Nvidia (NASDAQ:NVDA) – Nvidia’s stock closed

down 9.5% on Tuesday, leading to a $279 billion loss in market

value due to fading optimism over AI following weak economic data.

Historically, September has been tough for Nvidia, and this year is

no exception. The stock has already dropped 20% from its all-time

high. However, performance tends to improve in the following

months, especially in November. Additionally, the U.S. Department

of Justice has subpoenaed Nvidia as part of an antitrust

investigation, raising concerns about practices that hinder

supplier switching. Nvidia claims its customers choose its products

based on merit. Pre-market trading showed a 1.7% decline.

Athira Pharma (NASDAQ:ATHA) – Athira Pharma’s

stock dropped 71% in pre-market trading after closing down 8.41% on

Tuesday, following the failure of its drug fosgonimeton to meet

primary and secondary goals in an Alzheimer’s study. The company

found no statistical significance compared to placebo after 26

weeks of treatment.

Intel (NASDAQ:INTC) – Intel may be removed from

the Dow Jones index due to its nearly 60% stock price drop this

year, making it the worst-performing stock in the index. The

company faces financial challenges and increased competition, and

its removal could further damage its reputation. Nvidia and Texas

Instruments are potential replacements. Intel’s stock was up 0.4%

in pre-market trading after an 8.8% drop on Tuesday.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer rejected allegations from Hindenburg Research, which

accused it of “accounting manipulation” and export control issues.

The company called the report “false and inaccurate,” stating that

the situation does not affect its production or financial results.

Shares dropped 2.2% in pre-market trading after closing up 0.9% on

Tuesday.

Apple (NASDAQ:AAPL) – Starting in 2025, Apple

will replace LCD screens with OLED in all iPhone models. OLED

displays offer more vibrant colors and better contrast, pushing out

suppliers like Sharp and Japan Display. BOE Technology and LG

Display will begin supplying the new screens. The launch of Apple’s

new iPhone boosted its stock on expectations of AI advancements.

However, Apple’s stock has historically underperformed after

product launches. With a high price-to-earnings ratio, any failure

to meet expectations could hurt the company’s valuation. Apple

shares were down 0.9% in pre-market trading after a 2.7% drop on

Tuesday.

Hewlett Packard Enterprise (NYSE:HPE) – The

U.S. Department of Commerce proposed granting $50 million to

Hewlett Packard Enterprise to modernize and expand its Oregon

facility, focusing on semiconductor and microfluidics technology.

This investment aims to support the development of equipment for

biological sciences and AI, benefiting institutions like Harvard

and the CDC.

Meta Platforms (NASDAQ:META) – Elon Musk’s X

was banned in Brazil for failing to comply with legal orders

regarding misinformation and legal representatives. This ban

benefited rivals like Instagram and Threads from Meta Platforms,

which saw increased activity. Meta, which previously faced a ban

with WhatsApp, could face similar challenges in the future. Meta

shares dropped 0.5% in pre-market trading after a 1.8% decline on

Tuesday.

Snap Inc (NYSE:SNAP) – Snap CEO Evan Spiegel

announced a new strategy to improve the company’s ad performance,

focusing on augmented reality and automation. In response to slow

growth compared to competitors, Snap plans to expand its AR glasses

technology and new generative AI tools. Snap shares were down 0.1%

in pre-market trading after a 5.1% decline on Tuesday.

Salesforce (NYSE:CRM) – Salesforce announced

its acquisition of Tenyx, an AI startup specializing in voice

agents. The financial terms of the deal were not disclosed. Tenyx,

serving various sectors, will have its team, including co-founders,

integrated into Salesforce. The acquisition aims to strengthen

Salesforce’s AI-driven solutions.

Airbnb (NASDAQ:ABNB) – Airbnb has requested New

York to review Local Law LL18, which requires hosts to be permanent

residents and register before listing properties. The company

argues that the law has not impacted the housing crisis and has

increased travel prices, leading to an 83% drop in short-term

rental listings.

