0001881487Q1false--12-3191110001881487us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001881487acdc:EquifyNoteMember2024-03-310001881487us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-12-310001881487acdc:FinanceLeaseObligationsMemberacdc:AlpineSubsidiaryMember2024-03-310001881487acdc:FlyingAPumpServicesLLCMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:CarboCeramicsIncMember2023-01-012023-03-310001881487srt:ConsolidationEliminationsMember2024-01-012024-03-310001881487us-gaap:NoncontrollingInterestMember2023-12-310001881487acdc:ProppantProductionSegmentMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMember2024-01-012024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2024-01-012024-03-310001881487us-gaap:RetainedEarningsMember2023-01-012023-03-310001881487us-gaap:CommonClassAMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksEarthworksMember2024-03-310001881487us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberacdc:ExternalCustomersMemberus-gaap:AllOtherSegmentsMember2024-01-012024-03-310001881487acdc:SeriesARedeemableConvertiblePreferredStockMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:WilksEarthworksMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMemberacdc:MCEstatesLLCAndShopsAtWillowParkLLCMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-012023-03-310001881487acdc:MonarchNoteMember2024-03-310001881487acdc:PerformanceProppantsLlcMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-3100018814872024-01-012024-03-310001881487srt:ConsolidationEliminationsMember2023-12-310001881487us-gaap:OperatingSegmentsMemberacdc:ProppantProductionSegmentMember2024-03-310001881487acdc:ProducersServiceHoldingsLlcMember2023-01-032023-01-030001881487us-gaap:ProductMember2023-01-012023-03-3100018814872023-03-310001881487us-gaap:SubsequentEventMemberacdc:BPCInvestmentMember2024-04-302024-04-300001881487us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerSegmentBenchmarkMemberacdc:ProppantProductionSegmentMember2024-01-012024-03-310001881487us-gaap:RetainedEarningsMember2022-12-310001881487us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001881487acdc:SeriesARedeemableConvertiblePreferredStockMember2024-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksBrothersLLCMember2024-01-012024-03-310001881487srt:ParentCompanyMemberacdc:EquifyNoteMember2024-03-310001881487us-gaap:CommonClassAMember2024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:IntercompanyMemberacdc:ManufacturingSegmentMember2023-01-012023-03-310001881487us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMemberacdc:MCEstatesLLCAndShopsAtWillowParkLLCMember2023-12-310001881487acdc:FlotekIndustriesIncMember2023-12-310001881487us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001881487us-gaap:RetainedEarningsMember2024-01-012024-03-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-01-012024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ProppantProductionSegmentMember2023-12-310001881487acdc:StimulationServicesSegmentMember2024-03-310001881487us-gaap:AdditionalPaidInCapitalMember2024-03-310001881487acdc:IntercompanyMembersrt:ConsolidationEliminationsMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ExternalCustomersMemberus-gaap:ServiceMemberacdc:StimulationServicesSegmentMember2024-01-012024-03-310001881487us-gaap:NoncontrollingInterestMember2023-03-310001881487us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001881487acdc:ProducersServiceHoldingsLlcMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001881487acdc:BPCInvestmentMemberus-gaap:SubsequentEventMember2024-04-300001881487acdc:FlyingAPumpServicesLLCMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMember2023-12-3100018814872022-12-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-012023-03-310001881487us-gaap:CustomerConcentrationRiskMemberacdc:ManufacturingSegmentMemberus-gaap:RevenueFromContractWithCustomerSegmentBenchmarkMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:CarboCeramicsIncMember2023-12-310001881487acdc:FlotekSubsidiaryMemberacdc:FlotekABLCreditFacilityMember2024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMember2024-03-3100018814872024-05-060001881487us-gaap:AdditionalPaidInCapitalMember2022-12-310001881487acdc:FlotekSubsidiaryMember2023-12-310001881487acdc:PerformanceProppantsLlcMember2023-01-012023-03-310001881487acdc:FlotekSubsidiaryMemberacdc:FlotekOtherMember2023-12-3100018814872026-01-012024-03-310001881487srt:ParentCompanyMemberacdc:TwoThousandAndTwentyNineSeniorNotesMember2024-03-310001881487us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001881487acdc:StimulationServicesSegmentMember2024-01-012024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2024-03-310001881487srt:ParentCompanyMemberacdc:TwoThousandAndTwentyNineSeniorNotesMember2023-12-310001881487acdc:AlpineTwoThousandAndTwentyThreeTermLoanMemberacdc:AlpineSubsidiaryMember2023-12-310001881487acdc:ABLCreditFacilityMember2024-03-310001881487us-gaap:RelatedPartyMemberacdc:AutomatizeLLCMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMemberacdc:FHEUSALLCMember2024-01-012024-03-310001881487us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001881487acdc:PerformanceProppantsLlcMember2023-02-240001881487us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-3100018814872024-04-012024-03-310001881487acdc:FlotekIndustriesIncMember2024-01-012024-03-310001881487srt:ParentCompanyMemberacdc:OtherLongTermDebtMember2024-03-310001881487acdc:MonarchNoteMemberacdc:AlpineSubsidiaryMember2024-03-310001881487us-gaap:ServiceMember2023-01-012023-03-310001881487us-gaap:ProductMemberacdc:ExternalCustomersMember2024-01-012024-03-310001881487acdc:FlotekSubsidiaryMemberacdc:FlotekOtherMember2024-03-310001881487acdc:FinanceLeaseObligationsMemberacdc:AlpineSubsidiaryMember2023-12-310001881487acdc:MungerMakeWholeProvisionMemberus-gaap:FairValueInputsLevel3Member2023-12-310001881487us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:CarboCeramicsIncMember2024-01-012024-03-310001881487acdc:TwoThousandAndTwentyNineSeniorNotesMember2024-03-310001881487us-gaap:CommonClassBMember2023-12-3100018814872023-01-012023-03-3100018814872027-01-012024-03-310001881487acdc:AlpineSubsidiaryMember2023-12-310001881487acdc:ProducersServiceHoldingsLlcMember2023-01-012023-03-310001881487srt:ConsolidationEliminationsMemberacdc:IntercompanyMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:AutomatizeLLCMember2024-03-310001881487srt:ConsolidationEliminationsMember2024-03-310001881487us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:MCEstatesLLCAndShopsAtWillowParkLLCMember2024-01-012024-03-310001881487acdc:StimulationServicesSegmentMember2023-12-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ExternalCustomersMemberus-gaap:ServiceMemberacdc:StimulationServicesSegmentMember2023-01-012023-03-310001881487srt:ParentCompanyMemberacdc:TwoThousandTwentyTwoABLCreditFacilityMember2024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