Amended Current Report Filing (8-k/a)

March 19 2018 - 6:09AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K/A

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2018 (March 8, 2018)

FUNKO, INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38274

|

|

3-2593276

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

2802 Wetmore Avenue

Everett, Washington

|

|

98201

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (425)

783-3616

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Explanatory Note

On March 8, 2018, Funko, Inc. (the “Company”) filed a Current Report on Form

8-K

furnishing under Items 2.02 and 9.01 of the Form

8-K

the Company’s press release announcing its unaudited financial results for the quarter and year ended December 31, 2017 (the “Original

Filing”). The full text of the press release was included as Exhibit 99.1 to the Original Filing.

The purpose of this Current Report

on Form

8-K/A

is to amend certain of the results and amend the financial tables that were included in Exhibit 99.1 to the Original Filing to reflect the impact of the March 15, 2018 announcement of Toys

“R” Us, Inc., one of the Company’s customers, relating to the wind down of its U.S. operations and the potential insolvency proceedings of certain of its subsidiaries and to reflect certain balance sheet reclassifications relating to

the accounting for the Company’s acquisition of Underground Toys Limited (“Underground Toys”).

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On March 16, 2018, the Company

disclosed its amended financial results for the quarter and year ended December 31, 2017. The amended financial results are furnished as Exhibit 99.1 to this Current Report on Form

8-K/A.

On March 15, 2018, after the Company had released earnings for the quarter and year ended December 31, 2017, Toys “R” Us,

Inc. announced the filing of a motion seeking approval from the United States Bankruptcy Court for the Eastern District of Virginia, Richmond Division to begin the process of conducting an orderly wind-down of its U.S. business and close all of its

remaining retail stores in the United States (the “Liquidation”).

In accordance with U.S. generally accepted accounting

principles, the Company revised its financial results for the fourth quarter and full year ended December 31, 2017 to reflect the effects of the Liquidation. Based on the information available to management, the Company increased the allowance

for doubtful accounts within Accounts receivable, net by $2.0 million, which represents the remaining unpaid accounts receivable balance from Toys “R” Us that was outstanding at December 31, 2017. This adjustment is reflected as

bad debt expense in Selling, general, and administrative expenses for the year ended December 31, 2017. The following table reflects the changes to the Company’s Condensed Consolidated Statements of Operations for the three months and year

ended December 31, 2017 from the previously released unaudited financial results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2017

|

|

|

Year Ended December 31, 2017

|

|

|

($’s in thousands, except per share amounts)

|

|

As Reported

|

|

|

Adjustment

|

|

|

As Amended

|

|

|

As Reported

|

|

|

Adjustment

|

|

|

As Amended

|

|

|

Selling, general, and administrative expenses

|

|

$

|

35,545

|

|

|

$

|

1,987

|

|

|

$

|

37,532

|

|

|

$

|

118,957

|

|

|

$

|

1,987

|

|

|

$

|

120,944

|

|

|

Income tax expense

|

|

|

757

|

|

|

|

(263

|

)

|

|

|

494

|

|

|

|

1,803

|

|

|

|

(263

|

)

|

|

|

1,540

|

|

|

Total operating expenses

|

|

|

148,110

|

|

|

|

1,987

|

|

|

|

150,097

|

|

|

|

471,952

|

|

|

|

1,987

|

|

|

|

473,939

|

|

|

Income (loss) from operations

|

|

|

21,364

|

|

|

|

(1,987

|

)

|

|

|

19,377

|

|

|

|

44,132

|

|

|

|

(1,987

|

)

|

|

|

42,145

|

|

|

Income (loss) before income taxes

|

|

|

9,982

|

|

|

|

(1,987

|

)

|

|

|

7,995

|

|

|

|

9,127

|

|

|

|

(1,987

|

)

|

|

|

7,140

|

|

|

Net income (loss)

|

|

|

9,225

|

|

|

|

(1,724

|

)

|

|

|

7,501

|

|

|

|

7,324

|

|

|

|

(1,724

|

)

|

|

|

5,600

|

|

|

Less:

net income attributable to

non-controlling

interests

|

|

|

2,902

|

|

|

|

(1,027

|

)

|

|

|

1,875

|

|

|

|

2,902

|

|

|

|

(1,027

|

)

|

|

|

1,875

|

|

|

Net income (loss) attributable to Funko, Inc.

