TIDMZIOC

RNS Number : 3926N

Zanaga Iron Ore Company Ltd

28 September 2012

28 September 2012

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2012

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company")

(AIM:ZIOC) is pleased to announce its unaudited interim results for

the six months ended 30 June 2012.

Highlights

Zanaga Project, Republic of Congo

-- Pre-Feasibility Study to examine slurry pipeline

transportation option ("Pipeline PFS") nearing completion

- Publication of key outcomes expected October 2012

-- 57% increase in JORC Mineral Resource to 6.8 billion tonnes

at 32.0% Fe, with 69% in the Measured & Indicated resource

category

- Drilling programme to Feasibility Study standard completed

- 74% increase in Measured and Indicated resource category to

4.69 billion tonnes with an average grade of 32.5% Fe

- More than 176,000 metres drilled across only 25km of the 47km orebody

Corporate

-- Cash balance of US$42.5m as at 30 June 2012

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"I am pleased to report substantial progress on the Zanaga

Project during the first half of the year. Following the positive

results of the Value Engineering Exercise on a slurry pipeline

transportation option, a Pre-Feasibility Study was initiated to

further refine this option, with the potential for improved

economics and a higher grade product. The Pipeline PFS is nearing

completion and we expect to announce the results in October 2012.

This will assist in determining which transport option to take

through to final Feasibility Study.

In addition, an extensive drilling campaign has been conducted

to Feasibility Study standards, resulting in a 57% increase in the

size of the JORC Mineral Resource, as well as further improvements

in the understanding of our large orebody, The JORC Mineral

Resource has now increased to 6.8 billion tonnes at 32% Fe, with

69% contained in the Measured & Indicated resource

category."

Copies of the unaudited interim results for the six months ended

30 June 2012 are available on the Company's website at

www.zanagairon.com.

For further information please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Chris Bowman, Christopher

Britton

Adviser and Joint Corporate Broker and Christopher Kololian

+44 20 3100 2000

Citigroup Global Markets Limited

Joint Corporate Broker Alex Carter

+44 20 7986 4000

Pelham Bell Pottinger

Financial PR James MacFarlane and Daniel Thöle

+44 20 7861 3232

Business Review - Operations

Mineral Resource

Work during the first half of the year was aimed at increasing

the geology and mineralogical understanding of the Zanaga Iron Ore

deposit. The project team successfully completed an extensive

drilling programme on the Project's orebody, delivering a

substantial resource increase and upgrade in September 2012.

The scale and definition of the Mineral Resource Estimate,

reported in accordance with JORC, has now expanded to 6.8 billion

tonnes ("Bt") at a grade of 32% Fe,further supporting the large

scale, long life potential of the Project. Approximately 69% of the

resource is now in the Measured and Indicated categories. This

mineral resource has been defined from drilling conducted over only

25 kilometres of the 47-kilometre strike length of magnetic

mineralisation.

Data used in the preparation of the Mineral Resource Estimate

was sourced from all available information collected from diamond

and RC drilling completed at the Zanaga Project, to a cut-off date

of 15 July 2012. This includes an additional 49,125 metres (39%

increase) of drilling since the previous resource statement

announced on 26 October 2011. A total of 176,109 metres (1,213

holes) have been drilled to date, with 79,288 assays (XRF analyses

and Niton analyses) used to model the mineral resource.

Drilling completed Metres

---------------------------------------------------------- --------

At 26 Aug 2011 (previous resource estimate, announced 26

Oct 2011) 126,984

---------------------------------------------------------- --------

26 Aug 2011 - 15 July 2012 (cut-off for updated resource

estimate, announced 4 Sept 2012) 49,125

---------------------------------------------------------- --------

Total to date 176,109

---------------------------------------------------------- --------

Note: The Mineral Resource referred to above, announced by ZIOC

on 4 September 2012, is consistent with the terms and definitions

included in the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (JORC Code 2004

edition)

Pipeline Pre-Feasibility Study

The Value Engineering Exercise ("VEE") results, presented in Q4

2011, confirmed two viable transport options for the development of

the Zanaga Project, with a slurry pipeline demonstrating the

potential to be the more economically attractive option. Following

this, a Pipeline Pre-Feasibility Study ("Pipeline PFS") commenced

with the objective of further refining this option and its

costing.

The Pipeline PFS has progressed well and is nearing completion,

with the key outcomes expected to be announced during October 2012.

