NET REVENUE FROM SALES OF AGRICULTURAL PRODUCTS

|

Net Revenue (R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Total

|

17.907

|

14.946

|

20%

|

149.491

|

72.693

|

106%

|

|

Farms Sale

|

-

|

3.854

|

-100%

|

-

|

3.854

|

-100%

|

|

Soybean

|

16.957

|

8.727

|

94%

|

23.552

|

14.946

|

58%

|

|

Corn

|

662

|

403

|

64%

|

9.061

|

723

|

1153%

|

|

Sugarcane

|

(294)

|

1.105

|

n.a.

|

111.888

|

50.053

|

124%

|

|

Livestock

|

319

|

-

|

n.a.

|

2.847

|

-

|

n.a.

|

|

Leasing

|

1.041

|

602

|

73%

|

2.964

|

1.420

|

109%

|

|

Services

|

-

|

-

|

n.a.

|

-

|

26

|

-100%

|

|

Others

|

(778)

|

255

|

n.a.

|

(821)

|

1.671

|

n.a.

|

|

|

|

|

|

Tons

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Quantity sold

|

22.302

|

8.717

|

156%

|

1.272.545

|

527.755

|

141%

|

|

Soybean

|

15.741

|

7.752

|

103%

|

22.711

|

13.156

|

73%

|

|

Corn

|

6.561

|

956

|

586%

|

25.029

|

1.372

|

1724%

|

|

Sugarcane

|

-

|

-

|

n.a.

|

1.224.751

|

512.697

|

139%

|

|

Others

|

-

|

9

|

-100%

|

54

|

530

|

-90%

|

In 3Q18, the recorded net revenue from sales was R$17.9 million, with an increase in volume sold during the period of R$13.5 million compared to the previous year.

Net revenue from grains (soybean and corn) in 9M18 increased by R$16.9 million from the previous year, from R$15.7 million, from the sale of 14,500 tons, to R$32.6 million, from the sale of 47,700 tons.

Soybean revenue increased by R$8.6 million in 9M18 when compared to the previous year, from R$14.9 million, from the sale of 13,200 tons at R$1,136.06 per ton, to R$23.5 million, from the sale of 22,700 tons at R$1,037.03 per ton.

Corn revenue in 9M18 increased by R$8.3 million when compared to the previous year, from R$723 thousand from the sale of 1,400 tons at R$526.97 per ton, to R$9,0 million, from the sale of 25,000 tons at R$362.02 per ton. Corn sold until 6M18 was produced in the previous harvest and was stored as a sales strategy. As of 3Q18, the sale of corn already refers to the 17/18 harvest.

Sugarcane revenue in 9M18 increased by R$61.8 million when compared to the previous year, from R$50.0 million from the sale of 512,700 tons at R$97.63 per ton, to R$111.9 million from the sale of 1.2 million tons at R$91.36 per ton of sugarcane. The reduction in per-ton sugarcane price was due to the 1% reduction in the TRS (total recoverable sugar), which went from 146,62 kg/ton (0.668 R$/kg) in 9M17 to 145.43 kg/ton (0.669 R$/kg) in 9M18. The

difference of 153,800 tons of sugarcane produced in relation to the total sold is the result of leasing payment.

|

www.brasil-agro.com

|

11

|

BRASILAGRO 2018

|

Cattle-raising revenue totaled R$2.9 thousand in 9M18, resulting from the sale of 1,336 head of cattle in Brazil and Paraguay at R$5.23 per kg.

Leasing revenue reached R$2.9 million in 9M18 and reflects the third-party leases of Farms in Bahia and in the Midwest region.

The amount recorded in other sales revenue was R$821 thousand in 9M18 due to the payment of taxes (FUNRURAL). During the same period of the previous year, we had other revenue in the amount of R$1.5 million, which came from the sale of inputs (seeds, fertilizers and byproducts) from areas that were not planted in the 2016/17 harvest year and R$200 thousand, which came from the sale of 369 tons of sorghum.

GAINS OR LOSSES OF AGRICULTURAL PRODUCTS AND BIOLOGICAL ASSETS

|

Biological Assets and Agricultural Products (R$ thousand)

|

Soybean

|

Corn (crop)

|

|

|

|

Gain / Loss

|

|

|

17/18

|

17/18

|

Sugarcane

|

Livestok

|

Others

|

03/31/18

|

|

Gain and losses in agricultural products

|

12.586

|

770

|

43.780

|

1.141

|

(312)

|

57.965

|

|

Gain and losses in biological assets dos ativos biológicos

|

24.209

|

(1.062)

|

(6.483)

|

|

-

|

16.664

|

|

Change in fair value of biological assets and agricultural products

|

36.795

|

(292)

|

37.297

|

1.141

|

(312)

|

74.629

|

Gains or losses from the variation in the fair value of agricultural products are determined by the difference between their harvested volume at market value (net of selling expenses and taxes) and the production costs incurred (direct and indirect costs, leasing and depreciation).

Harvested agricultural products are measured at their value at the time of harvest considering the market price of the area of each farm.

Since July 1, 2016, biological assets corresponding to ratoons of sugarcane have been measured at cost less depreciation (Accounting Standard IAS 16), while planted cane will continue to be measured at fair value (Accounting Standard IAS 41).

|

Agricultural Products

|

Soybean

|

Corn (crop)

|

|

|

|

Gain / Loss

|

|

|

17/18

|

16/17

|

Sugarcane

|

Livestok

|

Others

|

03/31/18

|

|

Area (hectares)

|

9.650

|

937

|

20.431

|

14.643

|

-

|

45.661

|

|

Production (Tons)

|

35.633

|

4.303

|

1.378.554

|

1.742

|

-

|

1.420.232

|

|

Yield (Ton./ha)

|

3,69

|

4,59

|

67,47

|

0,12

|

-

|

31,10

|

|

Livestock - head of cattle

|

-

|

-

|

-

|

20.692

|

-

|

20.692

|

|

Production fair value (R$ thousand)

|

37.321

|

2.326

|

114.688

|

8.068

|

(143)

|

162.260

|

|

Production Cost (R$ thousand)

|

(24.735)

|

(1.556)

|

(70.908)

|

(6.927)

|

(169)

|

(104.295)

|

|

Gain and losses in agricultural products (R$ thousand)

|

12.586

|

770

|

43.780

|

1.141

|

(312)

|

57.965

|

Biological assets correspond to agricultural products in formation (not yet harvested) and cattle, measured at the net present value of the expected cash flow from these products. The calculation of fair value considers the best estimates in relation to sales prices, discount rates, direct and indirect costs, leasing, yields and selling expenses.

|

www.brasil-agro.com

|

12

|

BRASILAGRO 2018

|

Cattle biological assets are measured at fair value and controlled in accordance with two methodologies: 12 to 15-month calves and steers (heifers) are controlled and valued by head, while older animals are controlled by weight.

