong gross

margins and lower net losses in the first quarter, but we also

established a positive backdrop for the second quarter as we

anticipate launching our blockchain-enabled data exchange and

mobile loyalty ecosystem in parallel with our new initiatives

specific to patent licensing and intellectual property

monetization.”

First Quarter 2019 Business

Highlights

- Closed new and expansion contracts with

customers from healthcare, media and entertainment, real estate,

political, and travel and hospitality verticals

- Named by Columbia-IBM Center for

Blockchain and Data Transparency as Global Top 10 Category-Winning

Enterprise-Grade Blockchain Business Networks

- Announced data.world and Rifiniti

partnerships, expanding our global partner network for the

data and location services offerings within our

Multiscreen-as-a-Service (MaaS) platform

- Launched the Phunware Phenom

Certified Developer Program, with Applaudo Studios becoming the

first Phunware Phenom Certified Developer

- Awarded 3 patents for (i) Indoor /

Outdoor Mobile Device Location Monitoring, (ii) Enterprise Branded

Application Frameworks for Mobile and Other Environments, and (iii)

Mobile Device Localization Based on Relative Signal Strength

Indicators, bringing our intellectual property portfolio to a total

of 16 awarded patents and 6 patents-pending

- Launched the PhunCoin Launch

Alliance in conjunction with our blockchain-enabled data exchange

and mobile loyalty ecosystem

- Continued a Reg D, 506(c) token sale

for accredited investors, including KYC / AML verification via

CoinList

- Commenced a Reg CF PhunCoin token sale

to unaccredited investors via Republic crowdfunding portal

Safe Harbor Clause and Forward-Looking

Statements:

This press release includes forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding our future

results of operations and financial position, business strategy and

plans, and our objectives for future operations, are

forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “expose,” “intend,”

“may,” “might,” “opportunity,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar

expressions that convey uncertainty of future events or outcomes

are intended to identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements contained in this press release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. Future developments

affecting us may not be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control) and other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described under the heading “Risk

Factors” in our filings with the Securities and Exchange Commission

(SEC), including our reports on Forms 10-K, 10-Q, 8-K and other

filings that we make with the SEC from time to time. Should one or

more of these risks or uncertainties materialize, or should any of

our assumptions prove incorrect, actual results may vary in

material respects from those projected in these forward-looking

statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws. These risks and others described under

“Risk Factors” in our SEC filings may not be exhaustive.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future

performance and that our actual results of operations, financial

condition and liquidity, and developments in the industry in which

we operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if our results or operations, financial condition

and liquidity, and developments in the industry in which we operate

are consistent with the forward-looking statements contained in

this press release, those results or developments may not be

indicative of results or developments in subsequent periods.

Disclosure Information

Phunware uses the investor relations section on its website,

https://www.phunware.com, as a means of complying with its

disclosure obligations under Regulation FD. Accordingly, we

recommend that investors should monitor the investor relations

section on Phunware’s website in addition to following Phunware’s

press releases, SEC filings, and public conference calls and

webcasts.

About Phunware, Inc.

Everything You Need to Succeed on Mobile — Transforming Digital

Human Experience

Phunware, Inc. (NASDAQ: PHUN) is the pioneer of

Multiscreen-as-a-Service (MaaS), a fully integrated enterprise

cloud platform for mobile that provides companies the products,

solutions, data and services necessary to engage, manage and

monetize their mobile application portfolios and audiences globally

at scale. Phunware’s Software Development Kits (SDKs) include

location-based services, mobile engagement, content management,

messaging, advertising, analytics, loyalty and rewards (PhunCoin),

as well as a mobile application framework of pre-integrated iOS and

Android software modules for building in-house or channel-based

mobile application and vertical solutions. Phunware helps the

world’s most respected brands create category-defining mobile

experiences. For more information about how Phunware is

transforming the way consumers and brands interact with mobile in

the virtual and physical worlds, visit https://www.phunware.com and

https://www.phuncoin.com and follow @phunware and @phuncoin on all

social media platforms.

Financial Results

Phunware, Inc.

Condensed Consolidated Balance

Sheets

(In thousands, except per share

information)

March 31, December 31,

2019 2018 Assets: (Unaudited) Current assets:

Cash $ 1,065 $ 844 Accounts receivable, net 2,738 3,606 Prepaid

expenses and other current assets 1,036 272

Total current assets 4,839 4,722 Property and

equipment, net 50 66 Goodwill 25,846 25,821 Intangible assets, net

448 521 Deferred tax asset – long term 64 64 Restricted Cash —

5,500 Other assets 187 187 Total assets

$ 31,434 $ 36,881

Liabilities, redeemable

convertible preferred stock, and stockholders’ equity Current

liabilities: Accounts payable $ 8,600 $ 9,890 Accrued expenses

2,968 3,028 Deferred revenue 2,904 2,629 Factored receivables

payable 1,631 2,434 Short term notes payable - related party

— 1,993 Total current liabilities 16,103

19,974 Deferred tax liability 64 64 Deferred revenue 4,447

5,622 Deferred rent 13 17 Total

liabilities 20,627 25,677

Commitments and contingencies — — Redeemable convertible preferred

stock, $0.0001 par value — 5,377

Stockholders’ equity

Common stock, $0.0001 par value 4 3 Additional paid in capital

125,421 118,062 Accumulated other comprehensive loss (391 ) (418 )

Accumulated deficit (114,227 ) (111,820 ) Total

stockholders’ equity 10,807 5,827 Total

liabilities, redeemable convertible preferred stock, and

stockholders’ equity $ 31,434 $ 36,881

Phunware, Inc.