AT&T (NYSE:T), Nokia

(NYSE:NOK) – The CWA union withdrew from mediation with AT&T,

claiming the company was merely delaying the process. Over 17,000

workers have been on strike since last month. AT&T said

mediation stalled due to a lack of willingness for agreements and

that it is prepared to keep services running. Additionally,

AT&T and Nokia have agreed to build a new fiber network in the

U.S. This contract follows AT&T’s choice of Ericsson for its

wireless network and aims to expand broadband access. The financial

terms of the deal were not disclosed, but it is seen as a

significant step for Nokia. AT&T shares were down 0.2% in

pre-market trading after a 2.7% increase on Tuesday.

Verizon (NYSE:VZ) – Verizon may increase its

dividends later this week, potentially boosting its stock. Morgan

Stanley analyst Simon Flannery expects a nearly 2% increase,

raising the quarterly dividend from 66.5 cents to about 71 cents.

Verizon shares dropped 0.3% in pre-market trading after a 2.8%

increase on Tuesday.

Sony Group (NYSE:SONY) – Sony is canceling the

online game “Concord,” launched just two weeks ago, after failing

to attract players. The title, developed for PS5 and PC, will be

shut down on September 6, with refunds offered. The game faced

heavy criticism and competition, leading to its early closure.

Unity Software (NYSE:U) – Unity’s stock closed

up 2.02% on Tuesday following a positive update from Morgan

Stanley. Analyst Matthew Cost upgraded the stock from “Equal

Weight” to “Overweight,” maintaining a price target of $22,

highlighting that the stock is near historical lows and presents an

investment opportunity. Unity’s stock was down 0.4% in pre-market

trading.

US Steel (NYSE:X) – Nippon Steel stated that if

it acquires US Steel, most of the American company’s directors and

top management will be U.S. citizens. This comes in response to

concerns raised by politicians like Kamala Harris about U.S.

control over US Steel. Nippon Steel also announced plans to invest

$1.3 billion and has hired Mike Pompeo as an advisor. US Steel

shares fell 0.1% in pre-market trading after a 6.1% drop on

Tuesday.

Halliburton (NYSE:HAL) – Halliburton downplayed

the financial impact of a recent cyberattack, claiming it will not

materially affect its finances or operations. The company activated

its security response plan, shut down some systems, and notified

authorities but continues to provide services normally. Halliburton

shares dropped 1% in pre-market trading after a 4.0% decline on

Tuesday.

Berkshire Hathaway (NYSE:BRK.B), Bank

of America (NYSE:BAC) – Berkshire Hathaway sold more Bank

of America shares, totaling over $6 billion, following a

significant increase in the bank’s stock value. The sale, which

occurred between August 28 and 30, is seen as a profit-taking

strategy. Berkshire’s stake in Bank of America is now below 10%.

Berkshire shares were down 0.3% in pre-market trading after a 0.2%

increase on Tuesday. Bank of America shares dropped 0.5% in

pre-market trading.

Goldman Sachs (NYSE:GS) – Goldman Sachs

temporarily suspended its zinc market coverage due to “limited

capacity” after its metals strategist Nicholas Snowdon left for

Mercuria. Snowdon’s departure follows that of Jeff Currie, who

joined Carlyle, and Xiao Qin, who will retire. Additionally,

Goldman Sachs economists evaluated that a Donald Trump victory

could slow U.S. GDP growth due to higher tariffs and immigration

restrictions, while a Kamala Harris win could slightly boost GDP

through new spending and tax credits, despite a negative impact

from increased corporate taxes.

JPMorgan Chase & Co (NYSE:JPM) – JPMorgan

is forming a private banking team in Dubai to attract millionaires

moving to the region. The bank has relocated two bankers from

Geneva and London to begin the team, which will serve

high-net-worth individuals, family offices, and foundations. The

Middle East is becoming a hotspot for millionaires due to its

tax-free environment and luxurious lifestyle. JPMorgan shares

dropped 0.4% in pre-market trading after a 2% decline on

Tuesday.

Charles Schwab (NYSE:SCHW) – Three investors

have sued Charles Schwab for alleged fiduciary duty violations,

accusing the company of designing its cash sweep program to benefit

Schwab at clients’ expense. The lawsuit seeks class-action status

and monetary compensation, alleging Schwab did not disclose

financial agreements related to TD Bank. Schwab denies the

accusations and defends its cash sweep program as safe and

transparent. Schwab shares dropped 0.2% in pre-market trading after

a 0.5% decline on Tuesday.

