TIDMTSCO

RNS Number : 6237N

Tesco PLC

10 May 2018

10 May 2018

Tesco PLC

Annual Report and Financial Statements and Notice of Annual

General Meeting 2018

Further to the release of its preliminary results announcement

on 11 April 2018, Tesco PLC (the "Company") announces that it has

today published its Annual Report and Financial Statements 2018. In

addition, the Company announces that its Notice of Annual General

Meeting 2018 has been sent to shareholders. The 2018 Annual General

Meeting will be held at ExCeL London, One Western Gateway, Royal

Victoria Dock, London E16 1XL at 2.00 p.m. on Friday 15 June

2018.

The Company's Annual Report and Financial Statements 2018,

Strategic Report 2018 and Notice of Annual General Meeting 2018 can

be viewed on the Company's website at www.tescoplc.com.

In accordance with Listing Rule 9.6.1R, copies of the following

documents have been submitted to the National Storage Mechanism and

will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM:

-- Annual Report and Financial Statements 2018;

-- Strategic Report 2018;

-- Notice of Annual General Meeting 2018; and

-- Proxy Form for the 2018 Annual General Meeting.

The Company's preliminary consolidated financial information and

information on important events that have occurred during the year,

and their impact on the financial statements were included in the

Company's preliminary results announcement on 11 April 2018. That

information, together with the information set out below, which is

extracted from the Annual Report and Financial Statements 2018,

constitute regulated information, which is to be communicated to

the media in full unedited text through a Regulatory Information

Service in accordance with the FCA's Disclosure Guidance and

Transparency Rules ("DTR"), Rule 6.3.5R. This announcement is not a

substitute for reading the full Annual Report and Financial

Statements 2018. Page and note references in the text below refer

to page numbers and note references in the Annual Report and

Financial Statements 2018. To view the preliminary results

announcement, visit the Company's website: www.tescoplc.com.

Enquiries: Robert Welch

Company Secretary

Tesco PLC

Tesco House

Shire Park

Kestrel Way

Welwyn Garden City

Hertfordshire

AL7 1GA

Tel: 07793 222569

LEI Number: 2138002P5RNKC5W2JZ46

Principal risks and uncertainties

We have an established risk management process to identify,

assess and monitor the principal risks that we face as a business.

We have performed a robust review of those risks that we believe

could seriously affect the Group's performance, future prospects,

reputation or its ability to deliver against its priorities. This

review included an assessment of those risks that we believe would

threaten the Group's business model, future performance, solvency

or liquidity.

Following the review of the principal risks and our strategic

drivers we have included two additional shorter-term risks. These

relate to the ongoing uncertainty and approach to Brexit, and the

timely synergy realisation and integration of Booker into the wider

Group, set out on pages 24 and 25. Additionally, we have reframed

our product safety and supply chain risks, currently reflected at

the business unit level to form a new principal risk responsible

sourcing and supply chain, set out on page 24. This risk relates to

the social and environmental challenges facing our business, our

customers and our communities. Our approach is outlined in our

Little Helps Plan on pages 16 to 21.

The risk management process relies on our assessment of the risk

likelihood and impact and on the development and monitoring of

appropriate internal controls. Our process for identifying and

managing risk is set out in more detail on page 43.

We maintain risk registers for the principal risks faced by the

Group and this is an important component of our governance

framework and how we manage our business. As part of our risk

management process, risks are reviewed as a top down and bottom up

activity at the Group and the business unit level. The content of

the risk registers are considered and discussed through regular

meetings with senior management and reviewed by the Executive

Committee. Each principal risk is reviewed at least annually by the

Board.

The table below sets out our principal risks, their link to our

strategic drivers, their movement during the year and a summary of

key controls as well as any mitigating factors. The Board considers

these to be the most significant risks faced by the Group that may

impact the achievement of our six strategic drivers as set out on

pages 8 and 9. They do not comprise all of the risks associated

with our business and are not set out in priority order. Additional

risks not presently known to management, or currently deemed to be

less material, may also have an adverse effect on the business.

Principal risk Risk movement Key controls and mitigating

factors

-------------------------------- ----------------------------- --------------------------------

Customer

-------------------------------------------------------------------------------------------------

Failure to have a Ongoing fragmentation We now have a more

coherent, connected of our customer engagement consistent approach

and engaging customer channels exposes us to building impactful

journey and in-store to an increased risk customer propositions,

experience will lead of diluting our customer offering high quality,

us to be less competitive experience and ability competitive value,

and lose market share. to differentiate our while improving the

brand. customer experience.

