Form 8-K - Current report

October 08 2024 - 6:01AM

Edgar (US Regulatory)

false

0001368622

0001368622

2024-10-04

2024-10-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 4, 2024

AEROVIRONMENT,

INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-33261 |

|

95-2705790 |

| (State

or other jurisdiction of |

|

(Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

| incorporation

or organization) |

|

|

|

|

| 241

18th Street South, Suite

650 |

|

|

| Arlington,

Virginia |

|

22202 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (805) 520-8350

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

AVAV |

The

NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into

a Material Definitive Agreement.

On October 4, 2024, AeroVironment,

Inc. (the “Company”), as borrower, and its wholly owned subsidiaries Arcturus UAV, Inc. (“Arcturus UAV”) and Tomahawk

Robotics, Inc. (“Tomahawk” and, together with Arcturus UAV, the “Guarantors”), as guarantors, entered into that

certain Third Amendment to Credit Agreement relating to its existing Credit Agreement, dated as of February 19, 2021 (as amended and supplemented

to date, the “Existing Credit Agreement”), with the lenders party thereto, including Bank of America, N.A., as the administrative

agent (the “Administrative Agent”) and the swingline lender, and Bank of America, N.A., JPMorgan Chase Bank, N.A., U.S. Bank

National Association (collectively, the “Existing Lenders”) and Citibank, N.A. (the “New Lender”) (such amendment,

the “Third Amendment to Credit Agreement” and the Existing Credit Agreement as amended thereby, the “Amended Credit

Agreement”). Except as otherwise specified herein, capitalized terms used but not defined herein have the respective meanings given

to such terms under the Amended Credit Agreement.

The Amended Credit Agreement

now provides for an aggregate $200 million revolving credit facility, including a $25 million sublimit for the issuance of standby and

commercial letters of credit, and a $10 million sublimit for swingline loans, secured by all assets of the Company and the Guarantors,

and extends the maturity date for obligations pursuant to the Amended Credit Agreement to October 4, 2029. Upon effectiveness of the Amended

Credit Agreement, the Company drew $15 million from the amended revolving facility and repaid in full all outstanding amounts owed pursuant

to the prior Term A Facility (as defined in the Existing Credit Agreement). The Amended Credit Agreement reflects the removal of such

term loan facility. In addition to adding the New Lender and adjusting certain fee schedules, the Amended Credit Agreement also

allows the Company to incur additional forms of secured and unsecured permitted indebtedness without separate consent of the Administrative

Agent and make certain payments related thereto, including certain bilateral letters of credit, supply chain financing transactions, securitization

transactions pertaining to its accounts receivable, and issuance of unsecured convertible debt pertaining to its Common Stock (and certain

call spread transactions related thereto), subject in each instance to further specified parameters, including aggregate dollar limits

on certain activities and satisfaction of ongoing and pro forma financial covenants.

The Amended Credit Agreement

substitutes a Consolidated Senior Secured Leverage Ratio for the Consolidated Leverage Ratio (as defined under the Existing Credit Agreement)

required to be maintained under the Existing Credit Agreement. The Consolidated Leverage Ratio is now an incurrence test, used to determine

whether or not the Company may take certain actions, such as borrowing under the Amended Credit Agreement, acquisitions, incurring certain

unsecured debt, or making payments on junior debt. In order to take such actions, the Consolidated Leverage Ratio may not exceed 4.00

to 1.0. However, the ratio increases to 4.50 to 1.0 during a Leverage Increase Period, covering each of the four fiscal quarters of the

Company immediately following the consummation of any Qualified Acquisition. The newly added Consolidated Senior Secured Leverage

Ratio, measuring the Consolidated Senior Secured Funded Indebtedness, as of a date of determination, to Consolidated EBITDA for the applicable

measurement period, shall not exceed 3.00 to 1.0 at the end of any fiscal quarter of the Company, increasing to 3.50 to 1.0 in a Leverage

Increase Period. In each case, no more than one Leverage Increase Period shall be in effect at any time, and the basic ratio levels

must be achieved and maintained for at least two fiscal quarters immediately following each Leverage Increase Period prior to giving effect

to another Leverage Increase Period. The requirement for the Consolidated Fixed Charge Coverage Ratio to be no less than 1.25 to

1.0 at the end of any fiscal quarter of the Company remains unchanged in the Amended Credit Agreement.

The Amended Credit Agreement

removes the requirement that the Company prepay the loans with the proceeds of dispositions of assets or newly incurred debt.

The foregoing description

of the Third Amendment to Credit Agreement and the transactions contemplated thereby does not purport to be complete and is qualified

in its entirety by reference to the complete text of such agreement. The Company will file the Third Amendment to Credit Agreement

as an exhibit to its quarterly report on Form 10-Q for its fiscal quarter ending October 26, 2024.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above in Item 1.01

of this current report on Form 8-K is incorporated by reference in this Item 2.03.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AEROVIRONMENT, INC. |

| |

|

|

| |

|

|

| Date: October 8, 2024 |

By: |

/s/ Melissa Brown |

| |

|

Melissa Brown |

| |

|

Senior Vice President, General Counsel, Chief Ethics and Compliance Officer & Corporate Secretary |

v3.24.3

Cover

|

Oct. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 04, 2024

|

| Entity File Number |

001-33261

|

| Entity Registrant Name |

AEROVIRONMENT,

INC.

|

| Entity Central Index Key |

0001368622

|

| Entity Tax Identification Number |

95-2705790

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

241

18th Street South

|

| Entity Address, Address Line Two |

Suite

650

|

| Entity Address, City or Town |

Arlington

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22202

|

| City Area Code |

805

|

| Local Phone Number |

520-8350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

AVAV

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

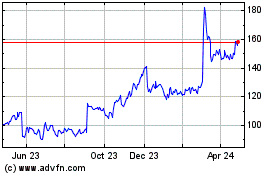

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Sep 2024 to Oct 2024

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Oct 2023 to Oct 2024