ProppantProductionSegmentMember2023-01-012023-03-310001881487us-gaap:CommonClassBMember2024-03-310001881487acdc:PerformanceProppantsLlcMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberacdc:ExternalCustomersMemberacdc:ProppantProductionSegmentMember2023-01-012023-03-3100018814872023-12-310001881487acdc:ProppantProductionSegmentMember2024-03-310001881487acdc:MungerMakeWholeProvisionMemberus-gaap:FairValueInputsLevel3Member2024-03-310001881487us-gaap:ProductMemberacdc:ExternalCustomersMember2023-01-012023-03-310001881487us-gaap:AllOtherSegmentsMember2023-12-310001881487us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberacdc:ExternalCustomersMemberus-gaap:AllOtherSegmentsMember2023-01-012023-03-310001881487acdc:FlyingAPumpServicesLLCMember2023-01-012023-06-300001881487us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001881487srt:ParentCompanyMember2024-03-310001881487us-gaap:AdditionalPaidInCapitalMember2023-03-310001881487us-gaap:AllOtherSegmentsMember2024-03-310001881487us-gaap:NoncontrollingInterestMember2024-03-3100018814872024-03-310001881487acdc:AlpineTwoThousandAndTwentyThreeTermLoanMembersrt:MinimumMember2024-01-012024-03-310001881487us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerSegmentBenchmarkMemberacdc:ProppantProductionSegmentMember2023-01-012023-03-310001881487acdc:ExternalCustomersMemberus-gaap:ServiceMember2023-01-012023-03-310001881487acdc:EquifyFinancialLLCMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksBrothersLLCMember2024-03-310001881487acdc:BPCInvestmentMemberus-gaap:FairValueInputsLevel3Member2024-03-310001881487us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-01-012024-03-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberacdc:ProppantProductionSegmentMember2024-01-012024-03-310001881487srt:ParentCompanyMemberacdc:FinanceLeaseObligationsMember2023-12-310001881487us-gaap:PerformanceSharesMember2024-01-012024-03-310001881487acdc:ProppantProductionSegmentMember2023-12-310001881487acdc:FlotekIndustriesIncMember2024-03-310001881487acdc:FlyingAPumpServicesLLCMemberus-gaap:RelatedPartyMember2023-12-310001881487acdc:FlyingAPumpServicesLLCMember2023-01-012023-09-300001881487us-gaap:RelatedPartyMember2024-03-310001881487us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310001881487acdc:AlpineSubsidiaryMember2024-03-310001881487us-gaap:RelatedPartyMemberacdc:FHEUSALLCMember2023-01-012023-03-310001881487acdc:ProducersServiceHoldingsLlcMember2023-01-030001881487us-gaap:RetainedEarningsMember2023-12-310001881487us-gaap:RelatedPartyMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMember2023-01-012023-03-310001881487srt:ParentCompanyMemberacdc:TwoThousandTwentyTwoABLCreditFacilityMember2023-12-310001881487us-gaap:NoncontrollingInterestMember2022-12-310001881487acdc:PerformanceProppantsLlcMember2023-02-242023-02-240001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMemberus-gaap:ProductMemberacdc:ExternalCustomersMember2024-01-012024-03-310001881487acdc:FlyingAPumpServicesLLCMemberus-gaap:RelatedPartyMember2024-03-310001881487acdc:FlotekSubsidiaryMemberacdc:FlotekABLCreditFacilityMember2023-12-310001881487us-gaap:CommonClassAMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:AutomatizeLLCMember2024-01-012024-03-310001881487us-gaap:CommonClassAMember2023-01-012023-03-310001881487acdc:ProFracLLCMember2024-03-310001881487us-gaap:CustomerConcentrationRiskMemberacdc:ManufacturingSegmentMemberus-gaap:RevenueFromContractWithCustomerSegmentBenchmarkMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksBrothersLLCMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:WilksBrothersLLCMember2023-01-012023-03-310001881487us-gaap:ProductMember2024-01-012024-03-310001881487acdc:ExternalCustomersMemberus-gaap:ServiceMember2024-01-012024-03-310001881487us-gaap:AdditionalPaidInCapitalMemberacdc:ProducersServiceHoldingsLlcMember2023-01-012023-03-310001881487srt:MaximumMemberacdc:AlpineTwoThousandAndTwentyThreeTermLoanMember2024-01-012024-03-310001881487acdc:MonarchNoteMemberacdc:AlpineSubsidiaryMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:MCEstatesLLCAndShopsAtWillowParkLLCMember2024-03-310001881487acdc:ProppantProductionSegmentMember2023-01-012023-03-310001881487acdc:AlpineTwoThousandAndTwentyThreeTermLoanMemberacdc:AlpineSubsidiaryMember2024-03-310001881487us-gaap:RelatedPartyMemberacdc:AutomatizeLLCMember2023-12-310001881487us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-03-310001881487acdc:EquifyFinancialLLCMemberus-gaap:RelatedPartyMember2023-12-310001881487acdc:BPCInvestmentMemberus-gaap:FairValueInputsLevel3Member2023-12-310001881487us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:InterstateMember2024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:IntercompanyMemberacdc:ProppantProductionSegmentMember2023-01-012023-03-310001881487us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMember2023-12-310001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMemberus-gaap:ProductMemberacdc:ExternalCustomersMember2023-01-012023-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ManufacturingSegmentMember2024-01-012024-03-310001881487srt:ConsolidationEliminationsMember2023-01-012023-03-310001881487acdc:EquifyFinancialLLCMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksEarthworksMember2023-12-310001881487us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310001881487us-gaap:RetainedEarningsMember2024-03-3100018814872025-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:CarboCeramicsIncMember2024-03-310001881487acdc:FlotekSubsidiaryMember2024-03-310001881487srt:ParentCompanyMemberacdc:EquifyNoteMember2023-12-310001881487us-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2023-12-310001881487us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberacdc:ExternalCustomersMemberacdc:ProppantProductionSegmentMember2024-01-012024-03-310001881487us-gaap:ServiceMember2024-01-012024-03-310001881487acdc:FlyingAPumpServicesLLCMember2024-01-012024-01-310001881487srt:ParentCompanyMember2023-12-310001881487us-gaap:AdditionalPaidInCapitalMember2023-12-310001881487srt:ParentCompanyMemberacdc:OtherLongTermDebtMember2023-12-310001881487us-gaap:RelatedPartyMemberacdc:InterstateMember2023-12-310001881487acdc:IntercompanyMemberus-gaap:OperatingSegmentsMemberacdc:StimulationServicesSegmentMember2024-01-012024-03-310001881487acdc:PriorBusinessCombinationsMember2024-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksEarthworksMember2024-01-012024-03-310001881487us-gaap:RetainedEarningsMember2023-03-310001881487srt:ParentCompanyMemberacdc:FinanceLeaseObligationsMember2024-03-310001881487us-gaap:OperatingSegmentsMemberacdc:ProppantProductionSegmentMember2024-01-012024-03-310001881487us-gaap:RelatedPartyMemberacdc:WilksConstructionCompanyLLCMember2023-01-012023-03-310001881487us-gaap:NoncontrollingInterestMember2024-01-012024-03-31xbrli:pureacdc:Segmentxbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from [ ] to [ ]