Condensed Consolidated Statements of

Operations and Comprehensive Loss

(In thousands, except per share

information)

(Unaudited)

Three Months Ended March 31,

2019 2018 Net revenues $ 5,315 $ 4,980

Cost of revenues 2,617 2,867 Gross

profit 2,698 2,113 Operating expenses: Sales and marketing

724 1,919 General and administrative 3,975 4,488 Research and

development 1,309 2,300 Total operating

expenses 6,008 8,707 Operating loss

(3,310 ) (6,594 ) Other income (expense): Interest expense

(188 ) (202 ) Fair value adjustment for warrant liabilities — (54 )

Impairment of digital currencies — (313 ) Other income (expense)

4 (1 ) Total other expense (184 )

(570 ) Loss before taxes (3,494 ) (7,164 ) Income tax

benefit — — Net loss (3,494 ) (7,164 )

Other comprehensive income Cumulative translation adjustment

27 54 Comprehensive loss $ (3,467 ) $ (7,110 )

Net loss per share, basic and diluted $ (0.12 ) $ (0.29 )

Weighted-average shares used to compute net loss per share, basic

and diluted 30,264 24,952

Non-GAAP Financial Measures and

Reconciliation

Adjusted EBITDA should be considered in addition to, not as a

substitute for, or superior to, financial measures calculated in

accordance with Generally Accepted Accounting Principles in the

United States (“GAAP”). It is not a measurement of our financial

performance under GAAP and should not be considered as an

alternative to revenue or net income (loss), as applicable, or any

other performance measures derived in accordance with GAAP and may

not be comparable to other similarly titled measures of other

businesses. Adjusted EBITDA has limitations as an analytical tool

and should not be considered in isolation or as a substitute for

analysis of our operating results as reported under GAAP. Some of

these limitations include: (i) Non-cash compensation is and will

remain a key element of our overall long-term incentive

compensation package, although we exclude it as an expense when

evaluating its ongoing operating performance for a particular

period, (ii) Adjusted EBITDA does not reflect the impact of certain

cash charges resulting from matters we consider not to be

indicative of ongoing operations, and (iii) other companies in our

industry may calculate Adjusted EBITDA differently than we do,

limiting their usefulness as comparative measures.

We compensate for these limitations to Adjusted EBITDA by

relying primarily on its GAAP results and using Adjusted EBITDA

only for supplemental purposes. Adjusted EBITDA includes

adjustments for items that may not occur in future periods.

However, we believe these adjustments are appropriate because the

amounts recognized can vary significantly from period to period, do

not directly relate to the ongoing operations of our business and

complicate comparisons of our internal operating results and

operating results of other peer companies over time. Each of the

normal recurring adjustments and other adjustments described in

this paragraph help management with a measure of our operating

performance over time by removing items that are not related to

day-to-day operations or are non-cash expenses.

Phunware, Inc.

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands)

(Unaudited)

Three Months EndedMarch

31,

2019 2018 Net loss $ (3,494 ) $ (7,164 ) Add back:

Depreciation and amortization 91 124 Add back: Interest expense 188

202 Less: Income tax benefit - - EBITDA

(3,215 ) (6,838 ) Add Back: Stock-based compensation 11

149 Adjusted EBITDA $ (3,204 ) $ (6,689 )

Phunware, Inc.

Supplemental Information

(In thousands, except percentages)

(Unaudited)

Three Months Ended March

31,

Change 2019 2018 Amount

% Revenue Platform subscriptions and services

$ 4,821 $ 4,004 $ 817 20.4 % Application transaction 494

976 (482 ) (49.4 )% Total revenue $

5,315 $ 4,980 $ 335 6.7 % Platform subscriptions and services as a

percentage of total revenue 90.7 % 80.4 % Application transactions

as a percentage of total revenue 9.3 % 19.6 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190515005371/en/

PR & Media Inquiries:Sarah

Millersmiller@axis-entertainment.comT: 310 276.2220

Investor Relations:Phunware,

Inc.investorrelations@phunware.comT: 512 693.4199

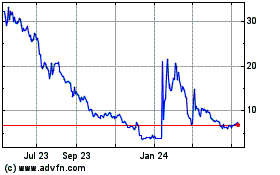

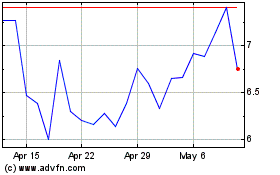

Phunware (NASDAQ:PHUN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Phunware (NASDAQ:PHUN)

Historical Stock Chart

From Sep 2023 to Sep 2024