SILVER finished at $17.53 on Tuesday and lost $22.0 (-1.22 percent). That being said, in today’s session, Silver (XAG) is growing as anticipated while buyers are about to challenge upside barriers at the $17.90/$18.00 level. As the market is steaming up and trading high back to the days before.

Key Levels

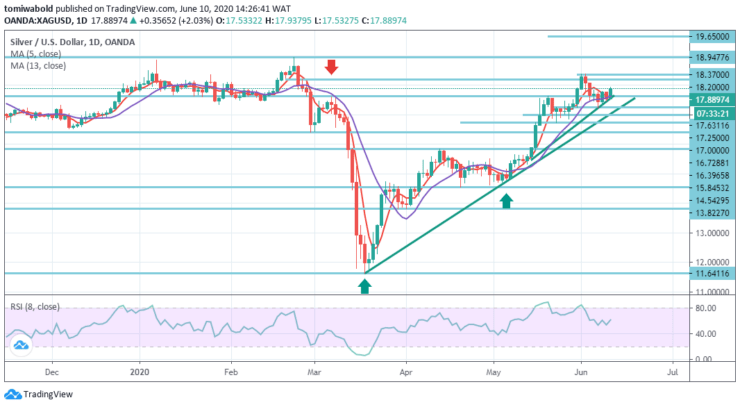

Resistance Levels: $19.65, $18.94, $18.20

Support Levels: $17.25, $16.72, $15.84

XAGUSD Long term Trend: Bullish

XAGUSD Long term Trend: Bullish

The pair closed lower but above the opening of the preceding day creating a bearish Harami Candle after moving lower in the corresponding session. Prices have risen back up but still below the $18.20 level main technical barrier, which is likely to serve as a forward-looking resistance.

The market may again run into bears at the level of around $18.20 for the third time in a row after finding sellers in the same area in previous sessions and at $18.37 a few days ago. The last time this happened on June 2, on the very next trading day, SILVER ended up losing about 3 percent.

XAGUSD Short term Trend: Bullish

XAGUSD Short term Trend: Bullish

Silver price bounced from $17.63 level on the 4-hour time frame, up 1.30 percent on a day, as seen Wednesday during the European session. Even so, a bullish technical structure of a rising trend is yet to be confirmed by the white metal, on the four-hour chart to validate further buying.

On the other hand, the pair is supposed to find support at $17.63, and a decline through might take it to the next level of support at $17.25.

Source: https://learn2.trade