Strategic drivers: Propositions are now

1. A differentiated developed across channels

brand Risk increasing and geographies to

2. Reduce operating ensure consistency

costs by GBP1.5bn in the engagement

3. Generate GBP9bn with customers. Group-wide

cash from operations customer insight management

4. Maximise the mix is undertaken to understand

to achieve a 3.5% customer behaviour,

- 4.0% margin expectations and experience,

6. Innovation and leverage more

consistently across

the different parts

of the business.

We monitor the effectiveness

of our processes by

regular tracking of

our business, and

those of our competitors,

against measures that

customers tell us

are important to their

shopping experience.

We have well established

product development

and quality management

processes, which keep

the needs of our customers

central to our decision

making.

-------------------------------- ----------------------------- --------------------------------

Transformation

-------------------------------------------------------------------------------------------------

Failure to achieve Achieving our transformation We have multiple transformation

our transformation goals continues to programmes underway

objectives due to demand further effort to simplify our business

poor prioritisation, and investment, especially with clear market

ineffective change with regard to technology strategies and business

management and a failure changes, as both internal plans in place. Our

to understand and and external expectations service model processes

deliver the technology have increased. provide a framework

required, resulting for implementing change.

in an inability to We have appropriate

progress sufficiently Risk increasing executive level oversight

quickly to maintain for all the transformation

or increase operating activities.

margin and generate

sufficient cash to Transformation programmes

meet business objectives. are supported by experienced

resources from within

the business and externally

Strategic drivers: as required.

2. Reduce operating

costs by GBP1.5bn

3. Generate GBP9bn

cash from operations

4. Maximise the mix

to achieve a 3.5%

- 4.0% margin

6. Innovation

-------------------------------- ----------------------------- --------------------------------

Liquidity

-------------------------------------------------------------------------------------------------

Failure of our business We have a disciplined We maintain an infrastructure

performance to deliver and policy-based approach of systems, policies

cash as expected; to treasury management. and reports to ensure

access to funding We have reduced our discipline and oversight

markets or facilities debt levels and have on liquidity matters,

is restricted; failures improving debt metrics. including specific

in operational liquidity Liquidity levels and treasury and debt-related

and currency risk sources of cash are issues. Our treasury

management; Tesco regularly reviewed policies are communicated

Bank cash call; or and the Group maintains across the Group and

adverse changes to access to committed are regularly reviewed

the pension deficit credit facilities. by the Board, Executive

funding requirement, Committee and management.

create calls on cash

higher than anticipated, Risk decreasing The Group's funding

leading to impacts strategy is approved

on financial performance, annually by the Board

cash liquidity or and includes maintaining

the ability to continue appropriate levels

to fund operations. of working capital,

undrawn committed

Strategic drivers: facilities and access

2. Reduce operating to the capital markets.

costs by GBP1.5bn The Audit Committee

3. Generate GBP9bn reviews and approves

cash from operations annually the viability

4. Maximise the mix and going concern

to achieve a 3.5% statements and reports

- 4.0% margin into the Board.

5. Maximise value

from property There is a long-term

funding framework

in place for the pension

deficit and there

is ongoing communication

and engagement with

the Pension Trustees.

While recognising

that Tesco Bank is

financially separate

from Tesco PLC, there

is ongoing monitoring

of the activities

of Tesco Bank that

could give rise to

risks to Tesco PLC.

-------------------------------- ----------------------------- --------------------------------

Competition and markets

-------------------------------------------------------------------------------------------------

Failure to deliver We continue to face Our Board actively

an effective, coherent the ongoing challenge develops and regularly

and consistent strategy of a changing competitive challenges the strategic

to respond to our landscape and price direction of our business

competitors and changes pressure across most and we actively seek

in macroeconomic conditions of our markets. to be competitive

in the operating environment, on price, range and

resulting in a loss service, as well as

of market share and No risk movement developing our online

failure to improve and multiple formats

profitability. to allow us to compete

in different markets.