The PFS has been conducted to Xstrata's rigorous standards, in

conjunction with a consortium of top-tier consultants based in

France and Australia, and has included a detailed metallurgical

test work campaign at SGA's laboratories in Germany to determine

the product specifications.

Feasibility Study

Under the terms of the joint venture, Xstrata must use

reasonable efforts to ensure a feasibility study ("FS") on the

Zanaga Project is completed by no later than three months prior to

the expiration of the exploration licences in August 2014 or any

subsequent renewal and subject to there being no material adverse

change. Xstrata is also obliged to fund the costs of the FS which

must comply with international best practice and Xstrata's internal

FS guidelines.

Outlook

The investment case for ZIOC continues to be supported by strong

industry fundamentals, while the scale and high quality of the

Project offer value and world-class potential.

Project milestones for H2 2012 are the announcement of the key

outcomes of the Pipeline PFS, advancement of the Project's FS and

ESIA work streams, as well as ongoing interaction with the

government of the Republic of Congo on the Project's development.

This will include discussions on terms for a definitive Mining

Convention (Convention d'Etablissement) which will secure the

legal, commercial and regulatory aspects required for the Project's

development.

Under the management of Xstrata, the Project continues to

progress as it moves towards the development and construction of a

world-class iron ore project. Xstrata's funding obligations in

relation to the Project and the FS means ZIOC does not currently

foresee any substantial near-term spending obligations until

completion of the FS. The cost of ZIOC personnel, financial

advisors and technical experts engaged or appointed by ZIOC in

relation to the Project are currently the only budgeted

expenditures for the Project during the FS phase of work. ZIOC

expects the substantial investment programme being undertaken on

the Project to continue to build shareholder value.

Financial review

Results from operations

The financial statements contain the results for ZIOC for the

first half of 2012. ZIOC made a loss in the half-year of US$7.4m

compared to a loss of US$22.9m in the year to 31 December 2011. The

loss for the half-year comprised:

1 January to 1 January to 1 January to

30 June 30 June 31 December

2012 2011 2011

Unaudited Unaudited Audited

US$000 US$000 US$000

-------------------------------------------------------------------- ------------ ------------ ------------

General expenses (2,499) (1,781) (4,570)

Net foreign exchange profit 417 1,593 274

Share-based payments (343) (707) (2,425)

Share of loss of associate (21) (2,996) (7,803)

Interest income 83 87 173

-------------------------------------------------------------------- ------------ ------------ ------------

Loss before tax (2,363) (3,804) (14,351)

Tax (20) - (28)

Currency translation 1 - 38

Share of other comprehensive income of associate - foreign exchange (5,037) 2 (8,517)

-------------------------------------------------------------------- ------------ ------------ ------------

Total comprehensive loss (7,419) (3,802) (22,858)

-------------------------------------------------------------------- ------------ ------------ ------------

General expenses of US$2.5m consist of staff costs of US$0.3m,

Directors fees of US$0.3m, professional fees of US$1.4m and US$0.5m

of other general operating expenses.

The foreign exchange profit of US$0.4m can be attributed to the

impact of the weakening of the US Dollar against UK Sterling during

the half-year on the cash balances that are held in UK

Sterling.

The share-based payment charge reflects the expense associated

with the grant of options under ZIOC's long-term incentive plan

("LTIP") and other options to ZIOC's directors, two key employees

and one of ZIOC's consultants.

The share of loss of associate reflected above relates to ZIOC's

investment in Jumelles Limited, the joint venture company in

respect of the Zanaga Project, which generated a loss of US$0.002m

in the six months to 30 June 2012, together with a charge of

US$0.019m made for equity accounting purposes for share options

provided to employees of Jumelles Limited.

During the half year period, Jumelles Limited spent US$28.2m on

exploration, increasing its capitalised exploration assets to

US$195.0m.

Financial position

ZIOC's net asset value ("NAV") of US$220.2m comprises of a

US$178.5m investment in Jumelles Limited, US$42.5m of cash balances

and US$0.8m of other net current liabilities.

