PG&E Stock Rises as Regulator Mulls Utility's Future -- 3rd Update

November 16 2018 - 6:30PM

Dow Jones News

By Katherine Blunt and Russell Gold

Shares of PG&E Corp. rallied Friday on hopes that California

officials would move to rescue the utility from potential wildfire

liability costs that threaten to drive it into bankruptcy.

But state legislators gave little indication of whether they

would propose a way to let PG&E pass costs from liability

lawsuits stemming from this year's fires to customers, a likely

necessity to ensure the company's solvency.

The stock's rebound came after California's top energy regulator

late Thursday indicated an openness to letting the utility bill

customers for some of those costs, a signal that boosted PG&E

by nearly 38% on Friday, to close at $24.40.

The share price had fallen for six consecutive days on concerns

that PG&E, already facing billions of dollars in potential

liability costs from 2017 wildfires, could face even higher costs

related to this year's Camp Fire in Northern California, which has

killed more than 60 people, making it the deadliest wildfire in

state history.

Michael Picker, president of the California Public Utilities

Commission, said in an interview Thursday that he preferred that

PG&E not enter into bankruptcy because it could raise its cost

of borrowing, which could end up raising energy costs for its

customers. "It is generally not good policy for utilities to go

into bankruptcy," he said.

The utility, which is based in San Francisco, disclosed late

last week that a problem occurred on one of its high-voltage power

lines in Northern California 15 minutes before the start of the

Camp Fire was reported in the area on Nov. 8. No definitive

connection between the line outage and the fire has been made, and

California fire investigators will likely take months to make a

final determination.

PG&E, which has stressed that the cause of the fire hasn't

been determined, welcomed the state's efforts to help it stabilize.

Spokeswoman Lynsey Paulo said, "We agree with CPUC President

Picker's statement that an essential component of providing safe

electrical service is long-term financial stability. Access to

affordable capital is critical to carrying out safety measures and

meeting California's bold clean-energy goals."

The state earlier this year passed legislation allowing

utilities to seek approval from the Public Utilities Commission to

securitize a portion of wildfire-related liability by issuing bonds

that would be paid off by their customers.

But as written, the measure applies only to liabilities arising

from wildfires that occurred in 2017. It also offers utilities

expanded protections for liabilities for events in 2019 and beyond,

under certain circumstances. But that leaves a gap for fires this

year.

Mr. Picker said Thursday that attorneys with the commission

believe the measure could be applied to 2018 fires. In a private

conference call hosted by Bank of America on Thursday, he indicated

such an extension could occur without help from the state

legislature -- which helped kick-start the rebound in PG&E

shares.

However, analysts said an extension would almost certainly

require California lawmakers to revise their earlier

legislation.

"The utilities are looking to the legislature to resolve the

2018 hole, not the CPUC," said Timothy Fox, vice president at

Clearview Energy Partners. "You can't interpret a date

differently."

Thus far, California's top lawmakers have remained mostly silent

on what steps the legislature might take to mitigate the liability

costs PG&E could face in the wake of the Camp Fire.

Fire liability has become a major problem for utilities in the

state due to a provision of the California constitution known as

"inverse condemnation." Among other things, the rule puts utilities

on the hook to pay damages resulting from fires sparked by their

equipment, even if they aren't found negligent.

Mr. Picker on Thursday also pledged a review of PG&E's

corporate governance and operations, expanding an existing probe

into its safety practices. He said his agency would consider

breaking up the utility if warranted.

California state Sen. Jerry Hill, the only Democrat in the

legislature's upper house who voted against the measure to help

utilities earlier this year, said he believed the breakup question

should be explored in light of the potential for new liabilities

arising from the Camp Fire.

"The legislature thought PG&E was too big to fail, but I

think they're too big to succeed," Mr. Hill said Friday. "Their

motive for business is profits for shareholders, not safety for

ratepayers."

Mr. Hill added, however, that he thinks the legislature will

likely move to enact a new bill extending the 2017 protection

measures to include damages incurred this year.

Despite Friday's rally, shares in PG&E are trading well

below levels prior to the outbreak of the Camp Fire. The stock is

off more than 45% this year, putting it on track for its worst year

on record.

--Jim Carlton and Kimberly Chin contributed to this article.

Write to Russell Gold at russell.gold@wsj.com

(END) Dow Jones Newswires

November 16, 2018 18:15 ET (23:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

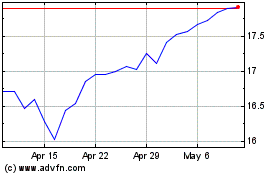

PG&E (NYSE:PCG)

Historical Stock Chart

From Aug 2024 to Sep 2024

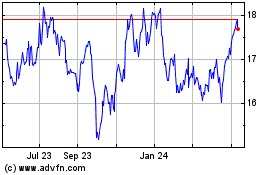

PG&E (NYSE:PCG)

Historical Stock Chart

From Sep 2023 to Sep 2024