Commission File Number: 001-41388

ProFrac Holding Corp.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

Delaware |

|

87-2424964 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

333 Shops Boulevard, Suite 301, Willow Park, Texas |

|

76087 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (254) 776-3722

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.01 per share |

|

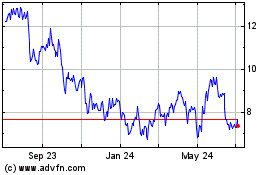

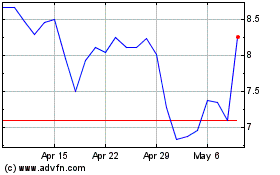

ACDC |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑Yes ☐No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☑ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐Yes ☑No

As of May 6, 2024, the registrant had 159,936,049 shares of Class A common stock outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Quarterly Report”) contains “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include those that express a belief, expectation or intention, as well as those that are not statements of historical fact. Forward-looking statements include information regarding our future plans and goals, as well as our expectations with respect to:

•Our business strategy and future growth prospects;

•Integration of acquired businesses;

•Our future profitability, cash flows and liquidity;

•Our financial strategy, budget, projections and operating results;

•The amount, nature and timing of our capital expenditures and the impact of such expenditures on our performance;

•The availability and terms of capital;

•Our exploration, development and production activities;

•The market for our existing and future products and services;

•Competition and government regulations; and

•General economic conditions.

These forward-looking statements may be accompanied by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “will,” “should,” “could,” “would,” “likely,” “future,” “budget,” “pursue,” “target,” “seek,” “objective,” or similar expressions that are predictions of or indicate future events or trends that do not relate to historical matters.

The forward-looking statements in this Quarterly Report speak only as of the date of this Quarterly Report, or such other date as specified herein. We disclaim any obligation to update these statements unless required by law, and we caution you not to place undue reliance on them. Forward-looking statements are not assurances of future performance and involve risks and uncertainties. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties include, but are not limited to, the following:

•our ability to finance, consummate, integrate and realize the benefits expected from our past or future acquisitions, including any related synergies;

•uncertainty regarding the timing, pace and extent of an economic recovery in the United States and elsewhere, which in turn will likely affect demand for crude oil and natural gas and therefore the demand for our services;

•the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil, natural gas, natural gas liquids and other hydrocarbons;

•a future decline in domestic spending by the onshore oil and natural gas industry;

•actions by members of the Organization of Petroleum Exporting Countries, Russia and other oil-producing countries with respect to oil production levels and announcements of potential changes in such levels;

•the political environment in oil and natural gas producing regions, including uncertainty or instability resulting from civil disorder, terrorism or war, such as the ongoing war between Russia and Ukraine and the war between Israel and Hamas, and the global response to such hostilities, which may negatively impact our operating results;

•changes in general economic and geopolitical conditions;

•competitive conditions in our industry;

•changes in the long-term supply of and demand for oil and natural gas;

•actions taken by our customers, competitors and third-party operators;

•a decline in demand for proppant;

•our ability to obtain permits, approvals and authorizations from governmental and third parties, and the effects of or changes to U.S. government regulation;

•changes in the availability and cost of capital;

•inflationary factors, such as increases in the labor costs, material costs and overhead costs;

•our ability to successfully implement our business plan, including a transaction to realize the value of our proppant production segment;

•large or multiple customer defaults, including defaults resulting from actual or potential insolvencies;

•the effects of consolidation on our customers or competitors;

•the price and availability of debt and equity financing (including changes in interest rates);

•our ability to complete growth projects on time and on budget;

•introduction of new drilling or completion techniques, or services using new technologies subject to patent or other intellectual property protections;

•operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control;

•acts of terrorism, war or political or civil unrest in the United States or elsewhere;

•loss or corruption of our information or a cyberattack on our computer systems;

•the price and availability of alternative fuels and energy sources;

•federal, state and local regulation of hydraulic fracturing and other oilfield service activities, as well as exploration and production activities, including public pressure on governmental bodies and regulatory agencies to regulate our industry;

•the availability of water resources, suitable proppant and chemicals in sufficient quantities for use in hydraulic fracturing fluids;

•the effects of existing and future laws and governmental regulations (or the interpretation thereof) on us and our customers;

•the severity and duration of widespread health events and related economic repercussions on the oil and gas industry and on demand for oil and gas; and

•the effects of future litigation.

Our forward-looking statements speak only as of the date they were made and, except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements because of new information, future events or other factors. All of our forward-looking information involves risks and uncertainties that could cause actual results to differ materially from the results expected. Although it is not possible to identify all factors, these risks and uncertainties include the risk factors and the timing of any of the risk factors identified in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 (the "Annual Report").

PART I

ITEM 1. FINANCIAL STATEMENTS

ProFrac Holding Corp.