30 June 2012 30 June 2011 31 December 2011

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------------------ ------------ ------------ ----------------

Investment in associate 178.5 195.8 183.0

Cash 42.5 48.5 45.0

Other net current liabilities (0.8) (0.2) (0.8)

------------------------------ ------------ ------------ ----------------

Net assets 220.2 244.1 227.2

------------------------------ ------------ ------------ ----------------

Cost of investment

The investment in associate relates to the value of the

investment in Jumelles which as at 30 June 2012 owned 100% of the

Project. The carrying value of this investment has decreased by

US$4.5m due to the US$5.0m comprehensive loss made by Jumelles

Limited during the half-year which resulted from a $5.0m currency

translation adjustment, and by a US$0.5m additional investment,

funded jointly (50/50) with Xstrata, for the survey of an

additional land area. Though Jumelles acquired the non-exclusive

prospecting licence for this area, it does not form part of the

existing ZIOC Xstrata joint venture agreement.

As at 30 June 2012, Jumelles Limited had aggregated assets of

US$219.5m (June 2011: US$228.1m) and aggregated liabilities of

US$48.0m (June 2011: US$16.0m). Assets consisted of US$195.0m (June

2011: US$126.6m) of capitalised exploration assets and US$15.2m

(June 2011: US$15.1m) of other fixed assets including property,

plant and equipment. A total of US$28.2m (2011: US$47.6m) of

exploration costs were capitalised during the half year period.

Cash balances totalled US$6.3m (June 2011: US$7.1m) and other

current assets decreased from US$10.3m to US$2.9m during the

half-year.

Cash flow

Cash balances have decreased by US$2.5m since 31 December 2011.

Operating activities utilised US$2.4m, the additional land area

investment in associate US$0.5m and foreign exchange differences

generated a cash profit of US$0.4m as the value of the US Dollar

weakened against the UK Sterling thereby increasing the US Dollar

value of the UK Sterling denominated cash balances.

Statement of comprehensive income

for the six months ended 30 June 2012

1 January 1 January 1 January

to to to

30 June 30 June 31 December

2012 2011 2011

Unaudited Unaudited Audited

Note US$000 US$000 US$000

-------------------------------------------------- ---- ---------- ---------- ------------

Administrative expenses (2,425) (895) (6,721)

Share of loss of associate (21) (2,996) (7,803)

-------------------------------------------------- ---- ---------- ---------- ------------

Operating loss (2,446) (3,891) (14,524)

Interest income 83 87 173

-------------------------------------------------- ---- ---------- ---------- ------------

Loss before tax (2,363) (3,804) (14,351)

Taxation 5 (20) - (28)

-------------------------------------------------- ---- ---------- ---------- ------------

Loss for the period (2,383) (3,804) (14,379)

Foreign exchange translation - foreign operations 1 - 38

Share of other comprehensive income of associate

- foreign exchange translation (5,037) 2 (8,517)

-------------------------------------------------- ---- ---------- ---------- ------------

Other comprehensive loss (5,036) 2 (8,479)

-------------------------------------------------- ---- ---------- ---------- ------------

Total comprehensive loss (7,419) (3,802) (22,858)

-------------------------------------------------- ---- ---------- ---------- ------------

Loss per share (basic and diluted) (Cents) 7 (0.9) (1.4) (5.2)

The loss for the period is attributable to the equity holders of

the parent company.

Statement of changes in equity

for the six months ended 30 June 2012

Foreign

currency

Share Retained translation Total

capital earnings reserve equity

US$000 US$000 US$000 US$000

-------------------------------------------------------- ------- -------- ----------- --------

Balance at 1 January 2011 256,070 (15,422) 536 241,184

Consideration for share-based payments - other services 6,674 - - 6,674

Loss for the period - (3,804) - (3,804)

Other comprehensive income - - 2 2

-------------------------------------------------------- ------- -------- ----------- --------

Total comprehensive loss - (3,804) 2 (3,802)

-------------------------------------------------------- ------- -------- ----------- --------

Balance at 30 June 2011 262,744 (19,226) 538 244,056

-------------------------------------------------------- ------- -------- ----------- --------

Consideration for share-based payments - other services 2,249 - - 2,249

Loss for the period - (10,575) - (10,575)

Other comprehensive income - - (8,481) (8,481)

-------------------------------------------------------- ------- -------- ----------- --------

Total comprehensive loss - (10,575) (8,481) (19,056)

-------------------------------------------------------- ------- -------- ----------- --------

Balance at 31 December 2011 264,993 (29,801) (7,943) 227,249

-------------------------------------------------------- ------- -------- ----------- --------

Consideration for share-based payments - other services 362 - - 362

Loss for the period - (2,383) - (2,383)