|

|

|

6,323

|

|

|

|

(697

|

)

|

|

|

5,626

|

|

|

|

4,422

|

|

|

|

(697

|

)

|

|

|

3,725

|

|

|

|

|

|

|

|

|

|

|

Earnings per share of Class A common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.07

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.04

|

|

|

$

|

0.07

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.04

|

|

|

Diluted

|

|

$

|

0.07

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.04

|

|

|

$

|

0.07

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.04

|

|

In addition, subsequent to the Company’s earnings release on March 8, 2018, and while

completing the audit of the Company’s UK subsidiary’s statutory accounts and the final purchase accounting for the Underground Toys acquisition, the Company identified various balance sheet reclassifications. These balance sheet

adjustments resulted in a reduction of $10.6 million to both Total current assets and Total current liabilities on the Company’s Condensed Consolidated Balance Sheet as of December 31, 2017. None of the adjustments impacted the statement of

operations for the three months or for the year ended December 31, 2017 and primarily related to the presentation of certain accounts net versus gross. The following table reflects the changes to the Company’s Condensed Consolidated

Balance Sheet as of December 31, 2017 from the previously released unaudited financial results and includes the impact of the foregoing reclassifications and the $2.0 million bad debt allowance related to Toys “R” Us.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2017

|

|

|

($’s in thousands)

|

|

As Reported

|

|

|

Adjustment

|

|

|

As Amended

|

|

|

Accounts receivable, net

|

|

$

|

122,842

|

|

|

$

|

(7,364

|

)

|

|

$

|

115,478

|

|

|

Inventory

|

|

|

84,338

|

|

|

|

(5,256

|

)

|

|

|

79,082

|

|

|

Accounts payable

|

|

|

52,504

|

|

|

|

924

|

|

|

|

53,428

|

|

|

Income taxes payable

|

|

|

2,393

|

|

|

|

(125

|

)

|

|

|

2,268

|

|

|

Accrued royalties

|

|

|

31,261

|

|

|

|

(5,292

|

)

|

|

|

25,969

|

|

|

Accrued expenses and other current liabilities

|

|

|

33,298

|

|

|

|

(6,266

|

)

|

|

|

27,032

|

|

|

Deferred tax liability

|

|

|

725

|

|

|

|

(137

|

)

|

|

|

588

|

|

|

Retained earnings (deficit)

|

|

|

1,738

|

|

|

|

(697

|

)

|

|

|

1,041

|

|

|

Non-controlling

interests

|

|

|

151,015

|

|

|

|

(1,027

|

)

|

|

|

149,988

|

|

The foregoing corrections are also contained in the corrected financial tables attached as Exhibit 99.1

hereto.

The information in this Item 2.02 of this Current Report on Form

8-K/A

(including Exhibit

99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

FUNKO, INC.

|

|

|

|

|

By:

|

|

/s/ Tracy D. Daw

|

|

Name:

|

|

Tracy D. Daw

|

|

Title:

|

|

Sr. Vice President, General Counsel, and Secretary

|

Date: March 16, 2018

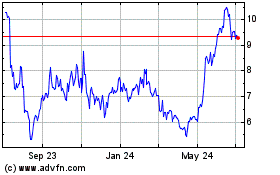

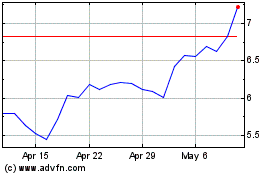

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Sep 2023 to Sep 2024