Amended Statement of Beneficial Ownership (sc 13d/a)

January 22 2018 - 3:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT

TO RULE 13d-2(a) *

(Amendment No. 6)*

|

GLOBUS

MARITIME LIMITED

|

|

(Name of Issuer)

|

|

|

|

Common Shares, par value $0.004 per share

|

|

(Title of Class of Securities)

|

|

|

|

Y27265308

|

|

(CUSIP Number)

|

|

|

|

Georgios Feidakis

128 Vouliagmenis Avenue, 2

nd

Floor

166 74 Glyfada, Athens, Greece

+ 30 210 960 8300

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

|

December

11, 2017

|

|

(Date of Event Which Requires Filing of the Statement)

|

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7 for other parties to whom

copies are to be sent.

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

This information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

1.

|

NAME OF REPORTING PERSONS

Firment Trading Limited

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (Entities Only).

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Marshall Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

0

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

0

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0

|

|

12.

|

CHECK IF THE AGGREGATE AMOUNT

IN ROW (9) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS)

¨

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.00%

|

|

14.

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

ITEM 1. SECURITY AND ISSUER.

This statement constitutes Amendment No.

6 on Schedule 13D (this “

Amendment

”) relating to the common shares, par value $0.004 per share (the “

Common

Shares

”), of Globus Maritime Limited, a Marshall Islands corporation (the “

Issuer

”), and hereby amends

the existing Schedule 13D on file, as it is has been amended and supplemented from time to time, on behalf of Firment Trading Limited

(“

Firment Trading

”). This Amendment is an exit filing for Firment Trading and, e

xcept

as set forth herein, this Amendment does not supplement, restate or amend any of the other information disclosed on the existing

Schedule 13D.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR

OTHER CONSIDERATION.

Item 3 is hereby supplemented by adding

the following:

From November 17 – December 11, 2017,

through a series of sales pursuant to Rule 144 by sales through Nasdaq, Firment Trading sold all the 202,144 Common Shares held

in the Issuer by Firment Trading for gross proceeds of $ 214,554.15, as shown in Schedule A attached hereto.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER.

Item 5(a) and (b) are hereby amended and

supplemented as follows:

As a result of the transactions described

in Item 3 of this Amendment, Firment Trading has no power to dispose of and vote any Common Shares. Firment Trading owns no Common

Shares.

(c) Except as set forth on Schedule A attached

hereto, no transactions in the Common Stock were effected by the Reporting Persons, or to the knowledge of the Reporting Persons,

nor by any executive officer or director of the Reporting Persons, or to their knowledge, since the most recent filing of Schedules

13D by the Reporting Persons.

Item 5(e) is hereby amended and supplemented

as follows:

(e) As of December 11, 2017, Firment Trading

ceased to be the beneficial owner of more than five percent (5%) of the Common Shares of the Issuer.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS.

|

Exhibit A.

|

Share Purchase Agreement dated December 31, 2015 between Firment Trading Limited of Cyprus and Firment Trading Limited of the Marshall Islands (incorporated by reference to Exhibit A to the Schedule 13D/A (Reg. No. 005-85956) filed on January 24, 2017)

|

|

Exhibit B.

|

Share and Warrant Purchase Agreement dated February 8, 2017 between Globus Maritime Limited and the Purchasers listed on Schedule A thereto (incorporated by reference to Exhibit 10.1 to the Report on Form 6-K of Globus Maritime Limited (Reg. No. 001-34985) filed on February 9, 2017)

|

|

Exhibit C.

|

Amendment to Loan Agreement dated February 8, 2017 between Globus Maritime Limited and Firment Trading Limited (incorporated by reference to Exhibit 10.3 to the Report on Form 6-K of Globus Maritime Limited (Reg. No. 001-34985) filed on February 9, 2017)

|

|

Exhibit D.

|

Amendment to Loan Agreement dated February 8, 2017 between Globus Maritime Limited and Silaner Investments Limited (incorporated by reference to Exhibit 10.4 to the Report on Form 6-K of Globus Maritime Limited (Reg. No. 001-34985) filed on February 9, 2017)

|

|

Exhibit E.

|

Warrant dated February 8, 2017 issued to nominee of Firment Trading Limited (incorporated by reference to Exhibit 10.6 to the Report on Form 6-K of Globus Maritime Limited (Reg. No. 001-34985) filed on February 9, 2017)

|

|

Exhibit F.

|

Warrant dated February 8, 2017 issued to nominee of Silaner Investments Limited (incorporated by reference to Exhibit 10.7 to the Report on Form 6-K of Globus Maritime Limited (Reg. No. 001-34985) filed on February 9, 2017)