Other comprehensive income - - (5,036) (5,036)

-------------------------------------------------------- ------- -------- ----------- --------

Total comprehensive loss - (2,383) (5,036) (7,419)

-------------------------------------------------------- ------- -------- ----------- --------

Balance at 30 June 2012 265,355 (32,184) (12,979) 220,192

-------------------------------------------------------- ------- -------- ----------- --------

Balance sheet

as at 30 June 2012

30 June 31 December

30 June 2011 2011

2012 Unaudited Unaudited Audited

Note US$000 US$000 US$000

----------------------------------------- ---- --------------- ---------- -----------

Non-current asset

Property, plant and equipment 74 - 13

Investment in associate 6 178,452 195,771 182,977

----------------------------------------- ---- --------------- ---------- -----------

178,526 195,771 182,990

----------------------------------------- ---- --------------- ---------- -----------

Current assets

Other receivables 160 96 104

Cash and cash equivalents 42,529 48,471 45,047

----------------------------------------- ---- --------------- ---------- -----------

42,689 48,567 45,151

----------------------------------------- ---- --------------- ---------- -----------

Total Assets 221,215 244,338 228,141

----------------------------------------- ---- --------------- ---------- -----------

Current liabilities

Trade and other payables (1,023) (282) (892)

----------------------------------------- ---- --------------- ---------- -----------

Net assets 220,192 244,056 227,249

----------------------------------------- ---- --------------- ---------- -----------

Equity attributable to equity holders of

the parent

Share capital 265,355 262,744 264,993

Retained earnings (32,184) (19,226) (29,801)

Foreign currency translation reserve (12,979) 538 (7,943)

----------------------------------------- ---- --------------- ---------- -----------

Total equity 220,192 244,056 227,249

----------------------------------------- ---- --------------- ---------- -----------

These financial statements set out on pages 7 to 14 were

approved by the Board of Directors on 27 September 2012 and were

signed on its behalf by:

Mr D Elzas

Director

Mr C Elphick

Director

Cash flow statement

for the six months ended 30 June 2012

1 January 1 January 1 January

to to to

30 June 30 June 31 December

2012 2011 2011

Unaudited Unaudited Audited

Note US$000 US$000 US$000

------------------------------------------------- ----- ---------- ---------- -----------

Cash flows from operating activities

Total comprehensive loss for the period (7,419) (3,802) (22,858)

Adjustments for:

Depreciation 8 - 3

Interest received (83) - (173)

Taxation expense 20 - 28

Increase in other receivables (56) (16) (24)

(Decrease)/ Increase in trade and other payables 134 (731) (65)

Net exchange profit (417) (1,593) (274)

Share of loss of associate 5,058 2,996 16,320

Share-based payments 343 706 2,425

-------------------------------------------------------- ---------- ---------- -----------

Net cash from operating activities (2,412) (2,440) (4,618)

Cash flows from financing activities

Proceeds from the issue of share capital - - -

Share issue costs - - -

Net cash from financing activities - - -

------------------------------------------------- ----- ---------- ---------- -----------

Cash flows from investing activities

Interest received 83 - 173

Acquisition of property, plant and equipment (69) - (16)

Investment in associate (515) - -

Net cash from investing activities (501) - 157

Net decrease in cash and cash equivalents (2,913) (2,440) (4,461)

Cash and cash equivalents at beginning of period 45,047 49,318 49,318

Effect of exchange rate difference 395 1,593 190

-------------------------------------------------------- ---------- ---------- -----------

Cash and cash equivalents at end of period 42,529 48,471 45,047

-------------------------------------------------------- ---------- ---------- -----------

The notes on pages 11 to 14 form an integral part of the

financial statements.

Notes to the financial statements

1 Business information and going concern basis of

preparation

In common with many exploration and development companies in the

mining sector, the Company raises funding in phases as its projects

develop.

Following exercise of the Xstrata First Call Option, Xstrata is

required to fund and implement the FS in accordance with the

Xstrata Joint Venture Agreement. Xstrata has undertaken to use its

reasonable endeavours to complete the FS at least three months

prior to the expiration of the Zanaga Exploration Licences in

August 2014 or any subsequent renewal, subject to there being no

adverse change. The directors have a reasonable expectation that

the Company has adequate financial resources to continue in

operational existence for the foreseeable future. For these

reasons, the financial statements of the Company have been prepared

on a going concern basis.

