Justin Sun Potential $66 Million Loss Revealed As Ethereum Price Declines

July 06 2024 - 5:30AM

NEWSBTC

Following a widespread crypto market crash on Friday, the price of

Ethereum took a severe price hit falling by about 10%. While the

prominent altcoin has made a minor recovery since then, its price

slip has revealed some vital information on the holdings of Tron

founder and key crypto figure Justin Sun. Related Reading: Doomsday

for Ethereum? ‘A Crash Down To $1,500 Is Coming,’ Says Skeptic,

Here’s Why Justin Sun $66 Million Loss, Motive For Massive Bitcoin

Buy Offer? Amidst the market mayhem on Friday, blockchain analytics

platform Spot on Chain shared an intriguing report on Justin Sun’s

investments in Ethereum. In an X post, Spot on Chain stated that

Sun has allegedly acquired 361,000 ETH (worth $1.1 billion) over

the last five months. The Tron founder reportedly made this

investment using three different wallet addresses purchasing

169,604 ETH with “0x7a9” in February at an average price of $2,870,

176,118 ETH with “0x435” in April at $3,177, and 15,416 ETH

with “0xdbf” in June at $3,474. Spot on Chain noted that the

aforementioned addresses always received ETH deposits from Binance

following Sun’s stablecoin deposits on the exchange thus leading to

suspicions that the Tron founder served as owner of these wallets.

Following the repayment of creditors by defunct exchange Mt. Gox,

coupled with a consistent massive Bitcoin sell-off by the US and

German governments, the price of Bitcoin has plummeted by 10% over

the last two days falling as low as $53,717. Unsurprisingly, this

decline soon extended across the crypto market, with Ethereum

crashing by a similar percentage to trade at $2810, marking its

lowest price in the last five months. At that point, Justin Sun’s

alleged ETH investments reached a $66 million loss.

Interestingly, the Tron founder had reached out to the German

government on Thursday to negotiate the sale of their remaining BTC

holdings valued at $2.3 billion in a private transaction order.

However, it remains unknown if the German government will take up

this offer as Sun attempts to reduce the impact of their constant

BTC sell-offs on his personal investments and the general crypto

market. At the time of writing, Ethereum has shown resilience since

its earlier slump rising by about 5% to currently trade at $2,975.

In tandem, the token’s daily trading volume is up by 47.33%

and valued at $30.47 billion. Related Reading: Analyst Predicts

Ethereum Nosedive, Cautions Investors To Prepare For $2,700 Target

Solana, Others Record Market Gains Amidst Market Crash While the

general cryptocurrency remains in a downtrend, with the total

market cap down by 1.02%, several assets have managed to stay

afloat providing investors with some form of relief. According to

data from CoinMarketCap, Solana is one of these assets, with a

4.99% daily gain alongside other prominent tokens such as Avalanche

(AVAX) and Shiba Inu with respective gains of 3.99% and 3.70%

respectively. Notably, prominent meme coin dogwifhat leads the

resistance with the highest daily gain of 12.28%. Featured image

from Bloomberg, chart from Tradingview

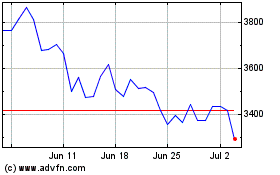

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024