In the context of cryptocurrency investments, fear of missing out (FOMO) is the term often used to describe the intense feeling of anxiety or regret people can get when they believe they are missing out on a lucrative investment opportunity—such as when Bitcoin (BTC) or another cryptocurrency is experiencing solid growth at the time.

While this is often a passing feeling that many do not act on, a large proportion of would-be investors end up taking steps to ‘get in on the action’. Sometimes, this action pays off, and the investor generates a profit. Other times, acting based on FOMO has disastrous consequences—particularly when the investor neglects proper risk management and doesn’t take the time to fully understand their investment.

Fortunately, FOMO can also be harnessed and used to make profitable investment choices. But you need to know what to do, and what to avoid, to stand the best chance of success.

If you’re currently experiencing FOMO, here’s what you need to bear in mind.

Security Comes First

Diving into a cryptocurrency investment without doing adequate research, typically with a dangerously high sum of money is colloquially known as ‘apeing in’ in crypto circles—and it’s rarely a good idea.

Not only do investors risk sums they often cannot afford to lose—breaking rule number 1 of investments. But they often do so while using insecure platforms that leave their funds at risk—which can include online exchange wallets and untested smart contracts.

Needless to say, storing your funds on an insecure platform can have disastrous consequences. If you want to maximize your security, it’s wise to avoid using platforms that require full control of your assets—typically known as custodial platforms.

Instead, always keep your funds in a secure wallet that gives you full access to your private keys. Coin Wallet is arguably one of the best for Bitcoin and altcoin investors since it not only supports a wide range of cryptocurrencies (including all ERC-20 tokens) but is also one of just a handful of cross-platform wallets to support hardware-based security—in the form of the optional YubiKey.

Regardless of which wallet option you use, always practice risk management. Bitcoin is widely considered to have significant long term potential, but it is also highly volatile in the short term. This volatility can pose a problem for those with tolerance for risk since short-term losses can and likely will occur at some point. Be prepared for it by setting your expectations on the long term outcome.

Understand Bitcoin’s Market Dynamics

Like many investments, the price of Bitcoin is set by minute-to-minute changes in supply and demand. When demand outstrips supply its value tends to increase, whereas if supply exceeds demand, the value will likely fall.

Over the long term, demand for Bitcoin has consistently eclipsed the supply—this is why Bitcoin has achieved such considerable growth in its just over a decade long existence. But since less than 0.1% of the world population currently own or use Bitcoin and institutions now pumping more money into Bitcoin than ever before, many economists think this will be the case for years to come.

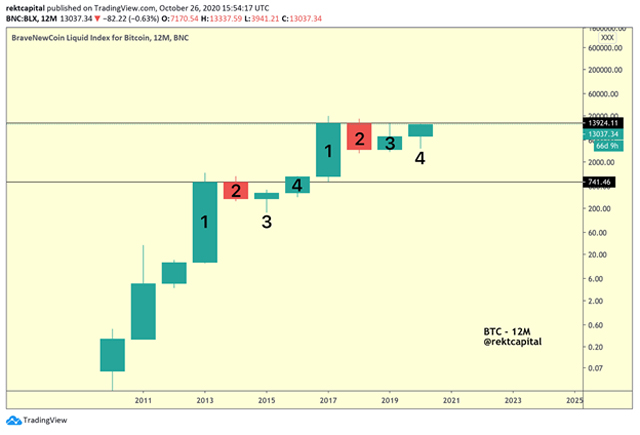

But with that said, Bitcoin has largely demonstrated a four-year market cycle. As described by Rekt Capital on Hackernoon, Bitcoin has so far moved in a regular four-year cycle. The first phase of each four-year cycle has so far seen Bitcoin achieve exponential growth—reaching new highest all time values.

Bitcoin then tends to undergo a major correction, before an accumulation period, which leads to a recovery and continuation phase before the cycle begins anew with further exponential growth.

As of January 2021, we appear to be entering into phase 1 of the cycle—exponential growth. This is arguably the point of maximum financial opportunity in this cycle, and could last anywhere from several weeks to several months. Bitcoin may fall at some point, but history indicates it will bounce back stronger than ever—regardless of how severe this fall might be.

Regardless, it’s important to understand that past performance isn’t always an indicator of what lies ahead. Always factor this into your decision-making.

Stay On Top of the Market

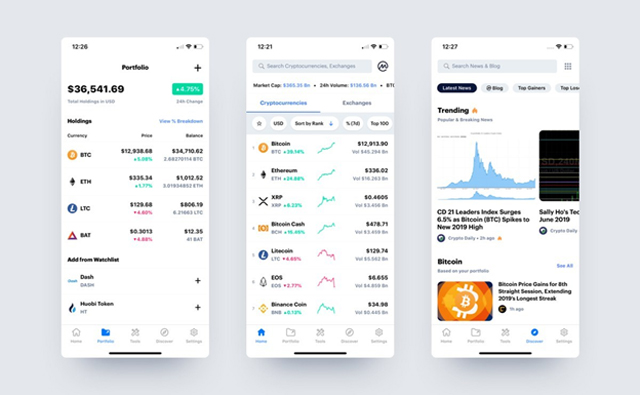

As with all investments, it’s important to check in on your Bitcoin or cryptocurrency portfolio from time to time to see how it is performing.

However, given that Bitcoin is extraordinarily volatile, many experts agree that it’s best to restrict how often you check in on its price—to avoid being adversely influenced by short-term changes in its value.

For this reason, many early-stage investors simply adopt the ‘buy it and forget about it’ approach and avoid checking the price of their assets for several years. So far, this has turned out to be an excellent strategy.

But if you really must keep track of the market, consider using one of the various market tracking tools like TradingView or the CoinMarketCap app to automatically send you an alert when a certain price is reached, rather than manually tracking the market directly.

This will both save you time, and prevent you from acting on an impulse.