In the event that a decision is taken to develop a mine at

Zanaga (and assuming that Xstrata Projects has not exercised its

call option to acquire the Company's interest in JumellesLimited)

the Company will need to raise further funds.

2 Accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the periods presented, unless

otherwise stated.

3 Basis of preparation

The condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU.

In accordance with the AIM Rules for Companies, the condensed

set of financial statements has been prepared in applying the

accounting policies and presentation that were applied in the

preparation of the Company's published consolidated financial

statements for the year ended 31 December 2011. The comparative

figures for the financial year ended 31 December 2011 are not the

Company's statutory accounts for that financial year. The accounts

have been reported on by the Company's auditors. The report of the

auditors was (i) unqualified and (ii) did not include a reference

to any matter to which the auditors drew attention by way of

emphasis without qualifying their report.

4 Segmental reporting

The Company has one operating segment, being its investment in

the Zanaga Project, held through Jumelles Limited. Financial

information regarding this segment is provided in note 6.

5 Taxation

The Company is exempt from most forms of taxation in the British

Virgin Islands ("BVI"), provided the Company does not trade in the

BVI and does not have any employees working in the BVI. All

dividends, interest, rents, royalties and other expense amounts

paid by the Company, and capital gains realised with respect to any

shares, debt obligations or other securities of the Company, are

exempt from taxation in the BVI.

The tax charge in the period relates to the Company's subsidiary

Zanaga UK Services Limited.

30 June 2012 30 June 2011 31 December 2011

Unaudited Unaudited Audited

US$000 US$000 US$000

--------------------------------------------------------------- ------------ ------------ ----------------

Recognised in other comprehensive income:

Current year (20) - (28)

Reconciliation of effective tax rate

Loss before tax (2,363) (3,804) (14,351)

Income tax using the BVI corporation tax rate of 0% (2011: 0%) - - -

Effect of tax rate in foreign jurisdictions (20) - (28)

--------------------------------------------------------------- ------------ ------------ ----------------

(20) - (28)

--------------------------------------------------------------- ------------ ------------ ----------------

The effective tax rate for the Group is 0.9% (December 2011:

0.2%).

6 Investment in associate

US$000

------------------------------ --------

Balance at 1 January 2011 192,799

Additions 5,968

Share of comprehensive income (2,996)

------------------------------ --------

Balance at 30 June 2011 195,771

------------------------------ --------

Additions 530

Share of comprehensive income (13,324)

------------------------------ --------

Balance at 31 December 2011 182,977

------------------------------ --------

Additions 533

Share of comprehensive income (5,058)

------------------------------ --------

Balance at 30 June 2012 178,452

------------------------------ --------

The investment represents a 100% holding in Jumelles for the

entire share capital of 2,000,000 shares. The shares were acquired

in exchange for shares in the Company and have been recorded at

fair value of the interest acquired.

The additions to the investment during 2012 are due to the Group

granting awards under the LTIP and other options to employees of

Jumelles ($19k), and a US$0.5m additional investment funded jointly

(50/50) with Xstrata for the survey of an additional land area.

Though Jumelles acquired the non-exclusive prospecting licence for

this area, it does not form part of the existing ZIOC Xstrata joint

venture agreement.

From its acquisition and up to 11 February 2011, the investment

in Jumelles did not represent an investment in a subsidiary due to

the call option held by Xstrata described in Note 1 above which

throughout that period gave Xstrata Projects potential voting

rights which would have been sufficient for Xstrata Projects to

control Jumelles. Following exercise of the Xstrata Call Option,

the residual rights retained by the Group are sufficient in the

view of the Directors to provide the Group with the power to

participate significantly in the financial and operating decisions

affecting Jumelles. As a consequence the Group's interest is

accounted for as an associate using the equity method of

accounting.

As explained in Note 1, on 11 February 2011, Xstrata Projects

exercised the Xstrata Call Option and from that date owns 50% plus

one share of Jumelles and Jumelles is controlled at both a

shareholder and director level by Xstrata Projects. However, as the

shares issued on exercise of the option are not considered to vest

until provision of the services relating to the PFS and the FS has

been completed, the Group will continue to account for a 100%

interest in Jumelles Limited until the FS has been completed. Only

at that time will the Group account for a reduction in its interest

in Jumelles.