Strategic drivers:

1. A differentiated Our Executive Committee

brand and operational management

2. Reduce operating regularly review markets,

costs by GBP1.5bn trading opportunities,

6. Innovation competitor strategy

and activity and,

additionally, we engage

in market scanning

and competitor analysis

to refine our customer

proposition.

-------------------------------- ----------------------------- --------------------------------

Brand, reputation and trust

-------------------------------------------------------------------------------------------------

Failure to create A broad range of factors We continue to develop

brand reappraisal impact our brand, communication and

opportunities to improve reputation and trust engagement programmes

quality, value and in the year and, on to listen to our customers

service perceptions balance, the level and stakeholders and

thus failing to rebuild of risk remains unchanged. reflect their needs

trust in our brand. in our plans. This

includes the supplier

Strategic driver: No risk movement viewpoint programme

1. A differentiated and the integration

brand of local community

and local marketing

programmes. We continue

to maximise the value

and impact of our

brand with the advice

of specialist external

agencies and in-house

marketing expertise.

Maintaining a differentiated

brand is one of our

strategic priorities

and our Group processes,

policies and our Code

of Business Conduct

sets out how we can

make the right decisions

for our customers,

colleagues, suppliers,

communities and investors.

Our Corporate Responsibility

Committee is in place

to oversee all corporate

responsibility activities

and initiatives ensuring

alignment with customer

priorities and our

brand. Further details

can be found on page

39.

-------------------------------- ----------------------------- --------------------------------

Technology

-------------------------------------------------------------------------------------------------

Failure of our IT Our technology landscape We continue to assess

infrastructure or continues to require our technology resilience

key IT systems result further investment capabilities and have

in loss of information, as external threats identified opportunities

inability to operate increase and the challenges to make significant

effectively, financial around securing the enhancements. We are

or regulatory penalties right capability to progressing greater

and negatively impacts deliver change continues. adoption of cloud

our reputation. Failure computing technologies

to build resilience to provide further

capabilities at the Risk increasing resilience.

time of investing

in and implementing We have combined governance

new technology. processes covering

both technology disaster

Strategic drivers: recovery and business

1. A differentiated continuity to ensure

brand alignment.

6. Innovation

Our technology security

programme is designed

to continuously strengthen

our infrastructure

and Information Technology

General Controls.

-------------------------------- ----------------------------- --------------------------------

Data security and data privacy

-------------------------------------------------------------------------------------------------

Failure to comply We continue to enhance Our multi-year data

with legal or regulatory our data security security programme

requirements relating to keep pace with has been driving the

to data security or increasing threats enhancement of our

data privacy in the on a global scale. security capabilities.

course of our business As a retail organisation We continue to work

activities, results we hold a large amount towards meeting regulatory

in reputational damage, of data and are working requirements and regularly

fines or other adverse to ensure we comply report the status

consequences, including with the General Data of the security programme

criminal penalties Protection Regulations. to governance and

and consequential oversight committees.

litigation, adverse

impact on our financial No risk movement We have established

results or unfavourable a team to detect,

effects on our ability report and respond

to do business. to security incidents

in a timely fashion.

Strategic drivers: We have a third-party

1. A differentiated supplier assurance

brand programme focusing

6. Innovation on data security and

privacy risks.

We are making significant

investment across

the Group to ensure

we comply with the

requirements of the

General Data Protection

Regulation (GDPR)

in Europe, and any

other relevant legislation

globally. We put our

customers and our

colleagues at the

heart of all decisions

we make in relation

to the processing

of personal data.

Our privacy compliance

programme, driven

by the Group Privacy

Officer continues

to drive compliance

throughout our global

business.

-------------------------------- ----------------------------- --------------------------------

Political, regulatory and compliance

-------------------------------------------------------------------------------------------------

Failure to comply We continue to monitor Wherever we operate,

with legal and other and improve our controls we aim to ensure that

requirements as the to ensure we comply the impact of political

regulatory environment with legal and regulatory and regulatory changes

becomes more restrictive, requirements across is incorporated in

due to changes in the Group. Given the our strategic planning.

the global political ongoing uncertainty We manage regulatory

landscape, results around Brexit, we risks through the

in fines, criminal have separated this use of our risk management

penalties for Tesco out as an independent framework and we have

or colleagues, consequential risk for the current implemented compliance

litigation and an year. programmes to manage

adverse impact on our most important

our reputation, financial risks (e.g. bribery

results, and/or our No risk movement and competition law).

ability to do business.