Condensed Consolidated Balance Sheets

(in millions, except per share amounts or where otherwise noted)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

28.3 |

|

|

$ |

25.3 |

|

Accounts receivable, net |

|

|

381.8 |

|

|

|

346.1 |

|

Accounts receivable — related party, net |

|

|

11.9 |

|

|

|

6.8 |

|

Inventories |

|

|

219.8 |

|

|

|

236.6 |

|

Prepaid expenses and other current assets |

|

|

22.8 |

|

|

|

23.3 |

|

Total current assets |

|

|

664.6 |

|

|

|

638.1 |

|

Property, plant, and equipment (net of accumulated depreciation of $1,083.8 and $1,010.2, respectively) |

|

|

1,689.8 |

|

|

|

1,779.0 |

|

Operating lease right-of-use assets, net |

|

|

77.7 |

|

|

|

87.2 |

|

Goodwill |

|

|

342.3 |

|

|

|

325.9 |

|

Intangible assets, net |

|

|

164.7 |

|

|

|

173.5 |

|

Investments ($24.9 and $23.4 at fair value, respectively) |

|

|

30.4 |

|

|

|

28.9 |

|

Deferred tax assets |

|

|

0.1 |

|

|

|

0.3 |

|

Other assets |

|

|

37.4 |

|

|

|

37.8 |

|

Total assets |

|

$ |

3,007.0 |

|

|

$ |

3,070.7 |

|

|

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY, AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

281.8 |

|

|

$ |

319.0 |

|

Accounts payable — related party |

|

|

16.6 |

|

|

|

21.9 |

|

Accrued expenses |

|

|

89.0 |

|

|

|

65.6 |

|

Current portion of long-term debt |

|

|

136.4 |

|

|

|

126.4 |

|

Current portion of operating lease liabilities |

|

|

19.6 |

|

|

|

24.5 |

|

Other current liabilities |

|

|

64.4 |

|

|

|

84.1 |

|

Other current liabilities — related party |

|

|

15.8 |

|

|

|

7.4 |

|

Total current liabilities |

|

|

623.6 |

|

|

|

648.9 |

|

Long-term debt |

|

|

895.1 |

|

|

|

923.5 |

|

Long-term debt — related party |

|

|

17.1 |

|

|

|

18.6 |

|

Operating lease liabilities |

|

|

63.2 |

|

|

|

67.8 |

|

Tax receivable agreement liability |

|

|

64.8 |

|

|

|

68.1 |

|

Other liabilities |

|

|

9.6 |

|

|

|

15.2 |

|

Total liabilities |

|

|

1,673.4 |

|

|

|

1,742.1 |

|

Commitments and contingencies (NOTE 9) |

|

|

|

|

|

|

Mezzanine equity: |

|

|

|

|

|

|

Series A redeemable convertible preferred stock, $0.01 par value, 50 thousand shares authorized, issued and outstanding |

|

|

59.9 |

|

|

|

58.7 |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value, 50.0 shares authorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Class A common stock, $0.01 par value, 600.0 shares authorized, 159.6 and 159.4 shares issued and outstanding, respectively |

|

|

1.5 |

|

|

|

1.5 |

|

Class B common stock, $0.01 par value, 400.0 shares authorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

1,227.2 |

|

|

|

1,225.4 |

|

Accumulated deficit |

|

|

(15.4 |

) |

|

|

(16.0 |

) |

Accumulated other comprehensive income |

|

|

0.3 |

|

|

|

0.3 |

|

Total stockholders' equity attributable to ProFrac Holding Corp. |

|

|

1,213.6 |

|

|

|

1,211.2 |

|

Noncontrolling interests |

|

|

60.1 |

|

|

|

58.7 |

|

Total stockholders' equity |

|

|

1,273.7 |

|

|

|

1,269.9 |

|

Total liabilities, mezzanine equity, and stockholders' equity |

|

$ |

3,007.0 |

|

|

$ |

3,070.7 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Condensed Consolidated Statements of Operations

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

Services |

|

$ |

505.4 |

|

|

$ |

786.7 |

|

Product sales |

|

|

76.1 |

|

|

|

70.8 |

|

Total revenues |

|

|

581.5 |

|

|

|

857.5 |

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

Cost of revenues, exclusive of depreciation, depletion and amortization |

|

|

373.7 |

|

|

|

545.9 |

|

Selling, general, and administrative |

|

|

50.6 |

|

|

|

77.9 |

|

Depreciation, depletion and amortization |

|

|

112.8 |

|

|

|

110.3 |

|

Acquisition and integration costs |

|

|

0.2 |

|

|

|

12.3 |

|

Other operating expense, net |

|

|

4.3 |

|

|

|

4.4 |

|

Total operating costs and expenses |

|

|

541.6 |

|

|

|

750.8 |

|

|

|

|

|

|

|

|

Operating income |

|

|

39.9 |

|

|

|

106.7 |

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

Interest expense, net |

|

|

(37.6 |

) |

|

|

(34.9 |

) |

Gain (loss) on extinguishment of debt |

|

|

(0.8 |

) |

|

|

4.1 |

|

Other income (expense), net |

|

|

1.8 |

|

|

|

(9.4 |

) |

Income before income taxes |

|

|

3.3 |

|

|

|

66.5 |

|

Income tax expense |

|

|

(0.3 |

) |

|

|

(6.7 |

) |

Net income |

|

|

3.0 |

|

|

|

59.8 |

|

Less: net loss attributable to ProFrac Predecessor |

|

|

— |

|

|

|

— |

|

Less: net (income) loss attributable to noncontrolling interests |

|

|

(1.2 |

) |

|

|

4.2 |

|

Less: net income attributable to redeemable noncontrolling interests |

|

|

— |

|

|

|

(42.0 |

) |

Net income attributable to ProFrac Holding Corp. |

|

$ |

1.8 |

|

|

$ |

22.0 |

|

Net income attributable to Class A common shareholders |

|

$ |

0.6 |

|

|

$ |

22.0 |

|

|

|

|

|

|

|

|

Earnings per Class A common share (basic and diluted) |

|

$ |

0.00 |

|

|

$ |

0.40 |

|

|

|

|

|

|

|

|

Weighted average Class A common shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

159.5 |

|

|

|

54.5 |

|

Diluted |

|

|

159.8 |

|

|

|

54.9 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Condensed Consolidated Statement of Comprehensive Income

