- Earnings per share-diluted from operations $0.37 HERSHEY, Pa.,

April 24 /PRNewswire-FirstCall/ -- The Hershey Company (NYSE:HSY)

today announced sales and earnings for the first quarter ended

March 30, 2008. Consolidated net sales were $1,160,342,000 compared

with $1,153,109,000 for the first quarter of 2007. Net income for

the first quarter of 2008 was $63,245,000, or $0.28 per

share-diluted, compared with $93,473,000, or $0.40 per

share-diluted, for the comparable period of 2007. For the first

quarters of 2008 and 2007, these results, prepared in accordance

with generally accepted accounting principles ("GAAP"), include net

pre-tax charges of $30.7 million and $40.4 million, or $0.09 and

$0.11 per share, respectively. The majority of the 2008 charges

were associated with the Global Supply Chain Transformation program

announced in February 2007. Net income from operations, which

excludes the net charges for the first quarters of 2008 and 2007,

was $83,915,000 or $0.37 per share-diluted in 2008, compared with

$118,786,000, or $0.51 per share-diluted in 2007. First-Quarter

Performance "Net sales increased slightly in the first quarter and

were in line with our expectations," said David J. West, President

and Chief Executive Officer. "As we previously communicated, the

current period was adversely impacted by an unusually early Easter

and the mid-January decision to discontinue the roll-out of Ice

Breakers PACS. Operating profit targets were achieved in a rising

input cost environment. We invested behind our core brands in the

first quarter and will continue to do so throughout 2008 to

strengthen our position in the marketplace. "During the first

quarter, Hershey made significant progress on growth initiatives

that will benefit net sales and earnings throughout the remainder

of the year. The Hershey's Bliss and Starbucks product launches

shipped to customers on schedule in mid-March. Consumer investment,

including advertising, sampling and merchandising, will accelerate

in the second quarter to ensure the success of these launches. "The

expansion of our businesses in Asia is moving ahead steadily. We

are focusing on the launch of Hershey's branded products

manufactured in and for the Indian market. In China, we continue to

make progress and have full manufacturing capabilities to support

our portfolio roll-out. "U.S. retail takeaway in the first quarter

was up 14.8 percent in channels that account for over 80 percent of

our retail business. However, this period benefited from an early

Easter season. Excluding seasonal activity, Hershey's retail

takeaway increased 1.8 percent. In the channels measured by

syndicated data, market share was off 0.8 points. Improvements in

certain channels, customers and core brands indicate that

marketplace plans, including higher levels of consumer investment

and increased retail coverage, are starting to take hold. The price

increase announced in late January had a minimal impact during the

quarter. Outlook "As we look ahead to the balance of 2008, plans

are in place to deliver our sales and earnings objectives.

