UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities and Exchange Act of 1934

For November 28, 2017

Commission file number: 1-13.396

Transportadora de Gas del Sur S.A.

Don Bosco 3672, Fifth Floor

1206 Capital Federal

Argentina

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to the Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No

X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

![[TGS002.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS002.GIF)

Condensed Interim Consolidated

Financial Statements

as of and for the nine-month period

ended September 30, 2017

English translation of the original prepared in Spanish for publication in Argentina

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FOR THE NINE-MONTH PERIOD ENDED SEPTEMBER 30, 2017

(1

)

The following discussion of the financial condition and results of operations of the Company should be read in conjunction with the Company's consolidated financial statements as of September 30, 2017 and December 31, 2016, and for the nine-month periods ended September 30, 2017 and 2016. These condensed interim consolidated financial statements have been prepared in accordance with and complied with IAS 34 issued by the International Accounting Standards Board (“IASB”) adopted by the

Comisión Nacional de Valores

("CNV") through the provisions of Title IV, Chapter I, Section I, Article 1 – B.1 of the Rules of the CNV ("New Text 2013" or "NT 2013").

The condensed interim consolidated financial statements of the Company for the nine-month period ended September 30, 2017 have been subject to a jointly review performed by Price Waterhouse & Co. S.R.L. ("Price") and Pistrelli, Henry Martin and Asociados S.R.L. The Company’s consolidated financial statements for the nine-month periods ended September 30, 2016, 2015, 2014 and 2013 have been subject to a review performed by Price.

1. Results of Operations

The following table presents a summary of the consolidated results of operations for the nine-month periods ended September 30, 2017 and 2016:

![[TGS004.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS004.GIF)

Overview

For the nine-month period ended September 30, 2017, the Company has reported a total comprehensive income of Ps. 1,818.6 million, compared with a total comprehensive income of Ps. 468.6 million reported in the same period last year, representing a Ps. 1,350.0 million increase.

This positive variation was mainly due to the increase in operating income of Ps. 1,847.3 million, which amounted to Ps. 3,229.1 million for the first nine months of 2017 from Ps. 1,381.8 million obtained in the same period of the previous year.

This positive variation was due to higher net revenues in the Natural Gas Transportation segment by Ps. 1,761.6 million , mainly as a result of the application of the tariff increases resolved by Resolutions No. 3724/2016 (“Resolution 3724”), No. 4054/2016 (“Resolution 4054”) and No. 4362/2017 (“Resolutions 4362”, jointly the “Resolutions”). Likewise, Liquids Production and Commercialization net revenues segment increased by Ps. 1,255.4 million compare to the amount reported in the same period last year, mainly because of higher reference prices. These effects were partially offset by higher operating costs and administrative and selling expenses of Ps. 1,458.9 million.

The net financial results showed a positive variation of Ps. 219.8 million, mainly as a result of the lower depreciation of the Argentine peso during the first nine months of 2017 compare to the same period last year.

On March 30, 2017, the National Gas Regulatory Body ("ENARGAS") issued Resolution No. 4362/2017 ("Resolution 4362"), which approved the technical-economic studies that emerged from the Integral Tariff Review process ("RTI" for its acronym in Spanish), initiated in April 2016. On the same date, the Company initiated the Integral Renegotiation License Agreement (“Integral Renegotiation Agreement”), which is being approved by the Ministry of Energy and Mining of the Nation ("MINEM"), the Ministry of Finance, Procurement of the Treasury of the Nation, the General Syndicate of Public Companies and the National Congress, for later ratification of the Executive Branch. It should be noted that the new tariff terms applicable to the Natural Gas Transportation segment were not included in the 2017 Integral Agreement, but an ambitious investment plan (the "Five-Year Investment Plan") was also approved for the five-year period April 1, 2017 - March 31, 2022. This Five Year Investment Plan will involve works by Ps. 6,786.5 million representing a value up to 4 times higher than the level of investments made for this business segment in the last 5 years.

It is worth noting that the tariff increase received through Resolution 3724 entails the execution of important investments (the "2016 Investment Plan"), which together with the Five-Year Investment Plan will be of utmost importance for the provision of a reliable service and insurance. As of September 30, 2017, the total accumulated investments made by these plans amounted to Ps. 1,255.6 million. Due to the delays in the implementation of the tariff increase authorized by Resolution 3724, the 2016 Investment Plan is in process of execution and will involve the execution of additional works by Ps. 46.6 million.

In the context of the steady increase in TGS’ operating costs and the non-compliance with the regulatory framework occurred over the last 16 years, which could only be partially offset by temporary tariff increases granted by ENARGAS, the completion of the RTI process will provide the Company with a framework of certainty in the performance of its regulated activity.

Net revenues

Natural Gas Transportation

The Natural Gas Transportation business segment represented approximately 38.2% and 27.5% of TGS’ total net revenues during the nine-month period ended September 30, 2017 and 2016, respectively. These business segment´s revenues are derived mainly from firm Natural Gas Transportation contracts, under which pipeline capacity is reserved and paid for, regardless of actual usage by the customer. The Company also provides interruptible natural gas transportation services subject to availability of the pipeline capacity. In addition, TGS renders operation and maintenance services for the Natural Gas Transportation facilities, which belong to the gas trusts (

fideicomisos de gas

) created by the Argentine Government to expand the capacity of the Argentine natural gas transportation pipeline system. For this service, the Company receives from customers who subscribed incremental natural gas transportation capacity the Charge for Access and Use (“CAU”). Since its inception in 2005, the CAU has remained unchanged since until its first update in May 2015.

Revenues derived from Natural Gas Transportation segment in the first nine months of 2017 increased by Ps. 1,761.6 million, compared to those obtained in the same period of 2016. The increase is mainly due to the combined effect of the full application throughout the first nine months of 2017 of the tariff increase granted by Resolution 3724, as subsequently modified by Resolution 4054, both issued by ENARGAS, which established the 200.1% tariff and of the increase granted pursuant to Resolution 4362 mentioned below.

Effective on April 1, 2017, within the framework of Resolution No. 74-E / 2017 ("Resolution 74") of the MINEM, ENARGAS issued Resolution 4362, in which the Company received an average tariff increase of 58% in the tariff charts applicable to the Natural Gas transportation service. This tariff increase was granted under the transitional agreement concluded on March 30, 2017 with MINEM (the "2017 Transitional Agreement") and the signing of a new version of the 2017 Integral Renegotiation Agreement, which is still subject to the approval of different government agencies and the National Congress and must be ratified by the National Executive Branch.

In addition, Resolution 4362 provided for the approval of the economic studies that will culminate with the RTI process, whose tariff increase, if applied in full as of April 1, 2017, would have meant an increase on a tariff of the natural gas transportation service and CAU of 214% and 37%, respectively. Pursuant to Resolution 74, such tariff increase will be granted in stages: (i) 30% of the increase as from April 1, 2017 (implemented through the 2017 Transitional Agreement), (ii) 40% of the increase as from December 1, 2017 and (iii) 30% of the increase as from April 1, 2018.

To determine the amount of the remaining increases, ENARGAS must consider the corresponding financial effect, without affecting the Five-Year Investment Plan.