(in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

3.0 |

|

|

$ |

59.8 |

|

Other comprehensive income: |

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

— |

|

|

|

0.3 |

|

Comprehensive income |

|

|

3.0 |

|

|

|

60.1 |

|

Less: comprehensive (income) loss attributable to noncontrolling interest |

|

|

(1.2 |

) |

|

|

4.1 |

|

Less: comprehensive income attributable to redeemable noncontrolling interest |

|

|

— |

|

|

|

(42.1 |

) |

Comprehensive income attributable to ProFrac Holding Corp. |

|

$ |

1.8 |

|

|

$ |

22.1 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Condensed Consolidated Statements of Changes in Equity

(in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

|

Additional

Paid-in |

|

|

Accumulated |

|

|

Accumulated

Other

Comprehensive |

|

|

Noncontrolling |

|

|

Total Stockholders' |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Income |

|

|

Interests |

|

|

Equity |

|

Balance, December 31, 2023 |

|

|

159.4 |

|

|

$ |

1.5 |

|

|

$ |

1,225.4 |

|

|

$ |

(16.0 |

) |

|

$ |

0.3 |

|

|

$ |

58.7 |

|

|

$ |

1,269.9 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.8 |

|

|

|

— |

|

|

|

1.2 |

|

|

|

3.0 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1.9 |

|

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

2.1 |

|

Tax withholding related to net share settlement of equity awards |

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

Share issuance |

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Adjustment of convertible preferred stock to redemption amount |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.2 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.2 |

) |

Balance, March 31, 2024 |

|

|

159.6 |

|

|

$ |

1.5 |

|

|

$ |

1,227.2 |

|

|

$ |

(15.4 |

) |

|

$ |

0.3 |

|

|

$ |

60.1 |

|

|

$ |

1,273.7 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Condensed Consolidated Statements of Changes in Equity (continued)

(in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

|

Class B Common Stock |

|

|

Additional

Paid-in |

|

|

(Accumulated Deficit) Retained |

|

|

Accumulated

Other

Comprehensive |

|

|

Noncontrolling |

|

|

Total Stockholders' (Deficit) |

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Earnings |

|

|

Income |

|

|

Interests |

|

|

Equity |

|

Balance, December 31, 2022 |

|

|

53.9 |

|

|

$ |

0.5 |

|

|

|

104.2 |

|

|

$ |

1.0 |

|

|

$ |

— |

|

|

$ |

(1,185.9 |

) |

|

$ |

— |

|

|

$ |

72.2 |

|

|

|

(1,112.2 |

) |

Class A shares issued to acquire Producers |

|

|

0.4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6.2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6.2 |

|

Class A shares issued to acquire Performance Proppants |

|

|

0.3 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.4 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22.0 |

|

|

|

— |

|

|

|

(4.2 |

) |

|

|

17.8 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.9 |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

|

1.0 |

|

Stock-based compensation related to deemed contribution |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.5 |

|

Conversion of Flotek notes to equity |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12.7 |

|

|

|

12.7 |

|

Foreign currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.2 |

|

Adjustment of redeemable noncontrolling interest to redemption amount |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9.2 |

) |

|

|

1,277.4 |

|

|

|

— |

|

|

|

— |

|

|

|

1,268.2 |

|

Balance, March 31, 2023 |

|

|

54.6 |

|

|

$ |

0.5 |

|

|

|

104.2 |

|

|

$ |

1.0 |

|

|

$ |

4.8 |

|

|

$ |

113.5 |

|

|

$ |

0.1 |

|

|

$ |

80.9 |

|

|

$ |

200.8 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Condensed Consolidated Statements of Cash Flows

(in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

2024 |

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Net income |

|

$ |

3.0 |

|

|

$ |

59.8 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

112.8 |

|

|

|

110.3 |

|

|

Amortization of acquired contract liabilities |

|

|

(16.5 |

) |

|

|

(8.1 |

) |

|

Stock-based compensation |

|

|

2.1 |

|

|

|

13.1 |

|

|

Loss (gain) on disposal of assets, net |

|

|

(1.4 |

) |

|

|

1.5 |

|

|

Non-cash loss (gain) on extinguishment of debt |

|

|

0.8 |

|

|

|

(4.1 |

) |

|

Amortization of debt issuance costs |

|

|

3.2 |

|

|

|

6.1 |

|

|

Acquisition earnout adjustment |

|

|

— |

|

|

|

(3.0 |

) |

|

Unrealized loss (gain) on investments, net |

|

|

(1.2 |

) |

|

|

9.7 |

|

|

Deferred tax expense |

|

|

0.2 |

|

|

|

— |

|

|

Other non-cash items, net |

|

|

— |

|

|

|

0.1 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(41.2 |

) |

|

|

(41.9 |

) |

|

Inventories |

|

|

16.6 |

|

|

|

(24.7 |

) |

|

Prepaid expenses and other assets |

|

|

1.4 |

|

|

|

(1.8 |

) |

|

Accounts payable |

|

|

(20.3 |

) |

|

|

136.5 |

|

|

Accrued expenses |

|

|

23.3 |

|

|

|

(3.1 |

) |

|

Other liabilities |

|

|

(3.7 |

) |

|

|

(16.9 |

) |

|

Net cash provided by operating activities |

|

|

79.1 |

|

|

|

233.5 |

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

|

— |

|

|

|

(443.6 |

) |

|

Investment in property, plant & equipment |

|

|

(59.9 |

) |

|

|

(83.2 |

) |

|

Proceeds from sale of assets |

|

|

6.6 |

|

|

|

1.0 |

|

|

Net cash used in investing activities |

|

|

(53.3 |

) |

|

|

(525.8 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

— |

|

|

|

320.0 |

|

|

Repayments of long-term debt |

|

|

(37.5 |

) |

|

|

(18.2 |

) |

|

Borrowings from revolving credit agreements |

|

|

501.1 |

|

|

|

406.7 |

|

|

Repayments of revolving credit agreements |

|

|

(485.2 |

) |

|

|

(363.0 |

) |

|

Payment of debt issuance costs |

|

|

(1.1 |

) |

|

|

(18.4 |

) |

|

Tax withholding related to net share settlement of equity awards |

|

|

(0.1 |

) |

|

|

— |

|

|

Net cash provided by (used in) financing activities |

|

|

(22.8 |

) |

|

|

327.1 |

|

|

|

|

|

|

|

|

|

|

Net increase in cash, cash equivalents, and restricted cash |

|

|

3.0 |

|

|

|

34.8 |

|

|

Cash, cash equivalents, and restricted cash beginning of period |

|

|

25.3 |

|

|

|

37.9 |

|

|

Cash, cash equivalents, and restricted cash end of period |

|

$ |

28.3 |

|

|

$ |

72.7 |

|

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities |

|

|

|

|

|

|

|

Capital expenditures included in accounts payable |

|

$ |

22.6 |

|

|

$ |

54.2 |

|

|

Operating lease liabilities incurred from obtaining right-of-use assets |

|

$ |

5.7 |

|

|

$ |

6.1 |

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements

(Amounts in millions, except per share amounts, or where otherwise noted)

1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Description of Business

ProFrac Holding Corp. ("ProFrac Corp.") is a vertically integrated and innovation-driven energy services holding company providing hydraulic fracturing, proppant production, other completion services and other complementary products and services to leading upstream oil and natural gas companies engaged in the exploration and production (“E&P”) of North American unconventional oil and natural gas resources.