Specifically, the launch of new products, increased levels of brand

support, consumer investment, retail coverage and merchandising

will continue to build throughout the year. We expect this to

result in a sequential improvement in net sales. Additionally, we

have good visibility into our full-year cost structure. In

Monterrey, Mexico, the construction of our new manufacturing

facility is progressing and initial production is underway. We are

encouraged by the development of our international investments and

will continue to follow a disciplined approach to growth

opportunities in emerging markets. Therefore, for the full-year

2008, we continue to expect net sales growth of 3-4 percent and

earnings per share-diluted from operations of $1.85 to $1.90," West

concluded. Note: In this earnings release, Hershey has provided

income measures excluding certain items described above, in

addition to net income determined in accordance with GAAP. These

non-GAAP financial measures, as shown in the attached pro forma

summary of consolidated statements of income, are used in

evaluating results of operations for internal purposes. These

non-GAAP measures are not intended to replace the presentation of

financial results in accordance with GAAP. Rather, the Company

believes exclusion of such items provides additional information to

investors to facilitate the comparison of past and present

operations. The aforementioned items relate to the Global Supply

Chain Transformation program announced in February 2007 and the

business realignment in Brazil announced in December 2007. The

Global Supply Chain Transformation program is expected to result in

pre-tax charges and non- recurring project implementation costs of

$525 million - $575 million. Total charges include project

management and start-up costs of approximately $50 million. In

2007, the Company recorded GAAP charges related to the Global

Supply Chain Transformation program of $400.0 million, or $1.10 per

share- diluted. Additionally, in the fourth quarter of 2007 the

Company recorded business realignment and impairment charges of

$12.6 million, or $0.05 per share-diluted, related to its business

in Brazil. In 2008, the Company expects to record total GAAP

charges of about $140 million - $160 million, or $0.37 - $0.42 per

share-diluted. Below is a reconciliation of GAAP and non- GAAP

items to the Company's earnings per share-diluted outlook: 2007

2008 Reported / Expected EPS-Diluted $0.93 $1.43 - $1.53 Total

Business Realignment and Impairment Charges $1.15 $0.37 - $0.42

EPS-Diluted from Operations* $2.08 -- Expected EPS-Diluted from

Operations* $1.85 - $1.90 *From operations, excluding business

realignment and impairment charges. Live Web Cast As previously

announced, the Company will hold a conference call with analysts

today at 8:30 a.m. Eastern Time. The conference call will be web

cast live via Hershey's corporate website http://www.hersheys.com/.

Please go to the Investor Relations section of the website for

further details. Safe Harbor Statement This release contains

statements which are forward-looking. These statements are made

based upon current expectations which are subject to risk and

uncertainty. Actual results may differ materially from those

contained in the forward-looking statements. Factors which could

cause results to differ materially include, but are not limited to:

our ability to implement and generate expected ongoing annual

savings from the initiatives to transform our supply chain and

advance our value-enhancing strategy; changes in raw material and

other costs and selling price increases; our ability to execute our

supply chain transformation within the anticipated timeframe in

accordance with our cost estimates; the impact of future

developments related to the product recall and temporary plant

closure in Canada in the fourth quarter of 2006, including our

ability to recover costs we incurred for the recall and plant

closure from responsible third-parties; the impact of future

developments related to the investigation by government regulators

of alleged pricing practices by members of the confectionery

industry, including risks of subsequent litigation or further

government action; pension cost factors, such as actuarial

assumptions, market performance and employee retirement decisions;