Fair value variation is impacted by variations between fair value and cost, as well as by fair value variations between the periods.

Gains or losses from the variation in the fair value of grains and sugarcane biological assets are determined by the difference between their fair value and their book value. Book value includes investments and costs effectively incurred until the moment of appraisal, as well as write-offs arising from the harvesting of the agricultural products.

The table below shows the results of the sugarcane harvest:

|

Period ended June 30, de junho de 2017

|

2016 Crop

|

2017 Crop

|

Total

|

|

Net Revenue

|

48.949

|

23.072

|

72.021

|

|

Cost of sales

|

(43.420)

|

(31.078)

|

(74.498)

|

|

Gain (loss) of agricultural products and biological assets value

|

7.215,00

|

4.316

|

11.531

|

|

Total

|

12.744

|

(3.689)

|

9.055

|

|

Tons

|

535.103

|

480.200

|

1.015.303

|

|

|

|

Period ended December 31, 2017

|

2016 Crop

|

2017 Crop

|

Total

|

|

Net Revenue

|

|

112.182

|

112.182

|

|

Cost of sales

|

|

(97.495)

|

(97.495)

|

|

Gain (loss) of agricultural products and biological assets value

|

|

38.975

|

38.975

|

|

Total

|

-

|

53.662

|

53.662

|

|

Produced Tons

|

|

1.378.554

|

1.378.554

|

IMPAIRMENT (REVERSAL OF PROVISIONS OF THE RECOVERABLE AMOUNT OF AGRICULTURAL PRODUCTS, NET)

A provision to adjust inventories at the net realized value of agricultural products is constituted when the fair value of the inventory is higher than the realized value. The realization value is the sales price estimated during the normal course of business less estimated selling expenses.

On March 31, 2018, the recognized amount corresponded to a gain of R$882 thousand.

|

www.brasil-agro.com

|

13

|

BRASILAGRO 2018

|

COST OF PRODUCTION

|

(%)

|

Soybean

|

Corn

|

Sugarcane

|

Livestock

|

|

Variable costs

|

76%

|

76%

|

73%

|

22%

|

|

Seeds

|

15%

|

16%

|

0%

|

0%

|

|

Fertilizers

|

16%

|

23%

|

10%

|

1%

|

|

Defensive

|

19%

|

15%

|

6%

|

0%

|

|

Agricultural services

|

19%

|

16%

|

47%

|

0%

|

|

Fuels and Lubricants

|

4%

|

4%

|

8%

|

1%

|

|

Maintence of machines and instruments

|

0%

|

0%

|

0%

|

6%

|

|

Animal Feed

|

0%

|

0%

|

0%

|

9%

|

|

Others

|

3%

|

2%

|

2%

|

5%

|

|

Fixed costs

|

24%

|

24%

|

27%

|

78%

|

|

Labor

|

4%

|

2%

|

3%

|

11%

|

|

Depreciation and amortization

|

11%

|

12%

|

12%

|

66%

|

|

Leasing

|

6%

|

8%

|

10%

|

0%

|

|

Others

|

3%

|

2%

|

2%

|

1%

|

|

(R$ / ha)

|

Crop16/17

|

Crop 17/18

|

Change

|

|

|

Realized

|

Estimated

|

|

|

Soybean

|

2.159

|

2.163

|

0,2%

|

|

Corn

|

2.397

|

2.164

|

-9,7%

|

|

Sugarcane

|

4.416

|

5.140

|

16,4%

|

The increase in the cost of production of sugarcane reflects the carrying out costs of the São José Farm, which did not occur in the previous harvest.

COST OF GOODS SOLD

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Total of cost of goods sold

|

(16.225)

|

(7.482)

|

117%

|

(130.474)

|

(58.769)

|

122%

|

|

Soybean

|

(15.447)

|

(6.665)

|

132%

|

(21.425)

|

(12.211)

|

75%

|

|

Corn

|

(316)

|

(391)

|

-19%

|

(8.642)

|

(569)

|

1419%

|

|

Sugarcane

|

(283)

|

145

|

n.a.

|

(97.778)

|

(43.275)

|

126%

|

|

Livestock

|

(246)

|

(7)

|

3423%

|

(2.875)

|

(64)

|

4392%

|

|

Others

|

67

|

(563)

|

n.a.

|

246

|

(2.650)

|

n.a.

|

Cost of goods sold (COGS) came to R$130.5 million in 9M18. Due to the fair value adjustments of agricultural products, period changes in costs are directly linked to the market price of commodities at the time of harvest.

Total soybean COGS increased by R$9.2 million in 9M18 when compared to the previous year, from R$12.2 million, from the sale of 13,200 tons at R$928.17 per ton, to R$21.4 million, from the sale of 22,700 tons at R$943.38 per ton. Total soybean COGS in 3Q18 and 3Q17 reflects the reversal of the provision for loss.

Total corn COGS increased by R$8.0 million in 9M18 versus the previous year, from R$569 thousand, from the sale of 1,400 tons at R$414,72 per ton, to R$8.6 million, from the sale of 25,000 tons at R$345,28 per ton.

|

www.brasil-agro.com

|

14

|

BRASILAGRO 2018

|

Total sugarcane COGS increased by R$54.5 million in 9M18 versus the previous year, from R$43.3 million, from the sale of 512,700 tons at R$84.41 per ton, to R$97.8 million, from the sale of 1.2 million tons at R$79.84 per ton of sugarcane.

Total cattle-raising COGS reached R$2.9 million in 9M18 and reflects the net result of animal death and birth during the period (R$52 thousand negative) and the sale cost of 1,336 head of cattle in Brazil and Paraguay at R$2.2 million (R$2,113.00 per head).

