21st Century Fox Earnings Buoyed by Cable TV Business -- WSJ

August 10 2017 - 3:02AM

Dow Jones News

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 10, 2017).

Higher fees for the Fox News, FX and sports cable networks

lifted revenues for 21st Century Fox Inc. and helped offset weak

performances from the Fox Broadcasting and film units in the most

recent quarter.

The cable networks unit reported a 10% gain in the fees pay-TV

distributors pay to carry the channels compared with the same

period a year ago. Domestic advertising revenue was up 6%, driven

by higher ratings at Fox News and price increases at National

Geographic, even as Fox Sports 1 and the regional sports networks

carried fewer marquee events.

The importance of news and sports to 21st Century Fox was

emphasized by Co-Executive Chairman Lachlan Murdoch, who told

analysts that news and sports account for more than half the

company's advertising revenue. Advertising brought in $8 billion in

the fiscal year ended in June.

The picture was bleaker at 21st Century Fox's broadcast network

and film studio.

At the studio, filmed entertainment swung to an operating loss

of $22 million, which was attributed to a decline in home

entertainment revenues and higher marketing costs for summer movies

including "War for the Planet of the Apes."

Fox Broadcasting, which has been mired in a ratings slump for a

few years, experienced a drop in ad revenue that was partially

offset by an increase in the fees distributors pay to carry the

Fox-owned television stations.

Overall, the company modestly beat analysts' earnings estimates

and fell just shy of revenue projections.

Net income for 21st Century Fox fell to $476 million, or 26

cents a share, in the quarter. Excluding restructuring charges and

other items, profit fell to 36 cents a share from 45 cents a share

a year earlier, when results included a tax benefit of 7 cents a

share.

Revenue rose to $6.75 billion, from $6.65 billion a year

earlier.

Analysts surveyed by Thomson Reuters had projected adjusted

profit of 35 cents a share on $6.77 billion in revenue.

The Wall Street Journal parent News Corp and 21st Century Fox

share common ownership.

The results come as 21st Century Fox seeks to buy the shares of

British TV giant Sky PLC it doesn't already own. The deal remains

under review in the U.K. On a conference call with analysts, 21st

Century Fox Chief Executive James Murdoch said he expected approval

to come in the first six months of next year.

Fox News turned in a strong financial performance, despite the

turmoil inside the network over the past year.

The network continues to deal with lawsuits and accusations of

sexual harassment and racial discrimination that have led to

several high-level departures, both in front of the camera, such as

host Bill O'Reilly, and in the executive suites, including that of

its former chief executive, Roger Ailes. Mr. Ailes and other

individuals accused have denied the allegations; Mr. Ailes died in

May. Fox hired a law firm to investigate the claims and has said it

is cooperating with a federal probe related to the allegations.

In a memo to employees released with its earnings announcement,

James and Lachlan Murdoch said the company is "committed to being

an organization where anyone, from anywhere, feels welcome and can

thrive."

For the nine months through March 31, the company disclosed $45

million in costs related to settlements and legal expenses

following Mr. Ailes's July 2016 departure.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 10, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

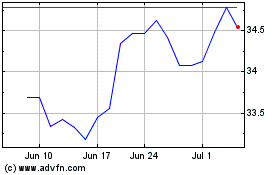

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Aug 2024 to Sep 2024

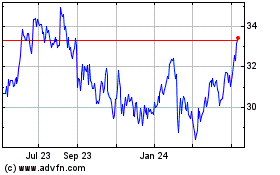

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Sep 2023 to Sep 2024