TIDMZIOC

RNS Number : 8411Q

Zanaga Iron Ore Company Ltd

25 October 2011

26 October 2011

ZANAGA IRON ORE COMPANY LIMITED

("ZIOC" or the "Company")

Zanaga Project Mineral Resource Update

Zanaga Iron Ore Company Limited (AIM:ZIOC) is pleased to

announce the following Mineral Resource update relating to the

expansion and improvement in resource classification on the Zanaga

Iron Ore Project (the "Zanaga Project") in the Republic of Congo

(Congo Brazzaville). The updated resource estimate was prepared by

independent consultants SRK Consulting (UK) Ltd ("SRK") and

reflects additional drill-hole and assay data obtained since the

preparation of the last estimate reported on 5 April 2011.

Highlights

-- Iron ore mineral resource expands to 4.3 billion tonnes at an

average grade of 33.0% Fe from 4.0 billion tonnes at an average

grade of 33.9% Fe, reported in accordance with the JORC Code

-- Improvement in resource classification: Ratio of Measured,

Indicated and Inferred Resources has improved to 3%:59%:38%

respectively, representing a significant change from the previous

estimate announced on 5 April 2011 of 0%:43%:57%

-- Total of 126,984 metres drilling included in updated JORC statement

-- Mineral Resources derived from only 25km of the 47km orebody trend

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"I am pleased to announce an improvement in the JORC compliant

Mineral Resource classification as well as an expansion in Mineral

Resource inventory at the Zanaga Iron Ore Project. A significant

drilling programme has been conducted on the Zanaga Project and

today's results provide further confidence in the large scale

orebody."

Zanaga Iron Ore Project Mineral Resource Grows to 4.3 billion

tonnes at 33.0% Fe

Mineral Resource Statement

Classification Tonnes Fe (%) SiO2 Al2O3 P (%) Mn (%) LOI (%)

(Mt) (%) (%)

---------------- ------- ------- ----- ------ ------ ------- --------

Measured 149 38.7 39.1 2.4 0.047 0.093 1.2

---------------- ------- ------- ----- ------ ------ ------- --------

Indicated 2,540 34.1 43.6 2.8 0.050 0.112 1.0

---------------- ------- ------- ----- ------ ------ ------- --------

Inferred 1,650 31 46 4 0.05 0.12 2

---------------- ------- ------- ----- ------ ------ ------- --------

Total 4,339 33.0 44.3 3.3 0.049 0.114 1.3

---------------- ------- ------- ----- ------ ------ ------- --------

Reported at a 0% Fe cut-off grade within an optimised Whittle

shell representing a metal price of 130 USc/dmtu.

The Mineral Resource statement set out above is reported in

accordance with the terms and definitions included in the

Australasian Joint Ore Reserves Committee (JORC) Code (2004) as at

September 2011. As at this date, the total Mineral Resources

reported at a 0%Fe COG constrained within an optimised Life of Mine

(LOM) pit shell, amounts to 4.34 Bt grading 33.0% Fe, 0.049% P,

44.3% SiO2, 3.3% Al2O3, 0.114% Mn, and 1.3% LOI. The shell was

determined by SRK using operating costs derived from the

Pre-Feasibility Study work streams and a selling price of 130

USc/dmtu based on the SRK 3(rd) Quarter 2011 consensus market

forecast for Brazilian fines without adjustment. The table above

presents the Measured Mineral Resource, Indicated Mineral Resource,

the Inferred Mineral Resource and the total Measured plus Indicated

plus Inferred Mineral Resource based on drilling to 26 August 2011

and as estimated by SRK in September 2011. The Competent Person, Dr

John Arthur of SRK, has given his permission for the publication of

this information in the form and context within which it

appears.

Drilling programme summary

The updated JORC Mineral Resource is estimated on drilling

completed on the Zanaga Project up until 26 August 2011 and

includes an additional 59,618 metres (88% increase) & 951 holes

(45% increase) to drilling carried out for the previous resource

statement announced on 5 April 2011. In addition, a total of 43,373

XRF analyses and 37,617 Niton analyses were used to model the

mineral resource, more than twice the amount used in the previous

mineral resource statement. Please see the table below for an

update on drilling completed.

Drilling completed Metres

---------------------------------------------------- --------

at 30 Jun 2010 (IPO JORC resource) 42,706

---------------------------------------------------- --------

30 Jun 2010 - 24 Nov 2010 (previous JORC resource,

announced 5 Apr 2011) 24,660

---------------------------------------------------- --------

24 Nov 2010 - 26 Aug 2011 (new JORC resource,

announced 26 Oct 2011) 59,618

---------------------------------------------------- --------

Total to date 126,984

---------------------------------------------------- --------

Geological Summary

The north-south oriented greenstone belt which hosts the Zanaga

deposit has been defined by an airborne geophysical survey over 47

km in length, and is typically between 0.5 and 3.0 km in width.

The iron bearing lithologies within the Zanaga deposit are

itabirites/BIF, interbedded with basic lavas. Typically, the

itabirites consist of layers of iron-rich and quartz rich

meta-sediments which alternate on a millimetre to centimetre scale

and which have been crosscut by late intrusions and dolerite

dykes.