It should be noted that this tariff increase was granted for TGS in order to obtain the necessary resources to execute the Five Year Investment Plan to be controlled by ENARGAS. Said plan includes indispensable works to attend the operation and maintenance, to provide a quality service, safe and reliable. Additionally, the implementation of the Five-Year Investment Plan is of utmost importance since it will ensure that the natural gas pipeline system responds to the needs derived from the development of the country's natural gas reserves.

Once the Integral Renegotiation Agreement is approved and ratified by the Executive Branch and the resulting tariff charts are published, the RTI process will be completed, which means a very important step for the Company to finally recover -after 16 years- the tariff charts through the collection of a fair and reasonable tariff that will allow developing a sustainable business ensuring the provision of an essential public service such as natural gas transportation.

Production and Commercialization of Liquids

Liquids Production and Commercialization segment revenues accounted for approximately 54.4% and 64.8% of the total net revenues in the nine-months periods ended September 30, 2017 and 2016, respectively. Liquids Production and Commercialization consists of natural gas processing activities conducted at the Cerri Complex, located near the city of Bahía Blanca, Province of Buenos Aires, where all of TGS’s main natural gas pipelines connect, and where ethane, propane, butane and natural gasoline are recovered. TGS sells its production of liquids in the domestic and the international markets. TGS sells part of its production of propane and butane to liquids marketers in the domestic market. The remainder of these products and all of its natural gasoline are exported at current international market prices. Ethane is entirely sold in the domestic market to PBB-Polisur S.A. (“Polisur”) at agreed prices.

Liquids Production and Commercialization segment revenues reached Ps. 4,409.1 million in the nine-month period ended September 30, 2017 a 39.8% increase or Ps. 1,255.4 million in comparison with the same period of 2016. The main cause of the increase in net revenues corresponds to the increase in international reference prices in the first nine months of 2017.

In addition, and favoring the positive impact of international reference prices, total volumes shipped increased by 4.5% or 31,390 short tons in the first nine months of 2017 compared to the same period in 2016, having been the total sales made by TGS’s own account .

During the first nine months of 2017, TGS continued to meet the requirements of the MINEM regarding the volumes to be supplied to the domestic market both under the

Programa Hogares con Garrafa

("Plan Hogar") and the Supply Agreement for Propane Gas Distribution Networks (“Propane Networks Agreement”).

In this sense, Resolution 74 established as from April 1, 2017 an increase in the price of undiluted propane gas for the Propane Network Agreement. The price is established in Ps. 1,267/tn and Ps. 2.832/tn depending on the customer to whom the product is intended. As in previous periods, the difference between the given price and the export parity price determined by the MINEM is economically compensated to the Company by the National Government.

With respect to

Plan Hogar

, on April 3, 2017, the Secretary for Hydrocarbon Resources issued Resolution No. 56-E/2017 which increases the price received for butane contributed to said program. Since April 2017, the specified price was Ps. 2,568 / tn. On the other hand, the compensation received from the MINEM is currently set at Ps. 550 / tn.

It is noteworthy that, as of the date of issuance of this Analysis of Financial Conditions, significant delays in the collection of compensation corresponding to the programs mentioned above continue to exist. In this sense, during 2017, we received from the Hydrocarbons Resources Secretariat the payment of Ps. 116, 8 million owed as compensation for the year 2016 and the months of January and February 2017 of the Propane Networks Agreement.

Regarding the ethane contract, on August 1, 2017, the Company concluded with Polisur the negotiations of the agreement that will govern the terms by which said product will be sold until May 1, 2018. It should be noted that said agreement has similar terms effective as the one in force until May 1, 2017 and that has retroactive effect from that date.

Finally, on July 10, 2017, the Company signed a sales agreement with Shell Trading US Company to export natural gasoline. It will be in force until January 2018. Between January and July 2017, TGS sold natural gasoline to that customer at spot prices minus a discount per sold ton.

Other services

The Company renders “midstream” services that mainly consist of gas conditioning, gathering and compression services, which are generally rendered at wellhead, as well as activities related to construction, operation and maintenance of pipelines and compressor plants. Other services also include telecommunication services rendered by Telcosur S.A., a company controlled by TGS.

Other Services revenues increased by Ps. 216.5 million in the first nine months of 2017 compared to the same period in 2016. The increase corresponds mainly to the increase in natural gas compression and treatment services. In addition, but to a lesser extent, they contributed to the increase in net revenues, higher operating and maintenance services, the effect of the exchange rate over the sales denominated in U.S. dollars and engineering services rendered during the first nine months of 2017.

Cost of sales and administrative and selling expenses

Cost of sales, administrative and selling expenses increased approximately Ps. 1,458.9 million, or 42.6% in the nine-month period ended September 30, 2017 when compared to the same period last year. This variation is mainly due to: (i) the cost of natural gas processed in the Cerri Complex, mainly as a consequence of the increase in the price and natural gas volumes purchased as Replacement Thermal Plant ("RTP"), (ii) higher labor costs, (iii) the costs of repair and maintenance of fixed assets, (iv) the butane purchases made from their resale, (v) the turnover tax; and (vi) depreciation of property, plant and equipment.

Other operating results

The other operating results showed a positive variation of Ps. 72.7 million mainly as a result of the positive result generated by the recovery obtained from the incident occurred at the Polisur production plant. This effect was partially offset by a higher negative charge for provisions for contingencies.

Net financial results

The negative financial results for the nine-month period ended September 30, 2017 had a positive effect of Ps. 219.8 million compared to the same period of 2016. The breakdown of net financial expense is as follows:

![[TGS006.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS006.GIF)

This positive variation is mainly due to the lower exchange loss of Ps. 288.4 million as a result of the lower depreciation of the Argentine peso against U.S. dollar. The selling exchange rate of the peso ended at a value of Ps. 17.31 per US dollar at September 30, 2017, representing an increase of 8.9% (or Ps. 1.42 per U.S. dollar) as compared with the exchange rate at year-end 2016. Meanwhile, during the nine-month period ended September 30, 2016 the exchange rate had risen 17.4% (or Ps. 2.27 per U.S. dollar) when compared with the listed price at year-end 2015.

This effect was partially offset by higher interest loss generated by financial liabilities and the lower interest income generated by financial assets. On the other hand, the interest generated by liabilities was increased by the effect of higher interest generated by financial leases and the appreciation of the exchange rate.

Income tax expense

For the nine-month period ended September 30, 2017, TGS reported a Ps. 969.8 million income tax loss, having reported in the same period of 2016 an income tax loss of Ps. 254.0 million. This negative variation is due to the taxable income generated in the first nine-month period of 2017.

2

2. Liquidity

The Company’s primary sources and application of funds during the nine-month periods ended September 30, 2017 and 2016 are shown in the table below:

![[TGS008.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS008.GIF)

The net positive variation in cash and cash equivalents in the first nine-months of 2017 was Ps. 193.5 million higher than the cash and cash equivalents variation reported in the first nine-months of 2016.

The increase in the net cash flow was due to a higher cash flow generated by operations for Ps. 679.3 million, primarily as a result of an improved operating income, which was partially offset by higher income tax payments and contingency cancellation. In addition, cash flow used for financing activities was less at Ps. 524.3 million due to lower amount of debt amortization and dividend payment.