Other COGS in the positive amount of R$246 thousand in 9M18 mainly refers to the raw material inventory adjustment. In 9M17, other COGS in the amount of R$1.7 million refers to the sale of inputs (seeds, fertilizers and byproducts) and R$900 thousand refers to the sale of 369 tons of sorghum.

SELLING EXPENSES

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Selling expenses

|

(2.257)

|

(417)

|

442%

|

(4.347)

|

(537)

|

709%

|

|

Freight

|

(607)

|

(160)

|

280%

|

(810)

|

(176)

|

360%

|

|

Storage and Processing

|

(1.277)

|

(207)

|

517%

|

(2.720)

|

(581)

|

368%

|

|

Others

|

(373)

|

(50)

|

646%

|

(817)

|

220

|

n.a.

|

In 9M18 we recorded R$4.3 million in selling expenses. This result is due to the increase in freight, reflected by the increase in grain sales during the period.

The increase in storage and processing expenses in 9M18 is due to the increase in storage expenses for grain inventory from the 16/17 harvest.

Other selling expenses refer to the loss for doubtful debtors (PDD).

GENERAL AND ADMINISTRATIVE EXPENSES

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

General and administrative expenses

|

(6.829)

|

(5.964)

|

15%

|

(21.619)

|

(19.638)

|

10%

|

|

Depreciations and amortizations

|

(145)

|

(179)

|

-19%

|

(482)

|

(530)

|

-9%

|

|

Personnel expenses

|

(4.374)

|

(4.114)

|

6%

|

(13.621)

|

(12.903)

|

6%

|

|

Expenses with services provider

|

(1.139)

|

(725)

|

57%

|

(3.414)

|

(2.402)

|

42%

|

|

Leases and Rents

|

(200)

|

(200)

|

0%

|

(496)

|

(589)

|

-16%

|

|

Others expenses

|

(971)

|

(746)

|

30%

|

(3.606)

|

(3.214)

|

12%

|

As of March 2017, we began to consolidate general and administrative expenses of the operation in Paraguay, which were previously accounted for under the equity pick up.

In 9M18, general and administrative expenses increased by 10% in comparison to the same period of the previous year, from R$19.6 million to R$21.6 million.

The 42% increase in expenses with service providers is mainly due to the expenses with advisors for the development of new projects, legal advice and information technology, and

expenses with the issuance of the Agribusiness Receivables Certificate (CRA).

|

www.brasil-agro.com

|

15

|

BRASILAGRO 2018

|

The 16% decrease in leases and rents is mainly due to renegotiations of lease contracts.

OTHER OPEARTING INCOME / EXPENSES

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Other operating income/expenses

|

37.116

|

(119)

|

n.a.

|

35.872

|

(5.736)

|

n.a.

|

|

Gain/Loss on sale of fixed assets

|

(135)

|

(14)

|

864%

|

(294)

|

(536)

|

-45%

|

|

Management Fee - Cresca Reversal

|

-

|

-

|

n.a.

|

-

|

(2.490)

|

-100%

|

|

Provisions for lawsuits

|

410

|

(83)

|

n.a.

|

299

|

(545)

|

n.a.

|

|

Alto Taquari Farm

|

-

|

34

|

-100%

|

-

|

34

|

-100%

|

|

Added value obteined by spin-off (Cresca - Paraguay)

|

5.040

|

-

|

n.a.

|

5.040

|

-

|

n.a.

|

|

Written-off in the conversion of joint venture by spin-off (Cresca - Paraguay)

|

30.616

|

-

|

n.a.

|

30.616

|

-

|

n.a.

|

|

Others

|

1.185

|

(56)

|

n.a.

|

211

|

(2.199)

|

n.a.

|

The increase in other operating expenses (income) is a result of the recognition of amounts incurred with the conclusion of the spin-off of the Cresca operation in Paraguay, in the amount of R$35.3 million. In 9M17, the management fee reversal of Cresca totaling R$2.5 million was recorded.

Spin-off of the Joint Venture Cresca S.A.

On February 9, 2018, the spin-off process of the Joint Venture Cresca S.A. (company that owns the property in Paraguay) was formalized. At that moment, the part owned by BrasilAgro was transferred to its subsidiary Agropecuária Morotí S.A., which is 100% controlled by the Company.

After the spin-off, considering that the Company obtained the control of assets and liabilities previously jointly controlled, as required by IFRS 3 – Business Combinations, the assets acquired, and the liabilities assumed were remeasured at their fair values on the acquisition date and the result recorded in profit or loss.

The investment was recorded at the Company for R$115.6 million and the fair value totaled R$120.6 million; therefore, we recorded gain of R$5.0 million. The fair value of assets and liabilities was preliminarily estimated and is expected to be concluded by June 30, 2018.

Moreover, the effects from the translation of investments abroad were recorded under other comprehensive income. With the spin-off, as required by accounting practices, the accumulated effect from the translation of investments abroad, totaling R$30.6 million, was written-off from other comprehensive income and recorded under profit/loss.

|

www.brasil-agro.com

|

16

|

BRASILAGRO 2018

|

FINANCIAL RESULT

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Total

|

(17.324)

|

5.784

|

n.a.

|

(9.839)

|

22.204

|

n.a.

|

|

Interest

(i)

|

(20.256)

|

(1.477)

|

1271%

|

(14.136)

|

(3.542)

|

299%

|

|

Monetary variation

(ii)

|

(166)

|

(185)

|

-10%

|

(6)

|

(495)

|

-99%

|

|

Exchange vartiation

(iii)

|

(254)

|

(1.603)

|

-84%

|

(190)

|

(1.380)

|

-86%

|

|

Unwind of present value adjustment

(iv)

|

5.294

|

(1.395)

|

n.a.

|

3.885

|

(2.888)

|

n.a.

|

|

Results with derivatives

(v)

|

(1.999)

|

8.558

|

n.a.

|

280

|

18.738

|

-99%

|

|

Other financial income / expenses

(vi)

|

57

|

1.886

|

-97%

|

328

|

11.771

|

-97%

|

The consolidated financial result is composed of the following items: (i) interest on financing; (ii) the impact of the monetary variation on the amount payable from the acquisition of the Nova Buriti Farm; (iii) the impact of the U.S. dollar exchange variation on the offshore account and Cresca’s receivables; (iv) the present value of Cremaq, Araucária and Jatobá Farms’ sales receivables, fixed in soybean bags; (v) the result from hedge operations; and (vi) bank fees and expenses and returns on cash investments.