Our compliance programmes

Long-term changes ensure that sustainable

in the global political controls are implemented

environment mean that to mitigate the risk

in some markets there and we conduct assurance

is a push towards activities for each

greater regulation risk area.

of foreign investors

and a favouring of Our Code of Business

local companies. Conduct is supported

by new starter and

Strategic driver: annual compliance

1. A differentiated training and other

brand tools such as our

whistleblowing hotline.

The engagement of

leadership and senior

management is critical

in the successful

management of this

risk area and leaders

provide clear tone

from the top for colleagues.

-------------------------------- ----------------------------- --------------------------------

Healthy and safety

-------------------------------------------------------------------------------------------------

Failure to meet safety We continue to focus We have a business-wide,

standards in relation our efforts on controls risk-based safety

to workplace, resulting which ensure colleague framework which defines

in death or injury and customer safety. how we implement safety

to our colleagues controls to ensure

or third parties. that colleagues, contractors

No risk movement and customers have

Strategic driver: a safe place to work

1. A differentiated and shop.

brand

Each business is required

to maintain a Safety

Improvement Plan to

document and track

enhancements. Overall

governance is provided

by the Group Risk

and Compliance Committee,

with each business

unit operating their

own Health and Safety

Committee.

Our annual colleague

survey programme allows

us to measure safety

behaviour improvements

Group-wide. The survey

results alongside

other inputs through

the year, informs

the delivery of safety

initiatives and targeted

communications.

-------------------------------- ----------------------------- --------------------------------

People

-------------------------------------------------------------------------------------------------

Failure to attract We continue to operate We seek to understand

and retain the required in a fast changing and respond to colleagues'

capability and continue and complex legislative needs by listening

to evolve our culture environment. Market to their feedback

could impact delivery competitiveness and from open conversations,

of our purpose and volatility affects social media, colleague

strategic drivers. our ability to attract surveys and performance

and retain key specialist reviews.

Strategic drivers: talent thereby increasing

1. A differentiated this risk. Talent planning and

brand people development

6. Innovation processes are well

Risk increasing established across

the Group. Talent

and succession planning

is discussed annually

by the Board and three

times a year at the

Executive Committee

and Nominations and

Governance Committee.

The Remuneration Committee

agrees objectives

and remuneration arrangements

for senior management,

and the current remuneration

policy is due for

review at this year's

Annual General Meeting.

There is a change

programme in place,

supported by Executive

Committee and Audit

Committee governance,

to deliver technology

and processes that

are simple, helpful

and trusted to all

our markets.

-------------------------------- ----------------------------- --------------------------------

Responsible sourcing and supply chain

-------------------------------------------------------------------------------------------------

Failure to meet product New principal risk We have product standards,

safety standards resulting policies and guidance

in death, injury or covering both food

illness to customers. and non-food, as well

Failure to ensure as goods and services

that products are not for resale, ensuring

sourced responsibly that products are

and sustainably across safe, legal and of

the supply chain (including the required quality,

fair pay for workers, and that the human

adhering to human rights of workers

rights, clean and are respected and

safe working environments environmental impacts

and that all social are managed responsibly.

and environmental Refer to pages 16

standards are met), to 21 for specific

leading to breaches actions highlighted

of regulations, illness, under our Little Helps

injury or death to Plan.

workers and communities.

Supplier audit programmes

Strategic drivers: are in place to monitor

1. A differentiated product safety, traceability

brand and integrity, human

6. Innovation rights and environmental

standards, including

unannounced specification

inspections of suppliers

and facilities.

We run colleague training

programmes on food

and product safety,

responsible sourcing,

hygiene controls and

provide support for

stores. We also provide

targeted training

for colleagues and

suppliers dealing

with specific challenges

such as modern slavery.

Our store audit programme

seeks to ensure we

comply with safety

and legal requirements.

-------------------------------- ----------------------------- --------------------------------

Booker synergy realisation and integration

-------------------------------------------------------------------------------------------------

Failure to successfully New principal risk A detailed synergy

integrate Booker is realisation and integration

dependent upon a number plan is being implemented

of factors, leading with period-end reporting

to a risk to our planned and tracking of targeted

synergy commitments benefits and key performance

and value creation. indicators.