On the other hand, the net cash flow used for investing activities rose by Ps. 1,010.1 million as a result of the higher funds used for investments not considered as cash equivalents, and higher payments for property, plant and equipment acquisition during 2017.

3

3. Third Quarter 2017 vs. Third Quarter 2016

The following table presents a summary of the consolidated results of operations for the third quarters ended September 30, 2017 and 2016:

![[TGS010.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS010.GIF)

For the third quarter 2017, TGS posted total comprehensive income of Ps. 518.2 million, compared to Ps. 151.2 million recorded in the 2016 period.

Total net revenues for the third quarter of 2017 increased Ps. 1,078.5 million or 69.7% over the same period of the previous year.

Net revenues from Natural Gas Transportation segment during the third quarter of 2017 increased by Ps. 857.4 million from those recorded in the same period of 2016. The positive variation was mainly due to the tariff increase authorized by Resolution 4362 and the full application of the tariff increase of 200.1% granted by Resolution 4054 that modified the provisions of Resolution 3724 (in force during the third quarter of 2016). On the other hand, it is noteworthy that during the third quarter of 2016, the Company reversed the net revenues recognized in the second quarter of 2016 by the tariff increase corresponding to services provided to residential users by virtue of compliance with the ruling of the Supreme Court of Justice on August 18, 2016 (which determined the invalidity of the tariff increases authorized by the ENARGAS with respect to residential users).

Liquids revenues increased Ps. 139.1 million or 12.7% in the third quarter of 2017, from the third quarter of 2016. The revenue increase is mainly due to the increase in reference prices and the positive variation in the exchange rate variation of the Argentine peso against the US dollar.

In terms of volumes shipped, the decrease of 24,141 short tons, or 10.8%, represented a negative variation on sales revenues. It is noteworthy that to this negative variation contributed the lower tons of ethane required by Polisur due to technical damage occurred in its production plant and propane and butane for export.

Other services revenues rose by Ps. 82.0 million in the third quarter of 2017. This increase is mainly attributable to higher sales associated with: (i) natural gas compression and treatment services, (ii) the exchange rate variation on revenues denominated in US dollars, (iii) higher operating and maintenance expenses of pipelines and compressor plants, and (iv) higher engineering services.

Costs of sales, administrative and selling expenses for the third quarter of 2017 were Ps. 1,634.6 million (Ps. 1,172.4 million in the third quarter of 2016) representing an increase of approximately Ps. 462.2 million (39.4%) from the same previous year period. This variation is mainly due to higher: (i) butane purchases to supply the local market, (ii) labor costs, (iii) the cost of natural gas processed in the Cerri Complex, (iv) turnover tax and (v) other expenses attributable to the natural gas transportation business segment.

Other negative operating results recorded in the third quarter of 2017 amounted to Ps. 19.2 million, compared to the negative result of Ps. 30.5 million reported in the period 2016. This variation was due to the lower charge for provisions recognized in such period.

In the third quarter of 2017, negative financial results rose by Ps. 79.5 million compared to the same period in 2016. This variation is mainly attributable to: (i) the higher negative charge for exchange differences as a result of the higher depreciation of the Argentine peso against the US dollar over the net liability position in foreign currency, (ii) tax on banking transactions and (iii) higher interest generated by financial liabilities.

4

4. Consolidated Financial Position Summary

Summary of the consolidated financial position information as of September 30, 2017, 2016, 2015, 2014 and 2013:

![[TGS012.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS012.GIF)

5. Consolidated Comprehensive Income Summary

Summary of the consolidated comprehensive income information for the nine-month periods ended September 30, 2017, 2016, 2015, 2014 and 2013:

![[TGS014.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS014.GIF)

5

6. Consolidated Cash Flows Summary

Summary of the consolidated cash flows information for the nine-month periods ended September 30, 2017, 2016, 2015, 2014 and 2013:

![[TGS016.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS016.GIF)

7. Statistical Data (Physical Units)

![[TGS018.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS018.GIF)

8. Comparative ratios

![[TGS020.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS020.GIF)

6

9. Other Information

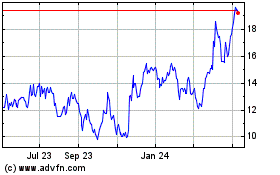

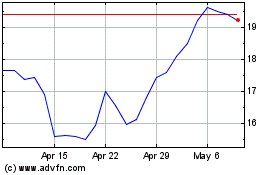

TGS share market value in Buenos Aires Stock Exchange at closing of last business day (in Argentine pesos per share)

|

|

|

|

|

|

|

|

2017

|

2016

|

2015

|

2014

|

2013

|

|

January

|

32.40

|

17.00

|

7.60

|

4.13

|

3.10

|

|

February

|

36.80

|

21.00

|

9.10

|

4.20

|

2.56

|

|

March

|

43.90

|

17.30

|

12.70

|

4.58

|

2.82

|

|

April

|

46.30

|

18.00

|

12.00

|

5.14

|

3.04

|

|

May

|

53.30

|

18.00

|

10.80

|

6.45

|

2.91

|

|

June

|

56.40

|

19.90

|

11.40

|

5.57

|

2.60

|

|

July

|

54.00

|

19.55

|

11.10

|

6.08

|

3.06

|

|

August

|

61.30

|

18.25

|

11.65

|

7.04

|

3.35

|

|

September

|

72.00

|

20.80

|

10.90

|

10.00

|

3.80

|

|

October

|

|

22.40

|

16.70

|

8.78

|

4.15

|

|

November

|

|

25.60

|

17.70

|

9.00

|

4.36

|

|

December

|

|

29.60

|

17.05

|

7.80

|

3.80

|

10. Outlook

As mentioned in note 17.a, on March 30, 2017, the Company signed the 2017 Transitional Agreement and its Board of Directors approved a new version of the 2017 Integral Renegotiation Agreement, which, as of the date of issuance of these Consolidated Interim Financial Statements, is still pending approval and ratification by the National Congress and the National Government. These two milestones, added to the measures adopted subsequently by ENARGAS and MINEM in the framework of the RTI process, which approved a new tariff scheme applicable in stages as from April 1, 2017 and the Five-Year Investment Plan, generated a framework of certainty for the Gas Natural Transportation business segment that will allow TGS to accompany the energy development of Argentina.

For this process, the Five-Year Investment Plan implies an important challenge for the Company as it will ensure that the pipeline system responds to the needs derived from the development of the country's gas reserves. In 2017, TGS will focus on management to achieve compliance and maintenance of the five-year plan mentioned above. This will continue enabling us to develop a reliable and safe Natural Gas Transportation business, which has characterized this Company in its 25 years of existence.

In this context, on October 20, 2017, ENARGAS issued Resolution No. 62/2017, which summon a public hearing to be held on November 14, 2017 in order to increase the transportation tariffs on account of the RTI, as it is not still in force. The new tariff charts will become effective as from December 1, 2017.

