Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the third quarter and first nine months of

fiscal 2018.

Nine Months Results

For the first nine months of fiscal 2018 ended March 31, 2018,

revenue increased 13% to $31,601,000 compared to $27,900,000 for

the first nine months of fiscal 2017, reflecting higher revenue in

each of the Company's business segments. Gross margin for the first

nine months of fiscal 2018 increased 10% to $7,787,000, or 25% of

revenue, compared to $7,099,000, or 25% of revenue, for the first

nine months of fiscal 2017.

Income from operations for this year's first nine months

increased 30% to $1,479,000, or 5% of revenue, compared to

$1,140,000, or 4% of revenue, for the same period last year.

Trio-Tech recognized a one-time, non-cash income tax expense of

$900,000, related to the 2017 United States Tax Cuts and Jobs Act,

which requires a mandatory one-time repatriation of certain

earnings and profits of the Company’s foreign subsidiaries

previously deferred from U.S. taxation. This estimated tax is

payable over a period of eight years at no interest and is not

expected to have a material effect on the Company’s working capital

position. After this one-time non-cash tax effect, net income

attributable to Trio-Tech common shareholders for the first nine

months of fiscal 2018 was $509,000, or $0.14 per diluted share.

Shareholders' equity at March 31, 2018 was $23,923,000, or $6.73

per outstanding share, compared to $21,527,000, or $6.11 per

outstanding share, at June 30, 2017. Shareholder’s equity benefited

from a foreign currency translation gain of $1,809,000, compared to

a loss of $1,087,000 for the first nine months last year. There

were approximately 3,553,055 common shares outstanding at March 31,

2018.

Third Quarter Results

For the third quarter of fiscal 2018 ended March 31, 2018,

revenue increased 3% to $10,104,000 compared to revenue of

$9,825,000 for the third quarter last year. A 24% increase in

testing services revenue and a 29% increase in distribution revenue

offset a 26% decrease in manufacturing revenue attributable to a

decrease in orders from a large customer. A change in product mix

in both manufacturing and testing services reduced overall gross

margin to 22% of sales for this year's third quarter, compared to

25% of sales for the third quarter of fiscal 2017.

After the one-time non-cash income tax expense mentioned above,

the net loss for the third quarter of fiscal 2018 was $739,000, or

$0.20 per diluted share.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, "It’s important to emphasize

that income from operations increased 30% for the first nine months

of fiscal 2018, compared to the same period last year and that the

Company would have posted a strong increase in net income, after

excluding the one-time effect of the new U.S. tax act.

"We are encouraged that demand for Trio-Tech's testing and

distribution services remained as robust in the third quarter as it

was in the year's first half. We are working diligently to take

advantage of opportunities for growth. While our fiscal third

quarter results are typically affected by a slowdown in business

activity related to the Chinese New Year and its festivities, we

expect improving business operations in the fourth quarter of

fiscal 2018.

"As always, we are focused on improving operating efficiencies

and reducing costs wherever possible, even as we deliver the

highest standard of service and value to our customers. This

time-tested strategy is viewed as the foundation for Trio-Tech's

continued success in the years ahead."

About Trio-Tech

Established in 1958 and headquartered in Van Nuys, California,

Trio-Tech International is a diversified business group with

interests in semiconductor testing services, manufacturing and

distribution of semiconductor testing equipment, and real estate.

Further information about Trio-Tech's semiconductor products and

services can be obtained from the Company's Web site at

www.triotech.com, www.universalfareast.com, and www.ttsolar.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company's products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications which could affect the market for

the Company's products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Asia, including currency fluctuations and devaluation, currency

restrictions, local laws and restrictions and possible social,

political and economic instability; changes in U.S. and global

financial and equity markets, including market disruptions and

significant interest rate fluctuations; and other economic,

financial and regulatory factors beyond the Company's control.

Other than statements of historical fact, all statements made in

this Quarterly Report are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward looking statements by the use of

terminology such as "may," "will," "expects," "plans,"

"anticipates," "estimates," "potential," "believes," "can impact,"

"continue," or the negative thereof or other comparable

terminology. Forward looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

UNAUDITED (IN THOUSANDS, EXCEPT EARNINGS PER SHARE)

Three Months Ended Nine Months Ended March 31, March

31, Revenue 2018 2017

2018 2017 Manufacturing $ 3,124 $ 4,230

$ 11,862 $ 11,221 Testing Services 4,913 3,977 14,454 12,204

Distribution 2,033 1,581 5,175 4,360 Others 34

37 110 115 10,104

9,825 31,601 27,900 Costs

of Sales Cost of manufactured products sold 2,530 3,345 9,246 8,762

Cost of testing services rendered 3,491 2,597 9,881 8,069 Cost of

distribution 1,821 1,407 4,598 3,899 Others 30

29 89 71 7,872

7,378 23,814 20,801 Gross

Margin 2,232 2,447 7,787 7,099 Operating Expenses: General and

administrative 1,773 1,659 5,339 5,178 Selling 181 222 612 587

Research and development 75 51 377 156 (Gain) Loss on disposal of

property, plant and equipment (31 ) 30

(20 ) 38 Total operating expenses 1,998

1,962 6,308 5,959 Income

from Operations 234 485 1,479 1,140 Other (Expenses) Income

Interest expense (64 ) (43 ) (174 ) (149 ) Other income, net

111 45 311 358

Total other income 47 2 137

209 Income from Continuing Operations before

Income Taxes 281 487 1,616 1,349 Income Tax Expenses (980 )