Raymond James Financial (NYSE:RJF) – Raymond

James agreed to pay over $1.9 million to settle charges of failing

to maintain records of client complaints and mutual fund

transactions. Finra alleged that the company did not comply with

Rule 4530, which requires the reporting of complaints within 30

days.

Robinhood Markets (NASDAQ:HOOD) – Robinhood

launched a stock lending program in the U.K., allowing investors to

earn passive income by “renting” their shares to other parties.

Investors receive a monthly fee and retain ownership of the shares.

This move is part of Robinhood’s effort to expand its international

presence. Robinhood shares dropped 1.6% in pre-market trading after

a 3.7% decline on Tuesday.

KKR & Co. (NYSE:KKR) – KKR has expedited

its public offer to acquire Fuji Soft to September 5, aiming to get

ahead of a rival bid from Bain Capital. KKR is looking to finalize

the purchase before Bain submits a binding proposal in October,

driving up Fuji Soft’s stock value.

Moody’s (NYSE:MCO), S&P

Global (NYSE:SPGI) – Moody’s, S&P, and Fitch will pay

$48 million in fines for failing to maintain electronic

communications, related to the WhatsApp investigations. The SEC

reported that Moody’s and S&P will each pay $20 million, while

Fitch will pay $8 million. The companies have agreed to hire

compliance consultants to correct their practices.

Boeing (NYSE:BA) – Boeing may delay its $10

billion free cash flow target to 2027-28 and will need to raise $30

billion before developing new aircraft, according to Wells Fargo.

The company’s current debt stands at $45 billion. Wells Fargo

downgraded Boeing to “underweight” and lowered its price target to

$119, a 32% drop from the last closing price. Boeing shares fell

0.5% in pre-market trading after a 7.3% decline on Tuesday.

Southwest Airlines Co. (NYSE:LUV) – Southwest

Airlines shares closed up 2.3% on Tuesday after activist investor

Elliott Investment Management revealed a 10% stake in the company.

Elliott seeks to call a special meeting to discuss replacing the

CEO and board members. Southwest will meet with Elliott to present

details of its transformation plan on September 26. Southwest

shares dropped 0.9% in pre-market trading.

Stellantis (NYSE:STLA) – Stellantis named Bob

Broderdorf as the new head of Jeep North America. Previously the VP

of operations for Ram and Dodge, Broderdorf will oversee Jeep’s

strategy, sales, and marketing in North America. He replaces Bill

Peffer, who will manage the dealer network in the region.

Stellantis shares were up 0.8% in pre-market trading after a 5.2%

drop on Tuesday.

Tesla (NASDAQ:TSLA) – Tesla plans to launch a

six-seat version of the Model Y in China starting in 2025,

initially boosting its stock on Tuesday before it closed down 1.6%.

Weak manufacturing data hit the broader market, and Tesla shares

were further affected by a general sales slowdown and concerns over

growth. Tesla stock was down 1.1% in pre-market trading.

iRhythm (NASDAQ:IRTC) – Expected benefits from

smartwatches and monitoring sensors, like iRhythm’s Zio, were not

proven in a recent study. Although more atrial fibrillation cases

were detected, the study did not show a reduction in stroke-related

hospitalizations. The low event rate and small number of

participants limited conclusions.

BioAge Labs – BioAge Labs, focused on obesity

therapy and partnerships with Eli Lilly and Novo Nordisk, filed for

an IPO in the U.S. to capitalize on the sector’s enthusiasm. The

startup, with no revenue and a $26.6 million loss for the

half-year, recently raised $170 million and will list its stock on

Nasdaq under the symbol “BIOA.”

Illumina (NASDAQ:ILMN), Grail

(NASDAQ:GRAL) – Illumina won its legal dispute against the European

Commission, which had tried to block its $7.1 billion acquisition

of Grail. The EU Court of Justice ruled that the Commission lacked

authority to review the merger under Article 22. Illumina will not

have to pay the $478 million fine.

Constellation Brands (NYSE:STZ) – Constellation

Brands will reduce the value of its wine and spirits division,

booking a charge of up to $2.5 billion due to weak U.S. demand. The

company also adjusted its net sales growth forecast to 4%-6%, down

from 6%-7%, and revised its earnings per share estimates for fiscal

2025.