Interest variation is mainly due to the recognition of the financial revenue obtained from the Nova Buriti Farm renegotiation, in the amount of R$9.3 million, interest on loans and financing in the amount of R$7.4 million, and interest on Cresca’s loan of R$16.5 million which was pardoned.

The derivatives result reflects the commodities hedge operations result and the impact of the exchange variation on cash, which was partially dollarized in order to maintain purchasing power in regard to inputs, investments and new acquisitions, which have a positive correlation with the US currency. In 9M18, the result of derivative transactions was R$280 thousand, of which R$1.7 million (negative) are related to currency operations and R$1.5 million are related to operations with commodities. In 9M17, derivative operations totaled R$18.7 million, of which R$11.1 million are a loss related to currency operations and R$7.6 million are in operations with commodities.

The reduction in other financial income / expenses is due to the decrease in the Company’s cash position, from an average cash flow of R$129.7 million in 9M17 to R$41.5 million in 9M18 and also decrease in the SELIC rate (Brazil’s basic interest rate) in the period, in addition to bank fees and expenses with financial investments.

On August 30, 2017, the title deed for the Nova Buriti Farm was given and, consequently, the payment of the Farm balance was paid. The Farm’s total price was adjusted, with the partial cancellation of the monetary adjustments (by the IGP-M – General Market Price Index) that would be owed by the Company. The amount of R$9.3 million was recognized as financial income in 9M18 and the outstanding balance of the debt will not be restated.

|

www.brasil-agro.com

|

17

|

BRASILAGRO 2018

|

DERIVATIVE OPERATIONS

Our risk policy primarily aims to hedge the Company’s cash flow. In this context, we are concerned not only with the main components of our revenue, but also the main components of our production costs. We therefore monitor on a daily basis: a) the international prices of the main agricultural commodities produced by the Company, usually expressed in U.S. dollars; b) the base premium, i.e. the difference between the international and domestic commodity price; c) exchange rates; and d) the prices of the main components such as freight, fertilizers and chemicals, that can significantly impact costs.

The points analyzed when deciding on the price and margin hedging strategy and tools are listed below:

• Estimated gross margin based on the current price environment.

• Standard deviation from the estimated gross margin for different pricing strategy scenarios.

• Analysis of the estimated gross margin in stress scenarios for different hedge strategies.

• Comparison between current estimates and the Company’s budget.

• Comparison of the estimated gross margin and the historical average.

• Market expectations and trends.

• Tax aspects.

Hedge Position on April 30, 2018

|

|

|

Soybean

|

|

|

FX

|

|

|

Crop

|

|

|

|

Volume

|

|

|

|

|

Volume

(1)

|

% of hedge

(2)

|

Price (USD/bu)

|

(thousand)

|

% of hedge

(3)

|

BRL/USD

|

|

17/18

|

80.897 ton

|

85,9%

|

10,46

|

USD 39.174

|

108,2%

|

3,37

|

|

(1) Net estimated volume of production + farm sales receivables.

|

|

(2) % of the volume of soybean locked in tons.

|

|

(3) % of estimated revenue in USD.

|

|

www.brasil-agro.com

|

18

|

BRASILAGRO 2018

|

NET ASSET VALUE – NAV

|

(R$ thousand)

|

March 31, 2018

|

|

|

Book

|

NAV

|

|

BrasilAgro's Equity

|

716.977

|

716.977

|

|

Properties appraisal

|

|

1.307.136

|

|

(-) Balance Sheet - Net Agri Openning Capex

|

-89.643

|

|

(-) Balance Sheet - Land Value

|

|

-539.101

|

|

NAV - Net Asset Value

|

716.977

|

1.395.369

|

|

Shares

|

56.889

|

56.889

|

|

NAV per share

|

12,60

|

24,53

|

CASH AND CASH EQUIVALENTS

|

Cash and Cash equivalents

|

03/31/2018

|

06/30/2017

|

Change

|

|

Cash and Cash equivalents

|

16.923

|

43.798

|

-61%

|

|

Cash and Banks

|

6.830

|

15.159

|

-55%

|

|

Repurchase agreements

|

10.003

|

28.639

|

-65%

|

|

Bank deposit certificates

|

90

|

-

|

n.a.

|

|

Markable securities

|

1.149

|

6.972

|

-84%

|

|

Restricted financial investments

|

2

|

2

|

0%

|

|

Bank deposit certificates

|

1.114

|

-

|

n.a.

|

|

Banco do Nordeste (loan guarantees)

|

-

|

5.502

|

-100%

|

|

Treasury financial bills

|

33

|

1.468

|

-98%

|

|

Restricted Markable securities

|

17.952

|

17.088

|

5%

|

|

Bank deposit certificates

|

9.427

|

8.982

|

5%

|

|

Banco do Nordeste (loan guarantees)

|

8.525

|

8.106

|

5%

|

|

Total

|

36.024

|

67.858

|

-47%

|

The Company ended the quarter with a cash position of R$36.0 million, a decrease of 47% over June 30, 2017, mainly due to investments in the amount of R$18.9 million and payment of dividends in the amount of R$13.0 million.

INVENTORY

|

(R$ thousand)

|

03/31/2018

|

06/30/2017

|

Change

|

|

Soybean

|

21.184

|

6.837

|

210%

|

|

Corn

|

336

|

6.819

|

-95%

|

|

Livestock

|

32.136

|

11.153

|

188%

|

|

Other crops

|

90

|

50

|

80%

|

|

Agricultural Products

|

53.746

|

24.859

|

116%

|

|

Supplies

|

10.465

|

8.952

|

17%

|

|

Total

|

64.211

|

33.811

|

90%

|

|

www.brasil-agro.com

|

19

|

BRASILAGRO 2018

|

INDEBTEDNESS

|

(R$ thousand)