In the Liquids Production and Marketing segment, the strategy will be aimed at optimizing the production mix that allows prioritizing those products and distribution channels that provide higher margins. In addition, the Company will work in maximizing the access to RTP at reasonable costs, in a context of higher cost of natural gas and in a framework of recovery of the sale prices of the products destined to the supply programs to the local market. For this, it will be very important to be efficient in the management of our assets, ensuring a coordinated, safe and efficient operation

In the "Other Services and Telecommunications" segments, in an even more challenging framework, the focus will be on developing attractive businesses that allow us to anticipate the needs of our clients in view of the opportunities that arise under the policies adopted by the National Government that allow for obtaining predictable prices and stable rules.

In financial terms, TGS plans to access financing to carry out the implementation of the demanding Five-Year Investment Plan and investment projects of non-regulated businesses. The objective of the Company is to maintain an optimal capital structure in accordance with its investment needs, at a cost of financing agreed, in order to maximize profitability for shareholders.

As regards their daily operations, TGS will remain committed to continuous improvement of each of its processes to optimize the use of the resources and to reduce operating costs. To this end, the Company will carry out actions aimed at the reduction of cost increases in operating and maintenance without affecting the reliability and availability of the pipeline system. We will continue with the implementation of various actions, such as the standardization and systematization of risk management in pipelines, compressor stations and processing facilities. Finally, we will deepen training initiatives for the staff for technical and management training resources.

Autonomous City of Buenos Aires, November 7, 2017.

Luis Alberto Fallo

Chairman of the Board of Directors

7

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE THREE AND NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2017 AND 2016

(Stated in thousands of pesos as described in Note 3 except for basic and diluted earnings per share)

![[TGS022.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS022.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

1

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF SEPTEMBER 30, 2017 AND DECEMBER 31, 2016

(Stated in thousands of pesos as described in Note 3)

![[TGS024.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS024.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

2

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2017 AND 2016

(Stated in thousands of pesos as described in Note 3)

![[TGS026.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS026.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2017 AND 2016

(Stated in thousands of pesos as described in Note 3)

_____________________________________________________________________________________________________

![[TGS028.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS028.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

4

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

1.

GENERAL INFORMATION

Business Overview

Transportadora de Gas del Sur S.A. (“TGS”) is one of the companies created as a result of the privatization of Gas del Estado S.E. (“GdE”). TGS commenced operations on December 29, 1992 and it is mainly engaged in the Transportation of Natural Gas, and Production and Commercialization of natural gas Liquids (“Liquids”). TGS’s pipeline system connects major natural gas fields in southern and western Argentina with natural gas distributors and industries in those areas and in the greater Buenos Aires area. The natural gas transportation license to operate this system was exclusively granted to TGS for a period of thirty-five years (“the License”). TGS is entitled to a one-time extension of ten years provided that it has essentially met the obligations imposed by the License and by the

Ente Nacional Regulador del Gas

(National Gas Regulatory Body or “ENARGAS”). The General Cerri Gas Processing Complex (the “Cerri Complex”), where TGS processes natural gas by extracting liquids, was transferred from GdE along with the gas transmission assets. TGS also provides midstream services, which mainly consist of gas treatment, removal of impurities from the natural gas stream, gas compression, wellhead gas gathering and pipeline construction, operation and maintenance services. Also, telecommunications services are provided through the subsidiary Telcosur S.A. (“Telcosur”). These services consist of data transmission services through a network of terrestrial and digital radio relay.

On April 26, 2017, the Ordinary and Extraordinary Shareholders’ Meeting (the “Shareholders’ Meeting”) approved the amendment of TGS’ bylaws (the “Statutory Modification”) in order to: (i) expand the corporate purpose in order to incorporate the development of complementary, accessory, related and / or derived activities of natural gas transportation, such as the generation and sale of electricity and the provision of other services for the hydrocarbons sector in general, and (ii) the creation of an Executive Committee of the Board of Directors under the terms of Article 269 of the General Companies Law. The objective is to provide this Administration body with greater flexibility in decision-making. In relation to compliance with the regulatory requirements, it has been recorded that the Statutory Modification has not received comments from ENARGAS, in what concerns its competence, as informed by a note dated April 25, 2017, nor from (ii) the

Comisión Nacional de Valores

("CNV"), which has made up the Statutory Modification through a note dated April 18, 2017.

On July 14, 2017, through the issuance of Resolution No. 18,852, the CNV approved the Statutory Modification, which finally was approved by the General Inspection of Justice on July, 25, 2017.

Major Shareholders

TGS’s controlling shareholder is Compañía de Inversiones de Energía S.A. (“CIESA”), which holds 51% of the common stock. Local and foreign investors hold the remaining ownership of TGS’s common stock. CIESA is under co-control of: (i) Petrobras Argentina S.A. (in the process of merging with Pampa Energía S.A. “Pampa Energía”), which holds 10% of CIESA’s common stock, (ii) CIESA Trust (whose trustee is The Royal Bank of Scotland N.V. Argentine Branch and whose beneficiary is Petrobras Hispano Argentina SA, a wholly owned subsidiary of by Pampa Energía) (the "Trust"), who has a trust shareholding of 40% of the share capital of CIESA) and (iii) Grupo Inversor Petroquímica S.L. (member of GIP Group, headed by Sielecki´s family; “GIP”), and PCT L.L.C. ("PCT"), which directly and together with WST S.A. (Member of Werthein Group, "WST") indirectly through PEPCA S.A. ("PEPCA"), hold a 50% of the shareholding in CIESA.

The current shareholding structure of CIESA is the result of the transaction carried out on July 27, 2016, by which: (i) Pampa Energía S.A. and its subsidiary Pampa Participaciones SA sold all of the capital stock and votes of its ownership in PEPCA in favor of GIP (by 51%), WST (by 45.8%) and PCT (by 3.2%), and (ii) Pampa Inversiones S.A. transferred its status as beneficiary of the Trust to GIP and PCT, with a holding of 55% and 45%, respectively (the "Transaction").

On July 27, 2016, Pampa Energía SA acquired from an affiliate of Petroleo Brasileiro SA the total shareholding and votes of Petrobras Participaciones S.L., the controlling company of Petrobras Argentina S.A., and consequently the indirect control of Petrobras Hispano Argentina S.A.

On August 9, 2016, ENARGAS authorized the change of share control in CIESA, approving through Resolution No. I/3939: (i) the acquisition by Pampa Energía of the entire shareholding that Petrobras Participaciones S.L. held in Petrobras Argentina; (ii) the acquisition by GIP, WST and PCT of PEPCA shareholding; (iii) the transfer of rights made by Pampa Energía to GIP and PCT and, (iv) the replacement of The Royal Bank of Scotland N.V. Argentine Branch as Trustee of the Trust, by TMF Trust Company (Argentina) S.A.

On December 7, 2016, Pampa Energía, Petrobras Argentina S.A., Petrobras Hispano Argentina S.A., Pampa Participaciones S.A. and Pampa Inversiones S.A. (jointly "Pampa Group") requested authorization from ENARGAS to exercise the exchange option (the "Exchange") provided for in the Transaction. The Exchange consists of a series of transfers by which Pampa Group transfers to GIP and PCT 40% of the capital stock of CIESA, while GIP and PCT transfer to Petrobras Hispano Argentina S.A. their status as Beneficiaries of the Trust. Thus, the Exchange did not modify GIP, PCT and WST percentage ownership of CIESA, and thereby TGS. Finally, the Exchange was approved by ENARGAS on December 29, 2016, and notified to CIESA on January 17, 2017.