The Group financial statements account for the Xstrata Projects

transaction as an in-substance equity-settled share-based payment

for the provision of services by Xstrata Projects to Jumelles in

relation to the PFS and the FS. These services largely are provided

through third party contractors and are measured at the cost of the

services provided.

As at 30 June 2012, Jumelles Limited had aggregated assets of

US$219.5m (June 2011: US$228.1m) and aggregated liabilities of

US$48.0m (June 2011: US$16.0m). For the 6 months ended 30 June

2012, it incurred administrative expenses of US$21k (June 2011:

US$3.1m) and incurred no taxation charge (June 2011: US$26k). A

summarised consolidated balance sheet of Jumelles Limited for the 6

months ended 30 June 2012, including adjustments made for equity

accounting, is included below:

30 June 30 June 31 December

2012 2011 2011

Unaudited Unaudited Audited

US$000 US$000 US$000

---------------------------------------- ---------- ---------- ------------

Non-current assets

Property, plant and equipment 15,089 15,095 12,704

Exploration and other evaluation assets 195,024 126,588 166,815

Intangible assets 146 - 145

---------------------------------------- ---------- ---------- ------------

210,259 141,683 179,664

---------------------------------------- ---------- ---------- ------------

Current assets 9,235 86,434 20,732

Current liabilities (47,982) (15,998) (37,461)

---------------------------------------- ---------- ---------- ------------

Net current assets/(liabilities) (38,747) 70,436 (16,729)

---------------------------------------- ---------- ---------- ------------

Net assets 171,512 212,119 162,935

---------------------------------------- ---------- ---------- ------------

Share capital 9,580 9,031 9,561

Share option reserve 203,324 227,131 190,738

Capital Contribution 1,030 - -

Translation reserve (13,606) (55) (8,569)

Retained earnings (28,816) (23,988) (28,795)

---------------------------------------- ---------- ---------- ------------

171,512 212,119 162,935

---------------------------------------- ---------- ---------- ------------

30 June 30 June 31 December

2012 2011 2011

7 Loss per share Unaudited Unaudited Audited

----------------------------------------------------------- ---------- ---------- -----------

Loss (Basic and diluted) (2,383) (3,804) (14,379)

Weighted average number of shares (thousands)

Basic and diluted

Issued shares at beginning of period 280,416 280,416 280,416

Effect of shares issued - - -

Effect of share repurchase - - -

Effect of own shares (5,010) (5,574) (5,574)

Effect of share split - - -

----------------------------------------------------------- ---------- ---------- -----------

Weighted average number of shares at end of period - basic 275,406 274,842 274,842

----------------------------------------------------------- ---------- ---------- -----------

Loss per share (cent)

Basic and diluted (0.9) (1.4) (5.2)

----------------------------------------------------------- ---------- ---------- -----------

8 Related parties

The following transactions occurred with related parties during

the period:

Transactions for the period Closing balance

---------- ----------------------------- ----------- -----------------------

30 June 30 June 31 December 30 June 30 June 31 December

2012 2011 2011 2012 2011 2011

Unaudited Unaudited Audited Unaudited Unaudited Audited

US$000 US$000 US$000 US$000 US$000 US$000

------------------------------------- ---------- ------------- -------------- ----------- ---------- -----------

Intercompany payable Jumelles Limited - 234 234 64 64 64

Intercompany payable Jumelles

Technical Services UK Limited - 27 (17) 21 11 21

Strata Capital UK LLP 170 57 52 175 - 5

------------------------------------- ---------- ------------- -------------- ----------- ---------- -----------

In addition to the transactions above, the Company has also

issued share options to Strata Capital UK LLP. In this regard see

page 54, note 15 in the Company's 2011 Annual Report. A further

award was granted in March 2012. These options have a weighted

average price of GBP1.06 (US$1.40), a weighted average fair value

of GBP0.37 (US$0.49) and a weighted average contractual life of 821

days.