Strategic drivers: For further information

1. A differentiated on the Tesco and Booker

brand merger see page 7.

2. Reduce operating

costs by GBP1.5bn

3. Generate GBP9bn

cash from operations

4. Maximise the mix

to achieve a 3.5%

- 4.0% margin

5. Maximise value

from property

6. Innovation

-------------------------------- ----------------------------- --------------------------------

Brexit

-------------------------------------------------------------------------------------------------

Failure to prepare New principal risk The nature of the

for the UK's departure UK's future trading

from the EU causes relationship with

disruption to and the EU is still to

creates uncertainty be determined. We

around our business continue to contribute

including: our ability to important public

to recruit; as well policy discussions

as impacting our relationships and engage with government,

with existing and regulatory bodies

future customers, and industry.

suppliers and colleagues.

These disruptions As further details

and uncertainties of the terms of our

could have an adverse departure from the

effect on our business, EU emerge, we will

financial results continue to assess

and operations. and monitor the potential

risks and impacts

Strategic driver: of these on Tesco

1. A differentiated customers, colleagues

brand and shareholders and

take appropriate measures.

-------------------------------- ----------------------------- --------------------------------

Tesco Bank

-------------------------------------------------------------------------------------------------

Tesco Bank is exposed The Bank continues The Bank has a defined

to a number of risks, to actively manage risk appetite, which

the most significant the risks to which is approved and reviewed

of which are operational it is exposed. regularly by both

risk, regulatory risk, the Bank's Board and

credit risk, capital No risk movement the Tesco PLC Board.

risk, funding and The risk appetite

liquidity risk, market defines the type and

risk and business amount of risk that

risk. the Group is prepared

to accept to achieve

Strategic driver: its objectives and

1. A differentiated forms a key link between

brand the day-to-day risk

management of the

business and its strategic

priorities, long-term

plan, capital planning

and liquidity management.

Adherence to risk

appetite is monitored

through a series of

ratios and limits.

The Bank operates

a risk management

framework that is

underpinned by governance,

policies, processes

and controls, reporting,

assurance and stress

testing.

There is Bank Board

risk reporting throughout

the year, with updates

to the Tesco PLC Audit

Committee by the Bank's

Chief Financial Officer,

Chief Risk Officer

and Audit Committee

Chairman. A member

of the Tesco PLC Board

is also a member of

the Bank's Board.

-------------------------------- ----------------------------- --------------------------------

Indicates that the principal risk has been included as part of

the longer term viability scenarios.

Related Party Transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

joint ventures and associates are disclosed below:

Transactions

Joint ventures Associates

----------------- --------------

2018 2017 2018 2017

GBPm GBPm GBPm GBPm

-------------------------------- -------- ------- ------ ------

Sales to related parties 474 418 - -

-------------------------------- -------- ------- ------ ------

Purchases from related parties 396 416 18 16

-------------------------------- -------- ------- ------ ------

Dividends received 15 17 11 11

-------------------------------- -------- ------- ------ ------

Injection of equity funding 21 - - -

-------------------------------- -------- ------- ------ ------

Sales to related parties consists of services/management fees

and loan interest.

Purchases from related parties include GBP275m (2017: GBP286m)

of rentals payable to the Group's joint ventures (including those

joint ventures formed as part of the sale and leaseback

programme).

Transactions between the Group and the Group's pension plans are

disclosed in Note 27.

Balances

Joint ventures Associates

----------------- ---------------------

2018 2017 2018 2017

GBPm GBPm GBPm GBPm

---------------------------------- -------- ------- ------------- ------

Amounts owed to related parties 20 17 - -

---------------------------------- -------- ------- ------------- ------

Amounts owed by related parties 27 16 - -

---------------------------------- -------- ------- ------------- ------

Loans to related parties (net

of deferred profits)* 138 137 - -

---------------------------------- -------- ------- ------------- ------

Loans from related parties (Note

21) 6 6 - -

---------------------------------- -------- ------- ------------- ------

* Loans to related parties of GBP138m (2017: GBP137m) are

presented net of deferred profits of GBP54m (2017: GBP54m)

historically arising from the sale of property assets to joint

ventures.

A number of the Group's subsidiaries are members of one or more

partnerships to whom the provisions of the Partnerships (Accounts)

Regulations 2008 (Regulations) apply. The financial statements for

those partnerships have been consolidated into these financial

accounts pursuant to Regulation 7 of the Regulations.