As a result of the Transaction and the Exchange, GIP, WST and PCT hold 50% of CIESA's capital stock in the following proportions: GIP 27.10%, WST 4.58% and PCT 18.32%, while Pampa Group holds the remaining 50%.

On February 16, 2017, the Extraordinary Shareholders’ Meetings of Pampa Energía and Petrobras Argentina S.A approved the merger commitment mentioned above. The merger will be effective as of November 1, 2016. At the date of issuance of these consolidated financial statements, the administrative compliance of the merger is still pending by the controlling bodies.

2.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

TGS presents its condensed interim consolidated financial statements for the nine-month periods ended September 30, 2017 and 2016 in compliance with the provisions of the New Text 2013 of the CNV. In these condensed interim consolidated financial statements, TGS and Telcosur, its consolidated subsidiary, are jointly referred to as “the Company”.

3.

BASIS OF PRESENTATION

These condensed interim consolidated financial statements have been prepared in accordance with and complied with International Accounting Standard 34 (“IAS 34”) issued by the International Accounting Standards Board (“IASB”) adopted by the CNV through NT 2013.

These condensed interim financial statements do not include all information and disclosures required for annual financial statements and should be read in conjunction with TGS’ annual financial statements as of December 31, 2016 issued on March 7, 2017.

Detailed data reflecting subsidiary control as of September 30, 2017 is as follows:

|

|

|

|

|

|

% of shareholding

|

|

|

|

Company

|

and votes

|

Closing date

|

Main activity

|

|

|

|

|

|

|

Telcosur

|

99.98

|

December 31

|

Telecommunication Services

|

|

CTG Energía S.A.

|

100.00

|

December 31

|

Electrical power related services

|

Functional and presentation currency

The condensed interim consolidated financial statements are stated in thousands of Argentine pesos (“Ps.” or “pesos”), the functional currency of the Company and its subsidiary, unless otherwise stated.

IAS 29 "Financial reporting in hyperinflationary economies" requires that the financial statements of an entity whose functional currency is that of a hyperinflationary economy, regardless of whether they are based on the historical cost method or the current cost method, are expressed in terms of the current unit of measure at the reporting date of the reporting period.

For this purpose, in general terms, the inflation produced from the date of acquisition or from the date of revaluation, as appropriate, should be included in non-monetary items.

In order to conclude about the existence of a hyperinflationary economy, the standard details a series of factors to consider including a cumulative rate of inflation in three years that approaches or exceeds 100%.

As of September 30, 2017, for companies in Argentina, it is not possible to compute the cumulative inflation rate for the three-year period ended on that date based on official data of the

Instituto Nacional de Estadísticas y Censos

(“INDEC”), because in October 2015, INDEC ceased to compute the Wholesale Price Index, and started to compute it again as from January 2016.

At the end of the reporting period, as a result of: (i) local inflation data has not been reported consistently, (ii) the slowdown in inflation as from the second half of 2016 and (iii) inconclusive qualitative indicators, the Argentine peso does not meet the characteristics to qualify as the currency of a hyperinflationary economy according to the guidelines established in IAS 29 and, therefore, these consolidated financial statements have not been restated in constant currency.

However in recent years, certain macroeconomic variables affecting the Company's operations, such as payroll costs, prices of inputs and services, have had significant annual variations. This circumstance should be considered in the evaluation and interpretation of the financial situation and results presented by the Company in these condensed interim consolidated financial statements.

4.

SIGNIFICANT ACCOUNTING POLICIES

The accounting policies applied to these condensed interim consolidated financial statements are consistent with those used in the financial statements for the last financial year prepared under IFRS, which ended on December 31, 2016.

New standards, amendments and mandatory interpretations for fiscal years beginning on January 1, 2017

The following standards, amendments and interpretations apply to the Company as from this fiscal year, which have had no significant impact on the financial position and results of operations.

Amendments to IAS 12 "Income Taxes"

In January 2016, the IASB issued certain amendments with respect to the recognition of deferred tax assets for unrealized losses.

These amendments are effective for the annual period beginning on January 1, 2017. The implementation of this amendment had no impact.

Amendments to IAS 7 "Statements of Cash Flows"

In February 2016, the IASB issued certain amendments regarding disclosures of the Statement of Cash Flows.

Modifications to the Disclosure Initiative (Amendments to IAS 7) aim entities to disclose information that enables users of financial statements to evaluate changes in liabilities arising from financing activities.

For this purpose, the IASB requires that an entity shall disclose the following changes in liabilities arising from financing activities: (i) changes from financing cash flows; (ii) changes arising from obtaining or losing control of subsidiaries or other businesses; (iii) the effect of changes in foreign exchange rates; (iv) changes in fair value; and (v) other changes.

Finally, the amendments state that changes in liabilities arising from financing activities must be disclosed separately from changes in other assets and liabilities.

The Company implemented these amendments in Note 7 to these condensed consolidated interim financial statements.

5.

FINANCIAL RISK MANAGEMENT

The Company’s activities and the market in which it operates expose it to a series of financial risks: market risk (including foreign exchange risk, cash flows interest rate risk, and commodity price risk), credit risk and liquidity risk.

There have been no significant changes since the last annual financial statements in risk management policies.

6.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of the condensed interim consolidated financial statements in accordance with generally accepted accounting principles requires management to make accounting estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, as well as the reported amounts of revenues and expenses during the reporting period. These estimates require management to make difficult, subjective or complex judgments and estimates about matters that are inherently uncertain. Management bases its estimates on various factors, including past trends, expectation of future events regarding the outcome of events and results and other assumptions that it believes are reasonable.

After the issuance of the financial statements for the year ended December 31, 2016, and for the purposes of issuing the financial statements as of that date included in the form 20-F, the Company updated the recoverability test of the assets affected to the Natural Gas Transportation segment. In this sense, TGS considered that the uncertainty existing as of December 31, 2016 with respect to the critical assumptions used to calculate the different cash flows applicable to the test was reduced due to the fact that the ENARGAS through Resolution No. I-4362/17 (the “Resolution 4362”) approved the economic studies of the Integral Tariff Review (“RTI”) establishing a new temporary tariff schedule and effects of the signing of a new version of the Integral Renegotiation Agreement Act (the "2017 Integral Renegotiation Agreement"), (for more information on see note 17).

In this reevaluation of the recoverability of the fixed assets involved as of December 31, 2016, the impact of the temporary tariff increase granted by the Resolution 4362 was considered, and a single cash flow was prepared. This cash flow considers the estimates regarding: (i) the amount of the first installment of the tariff increase granted by Resolution 4362, (ii ) the opportunity in which the remaining increases will be granted, (iii) the rate increases to be received in the future, (iv) the semiannual adjustment mechanism provided by Resolution 4362, (v) mandatory works to be performed according to Resolution 4362 ("Five-Year Investment Plan") and (vi) the macroeconomic variables that will impact on the Company.

Based on those estimations, Company´s management considers that the recoverable value of Property, Plant and equipment used in the gas transportation segment is higher than the carrying amount of such assets as of September 30, 2017.

7.