Molson Coors Beverage (NYSE:TAP) – Molson Coors

is scaling back its corporate diversity efforts following criticism

from conservative activists. The company will remove the link

between executive compensation and diversity goals, discontinue

supplier diversity goals, and drop its Human Rights Campaign

ratings. The move follows an online attack by conservative activist

Robby Starbuck.

Earnings

Zscaler (NASDAQ:ZS) – The cloud security

company reported earnings per share of 88 cents, up 37%

year-over-year, and revenue of $592.9 million, beating estimates of

$567.5 million. Fourth-quarter billings grew 27% to $910.8 million.

However, the fiscal 2025 forecast disappointed: EPS of $2.84 (below

the $3.33 expected) and revenue of $2.61 billion (slightly below

the $2.62 billion forecast). For the current quarter, revenue is

projected at $605 million, just above the $603 million expected.

Zscaler shares dropped 15.3% in pre-market trading after a 3.4%

decline on Tuesday.

GitLab (NASDAQ:GTLB) – GitLab reported

second-quarter earnings per share of $0.15, beating the $0.10

estimate. Revenue reached $182.6 million, above the $177.1 million

expected. For fiscal 2025, the company projects revenue between

$742 million and $744 million, and adjusted EPS of $0.45 to $0.47,

exceeding forecasts of $737.8 million and $0.36, respectively.

GitLab shares were up 15.5% in pre-market trading after a 5.7% drop

on Tuesday.

Asana (NYSE:ASAN) – The project management

software company reported an adjusted second-quarter loss of five

cents per share, better than the eight cents expected, with revenue

of $179.2 million, above the $177.67 million forecast. For the

third quarter, revenue is projected between $180 million and $181

million, with a loss of seven cents per share, below estimates of

$182.29 million in revenue and a three-cent loss. For the fiscal

year, a loss of 19 to 20 cents per share is expected on revenue of

$719 million to $721 million, slightly below analyst forecasts.

Asana shares fell 15.1% in pre-market trading after a 5.5% decline

on Tuesday.

PagerDuty (NYSE:PD) – PagerDuty reported

revenue of $115.9 million, beating the $112 million estimate, and a

net loss of $13 million (14 cents per share), better than last

year’s loss of $24 million (26 cents per share). For the year,

PagerDuty raised its earnings per share forecast to $0.67 to $0.72

and annual revenue to $463 million to $467 million. PagerDuty

shares dropped 13.2% in pre-market trading after a 7.5% decline on

Tuesday.

OneStream (NASDAQ:OS) – OneStream’s

second-quarter total revenue grew 36% year-over-year to $117.5

million. The company’s GAAP operating loss was reduced to $11.6

million, and its GAAP operating margin improved to -10%. For the

third quarter of 2024, OneStream projects revenue between $123

million and $125 million, with non-GAAP earnings per share between

-$0.01 and $0.01.

HealthEquity (NASDAQ:HQY) – HealthEquity

reported earnings per share of $0.86 last quarter, beating the

$0.70 estimate. Revenue reached $299.93 million, above the $284.24

million forecast. For the next quarter, earnings are projected at

$0.73 per share, with revenue of $289.42 million and $3 in $1.17

billion in revenue for the current fiscal year.

Sportsman’s Warehouse (NASDAQ:SPWH) – The

outdoor sporting goods retailer reported second-quarter net sales

of $288.7 million, down from $309.5 million last year. The net loss

was $5.9 million (16 cents per share), compared to $3.3 million (9

cents per share) a year ago. Same-store sales fell 9.8%

year-over-year. The fiscal 2024 outlook is for sales of $1.13

billion to $1.17 billion and adjusted EBITDA of $20 million to $35

million.

Ascendis Pharma (NASDAQ:ASND) – The biotech

company reported a 24% revenue decline in the second quarter, from

EUR 36 million, below the expected EUR 83 million, with a net loss

of $120.8 million (EUR 1.91 per share). For the quarter, Ascendis

also secured a $150 million royalty financing deal with Royalty

Pharma.

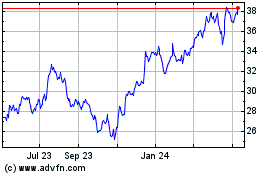

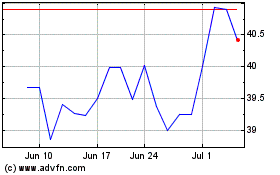

Bank of America (NYSE:BAC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Sep 2023 to Sep 2024