The weathered itabirite units which overlie un-weathered ore are

typical of iron ore deposits and characterised by an enrichment in

iron due to a mass reduction and associated leaching of the

silicate layers.

For further information please contact:

Zanaga UK Services Limited

Corporate Development and Andrew Trahar Investor Relations

Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Chris Bowman, Christopher Britton

Adviser and Joint Corporate Broker and Christopher Kololian

+44 20 3100 2000

Citigroup Global Markets Limited

Joint Corporate Broker Alex Carter

+44 20 7986 4000

Pelham Bell Pottinger

Financial PR James MacFarlane

and Philippe Polman

+44 20 7861 3232

About us:

Zanaga Iron Ore Company Limited (AIM:ZIOC) is a BVI registered

Company and the owner of 50% less one share interest in the Zanaga

Iron Ore Project based in the Republic of Congo (Congo Brazzaville)

through its joint venture partnership with Xstrata. The Zanaga Iron

Ore Project is focused on the management, development and

construction of a world-class iron ore mine and related,

processing, rail and port infrastructure

Important Notice

The Competent Person who has reviewed the Mineral Resources as

reported by the Company is Dr John Arthur (CEng MIMMM, CGeol FGS),

who is an employee of SRK Consulting (UK) Ltd. Dr Arthur is a

Member of the Geological Society of London (CGeol) and of the

Institute of Materials, Minerals and Mining (CEng) and has

sufficient experience, which is relevant to the style of

mineralisation and type of deposit under consideration, and to the

activity he is undertaking, to qualify as a Competent Person in

terms of the "Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves"(JORC Code 2004

Edition) and is a "Qualified Person" under National Instrument

43-101 - 'Standards of Disclosure for Mineral Projects'.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. These

forward-looking statements include all matters that are not

historical facts. They appear in a number of places throughout this

announcement and include, but are not limited to, statements

regarding the Company's intentions, beliefs or current expectations

concerning, among other things, the Company's and its subsidiaries'

results of operations, financial position, liquidity, prospects,

growth, strategies and expectations.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances.

Forward-looking statements are not guarantees of future performance

and the development of the markets and the industry in which the

Company and its subsidiaries operate, may differ materially from

those described in, or suggested by, the forward-looking statements

contained in this Announcement. In addition, even if the

development of the markets and the industry in which the Company

and its subsidiaries operate are consistent with the

forward-looking statements contained in this announcement, those

developments may not be indicative of developments in subsequent

periods. A number of factors could cause developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, changes in

regulation or government, changes in its business strategy,

political and economic uncertainty and other factors.

Any forward-looking statements in this announcement reflect the

Company's current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company's and its

subsidiaries' operations and growth strategy. Subject to the

requirements of the AIM Rules for Companies or applicable law, the

Company undertakes no obligation publicly to release the result of

any revisions of any forward-looking statements in this

announcement that may occur due to any change in the Company's

expectations or to reflect events or circumstances after the date

of this announcement.

Glossary

AL2O3 Alumina (Aluminium Oxide)

BIF Banded Iron Formation is the fresh, hard, un-oxidised,

banded, magnetite itabirite and consists of magnetite,

silica and occasional amphibolite, at Zanaga the BIF has

a total iron grade range of 10%Fe to 47%Fe averaging 30%Fe.

Concentrate the clean product recovered through the beneficiation processes

Fe Iron

Feasibility Study a technical and economic study which demonstrates the technical

("FS") and economic viability of a mining project to within a

range of accuracy of 15% and to an appropriate degree of

detail such that a decision for proceeding to the project

development stage may be made without substantive revision

to either scope or scale

Itabirite metamorphosed banded iron formation

JORC Code the 2004 Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves as published

by the Joint Ore Reserves Committee of the Australasian

Institute of Mining and Metallurgy, Australian Institute

of Geoscientists and Minerals Council of Australia

LOI Loss on ignition

Magnetite a magnetic greyish black iron mineral (Fe2O4)

Mineral Resource a concentration or occurrence of material of intrinsic

economic interest in or on the Earth's crust in such form,

quality and quantity that there are reasonable prospects

for eventual economic extraction. The location, quantity,

grade, geological characteristics and continuity of a Mineral

Resource are known, estimated or interpreted from specific

geological evidence and knowledge. Mineral Resources are

sub-divided, in order of increasing geological confidence,

into Inferred, Indicated and Measured categories

Mn Manganese

P Phosphorus

Pre-Feasibility a technical and economic study which demonstrates the technical

Study ("PFS") and economic viability of a mining project to within a

range of accuracy of 25% and to an appropriate degree of

detail such that a decision for proceeding to the project

development stage may be made without substantive revision

to either scope or scale

SiO2 Silica

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLFEUFUIFFSELS

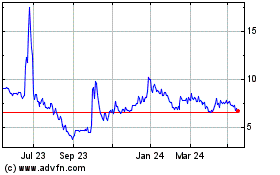

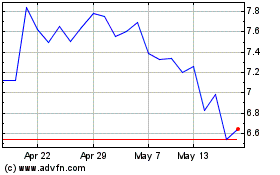

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Jul 2024 to Aug 2024

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Aug 2023 to Aug 2024