AT&T CEO Will Lead Distinct Telecom, Media Units After Time Warner Merger -- 2nd Update

July 14 2017 - 1:52PM

Dow Jones News

By Drew FitzGerald

AT&T Inc. plans to split the management of its telecom

operations and its media assets after clinching a takeover of Time

Warner Inc., putting veteran AT&T executive John Stankey in

charge of the Time Warner business, according to people familiar

with the matter.

The reorganization would create two divisions. One would contain

AT&T's wireless business and its DirecTV satellite television

business, the other would comprise the Time Warner assets it plans

to acquire, including HBO, Warner Bros. and the Turner cable unit

that houses CNN, the people said. AT&T last year said it would

take control of the entertainment company in a cash-and-stock deal

worth about $85 billion.

The new structure would keep AT&T Chairman and Chief

Executive Randall Stephenson atop the company with two top

lieutenants, in an organization that would resemble Comcast Corp.

Brian Roberts, Comcast's chairman and chief executive, has two

segment chiefs: one in charge of the cable business and the other

heading NBCUniversal.

"Randall Stephenson will remain chairman and CEO after we close

the Time Warner transaction," AT&T spokesman Larry Solomon

said. He added that the company is still developing its integration

plans and hasn't completed the new organizational chart.

Mr. Stankey, a 30-year AT&T veteran, is currently head of

AT&T's entertainment business, which includes DirecTV and has

offices near Los Angeles. He has previously served as the company's

strategy chief and held various executive roles in its traditional

telecom business.

Under the new structure, DirecTV would be combined with the

company's telecom operations, which are run out of AT&T's

Dallas headquarters and include both the wireless and landline

business, the people familiar with the matter said. That segment

would be run by John Donovan, another AT&T veteran who is

currently chief strategy officer, one of the people said.

News of planned executive changes were earlier reported by

Bloomberg News.

AT&T is still navigating a regulatory review of its proposed

takeover of Time Warner, which President Donald Trump vowed to

block when he was still a candidate for office. The Justice

Department is conducting an antitrust review of the transaction.

AT&T has said it expects the deal to be completed this

year.

Companies often reorganize themselves to clarify lines of

management before mergers to ease concerns about the independence

of newly combined businesses and their effect on competition.

AT&T has hinted it will be more than just a passive owner of

Time Warner's news and entertainment assets. Mr. Stephenson in May

floated some ideas for the combination that included shorter,

smartphone-friendly HBO videos and specially targeted

advertising.

How Time Warner, as part of AT&T, might negotiate with the

carrier's competitors is another potential concern. Mr. Stephenson

addressed some of those fears in May by repeating his pledge to

keep its most popular content available to all distributors.

"You can't think about taking 'Game of Thrones' and you're only

going to make it available to AT&T customers," he said at the

time. "That's crazy."

AT&T has started toying with special entertainment offers

ahead of the deal's close. In April, it offered subscribers of its

premium unlimited data plans free access to HBO, which normally

costs $15 a month.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

July 14, 2017 13:37 ET (17:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

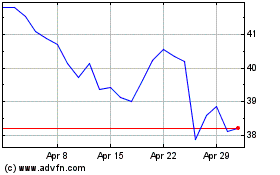

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Sep 2023 to Sep 2024