ProFrac Corp. operates in three business segments: stimulation services, proppant production and manufacturing. Our stimulation services segment owns and operates a fleet of mobile hydraulic fracturing units and other auxiliary equipment that generates revenue by providing stimulation services to our customers. Our proppant production segment provides proppant to oilfield service providers and E&P companies. Our manufacturing segment sells highly engineered, tight tolerance machined, assembled, and factory tested products such as high horsepower pumps, valves, piping, swivels, large-bore manifold systems, and fluid ends.

Mr. Dan Wilks and Mr. Farris Wilks are brothers and are the founders and principal stockholders of the Company. Their sons, Mr. Matthew D. Wilks and Mr. Johnathan Ladd Wilks are the Company’s Executive Chairman and Chief Executive Officer, respectively. In the normal course of business, we enter into transactions with related parties where Mr. Dan Wilks and Mr. Farris Wilks and entities owned by or affiliated with them (collectively, the "Wilks Parties") hold a controlling financial interest. See "Note 13. Related Party Transactions" for further information.

Basis of Presentation

The unaudited condensed consolidated financial statements presented herein include the accounts of ProFrac Corp. and those of its subsidiaries that are wholly owned, controlled by it or a variable interest entity ("VIE") where it is the primary beneficiary. Unless the context requires otherwise, the use of the terms "Company," "we," "us," "our" or "ours" in these notes to the unaudited condensed consolidated financial statements refer to ProFrac Corp., together with its consolidated subsidiaries.

These unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC") for interim financial reporting. Accordingly, certain information and disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. We believe that the presentations and disclosures herein are adequate to make the information not misleading. The unaudited condensed consolidated financial statements reflect all adjustments (consisting of normal recurring adjustments) for a fair statement of the interim periods. The results of operations for the interim periods are not necessarily indicative of the results of operations to be expected for the full year. The unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes included in Item 8 "Financial Statements and Supplementary Data" of our Annual Report.

All significant intercompany accounts and transactions have been eliminated in consolidation.

Concentrations of Risk

Our business activities are concentrated in the well completion services segment of the oilfield services industry in the United States. The market for these services is cyclical, and we depend on the willingness of our customers to make operating and capital expenditures to explore for, develop, and produce oil and natural gas in the United States. The willingness of our customers to undertake these activities depends largely upon prevailing industry conditions that are predominantly influenced by current and expected prices for oil and natural gas. Historically, a low commodity-price environment has caused our customers to significantly reduce their hydraulic fracturing activities and the prices they are willing to pay for those services. During these periods, these customer actions materially adversely affected our business, financial condition and results of operations.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

Recently Issued Standards Not Yet Adopted

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which enhances the disclosures required for operating segments in the Company's annual and interim consolidated financial statements. This ASU is effective retrospectively for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company is currently evaluating the impact of this standard on our disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which is intended to enhance the transparency and decision usefulness of income tax disclosures. This ASU provides for enhanced income tax information primarily through changes to the rate reconciliation and income taxes paid information. This ASU is effective for the Company prospectively to all annual periods beginning after December 15, 2024. Early adoption is permitted. The Company is currently evaluating the impact of this standard on our disclosures.

2. SUPPLEMENTAL BALANCE SHEET INFORMATION

Cash, Cash Equivalents, and Restricted Cash

Cash, cash equivalents, and restricted cash are recorded in our unaudited condensed consolidated balance sheet as follows:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash and cash equivalents |

|

$ |

28.3 |

|

|

$ |

69.9 |

|

Restricted cash included in prepaid expenses and other current assets |

|

|

— |

|

|

|

2.8 |

|

Total cash, cash equivalents, and restricted cash |

|

$ |

28.3 |

|

|

$ |

72.7 |

|

Inventories

Inventories are comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Raw materials and supplies |

|

$ |

74.6 |

|

|

$ |

84.2 |

|

Work in process |

|

|

21.1 |

|

|

|

20.5 |

|

Finished products and parts |

|

|

124.1 |

|

|

|

131.9 |

|

Total |

|

$ |

219.8 |

|

|

$ |

236.6 |

|

Accrued Expenses

Accrued expenses are comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Employee compensation and benefits |

|

$ |

37.2 |

|

|

$ |

22.6 |

|

Sales, use, and property taxes |

|

|

16.8 |

|

|

|

24.0 |

|

Insurance |

|

|

10.9 |

|

|

|

10.9 |

|

Interest |

|

|

21.2 |

|

|

|

5.4 |

|

Income taxes |

|

|

1.6 |

|

|

|

1.5 |

|

Other |

|

|

1.3 |

|

|

|

1.2 |

|

Total accrued expenses |

|

$ |

89.0 |

|

|

$ |

65.6 |

|

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

Other Current Liabilities

Other current liabilities are comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Acquired contract liabilities |

|

$ |

35.6 |

|

|

$ |

43.5 |

|

Accrued legal contingencies |

|

|

10.8 |

|

|

|

20.7 |

|

Deferred revenue |

|

|

3.3 |

|

|

|

7.3 |

|

Tax receivable agreement obligation |

|

|

6.4 |

|

|

|

2.8 |

|

Other |

|

|

8.3 |

|

|

|

9.8 |

|

Total other current liabilities |

|

$ |

64.4 |

|

|

$ |

84.1 |

|

3. BUSINESS COMBINATIONS

On January 3, 2023, we acquired 100% of the issued and outstanding membership interest of Producers Service Holdings LLC (“Producers”), an employee-owned pressure pumping services provider serving Appalachia and the Mid-Continent, for a total purchase consideration of $36.5 million.