|

Expiration

|

Annual Interest Tax - %

|

03/31/2018

|

06/30/2017

|

Change

|

|

Short term

|

|

|

|

|

|

|

Financiamento de Custeio Agrícola

|

Sep-18

|

8,50 and 12,75

TJLP + 3,45 and 4,45 / SELIC + 3,45 / Pre 4,00 to

|

65.722

|

10.703

|

514,1%

|

|

Financiamento Projeto Bahia

|

Dec-18

|

9,00

|

3.097

|

15.236

|

-79,7%

|

|

Capital de Giro

|

May-18

|

1,40 to 2,30% + 100% of CDI

|

16.638

|

15.782

|

5,4%

|

|

Capital de Giro (USD)

|

Aug-17

|

3,49%

|

-

|

5.031

|

-100,0%

|

|

Financiamento de Máquinas e Equipamentos

|

Dec-18

|

TJLP + 3,73

|

255

|

1

|

25400,0%

|

|

Financiamento de cana-de-açúcar

|

Dec-18

|

TJLP + 2,70 and 12,75%

|

1.442

|

8.248

|

-82,5%

|

|

Arrendamento Financeiro Canavial - Parceria III

|

May-18

|

6,92%

|

2.424

|

1.619

|

49,7%

|

|

|

|

|

89.578

|

56.620

|

58,2%

|

|

Long term

|

|

|

|

|

|

|

Financiamento de cana-de-açúcar

|

Dec-23

|

TJLP + 2,70 and 12,75%

|

33.131

|

1.025

|

3132,3%

|

|

Financiamento de Máquinas e Equipamentos

|

Jun-24

|

TJLP + 3,73%

|

5.833

|

1.208

|

382,9%

|

|

Financiamento Projeto Bahia

|

Aug-23

|

TJLP + 3,45 and 4,45/SELIC + 3,45/Pre 4,00 to 9,00

|

26.777

|

30.862

|

-13,2%

|

|

Arrendamento Financeiro Canavial - Parceria III

|

nov-18

|

6,92%

|

-

|

1.665

|

-100,0%

|

|

Arrendamento Financeiro Canavial - Parceria IV

|

Jan-32

|

R$/kg 0,6462

|

21.118

|

20.795

|

1,6%

|

|

|

|

|

86.859

|

55.555

|

56,3%

|

|

Total

|

|

|

176.437

|

112.175

|

57,3%

|

On March 31, 2018 and June 30, 2017, the balance of loans and financing was R$176.4 million and R$112.2 million, respectively. The payment of interest and principal totaled R$73.2 million in 9M18.

During the period, a total of R$116.2 million was disbursed in new financing referring to the cost of sugarcane, soybean and corn operations and R$13.9 million was disbursed for investments related to area opening.

ACQUISITIONS PAYABLE

|

(R$ thousand)

|

Adjustment Rate

|

03/31/2018

|

06/30/2017

|

Change

|

|

Nova Buriti Farm

|

IGP-M

|

1.706

|

22.085

|

-92%

|

|

São José Farm

|

CDI

|

-

|

2.561

|

-100%

|

|

Total

|

|

1.706

|

24.646

|

-93%

|

On August 30, 2017, the title deed for the Nova Buriti Farm was given and, consequently, the partial payment of R$5.8 million was made. Part of the remaining balance, in the amount of R$1.5 million, was paid on October 18, 2017, and in January 2018, R$6.1 million of the outstanding balance of accounts payable on acquisitions were paid.

At the time of the negotiation, the Farm’s total price was adjusted, with the partial cancellation of the monetary adjustments (by the IGP-M – General Market Price Index) that would be owed by the Company. The discount on the amount of R$9.3 million was recognized as financial income in 9M18 and the outstanding balance of the debt will not be restated.

|

www.brasil-agro.com

|

20

|

BRASILAGRO 2018

|

PROPERTIES FOR INVESTMENT

The fundamental pillars of the Company’s business strategy are the acquisition, development, exploration and sale of rural properties suitable for agricultural activities. The Company acquires rural properties with significant potential for generating value, subsequently holding the assets and carrying out profitable agricultural activities on them.

Once we acquire our rural properties, we begin to implement high-value added crops and to transform these rural properties by investing in infrastructure and technology, while also entering into lease agreements with third parties. In line with our strategy, when we deem a rural property has reached its optimal value, we sell it to capture the capital gains.

The rural properties acquired by the Company are booked at their acquisition cost, which does not exceed their realized net value, and are recognized under “Non-Current Assets”.

Properties for investment are evaluated at their historical cost, plus investments in buildings, improvements and the clearing of new areas, less accrued depreciation, in accordance with the same criteria detailed for fixed assets.

|

(R$ thousand)

|

Acquisition

|

Buildings and

|

|

Construction in

|

Investment

|

|

|

value

|

improvements

|

Opening area

|

progress

|

Properties

|

|

Initial Balance

|

300.487

|

26.369

|

53.021

|

9.922

|

389.799

|

|

In June 30, 2017

|

|

|

|

|

|

|

Acquisitions

|

1.890

|

99

|

901

|

14.961

|

17.851

|

|

Incorporation - corporate reorganization

|

121.269

|

18

|

9.518

|

10.147

|

140.952

|

|

Reductions

|

-

|

-53

|

-

|

-1

|

-54

|

|

(-) Depreciation/ Amortization

|

-

|

-621

|

-8.826

|

-

|

-9.447

|

|

In March 31, 2017

|

423.646

|

25.812

|

54.614

|

35.029

|

539.101

|

On March 31, 2018, we recorded R$35.0 million in ongoing work, which refers to the clearance of areas at the Palmeiras, Chaparral and Araucária Farms.

In February, we formalized the spin-off process of Cresca S.A., which started in October 2016. With the end of the Joint Venture, BrasilAgro acquired 50% of Cresca’s assets and liabilities through the subsidiary Agropecuária Morotí S.A. As a result, the farm was accounted for as properties for investment as of this quarter in the amount of R$140.9 million, as mentioned at the table above in incorporation – corporate reorganization.

|

www.brasil-agro.com

|

21

|

BRASILAGRO 2018

|

CAPEX – AREA OPENING

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Maintenance

|

785

|

915

|

-14%

|

3.407

|

2.265

|

50%

|

|

Opening

|

321

|

221

|

46%

|

5.930

|

5.981

|

-1%

|

|

Total

|

1.106

|

1.136

|

-3%

|

9.337

|

8.246

|

13%

|

DEPRECIATION – AREA OPENING

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Maintenance

|

(596)

|

(465)

|

28%

|

(1.739)

|

(1.391)

|

25%

|

|

Opening

|

(4.765)

|

(2.276)

|

109%

|

(9.455)

|

(6.663)

|

42%

|

|

Total

|

(5.361)

|

(2.741)

|

96%

|

(11.194)

|

(8.054)

|

39%

|

|

www.brasil-agro.com

|

22

|

BRASILAGRO 2018

|

The Company was the first agricultural production company to list its shares on the Novo Mercado segment of the B3 (São Paulo Stock Exchange) and was also the first Brazilian agribusiness company to list its ADRs (American Depositary Receipts) on NYSE (New York Stock Exchange).