changes in our stock price, and resulting impacts on our expenses

for incentive compensation, stock options and certain employee

benefits; market demand for our new and existing products; changes

in our business environment, including actions of competitors and

changes in consumer preferences; changes in governmental laws and

regulations, including taxes; risks and uncertainties related to

our international operations; and such other matters as discussed

in our Annual Report on Form 10-K for 2007. All information in this

press release is as of April 24, 2008. The Company undertakes no

duty to update any forward-looking statement to conform the

statement to actual results or changes in the Company's

expectations. The Hershey Company Summary of Consolidated

Statements of Income for the periods ended March 30, 2008 and April

1, 2007 (in thousands except per share amounts) First Quarter 2008

2007 Net Sales $1,160,342 $1,153,109 Costs and Expenses: Cost of

Sales 783,890 739,078 Selling, Marketing and Administrative 249,949

216,433 Business Realignment and Impairment Charges, net 4,085

27,545 Total Costs and Expenses 1,037,924 983,056 Income Before

Interest and Income Taxes (EBIT) 122,418 170,053 Interest Expense,

net 24,386 28,255 Income Before Income Taxes 98,032 141,798

Provision for Income Taxes 34,787 48,325 Net Income $63,245 $93,473

Net Income Per Share - Basic - Common $0.29 $0.42 - Basic - Class B

$0.26 $0.37 - Diluted $0.28 $0.40 Shares Outstanding - Basic -

Common 166,771 169,836 - Basic - Class B 60,806 60,816 - Diluted

228,926 233,708 Key Margins: Gross Margin 32.4% 35.9% EBIT Margin

10.6% 14.7% Net Margin 5.5% 8.1% The Hershey Company Pro Forma

Summary of Consolidated Statements of Income for the periods ended

March 30, 2008 and April 1, 2007 (in thousands except per share

amounts) First Quarter 2008 2007 Net Sales $1,160,342 $1,153,109

Costs and Expenses: Cost of Sales 758,736(a) 729,219(b) Selling,

Marketing and Administrative 248,515( c ) 213,447(d) Business

Realignment and Impairment Charges, net --(e) --(f) Total Costs and

Expenses 1,007,251 942,666 Income Before Interest and Income Taxes

(EBIT) 153,091 210,443 Interest Expense, net 24,386 28,255 Income

Before Income Taxes 128,705 182,188 Provision for Income Taxes

44,790 63,402 Net Income $83,915 $118,786 Net Income Per Share -

Basic - Common $0.38 $0.53 - Basic - Class B $0.34 $0.48 - Diluted

$0.37 0.51 Shares Outstanding - Basic - Common 166,771 169,836 -

Basic - Class B 60,806 60,816 - Diluted 228,926 233,708 Key

Margins: Adjusted Gross Margin 34.6% 36.8% Adjusted EBIT Margin

13.2% 18.3% Adjusted Net Margin 7.2% 10.3% (a) Excludes business

realignment and impairment charges of $25.2 million pre-tax or

$17.5 million after-tax for the first quarter of 2008. (b) Excludes

business realignment and impairment charges of $9.9 million pre-tax

or $6.2 million after-tax for the first quarter of 2007. (c)

Excludes business realignment and impairment charges of $1.4

million pre-tax or $.6 million after-tax for the first quarter of

2008. (d) Excludes business realignment and impairment charges of

$3.0 million pre-tax or $1.8 million after-tax for the first

quarter of 2007. (e) Excludes business realignment and impairment

charges of $4.1 million pre-tax or $2.6 million after-tax for the

first quarter of 2008. (f) Excludes business realignment and

impairment charges of $27.5 million pre-tax or $17.3 million

after-tax for the first quarter of 2007. The Hershey Company

Consolidated Balance Sheets as of March 30, 2008 and December 31,

2007 (in thousands of dollars) Assets 2008 2007 Cash and Cash

Equivalents $152,875 $129,198 Accounts Receivable - Trade (Net)

298,668 487,285 Deferred Income Taxes 73,539 83,668 Inventories

619,406 600,185 Prepaid Expenses and Other 118,115 126,238 Total

Current Assets 1,262,603 1,426,574 Net Plant and Property 1,510,667

1,539,715 Goodwill 582,326 584,713 Other Intangibles 168,459

155,862 Other Assets 542,962 540,249 Total Assets $4,067,017

$4,247,113 Liabilities, Minority Interest and Stockholders' Equity

Loans Payable $479,037 $856,392 Accounts Payable 231,982 223,019

Accrued Liabilities 466,050 538,986 Taxes Payable 23,921 373 Total

Current Liabilities 1,200,990 1,618,770 Long-Term Debt 1,528,691

1,279,965 Other Long-Term Liabilities 523,410 544,016 Deferred

Income Taxes 178,800 180,842 Total Liabilities 3,431,891 3,623,593

Minority Interest 43,935 30,598 Total Stockholders' Equity 591,191

592,922 Total Liabilities, Minority Interest and Stockholders'

Equity $4,067,017 $4,247,113 DATASOURCE: The Hershey Company

CONTACT: Financial, Mark Pogharian, +1-717-534-7556, or Media, Kirk

Saville, +1-717-534-7641, both of The Hershey Company Web site:

http://www.hersheys.com/

Copyright

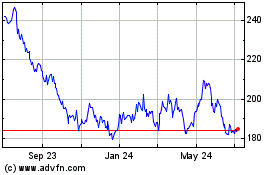

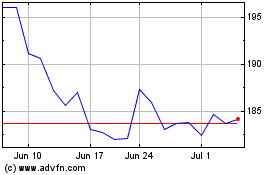

Hershey (NYSE:HSY)

Historical Stock Chart

From Jul 2024 to Aug 2024

Hershey (NYSE:HSY)

Historical Stock Chart

From Aug 2023 to Aug 2024