On February 24, 2023, we acquired 100% of the issued and outstanding membership interests in (i) Performance Proppants, LLC, (ii) Red River Land Holdings, LLC, (iii) Performance Royalty, LLC, (iv) Performance Proppants International, LLC, and (v) Sunny Point Aggregates, LLC (together, “Performance Proppants”) for a total purchase consideration of $462.8 million.

We accounted for these acquisitions as business combinations. The following table reflects pro forma revenues and net income for the three months ended March 31, 2023 as if these acquisitions had taken place on January 1, 2022. These unaudited pro forma amounts are not necessarily indicative of results that would have actually been obtained during the periods presented or that may be obtained in the future.

|

|

|

|

|

|

|

Three Months Ended |

|

(unaudited) |

|

March 31, 2023 |

|

Revenues |

|

$ |

882.3 |

|

Net income |

|

$ |

67.2 |

|

The changes in the carrying amount of goodwill by reportable segment were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stimulation

Services |

|

|

Proppant

Production |

|

|

Manufacturing |

|

|

Other |

|

|

Total |

|

Balance, December 31, 2023 |

|

$ |

169.7 |

|

|

$ |

74.5 |

|

|

$ |

— |

|

|

$ |

81.7 |

|

|

$ |

325.9 |

|

Adjustment |

|

|

16.4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16.4 |

|

Balance, March 31, 2024 |

|

$ |

186.1 |

|

|

$ |

74.5 |

|

|

$ |

— |

|

|

$ |

81.7 |

|

|

$ |

342.3 |

|

The adjustment to goodwill in our stimulation services reportable segment was to correct an immaterial error in the accounting for our acquisition of U.S. Well Services, which decreased property, plant, and equipment and increased goodwill.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

NOTE 4. DEBT

Debt is comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

ProFrac Holding Corp.: |

|

|

|

|

|

|

2029 Senior Notes |

|

$ |

500.0 |

|

|

$ |

520.0 |

|

2022 ABL Credit Facility |

|

|

137.7 |

|

|

|

117.4 |

|

Equify Notes (1) |

|

|

17.1 |

|

|

|

18.6 |

|

Finance lease obligations |

|

|

8.1 |

|

|

|

8.6 |

|

Other |

|

|

8.8 |

|

|

|

13.8 |

|

ProFrac Holding Corp. principal amount |

|

|

671.7 |

|

|

|

678.4 |

|

Less: unamortized debt discounts, premiums, and issuance costs |

|

|

(16.5 |

) |

|

|

(17.4 |

) |

Less: current portion of long-term debt |

|

|

(57.8 |

) |

|

|

(47.2 |

) |

ProFrac Holding Corp. long-term debt, net |

|

|

597.4 |

|

|

|

613.8 |

|

|

|

|

|

|

|

|

Alpine Subsidiary: |

|

|

|

|

|

|

Alpine 2023 Term Loan |

|

|

365.0 |

|

|

|

365.0 |

|

Monarch Note |

|

|

43.8 |

|

|

|

54.7 |

|

Finance lease obligations |

|

|

1.3 |

|

|

|

2.1 |

|

Alpine principal amount |

|

|

410.1 |

|

|

|

421.8 |

|

Less: unamortized debt discounts, premiums, and issuance costs |

|

|

(20.0 |

) |

|

|

(22.0 |

) |

Less: current portion of long-term debt |

|

|

(75.3 |

) |

|

|

(71.6 |

) |

Alpine long-term debt, net |

|

|

314.8 |

|

|

|

328.2 |

|

|

|

|

|

|

|

|

Flotek Subsidiary: |

|

|

|

|

|

|

Flotek ABL credit facility |

|

|

3.1 |

|

|

|

7.5 |

|

Flotek other |

|

|

0.2 |

|

|

|

0.2 |

|

Flotek principal amount |

|

|

3.3 |

|

|

|

7.7 |

|

Less: current portion of long-term debt |

|

|

(3.3 |

) |

|

|

(7.6 |

) |

Flotek long-term debt, net |

|

|

— |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

Consolidated: |

|

|

|

|

|

|

Total principal amount |

|

|

1,085.1 |

|

|

|

1,107.9 |

|

Less: unamortized debt discounts, premiums, and issuance costs |

|

|

(36.5 |

) |

|

|

(39.4 |

) |

Less: current portion of long-term debt |

|

|

(136.4 |

) |

|

|

(126.4 |

) |

Total long-term debt |

|

$ |

912.2 |

|

|

$ |

942.1 |

|

(1)Related party debt agreements.

Senior Secured Notes Due 2029

During the three months ended March 31, 2024, we made principal payments of $20.0 million on our 2029 Senior Notes.

ABL Credit Facility

As of March 31, 2024, the maximum availability under the ABL credit facility was limited to our eligible borrowing base of $291.6 million with $137.7 million of borrowings outstanding and $10.1 million of letters of credit outstanding, resulting in approximately $143.8 million of remaining availability.

Monarch Note

During the three months ended March 31, 2024, we made principal payments of $10.9 million on the Monarch Note.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

Equify Note

During the three months ended March 31, 2024, we made principal payments of $1.5 million on the Equify Note.

Debt Compliance

Both the 2029 Senior Notes and the ABL Credit Facility contain certain customary representations and warranties and affirmative and negative covenants. As of March 31, 2024, we were in compliance with these covenants and expect to be compliant for at least the next twelve months.

Commencing with the fiscal quarter ending September 30, 2024, the Alpine 2023 Term Loan contains a covenant requiring Alpine not to exceed a maximum Total Net Leverage Ratio (as defined in the Alpine Term Loan Credit Agreement) of 2.00 to 1.00. This ratio is generally the consolidated total debt of Alpine divided by Alpine's adjusted EBITDA. As a result of Alpine’s lower than expected operating results in the three months ended March 31, 2024, Alpine is closely monitoring compliance with this covenant. While there can be no assurance, Alpine believes that it will be able to meet, modify, or further defer this debt covenant.

Restricted Assets

Our Alpine 2023 Term Loan requires us to segregate collateral associated with our Alpine subsidiary, which comprises our proppant production segment, and limits our ability to use Alpine's cash or assets to satisfy our obligations or the obligations of our other subsidiaries. We also have limited ability to provide Alpine with liquidity to satisfy its obligations. See “Note 12. Business Segments” for certain financial information for Alpine.