SUPPLEMENTAL CASH FLOW INFORMATION

For purposes of the condensed interim consolidated statement of cash flows, the Company considers all highly liquid temporary investments with an original maturity of three months or less at the time of purchase to be cash equivalents. The cash flow statement has been prepared using the indirect method, which requires a series of adjustments to reconcile net income for the period to net cash flows from operating activities.

Non-cash investing and financing activities for the nine-month periods ended September 30, 2017 and 2016 are presented below:

![[TGS030.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS030.GIF)

Note 13 includes a reconciliation between the opening and closing balance of the financial liabilities arising from financing activities.

8.

CONSOLIDATED BUSINESS SEGMENT INFORMATION

IFRS 8 “Operating Segments” requires an entity to report financial and descriptive information about its reportable segments, which are operating segments or aggregations of operating segments that meet specified criteria. Operating segments are components of an entity about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”) in deciding how to allocate resources and in assessing performance. The Company’s CODM is the Board of Directors.

The Company analyzes its businesses into four segments: (i) Natural Gas Transportation Services, (ii) Liquids Production and Commercialization, (iii) Other Services, and (iv) Telecommunications. These last three business segments are not regulated by ENARGAS. Production and Commercialization of Liquids segment is regulated by the Ministry of Energy and Mining (“MINEN”) and the Secretariat of Hydrocarbons Resources.

Detailed information on each business segment for the nine-month periods ended September 30, 2017 and 2016 is disclosed below:

![[TGS032.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS032.GIF)

![[TGS034.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS034.GIF)

9.

SUMMARY OF SIGNIFICANT STATEMENT OF FINANCIAL POSITION AND STATEMENT OF COMPREHENSIVE INCOME ITEMS

a)

Other receivables

![[TGS036.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS036.GIF)

The breakdown of other receivables based on its currency of origin is the following:

![[TGS038.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS038.GIF)

b)

Trade receivables

![[TGS040.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS040.GIF)

The breakdown of trade receivables based on its currency of origin is the following:

![[TGS042.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS042.GIF)

The movement of the allowance for doubtful accounts is as follows:

![[TGS044.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS044.GIF)

c)

Cash and cash equivalents

![[TGS046.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS046.GIF)

The breakdown of cash and cash equivalents based on its currency of origin is the following:

![[TGS048.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS048.GIF)

d)

Advances from customers

(1)

![[TGS050.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS050.GIF)

Advances from customers are denominated in pesos.

e)

Other payables

![[TGS052.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS052.GIF)

Other payables are denominated in pesos.

5

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

f)

Taxes payables

![[TGS054.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS054.GIF)

Taxes payables are denominated in pesos.

g)

Trade payables

![[TGS056.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS056.GIF)

The breakdown of trade payables based on its currency of origin is the following:

![[TGS058.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS058.GIF)

h)

Cost of sales

![[TGS060.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS060.GIF)

6

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3)

___________________________________________________________________________________________________________________________________________________________

i)

Expenses by nature – Information required under art. 64 paragraph I, clause B) Commercial Companies Law for the nine-month period ended September 30, 2017 and 2016

![[TGS062.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS062.GIF)

7

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

j)

Net financial results

![[TGS064.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS064.GIF)

k)

Other operating expense

![[TGS066.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS066.GIF)

l)

Other financial assets at fair value through profit or loss

![[TGS068.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS068.GIF)

Other financial assets at fair value through profit or loss are denominated in US dollars.

m)

Other financial assets at amortized cost

![[TGS070.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS070.GIF)

The breakdown of other financial assets at amortized cost based on its currency of origin is the following:

![[TGS072.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS072.GIF)

2.

INVESTMENTS IN ASSOCIATES

![[TGS074.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS074.GIF)

3.

SHARE OF LOSS FROM ASSOCIATES

![[TGS076.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS076.GIF)

8

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

___________________________________________________________________________________________________________________________________________________________

4.

PROPERTY, PLANT AND EQUIPMENT

![[TGS078.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS078.GIF)

9

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

5.

LOANS

Short-term and long-term loans as of September 30, 2017 and December 31, 2016 comprise the following:

![[TGS080.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS080.GIF)

The breakdown of loans based on its currency of origin is the following:

![[TGS082.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS082.GIF)

The activity of the loans as of September 30, 2017 and 2016 is the following:

![[TGS084.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS084.GIF)

The maturities of the current and non-current loans as of September 30, 2017 are as follows:

![[TGS086.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS086.GIF)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

The following are the maturities of the financial leasing in force as of September 30, 2017:

![[TGS088.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS088.GIF)

6.

INCOME TAX AND DEFERRED TAX

As of the date of the issuance of these condensed interim consolidated financial statements, there are no significant changes with respect to the situation disclosed by the Company as of December 31, 2016.

The reconciliation between the tax computed for tax purposes and the income tax expense charged to the statement of comprehensive income in the nine-month periods ended September 30, 2017 and 2016 is as follows:

![[TGS090.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS090.GIF)

7.

PROVISIONS

![[TGS092.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS092.GIF)

The total amount of provisions is included on current Liabilities.

8.

FINANCIAL INSTRUMENTS BY CATEGORY AND HIERARCHY

1.1

Financial instrument categories

There have been no significant changes regarding the accounting policies for the categorization of financial instruments since the policies disclosed by the Company as of December 31, 2016.

The categories of financial assets and liabilities as of September 30, 2017 and December 31, 2016 are as follows:

![[TGS094.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS094.GIF)

![[TGS096.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS096.GIF)

1.2

Fair value measurement hierarchy and estimates

According to IFRS 13, the fair value hierarchy introduces three levels of inputs based on the lowest level of input significant to the overall fair value. These levels are:

·

Level 1: includes financial assets and liabilities whose fair values are estimated using quoted prices (unadjusted) in active markets for identical assets and liabilities. The instruments included in this level primarily include balances in mutual funds and public or private bonds listed on the

Bolsas y Mercados Argentinos S.A.

(“BYMA”). The mutual funds mainly made their placements in letters issued by the Central Bank of the Argentine Republic.

·

Level 2: includes financial assets and liabilities whose fair value is estimated using different assumptions quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (for example, derived from prices). Within this level, the Company includes those derivate financial instruments for which it was not able to find an active market.

·

Level 3:

includes financial instruments for which the assumptions used in estimating fair value are not based on observable market information.

The table below shows different assets at their fair value classified by hierarchy as of September 30, 2017:

![[TGS098.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS098.GIF)

The fair value amount of the financial assets is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

As of September 30, 2017, the carrying amount of certain financial instruments used by the Company including cash, cash equivalents, other investments, receivables, payables and short-term loans are representative of fair value because of the short-term nature of these instruments.

The estimated fair value of other Non-current assets and Other loans does not differ significantly from the carrying amount. The following table reflects the carrying amount and estimated fair value of the 2014 Notes at September 30, 2017, based on their quoted market price:

![[TGS100.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS100.GIF)

16

REGULATORY FRAMEWORK

a)

General framework of the regulated segment and general tariff situation

On March 30, 2017, the Company and the National Government signed a new transitional agreement (the “2017 Transitional Agreement”). On the same day and as agreed in the 2017 Transitional Agreement, ENARGAS issued Resolution 4362 by which:

·

The Integral Tariff Review Process (“RTI”),

which will culminate in the signing of the integral agreement, was approved. As a result of this RTI, a new tariff schedule was also approved. However, according to the provisions of

Resolution No. 74/2017 ("Resolution 74")

, the Ministry of Energy has limited the tariff increase arising from the RTI process.

