Hershey Announces New Consumer-Centric Approach and Allocates Resources Behind Core Brands to Drive Long-Term Net Sales and Earn

June 17 2008 - 7:30AM

PR Newswire (US)

- Market structure and segmentation to drive targeted innovation

and consumer investment - Long-term net sales and earnings per

share growth rates of +3-5% and +6-8% established - Outlook

reaffirmed for 2008, growth in net sales 3-4%, with earnings per

share-diluted from operations expected to be in the $1.85 to $1.90

range HERSHEY, Pa., June 17 /PRNewswire-FirstCall/ -- The Hershey

Company (NYSE:HSY) today will announce initiatives designed to

deliver its long-term goals for net sales and earnings per share

growth. After completing an in-depth market structure and category

segmentation review, the Company is targeting key consumer segments

that will drive growth. The Company is aligning resources in

support of this approach and expects total advertising to increase

by at least 20 percent in both 2008 and 2009. The increased support

will be focused on core brands that currently generate

approximately 60 percent of total U.S. net sales. This targeted

allocation and disciplined approach, combined with an increase in

U.S. retail coverage, will enable the Company to consistently meet

its net sales and earnings objectives in the future. "Our extensive

consumer research validates our strategy of increasing advertising

and consumer investment behind the core U.S. brands that offer the

greatest potential for growth," said David J. West, President and

Chief Executive Officer. "We will combine this focused approach

with consumer-centric innovation and continued international

expansion to achieve our long-term net sales growth rate of 3-5

percent. Longer term, as marketplace trends improve and targeted

consumer initiatives are executed, the Company expects to generate

earnings per share growth of 6-8 percent." The Company expects

full-year 2008 net sales growth of 3-4 percent and earnings per

share-diluted from operations of $1.85 to $1.90. A reconciliation

of full-year earnings per share-diluted excluding realignment

charges to full-year earnings per share-diluted on a GAAP basis is

included below. Management will discuss the new strategy and

long-term goals during a meeting with analysts and investors this

morning. The meeting begins at 8:30 a.m. EDT today and will be web

cast live at The Hershey Company web site,

http://www.hersheys.com/, or can be accessed via a listen-only

conference call at 1-800-990-8039. Please go to the Investor

Relations Section of the web site for further details. Note: In

this release, Hershey has provided income measures excluding

certain items described above, in addition to net income determined

in accordance with GAAP. These non-GAAP financial measures are used

in evaluating results of operations for internal purposes. These

non-GAAP measures are not intended to replace the presentation of

financial results in accordance with GAAP. Rather, the Company

believes exclusion of such items provides additional information to

investors to facilitate the comparison of past and present

operations. The aforementioned items relate to the Global Supply

Chain Transformation program announced in February 2007 and the

business realignment in Brazil announced in December 2007. The

Global Supply Chain Transformation program is expected to result in

pre-tax charges and non-recurring project implementation costs of

$550 million - $575 million. Total charges include project

management and start-up costs of approximately $60 million. In

2007, the Company recorded GAAP charges related to the Global

Supply Chain Transformation program of $400.0 million, or $1.10 per

share-diluted. Additionally, in the fourth quarter of 2007 the

Company recorded business realignment and impairment charges of

$12.6 million, or $0.05 per share-diluted, related to its business

in Brazil. In 2008, the Company expects to record total GAAP

charges of about $135 million - $145 million, or $0.39 - $0.42 per

share-diluted. Below is a reconciliation of GAAP and non-GAAP items

to the Company's earnings per share-diluted outlook: 2007 2008

Reported / Expected EPS-Diluted $0.93 $1.43 - $1.51 Total Business

Realignment and Impairment Charges $1.15 $0.39 - $0.42 EPS-Diluted

from Operations* $2.08 -- Expected EPS-Diluted from Operations*

$1.85 - $1.90 *From operations, excluding business realignment and

impairment charges. Safe Harbor Statement This release contains

statements which are forward-looking. These statements are made

based upon current expectations which are subject to risk and

uncertainty. Actual results may differ materially from those

contained in the forward-looking statements. Factors which could

cause results to differ materially include, but are not limited to:

our ability to implement and generate expected ongoing annual

savings from the initiatives to transform our supply chain and

advance our value-enhancing strategy; changes in raw material and

other costs and selling price increases; our ability to execute our

supply chain transformation within the anticipated timeframe in

accordance with our cost estimates; the impact of future

developments related to the product recall and temporary plant

closure in Canada in the fourth quarter of 2006, including our

ability to recover costs we incurred for the recall and plant

closure from responsible third-parties; the impact of future

developments related to the investigation by government regulators

of alleged pricing practices by members of the confectionery

industry, including risks of subsequent litigation or further

government action; pension cost factors, such as actuarial

assumptions, market performance and employee retirement decisions;

changes in our stock price, and resulting impacts on our expenses

for incentive compensation, stock options and certain employee

benefits; market demand for our new and existing products; changes

in our business environment, including actions of competitors and

changes in consumer preferences; changes in governmental laws and

regulations, including taxes; risks and uncertainties related to

our international operations; and such other matters as discussed

in our Annual Report on Form 10-K for 2007. All information in this

press release is as of June 17, 2008. The Company undertakes no

duty to update any forward-looking statement to conform the

statement to actual results or changes in the Company's

expectations. DATASOURCE: The Hershey Company CONTACT: Financial:

Mark Pogharian, +1-717-534-7556; or Media: Kirk Saville,

+1-717-534-7641, both of The Hershey Company Web site:

http://www.hersheys.com/

Copyright

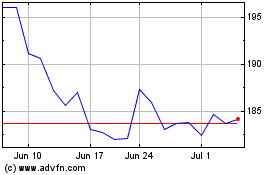

Hershey (NYSE:HSY)

Historical Stock Chart

From Jul 2024 to Aug 2024

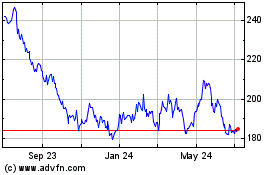

Hershey (NYSE:HSY)

Historical Stock Chart

From Aug 2023 to Aug 2024