NOTE 5. REVENUE FROM CONTRACTS WITH CUSTOMERS

We believe that disaggregating our revenue by reportable segment in "Note 12. Business Segments" provides the information necessary to understand the nature, amount, timing and uncertainty of our revenues and cash flows.

Contract Balances with Customers

Our contract assets are included in “Accounts receivable” in our unaudited condensed consolidated balance sheets. Accounts receivable consist of invoiced amounts or amounts for which we have a right to invoice based on services completed or products delivered.

Our current and non-current contract liabilities are included in “Other current liabilities” and “Other liabilities,” respectively, in our unaudited condensed consolidated balance sheets. Our contract liabilities consist of deferred revenues from advance consideration received from customers related to future performance of service or delivery of products and off-market contract liabilities from unfavorable contracts recognized in connection with our business acquisitions in the Proppant Production segment.

In the accounting for prior business combinations, we recorded off-market contract liabilities. During the three months ended March 31, 2024 and 2023, we recorded amortization of $13.6 million and $8.1 million, respectively, related to these contract liabilities to revenue. As of March 31, 2024, our off-market contract liabilities amounted to $37.5 million and the related estimated future amortization to revenue is $29.9 million for the remainder of 2024, and $7.6 million in 2025.

Performance Obligations

Certain of our Proppant Production contracts contain multiple performance obligations to provide a minimum quantity of proppant products to our customers in future periods. For these contracts, the transaction price is allocated to each performance obligation at estimated selling prices and we recognize revenue as we satisfy these performance obligations. As of March 31, 2024, the aggregate amount of transaction price allocated to unsatisfied performance obligations was $231.3 million, and we expect to perform these obligations and recognize revenue of $129.8 million for the remainder of 2024, $43.5 million in 2025, $43.5 million in 2026, $14.5 million in 2027.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

We have elected the practical expedient permitting the exclusion of disclosing the value of unsatisfied performance obligations for Stimulation Services and Manufacturing contracts as these contracts have original contract terms of one year or less or we have the right to invoice for services performed.

NOTE 6. OTHER OPERATING EXPENSE, NET

Other operating expense, net is comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

(Gain) loss on disposal of assets |

|

$ |

(1.4 |

) |

|

$ |

1.5 |

|

Litigation expenses and accruals for legal contingencies |

|

|

4.8 |

|

|

|

5.8 |

|

Severance charges |

|

|

0.7 |

|

|

|

— |

|

Supply commitment charge |

|

|

0.2 |

|

|

|

— |

|

Acquisition earnout adjustments |

|

|

— |

|

|

|

(3.0 |

) |

Provision for credit losses, net of recoveries |

|

|

— |

|

|

|

0.1 |

|

Total |

|

$ |

4.3 |

|

|

$ |

4.4 |

|

(Gain) loss on disposal of assets, net consists of gains and losses on the sale of excess property, early equipment failures and other asset dispositions.

Litigation expenses and accruals for legal contingencies generally represent legal and professional fees incurred in litigation as well as estimates for loss contingencies with regards to certain vendor disputes and litigation matters. In the periods presented, these costs represent litigation costs incurred in connection with a patent infringement lawsuit against Halliburton. See "Note 9. Commitments and Contingencies" for a discussion of significant litigation matters.

Severance charges in the three months ended March 31, 2024 relate to the departure of an executive.

The acquisition earnout adjustment in the three months ended March 31, 2023 represents a decrease in the fair value of the contingent consideration related to our acquisition of REV Energy Holdings, LLC in December 2022.

NOTE 7. INCOME TAXES

We record income taxes for interim periods based on an estimated annual effective tax rate. The estimated annual effective rate is recomputed on a quarterly basis and may fluctuate due to changes in forecasted annual operating income, positive or negative changes to the valuation allowance for net deferred tax assets and changes to actual or forecasted permanent book to tax differences. Our effective tax rate for the three months ended March 31, 2024 was 9.1%, compared with 10.1% in the same period in 2023. In 2024, the difference between our effective tax rate and the federal statutory rate related to changes in the valuation allowance on our net deferred tax assets. In 2023, the difference between our effective tax rate and the federal statutory rate related to changes in the valuation allowance on our net deferred tax assets and to the income that was earned within the financial statement consolidated group that is not subject to tax within the financial statement consolidated group.

ProFrac Holding Corp.

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

(Amounts in millions, except per share amounts, or where otherwise noted)

NOTE 8. EARNINGS PER SHARE

The calculation of earnings per share ("EPS") for our Class A common stock is as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Numerator: |

|

|

|

|

|

|

Net income attributable to ProFrac Holding Corp. |

|

$ |

1.8 |

|

|

$ |

22.0 |

|

Adjust Series A preferred stock to its maximum redemption value |

|

|

(1.2 |

) |

|

|

— |

|

Net income used for basic earnings per Class A common share |

|

|

0.6 |

|

|

|

22.0 |

|

Net income reallocated to dilutive Class A common shares |

|

|

— |

|

|

|

0.1 |

|

Net income used for diluted earnings per Class A common share |

|

$ |

0.6 |

|

|

$ |

22.1 |

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

Weighted average Class A common shares |

|

|

159.5 |

|

|

|

54.5 |

|

Dilutive potential of employee restricted stock units |

|

|

0.3 |

|

|

|

0.4 |

|

Weighted average Class A common shares — diluted |

|

|

159.8 |

|

|

|

54.9 |

|

|

|

|

|

|

|

|

Basic and diluted earnings per Class A common share |

|

$ |

0.00 |

|

|

$ |

0.40 |

|

The dilutive potential of employee restricted stock units is calculated using the treasury stock method.

The dilutive potential of our Preferred Stock is calculated using the if-converted method. At March 31, 2024, there were 2.6 million common stock equivalents related to Preferred Stock that were not included in diluted earnings per share because the effect of their inclusion would be antidilutive.

NOTE 9. COMMITMENTS AND CONTINGENCIES

Litigation

In the ordinary course of business, we are the subject of, or party to a number of pending or threatened legal actions and administrative proceedings. While many of these matters involve inherent uncertainty, we believe that, other than as described below, the amount of the liability, if any, ultimately incurred with respect to proceedings or claims will not have a material adverse effect on our consolidated financial position as a whole or on our liquidity, capital resources or future annual results of operations.