Share Performance

......................................................................................................................................................

On May 04, 2018, BrasilAgro’s shares (AGRO3) were traded at R$13.10, resulting in a market cap of R$745.2 million, while its ADRs (LND) were traded at US$3.66.

|

HIGHLIGHTS - AGRO3

|

3Q18

|

3Q17

|

|

Average Daily Trade Volume (R$)

|

607.329

|

1.163.502

|

|

Maximun (R$ per share)

|

13,50

|

12,88

|

|

Mininum (R$ per share)

|

12,40

|

10,85

|

|

Average (R$ per share)

|

13,32

|

11,87

|

|

Closing Quote (R$ per share)

|

13,00

|

11,98

|

|

Variation in the period (%)

|

-2,99%

|

0,67%

|

During 3Q18, BrasilAgro’s shares reached a trading volume of R$36.4 million, from 9,893 trades, with a daily average traded volume of R$0.6 million.

|

www.brasil-agro.com

|

23

|

BRASILAGRO 2018

|

|

Disclaimer

|

|

The statements contained in this document related to the prospects for BrasilAgro’s businesses, projected operating and financial income and growth are merely projections, and as such are based exclusively on management’s expectations. These expectations depend materially on market conditions, the performance of the Brazilian economy, the industry and international markets, and are therefore subject to change without prior notice.

|

|

WEIGHTS AND MEASURES USED IN AGRICULTURE

|

|

Weights and Measures used in Agriculture

|

|

1 ton

|

1.000 kg

|

|

|

1 Kilo

|

2.20462 pounds

|

|

|

1 pound

|

0.45359 kg

|

|

|

1 acre

|

0.1840 bushel

|

|

|

1 hectare (ha)

|

2.47105 acres

|

|

|

1 hectare (ha)

|

10.000 m2

|

|

|

1 bushel

|

5.4363 acres

|

|

|

|

|

|

|

Soybean

|

|

|

|

1 bushel of soybean

|

60 pounds

|

27.2155 kg

|

|

1 bags of soybean

|

60 kg

|

2.20462 bushels

|

|

1 bushel/acre

|

67.25 kg/ha

|

|

|

1.00 US$/bushel

|

2.3621 US$/saca

|

|

|

|

|

|

|

Corn

|

|

|

|

1 bushel of corn

|

56 pounds

|

25.4012 kg

|

|

1 bags of corn

|

60 kg

|

2.36210 bushels

|

|

1 bushel/acre

|

62.77 kg/ha

|

|

|

1.00 US$/bushel

|

2.3621 US$/saca

|

|

|

www.brasil-agro.com

|

24

|

BRASILAGRO 2018

|

|

(R$ thousand)

|

3Q18

|

3Q17

|

Change

|

9M18

|

9M17

|

Change

|

|

Revenues from Farm Sales

|

-

|

3.854

|

-100,0%

|

-

|

3.854

|

-100%

|

|

Revenues from grains

|

18.096

|

9.447

|

91,6%

|

33.673

|

16.420

|

105%

|

|

Revenues from sugarcane

|

(225)

|

1.137

|

n.a.

|

115.122

|

51.727

|

123%

|

|

Revenues from leasing

|

1.427

|

629

|

126,9%

|

3.861

|

1.563

|

147%

|

|

Revenues from Livestock

|

322

|

-

|

n.a.

|

2.869

|

-

|

n.a.

|

|

Other revenues

|

67

|

467

|

-85,7%

|

136

|

2.137

|

-94%

|

|

Deductions from gross revenue

|

(1.780)

|

(588)

|

202,7%

|

(6.170)

|

(3.008)

|

105%

|

|

Net Sales Revenue

|

17.907

|

14.946

|

19,8%

|

149.491

|

72.693

|

106%

|

|

Change in fair value of biological assets and agricultural products

|

32.528

|

241

|

13397,1%

|

74.629

|

5.464

|

1266%

|

|

Impairment

|

(31)

|

(186)

|

-83,3%

|

882

|

(437)

|

n.a.

|

|

Net Revenue

|

50.404

|

15.001

|

236,0%

|

225.002

|

77.720

|

190%

|

|

Cost of agricultural products sale

|

(16.225)

|

(7.482)

|

116,9%

|

(130.474)

|

(58.769)

|

122%

|

|

Gross Profit

|

34.179

|

7.519

|

354,6%

|

94.528

|

18.951

|

399%

|

|

Selling expenses

|

(2.257)

|

(417)

|

441,2%

|

(4.347)

|

(537)

|

709%

|

|

General and administrative expenses

|

(6.829)

|

(5.964)

|

14,5%

|

(21.619)

|

(19.638)

|

10%

|

|

Depreciations and amortizations

|

(145)

|

(179)

|

-19,0%

|

(482)

|

(530)

|

-9%

|

|

Personnel expenses

|

(4.374)

|

(4.114)

|

6,3%

|

(13.621)

|

(12.903)

|

6%

|

|

Expenses with services provider

|

(1.139)

|

(725)

|

57,1%

|

(3.414)

|

(2.402)

|

42%

|

|

Leases and Rents

|

(200)

|

(200)

|

0,0%

|

(496)

|

(589)

|

-16%

|

|

Others expenses

|

(971)

|

(746)

|

30,2%

|

(3.606)

|

(3.214)

|

12%

|

|

Other operating income/expenses, net

|

37.116

|

(119)

|

n.a.

|

35.872

|

(5.736)

|

n.a.

|

|

Equity pick up

|

16.096

|

(1.430)

|

n.a.

|

14.699

|

(3.730)

|

n.a.

|

|

Financial result

|

(17.324)

|

5.784

|

n.a.