MINEM provides for a limitation to the full validity of the tariff increase until the approvals of the Integral Agreement Act are completed (the "2017 Integral Renegotiation Agreement").

Accordingly, a new transitional tariff schedule in force as of April 1, 2017, which contemplates a rate increase of 64.2%, has been approved, but no increases for the

Access and Use Charge ("CAU")

have been approved at this stage.

·

The total tariff increase arising from the RTI process will be 214.2% and 37%, in the event that it had been granted in a single installment as of April 1, 2017, on the natural gas transportation service tariff and the CAU, respectively. As mentioned above the first stage of the increase was granted as of April 1, 2017.

Resolution 74 provides that the remaining tariff increases resulting from the RTI will be granted as from December 1, 2017 (40% of the total increase) and April 1, 2018 (30% of the total increase). According to said resolution, the ENARGAS should consider the corresponding financial impact of the delay in the implementation of the tariff increase.

To determine the amount of the remaining increases, ENARGAS must consider the corresponding financial effect, without affecting the Five-Year Investment Plan.

·

A Five-Year Investment Plan is approved.

Resolution 4362 obliged TGS for the execution of the Five-Year Plan, which requires a high level of essential investments for the operation and maintenance of the pipeline system, to provide quality, safe and reliable service.

The Five-Year Plan shall be for the period from April 1, 2017 to March 31, 2022 and will

amount to Ps. 6,786,543

.

However, pursuant to Resolution 4362, pending the entry into force of the 2017 Integral Renegotiation Agreement, a transition investment plan is established to be made equal to 10% of the total amount of the Five-Year Investment Plan. This without prejudice to the full compliance of the Five-Year Investment Plan once the 2017 Integral Renegotiation Agreement is in force.

·

A non-automatic six-month adjustment mechanism for the natural gas transportation tariff and the investment commitments were approved. This adjustment must be approved by ENARGAS and for its calculation, the evolution of the Wholesale Price Index (“WPI”) published by INDEC will be considered.

On October 20, 2017, the ENARGAS issued Resolution No. 62/2017, which summon a public hearing to be held on November 14, 2017 in order to increase the transportation tariffs on account of the RTI, as it is not still in force. The new tariff charts will become effective as from December 1, 2017.

In addition, the 2017 Transitional Agreement provides for the inability to pay dividends. For further information, see “Note 18 - Capital Stock and Dividends - b) Dividends distribution”.

At the date of issuance of these consolidated condensed interim financial statements, the 2017 Integral Renegotiation Agreement is in process of approval by the various governmental agencies involved, including the National Congress, for subsequent ratification by the National Executive Branch.

The entry into force of the 2017 Integral Renegotiation Agreement will entail the conclusion of the 2017 Transitional Agreement.

It should be noted that the 2017 Integral Renegotiation Agreement contains similar terms and conditions as those set out in the initial agreements in 2008, 2011 and 2015.

Acquisition of the Rights of Arbitration Proceedings

As of the date of issuance of this condensed interim consolidated financial statements, by agreement with the National Government,

informed that the claim that was filed jointly by Ponderosa Assets L.P. and Enron Corp. against the Argentine Government under the International Centre for Settlement of Investment Disputes of the World Bank (the “ICSID Claim”),

is suspended until January 15, 2018.

On the other hand, as provided for in the 2017 Integral Renegotiation Agreement, once the last tariff increase is in force, the Company, CIESA and shareholders representing at least two thirds of the share capital of CIESA must desist from all claims initiated or to be initiated against the National Government as from the enactment of the Public Emergency Law.

b)

Regulatory Framework for non-regulated segments

On March 14, 2017, MINEM issued Resolution No. 34 authorizing the payment of Ps. 91,578 corresponding to the compensation owed for the participation in the Propane for Networks Agreement from January to March and May to October 2016, which were collected on April 26, 2017.

As of September 30, 2017, the Argentine Government owes the Company Ps. 193,227 for these concepts.

Resolution 74 provides for an increase as from April 1, 2017 in the price of propane gas for the Propane for Networks Agreement. According to Resolution 74, the price is established in Ps. 1,267/tones ("tn") and Ps. 2,832/tn depending on the customer to whom the product is intended. As in previous periods, the difference between the given price and the export parity price determined by the MINEM is offset by the Company by means of the economic compensation paid by the

National Government

.

Regarding the Households with Bottles Program ("

Plan Hogar

") created by Presidential Decree No. 470/15, on April 3, 2017, the Ministry of Hydrocarbon Resources issued Resolution 56-E72017, which increases the price received by the butane contributed to said program, being Ps. 2,568/tn. On the other hand, the compensation received by the National

Government

was maintained at Ps. 550/tn.

16

COMMON STOCK AND DIVIDENDS

a)

Common stock structure and shares’ public offer

As of September 30, 2017 and 2016, TGS’ common stock was as follows:

|

|

|

|

Common Shares Class

(Face value $ 1, 1 vote)

|

|

Amount of common stock, subscribed, issued, paid in, and authorized for public offer

|

|

Class “A”

|

|

405,192,594

|

|

Class “B”

|

|

389,302,689

|

|

|

|

794,495,283

|

TGS's shares are traded on the

BYMA

and under the form of the ADSs (registered with the Securities and Exchange Commission (“SEC”) and representing 5 shares each) on the New York Stock Exchange.

b)

Dividends Distribution

The Company is temporarily limited to the distribution and payment of dividends in accordance with the provisions of the 2017 and 2016 Transitional Agreements applicable until the definitive tariff tables that arise from the RTI are in force, which will happen once the 2017 Integral Renegotiation Agreement obtain the corresponding governmental approvals.

In accordance with the provisions of the aforementioned 2017 and 2016 Transitional Agreement, TGS may not distribute dividends without the prior authorization of ENARGAS, for which purpose the compliance of the 2016 Five-Year Investment Plan and/or the corresponding part of 2017 must be accredited.

17

LEGAL CLAIMS AND OTHER MATTERS

The main changes occurring between January 1, 2017 and the date of issuance of these consolidated interim financial statements are as follows. For further information regarding the claims and legal matters of the Company, see Note 17 “Legal Claims and Other Matters” to the consolidated financial statements as of December 31, 2016 issued on March 7, 2017.

a)

Turnover tax calculated on the natural gas price used by TGS as fuel to render its transportation services

The Company has interpretative differences with several provinces regarding the liquidation of the turnover tax calculated on the natural gas price used by TGS as fuel to render its transportation services. In this framework there have been initiated several lawsuits against TGS, which have adversely concluded by the Company.

On April 18, 2017, the Company entered into an agreement with the Tax Bureau of the Province of

Tierra del Fuego, Antártida e Islas del Atlántico Su

r, for which payment of Ps. 110.1 million corresponding to the settlement of the turnover tax for the period January 2013 to September 2016. As of September 30, 2017, the Company has canceled all the amounts claimed for this concept.