Transactions with key management personnel

Members of the Board of Directors and Executive Committee of

Tesco PLC are deemed to be key management personnel.

Key management personnel compensation for the financial year was

as follows:

2018 2017

GBPm GBPm

------------------------------------------------- ------ ------

Salaries and short-term benefits 17 13

------------------------------------------------- ------ ------

Pensions and cash in lieu of pensions 2 2

------------------------------------------------- ------ ------

Share-based payments 19 17

------------------------------------------------- ------ ------

Joining costs and loss of office costs 4 1

------------------------------------------------- ------ ------

42 33

------------------------------------------------- ------ ------

Attributable to:

------------------------------------------------- ------ ------

The Board of Directors (including Non-executive

Directors) 12 12

------------------------------------------------- ------ ------

Executive Committee (members not on the

Board of Directors) 30 21

------------------------------------------------- ------ ------

42 33

------------------------------------------------- ------ ------

Of the key management personnel who had transactions with Tesco

Bank during the financial year, the following are the balances at

the financial year end:

Credit card, mortgage Current and saving

and personal loan balances deposit accounts

-------------------------------- ---------------------------------

Number of key management GBPm Number of key management GBPm

personnel personnel

---------------- ------------------------- ----- ------------------------- ------

At 24 February

2018 7 1 5 -

---------------- ------------------------- ----- ------------------------- ------

At 25 February

2017 6 1 4 -

---------------- ------------------------- ----- ------------------------- ------

Statement of Directors' responsibilities

In compliance with DTR 4.1.12R, the Annual Report and Financial

Statements 2018 contains a Directors' responsibility statement.

This is reproduced below, in line with DTR 6.3.5R. The statement

relates to and is extracted from the Annual Report and Financial

Statements 2018 and does not attach to the extracted information

presented in this announcement or the preliminary results

announcement released on 11 April 2018.

The Directors are required by the Companies Act 2006 to prepare

financial statements for each financial year that give a true and

fair view of the state of affairs of the Group and the Company as

at the end of the financial year, and of the profit or loss of the

Group for the financial year. Under that law, the Directors are

required to prepare the Group financial statements in accordance

with International Financial Reporting Standards (IFRS) as adopted

by the European Union (EU) and have elected to prepare the Parent

Company financial statements in accordance with United Kingdom

Generally Accepted Accounting Practice, including FRS 101 'Reduced

Disclosure Framework' (UK Accounting Standards and applicable

law).

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether IFRSs as adopted by the EU and applicable UK

Accounting Standards have been followed, subject to any material

departures disclosed and explained in the Group and Parent Company

financial statements respectively;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRS are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- prepare the financial statements on the going concern basis,

unless it is inappropriate to presume that the Group and the

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group and the Company, and which enable

them to ensure that the financial statements and the Directors'

remuneration report comply with the Companies Act 2006 and, as

regards the Group financial statements, Article 4 of the IAS

Regulation. They also have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Group and the Company, and to prevent and detect fraud and other

irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions. The Directors

consider that the Annual Report and Financial Statements, taken as

a whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Group's and

the Company's performance, business model and priorities. Each of

the Directors, whose names and functions are set out on pages 28

and 29 confirm that, to the best of their knowledge:

-- the financial statements, which have been prepared in

accordance with the relevant financial reporting framework, give a

true and fair view of the assets, liabilities, financial position

and profit or loss of the Group and the undertakings included in

the consolidation taken as a whole; and

-- the Strategic report contained within this document includes

a fair review of the development and performance of the business

and the position of the Group and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that the Group faces.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLIFEEEIIILIT

(END) Dow Jones Newswires

May 10, 2018 02:01 ET (06:01 GMT)

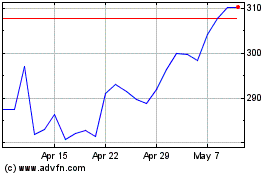

Tesco (LSE:TSCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

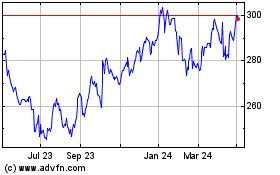

Tesco (LSE:TSCO)

Historical Stock Chart

From Sep 2023 to Sep 2024