|

(9.839)

|

22.204

|

n.a.

|

|

Financial income

|

14.381

|

21.147

|

-32,0%

|

57.378

|

71.475

|

-20%

|

|

Interest on Financial Investments

|

377

|

2.335

|

-83,9%

|

1.648

|

14.614

|

-89%

|

|

Interest on assets

|

(572)

|

677

|

n.a.

|

10.266

|

3.272

|

214%

|

|

Monetary variations

|

(161)

|

-

|

n.a.

|

160

|

-

|

n.a.

|

|

Foreign exchange variations on liabilities

|

1.463

|

976

|

49,9%

|

7.169

|

8.997

|

-20%

|

|

Unwind of present value adjustment

|

6.667

|

976

|

583,1%

|

19.014

|

4.121

|

361%

|

|

Realized results with derivatives

|

3.468

|

1.427

|

143,0%

|

7.084

|

11.334

|

-37%

|

|

Unrealized results with derivatives

|

3.139

|

14.756

|

-78,7%

|

12.037

|

29.137

|

-59%

|

|

Financial expenses

|

(31.705)

|

(15.363)

|

106,4%

|

(67.217)

|

(49.271)

|

36%

|

|

Interest expenses

|

(199)

|

(328)

|

-39,3%

|

(870)

|

(1.906)

|

-54%

|

|

Bank charges

|

(121)

|

(121)

|

0,0%

|

(450)

|

(937)

|

-52%

|

|

Interest on liabilities

|

(19.684)

|

(2.154)

|

813,8%

|

(24.402)

|

(6.814)

|

258%

|

|

Monetary variations

|

(5)

|

(185)

|

-97,3%

|

(166)

|

(495)

|

-66%

|

|

Foreign exchange variations on liabilities

|

(1.717)

|

(2.579)

|

-33,4%

|

(7.359)

|

(10.377)

|

-29%

|

|

Unwind of present value adjustment

|

(1.373)

|

(2.371)

|

-42,1%

|

(15.129)

|

(7.009)

|

116%

|

|

Realized results with derivatives

|

(1.055)

|

(70)

|

1407,1%

|

(4.949)

|

(2.149)

|

130%

|

|

Unrealized results with derivatives

|

(7.551)

|

(7.555)

|

-0,1%

|

(13.892)

|

(19.584)

|

-29%

|

|

Profit (loss) before income and social contribution taxes

|

60.981

|

5.373

|

1034,9%

|

109.294

|

11.514

|

849%

|

|

Income and social contribution taxes

|

(6.997)

|

(832)

|

741,0%

|

(23.673)

|

(5.331)

|

344%

|

|

Profit (loss) for the period

|

53.984

|

4.541

|

1088,8%

|

85.621

|

6.183

|

1285%

|

|

Outstanding shares at the end of the period

|

56.888.916

|

56.888.916

|

|

56.888.916

|

56.888.916

|

|

|

Basic earnings (loss) per share - R$

|

0,95

|

0,08

|

1088,8%

|

1,51

|

0,11

|

1285%

|

|

www.brasil-agro.com

|

25

|

BRASILAGRO 2018

|

|

Assets (R$ thousand)

|

03/31/2018

|

06/30/2017

|

Change

|

|

Current assets

|

|

|

|

|

Cash and Cash equivalents

|

16.780

|

43.798

|

-61,7%

|

|

Markable securities

|

1.149

|

6.972

|

-83,5%

|

|

Trade accounts receivable

|

65.146

|

54.026

|

20,6%

|

|

Inventories

|

32.075

|

22.658

|

41,6%

|

|

Biologial assets

|

118.583

|

38.260

|

209,9%

|

|

Derivative financial instruments

|

3.809

|

4.090

|

-6,9%

|

|

Transactions with related parties

|

2.639

|

1.298

|

103,3%

|

|

|

240.181

|

171.102

|

40,4%

|

|

|

|

Non-current assets

|

|

|

|

|

Biological assets

|

32.136

|

13.435

|

139,2%

|

|

Markable securities

|

17.952

|

17.088

|

5,1%

|

|

Diferred taxes

|

31.727

|

53.780

|

-41,0%

|

|

Derivative financial instruments

|

641

|

1

|

64000,0%

|

|

Accounts receivable and sundry credits

|

39.859

|

44.605

|

-10,6%

|

|

Investment properties

|

539.101

|

389.799

|

38,3%

|

|

Transactions with related parties

|

-

|

35.640

|

-100,0%

|

|

Investments

|

100

|

101.426

|

-99,9%

|

|

Property, plant and euipment

|

72.018

|

54.745

|

31,6%

|

|

Intagible assets

|

1.364

|

1.672

|

-18,4%

|

|

|

734.898

|

712.191

|

3,2%

|

|

|

|

Total assets

|

975.079

|

883.293

|

10,4%

|

|

www.brasil-agro.com

|

26

|

BRASILAGRO 2018

|

|

BALANCE SHEET – LIABILITIES

|

|

Liabilities (R$ thousand)

|

03/31/2018

|

06/30/2017

|

Change

|

|

Current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

52.941

|

55.615

|

-4,8%

|

|

Loans and financing

|

89.578

|

56.620

|

58,2%

|

|

Labor obligations

|

6.962

|

11.513

|

-39,5%

|

|

Derivative financial instruments

|

8.746

|

3.978

|

119,9%

|

|

Accounts payable for acquisitions

|

1.706

|

24.646

|

-93,1%

|

|

Transactions with related parties

|

2.526

|

4.784

|

-47,2%

|

|

|

162.459

|

157.156

|

3,4%

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

7.489

|

1.520

|

392,7%

|

|

Loans and financing

|

86.859

|

55.555

|

56,3%

|

|

Derivative financial instruments

|

-

|

-

|

n.a.

|

|

Provision for legal claims

|

1.295

|

1.594

|

-18,8%

|

|

|

95.643

|

58.669

|

63,0%

|

|

Total liabilities

|

258.102

|

215.825

|

19,6%

|

|

|

|

|

|

|

Equity

|

|

|

|

|

Capital

|

584.224

|

584.224

|

n.a.