On July 4, 2017, the Company canceled Ps. 8.4 million corresponding to the fiscal periods August 2014 to January 2017 claimed by the province of Santa Cruz.

As of September 30, 2017 and December 31, 2016, the Company recorded a provision of Ps. 169.8 million and Ps. 207.7 million, respectively, in respect of this contingency under the line item “Provisions.” Those amounts were determined in accordance with the estimations of tax and interests, that would be payable as of such date.

c)

Action for annulment of ENARGAS Resolutions No. I-1,982/11 and No. I-1,991/11 (the “Resolutions”)

On September 19, 2017, a new extension of the provisional measure was granted (which prevents the National Government from claiming to TGS the payment of the amounts resulting from the new value of the Charge for the period from November 2011 to March 2016), thus extending its validity until March 2018, or until the dictating of the sentence that solves the matter, whichever occurs sooner.

TGS’s Management believes it has sufficient valid arguments to defend its position, and thus, the Company has not recorded the increase of the charge for natural gas consumptions from the date of obtaining the injunction until April 1, 2016, effective date of Resolution 28. In the event this injunction had not been obtained, the impact of the Resolutions for the nine-month period ended September 30, 2017, would have implied an accumulated negative impact on the retained earnings of Ps. 601.6 million.

c)

Arbitral claim

On March 16, 2017, Pan American Energy LLC Sucursal Argentina and Pan American Sur S.A. (the “Claimants”) filed their Complaint Memorial, in which they replied to the TGS Response Memorial and adjusted the amount of their claim to US$ 306.3 million as of March 15, 2017, total amount that would consist of US$ 134.0 million in nominal damages plus US$ 172.3 million in interest (the “Claim”). This amount would be added to accrued interest from March 15, 2017 until the date of its actual payment.

Subsequently, on July 14, 2017, the Company filed the Complaint Memorial, in which the arguments put forward by the plaintiffs in its Memorial of Replica were answered.

Between September 25 and 29, 2017, the Arbitration Hearing took place in the City of Buenos Aires. After the hearing took place, the legal advisors of the Company understand that the evidence produced confirmed TGS's position regarding the main aspects of the claim.

Not later than on December 15, the Claimants and TGS will have to present their Final Conclusions Memorials.

TGS considers that the Claim contains inconsistencies resulting from misinterpretations of the contractual provisions and an incorrect application of the mechanisms for calculating the allocation of the Products, and therefore the Company believes that the amount claimed is improper.

The external legal advisors of the Company understand that at the date of issuance of these interim consolidated financial statements, the contingency is uncertain. Notwithstanding the foregoing, the TGS Management considers that there are sufficient defense arguments that will allow rebutting the claim.

d)

VAT and income tax repetition claim

On June 6, 2017, the National Tax Court rejected the claim of repetition filed by the Company. This resolution was appealed by TGS. Management considers that it has sufficient arguments to assert its position before the Justice and obtain the revocation of the resolution of the Tax Court.

e)

Turnover tax withholding in the Province of Buenos Aires

In March 2017, TGS partially canceled the debt claimed by ARBA as agent of withholding and collection of the turnover tax, paying Ps. 2.9 million through the adherence to the payment plans offered by the Province of Buenos Aires through Law 14,890. Adherence to these payment plans allowed the partial cancellation of compensatory interest and all fines and charges claimed by ARBA.

As of the date of issuance of these condensed interim financial statements, only two files remain pending in relation to the alleged failure of TGS to act as withholding and collection agent during 2009 and 2010. The Company's Management considers that it has sufficient arguments to assert its defense so that as of September 30, 2017 it has no provision for this concept.

16

BALANCES AND TRANSACTIONS WITH RELATED COMPANIES

Key management compensation

The accrued amounts corresponding to the compensation of the members of the Board of Directors, the Statutory Committee and the Executive Committee for the nine-month periods ended September 30, 2017 and 2016 were Ps. 31,148 and Ps. 26,561, respectively.

Balances and transactions with related parties

The detail of significant outstanding balances for transactions entered into by TGS and its related parties as of September 30, 2017 and December 31, 2016 is as follows:

![[TGS102.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS102.GIF)

The detail of significant transactions with related parties for the nine-month period ended September 30, 2017 and 2016 is as follows:

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2017 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

Nine-month period ended September 30, 2017:

![[TGS104.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS104.GIF)

Nine-month period ended September 30, 2016:

![[TGS106.GIF]](https://content.edgar-online.com/edgar_conv_img/2017/11/28/0000931427-17-000025_TGS106.GIF)

17

ASSOCIATES AND JOINT AGREEMENT

Link:

Link was created in February 2001, with the purpose of the operation of a natural gas transportation system, which links TGS’s natural gas transportation system with the Cruz del Sur S.A. pipeline. The connection pipeline extends from Buchanan, located in the high-pressure ring that surrounds the city of Buenos Aires, which is part of TGS’s pipeline system, to Punta Lara. TGS’s ownership interest in such company is 49% and Dinarel S.A. holds the remaining 51%.

TGU:

TGU is a company incorporated in Uruguay. This company rendered operation and maintenance services to Gasoducto Cruz del Sur S.A. and its contract terminated in 2010. TGS holds 49% of its common stock and Petrobras Argentina holds the remaining 51%.

EGS (in liquidation):

In September 2003, EGS, a company registered in Argentina, was incorporated. The ownership is distributed between TGS (49%) and TGU (51%). EGS operates its own pipeline, which connects TGS’s main pipeline system in the Province of Santa Cruz with a delivery point on the border with Chile.

In October 2012, ENARGAS issued a resolution which authorizes EGS to transfer the connection pipeline and service offerings in operation to TGS. On December 17, 2013, the sale of all the fixed assets of EGS to TGS for an amount of $ 350,000 was made, the existing natural gas transportation contracts were transferred and the procedures to dissolve the Company were initiated.

The Board of Directors Meeting held on January 13, 2016, approved to initiate the necessary steps for the dissolution of EGS. The Extraordinary Shareholders’ Meeting held on March 10, 2016 appointed EGS’ liquidator.

On October 13, 2016, the liquidator of EGS resolved the distribution of a dividend in kind of Ps. 4,673 through the partial transfer of the credit that EGS has with TGS as a result of the sale of the Connection Gas Pipeline, which was implemented through TGS and TGU Assignment Agreements, which had full effects on November 4, 2016.

TRANSPORTADORA DE GAS DEL SUR S.A. - SACDE SOCIEDAD ARGENTINA DE CONSTRUCCIÓN Y DESARROLLO ESTRATÉGICO S.A. - UNIÓN TRANSITORIA”.(“TGS - SACDE UT”):

The Board of TGS approved to set up the UT together with SACDE for the joint venture of the parties in the National Public Bid No. 452-0004-LPU17 for the construction of a natural gas pipeline, the "Expansion System Transport and Distribution of Natural Gas” project, convened by the MINEM. Through Resolution N ° 313-E/2017, the MINEM awarded the UT the works for the construction of the Regional Natural Gas Pipeline Center II - Recreo/Rafaela/Sunchales. The works will involve a joint investment of approximately Ps. 946 million (VAT included) ). On October 27, 2017, TGS - SACDE UT signed the corresponding construction agreement with the MINEM.

18

SUBSEQUENT EVENTS