Board of Directors

Clifford Thomas Elphick

Non-Executive Chairman

51 years

Clifford Elphick is the founder and CEO of Gem Diamonds Limited,

a diamond mining company listed on the Main Market of the London

Stock Exchange. Mr Elphick joined Anglo American Corporation in

1986 and was seconded to E Oppenheimer & Son as Harry

Oppenheimer's personal assistant in 1988. In 1990 he was appointed

managing director of E Oppenheimer & Son, a position he held

until his departure from the company in December 2004. During that

time, Mr Elphick was also a director of Central Holdings, Anglo

American and DB Investments. Following the buy-out of De Beers in

2000, Mr Elphick served on the De Beers executive committee until

2004. Mr. Elphick formed Gem Diamonds Limited in July 2005.

Colin John Harris

Non-Executive Director

65 years

Colin Harris has been working as an exploration geologist for

over 40 years and has a wealth of experience in the generation,

exploration and evaluation of projects covering a variety of

commodities and deposit styles in over 25 countries mainly in

Africa and Europe. He has worked for major international mining

companies including Anglo American, Cominco and more recently Rio

Tinto. During his 18 years at Rio Tinto Mr Harris managed

multi-million dollar programmes which in the past 15 years included

the evaluation of iron ore deposits in Greenland, Scandinavia,

Mali, Mauritania, Algeria, Morocco, Liberia, Senegal and Sierra

Leone and more importantly between 1998 and 2008 heading up the

team evaluating the world-class Simandou iron ore project in the

Republic of Guinea. Mr Harris resigned from Rio Tinto in 2008 and

joined the Zanaga team later in the year as Project Director. Mr

Harris stepped down as Project Director of the Project after

Xstrata exercised its First Call Option. Mr Harris is also a

non-executive director of AIM listed Ncondezi Coal Company Limited

and AIM and Oslo AXESS listed London Mining plc.

Clinton James Dines

Non-Executive Director

54 years

Clinton Dines has been involved in business in China since 1980,

including senior positions with the Jardine Matheson Group, Santa

Fe Transport Group and Asia Securities Venture Capital. In 1988 he

joined BHP as their senior executive in China and, following the

merger of BHP and Billiton in 2001, he became president, BHP

Billiton China, a position from which he retired in 2009. Mr Dines

is currently a non-executive director of Kazakhmys plc, which is

listed on the Main Market of the London Stock Exchange.

Michael John Haworth

Non-Executive Director

46 years

Michael Haworth is a director of Strata Limited, Garbet Limited

and is the managing partner of Strata Capital UK LLP. Mr Haworth

has 12 years' investment banking experience, predominantly in

emerging markets and natural resources. Prior to establishing

Strata Limited in 2006, Mr Haworth was a Managing Director at J.P.

Morgan and Head of Mining and Metals Corporate Finance in London.

During his 10 years at J.P. Morgan, Mr Haworth held a number of

other positions, including head of M&A for Central Eastern

Europe, Middle East and Africa and, before that, head of M&A in

South Africa. Mr Haworth is also Non-Executive Chairman of AIM

listed Ncondezi Coal Company Limited.

Dave John Elzas

Non-Executive Director

46 years

Dave Elzas has over 15 years' experience in international

investment banking. Between 1994 and 2000, Mr Elzas served as a

senior executive and subsequently managing director of the Beny

Steinmetz Group. Mr Elzas is currently the senior partner and CEO

of the Geneva Management Group, an international wealth management

and financial services company. Mr Elzas has been a non-executive

director of Gem Diamonds Limited since October 2005.

Advisors

Nominated Advisor and Joint Corporate Broker

Liberum Capital Limited

Ropemaker Place, Level 12

25 Ropemaker Street

London EC2Y 9LY

Joint Corporate Broker

Citigroup Global Markets Limited

Citigroup Centre

33 Canada Square, Canary Wharf

London E14 5LB

Auditors and Reporting Accountants

KPMG Audit Plc

15 Canada Square

London E14 5GL

Legal

Berwin Leighton Paisner LLP

Adelaide House

London Bridge

London EC4R 9HA

Registrars

Computershare Investor Services (BVI) Limited

Woodbourne Hall

PO Box 3162

Road Town

Tortola

British Virgin Islands

Financial PR

Pelham Bell Pottinger

5th Floor

Holborn Gate

330 High Holborn

London WC1V 7QD

United Kingdom

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UBRARUKAKUUR

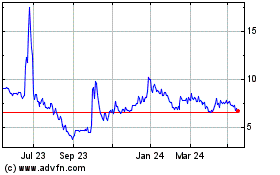

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Jul 2024 to Aug 2024

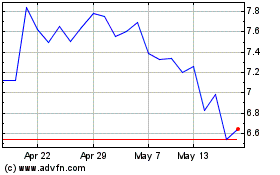

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Aug 2023 to Aug 2024