|

|

Capital reserves

|

1.153

|

1.525

|

-24,4%

|

|

Treasury shares

|

(35.208)

|

(36.797)

|

-4,3%

|

|

Profits reserves

|

68.615

|

68.615

|

0,0%

|

|

Proposed additional dividends

|

-

|

6.486

|

-100,0%

|

|

Equity variation adjustment

|

12.552

|

43.415

|

-71,1%

|

|

Accumulated losses

|

85.641

|

-

|

n.a.

|

|

Total equity

|

716.977

|

667.468

|

7,4%

|

|

|

|

|

|

|

Total liabilities and equity

|

975.079

|

883.293

|

10,4%

|

|

www.brasil-agro.com

|

27

|

BRASILAGRO 2018

|

|

R$ (thousand)

|

9M18

|

9M17

|

Change

|

|

CASH FLOW OF OPERATIONAL ACTIVITIES

|

|

|

|

|

Profit (loss) for the period

|

85.621

|

6.183

|

1285%

|

|

Adjustments to reconcile net income

|

|

|

|

|

Depreciation and amortization

|

18.364

|

7.201

|

155%

|

|

Added value obteined by spin-off

|

(5.040)

|

-

|

n.a.

|

|

Written-off in the conversion of joint venture by spin-off

|

(30.616)

|

-

|

n.a.

|

|

Residual value of fixed assets

|

408

|

1.587

|

-74%

|

|

Written-off in investment properties

|

54

|

62

|

-13%

|

|

Equity Pickup

|

(14.699)

|

3.730

|

n.a.

|

|

Exchance variation effect

|

-

|

79

|

-100%

|

|

Gain unrealized results with derivatives

|

1.855

|

(9.553)

|

n.a.

|

|

Exchange rate, monetary and financial charges unrealized

|

15.052

|

(7.291)

|

n.a.

|

|

Adjustment to present value for receivables from sale of farms, machinery and financial

|

(3.885)

|

2.888

|

n.a.

|

|

leasings

|

|

|

|

|

Income and social contribution taxes

|

22.053

|

3.055

|

622%

|

|

Fair value of biological assets and agricultural products and depletion of harvest

|

(74.629)

|

(5.464)

|

1266%

|

|

Provision (Reversal) of impairment of agricultural products after harvest

|

(882)

|

437

|

n.a.

|

|

Allowance for doubtful accounts

|

(744)

|

269

|

n.a.

|

|

Provisions for lawsuits

|

(299)

|

545

|

n.a.

|

|

|

12.613

|

3.728

|

238%

|

|

|

|

Trade accounts receivable

|

(1.351)

|

(1.762)

|

-23%

|

|

Inventories

|

(8.199)

|

15.758

|

n.a.

|

|

Biological Assets

|

(24.395)

|

(25.648)

|

-5%

|

|

Recoverable Taxes

|

426

|

(349)

|

n.a.

|

|

Derivative Transactions

|

2.514

|

20.573

|

-88%

|

|

Other assets

|

243

|

(1.250)

|

n.a.

|

|

Suppliers

|

9.462

|

8.685

|

9%

|

|

Related parties

|

(2.782)

|

17.305

|

n.a.

|

|

Taxes payable

|

(1.744)

|

(2.437)

|

-28%

|

|

Income tax and social contribution

|

(286)

|

(2.643)

|

-89%

|

|

Labor obligations

|

(4.551)

|

(3.829)

|

19%

|

|

Advance from customers

|

(4.820)

|

72

|

n.a.

|

|

Other obligations

|

(461)

|

(4.976)

|

-91%

|

|

Net Cash generated by (used in) operating activities

|

(23.331)

|

23.227

|

n.a.

|

|

CASH FLOW OF INVESTMENT ACTIVITIES

|

|

|

|

|

Additions to immobilized and intangible

|

(27.263)

|

(21.599)

|

26%

|

|

Additions to property for investments

|

(17.851)

|

(109.800)

|

-84%

|

|

Redemption of (investment in) marketable securities

|

6.159

|

124.728

|

-95%

|

|

Increase in investments and participations

|

-

|

-

|

n.a.

|

|

Payments of farm acquisition

|

(13.672)

|

-

|

n.a.

|

|

Receivables from farm sale

|

5.588

|

-

|

n.a.

|

|

Net Cash generated by (used in) investment activities

|

(47.039)

|

(6.671)

|

605%

|

|

CASH FLOW OF FINANCING ACTIVITIES

|

|

|

|

|

Raising of Loans and financing

|

130.144

|

38.268

|

240%

|

|

Interest from Loans and Financing

|

(7.166)

|

(6.137)

|

17%

|

|

Payment of loans and financing

|

(66.043)

|

(46.394)

|

42%

|

|

Treasury shares

|

(610)

|

(5.848)

|

-90%

|

|

Dividends paid

|

(12.973)

|

(32.042)

|

-60%

|

|

Generated (provided) net cash by financing activities

|

43.352

|

(52.153)

|

n.a.

|

|

Increase (decrease) in cash and cash equivalents

|

(27.018)

|

(35.597)

|

-24%

|

|

Cash and cash equivalents at the beginning of the year

|

43.798

|

54.204

|

-19%

|

|

Cash and cash equivalents at the end of the year

|

16.780

|

18.607

|

-10%

|

|

|

(27.018)

|

(35.597)

|

-24%

|

|

www.brasil-agro.com

|

28

|

BRASILAGRO 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: May 8, 2018.

|

|

|

|

|

|

|

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

|

|

|

|

|

|

|

|

|

By:

|

/s/ André Guillaumon

|

|

|

|

Name:

|

André Guillaumon

|

|

|

|

Title:

|

Chief Executive Officer and Operation Officer

|

|

Date: May 8, 2018.

|

|

|

|

By:

|

/s/ Gustavo Javier Lopez

|

|

|

|

Name:

|

Gustavo Javier Lopez

|

|

|

|

Title:

|

Administrative Officer and Investor Relations Officer

|

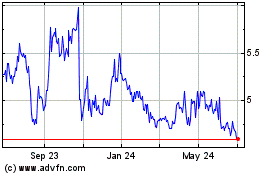

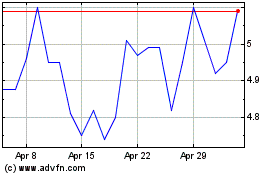

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Aug 2024 to Sep 2024

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Sep 2023 to Sep 2024