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

January 17,

2018

|

|

|

(Date)

|

|

|

|

|

|

FIRMENT TRADING LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Philippos Philippou

|

|

|

|

Name: Philippos Philippou

|

|

|

|

Title: Sole Director, President,

Secretary and Treasurer

|

The original statement shall be signed

by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of

a person by his authorized representative other than an executive officer or general partner of the filing person, evidence of

the representative’s authority to sign on behalf of such person shall be filed with the statement,

Provided, however

,

that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name

and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions of fact

constitute Federal criminal violations

(

see

18 U.S.C. 1001).

SCHEDULE A

|

Entity

|

Date

|

Number of shares sold

|

Average Price per share ($)

|

|

|

|

|

|

|

Firment Trading

(Marshall Islands)

|

21.12.2016

|

5,269

|

6.162586

(1)

|

|

|

22.12.2016

|

13,770

|

5.780

|

|

|

29.12.2016

|

12,300

|

4.283

|

|

|

30.12.2016

|

8,262

|

4.104

|

|

|

18.04.2017

|

29,771

|

2.850957

(2)

|

|

|

19.04.2017

|

23,859

|

2.803

|

|

|

24.04.2017

|

28,646

|

3.042460

(3)

|

|

|

25.04.2017

|

32,200

|

2.650

|

|

|

26.04.2017

|

51,625

|

2.614849

(4)

|

|

|

27.04.2017

|

17,414

|

2.572

|

|

|

28.04.2017

|

1,050

|

2.533

|

|

|

04.05.2017

|

7,700

|

1.872

|

|

|

05.05.2017

|

18,488

|

1.727481

(5)

|

|

|

08.05.2017

|

30,000

|

1.513

|

|

|

09.05.2017

|

500

|

1.462

|

|

|

11.05.2017

|

30,000

|

1.377

|

|

|

12.05.2017

|

292,238

|

1.531894

(6)

|

|

|

17.05.2017

|

33,303

|

1.408703

(7)

|

|

|

02.06.2017

|

600

|

1.400

|

|

|

08.06.2017

|

100

|

1.450

|

|

|

09.06.2017

|

5,416

|

1.450

|

|

|

19.06.2017

|

20,300

|

1.553

|

|

|

12.07.2017

|

700

|

1.180

|

|

|

13.07.2017

|

20,000

|

1.110

|

|

|

14.07.2017

|

36,882

|

1.100

|

|

|

17.07.2017

|

600

|

1.100

|

|

|

18.07.2017

|

2,300

|

1.100

|

|

|

20.07.2017

|

15,400

|

1.100

|

|

|

21.07.2017

|

1,180

|

1.150

|

|

|

24.07.2017

|

161,620

|

1.206255

(8)

|

|

|

01.08.2017

|

12,900

|

1.102

|

|

|

10.08.2017

|

23,950

|

1.104

|

|

|

26.09.2017

|

6,041

|

0.930

|

|

|

27.09.2017

|

30,300

|

1.003

|

|

|

28.09.2017

|

4,290

|

0.950

|

|

|

17.11.2017

|

194,987

|

1.069122

(9)

|

|

|

11.12.2017

|

7,157

|

1.350

|

|

|

(1) Reflects a weighted average sale price of $6.162586 per share, at prices ranging from $5.987 to $6.312 per share.

|

|

|

(2) Reflects a weighted average sale price of $2.850957 per share, at prices ranging from $2.804 to $2.855 per share.

|

|

|

(3) Reflects a weighted average sale price of $3.042460 per share, at prices ranging from $2.802 to $3.526 per share.

|

|

|

(4) Reflects a weighted average sale price of $2.614849 per share, at prices ranging from $2.600 to $2.734 per share.

|

|

|

(5) Reflects a weighted average sale price of $1.727481 per share, at prices ranging from $1.723 to $1.800 per share.

|

|

|

(6) Reflects a weighted average sale price of $1.531894 per share, at prices ranging from $1.429 to $1.755 per share.

|

|

|

(7) Reflects a weighted average sale price of $1.408703 per share, at prices ranging from $1.400 to $1.409 per share.

|

|

|

(8) Reflects a weighted average sale price of $1.206255 per share, at prices ranging from $1.150 to $1.404 per share.

|

|

|

(9) Reflects a weighted average sale price of $1.069122 per share, at prices ranging from $1.050 to $1.111 per share.

|

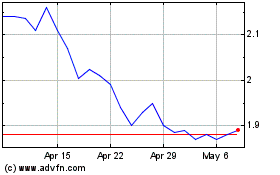

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Sep 2023 to Sep 2024