(106 ) (1,035 ) (256 ) (Loss) Income from

Continuing Operations before Non-controlling Interest, net of tax

(699 ) 381 581 1,093 Loss from Discontinued Operations, net of tax

(6 ) (1 ) (11 ) (4 ) NET (LOSS) INCOME

(705 ) 380 570 1,089 Less: Net Income Attributable to

Non-controlling Interest 34 30

61 126 Net (Loss) Income Attributable to

Trio-Tech International (739 ) 350 509 963 Net (Loss) Income

Attributable to Trio-Tech International: (Loss) Income from

Continuing Operations, net of tax (736 ) 351 520 970 Loss from

Discontinued Operations, net of tax (3 ) (1 )

(11 ) (7 ) Net (Loss) Income Attributable to Trio-Tech

International $ (739 ) $ 350 $ 509 $ 963 Basic

(Loss) Earnings per Share $ (0.21 ) $ 0.10 $ 0.15 $

0.28 Diluted (Loss) Earnings per Share $ (0.20 ) $ 0.10

$ 0.14 $ 0.27 Weighted Average Shares

Outstanding - Basic 3,553 3,523 3,553 3,523 Weighted Average Shares

Outstanding - Diluted 3,772 3,639 3,778 3,577

TRIO-TECH

INTERNATIONAL AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME UNAUDITED (IN THOUSANDS)

Three Months Ended Nine Months Ended

March 31, March 31, 2018 2017

2018 2017 Comprehensive (Loss)

Income Attributable to Trio-Tech International: Net (loss)

income $ (705 ) $ 380 $ 570 $ 1,089 Foreign Currency Translation,

net of tax 849 290 1,809

(1,087 ) Comprehensive (Loss) Income 144 670 2,379 2 Less:

Comprehensive Income (loss) Attributable to Non-controlling

Interest 142 (38 ) 255

(75 ) Comprehensive Income Attributable to Trio-Tech International

$ 2 $ 708 $ 2,124 $ 77

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT NUMBER OF SHARES)

Mar. 31, Jun. 30, 2018 2017

ASSETS (unaudited) CURRENT ASSETS: Cash and cash equivalents

$ 5,376 $ 4,772 Short-term deposits 678 787 Trade accounts

receivable, net 8,617 9,009 Other receivables 392 401 Inventories,

net 2,369 1,756 Prepaid expenses and other current assets 219 226

Asset held for sale 96 86 Total current assets 17,747

17,037 Deferred tax assets 453 375 Investment properties,

net 1,231 1,216 Property, plant and equipment, net 12,881 11,291

Other assets 2,315 1,922 Restricted term deposits 1,761

1,657 Total non-current assets 18,641 16,461

TOTAL ASSETS $ 36,388 $ 33,498

LIABILITIES AND

SHAREHOLDER'S EQUITY CURRENT LIABILITIES: Lines of credit $

1,311 $ 2,556 Accounts payable 2,099 3,229 Accrued expenses 4,648

3,043 Income taxes payable 1,117 233 Current portion of bank loans

payable 376 260 Current portion of capital leases 260

228 Total current liabilities 9,811 9,549 Bank loans

payable, net of current portion 1,593 1,552 Capital leases, net of

current portion 614 531 Deferred tax liabilities 404 295 Other

non-current liabilities 43 44 Total non-current

liabilities 2,654 2,422 TOTAL LIABILITIES

12,465 11,971 EQUITY TRIO-TECH INTERNATIONAL'S SHAREHOLDERS'

EQUITY: Common stock, no par value, 15,000,000 shares authorized;

3,553,055 and 3,523,055 shares issued and outstanding at March 31,

2018 and June 30, 2017, respectively 11,023 10,921 Paid-in capital

3,246 3,206 Accumulated retained earnings 4,850 4,341 Accumulated

other comprehensive gain-translation adjustments 3,248

1,633 Total Trio-Tech International shareholders' equity

22,367 20,101 Non-controlling interest 1,556 1,426

TOTAL EQUITY 23,923 21,527 TOTAL LIABILITIES AND

EQUITY $ 36,388 $ 33,498

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180518005010/en/

Company Contact:Trio-Tech InternationalA. Charles

WilsonChairman(818) 787-7000orInvestor Contact:Berkman

Associates(310) 477-3118info@BerkmanAssociates.com

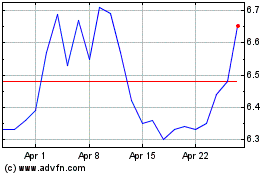

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Aug 2024 to Sep 2024

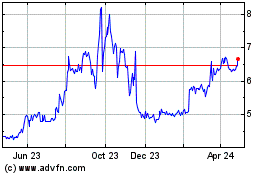

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Sep 2023 to Sep 2024