TIDMXLM

RNS Number : 2037N

XLMedia PLC

23 September 2019

23 September 2019

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Interim results for the six months ended 30 June 2019 and full

year update

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, announces its unaudited interim results for the

six months ended 30 June 2019.

Financial highlights(1)

-- Revenues of $42.5 million (H1 2018: $47.2 million)

-- Gross profit of $28.8 million (H1 2018: $31.7 million)

-- Adjusted EBITDA(2) of $18.6 million (H1 2018: $21.6 million)

-- Profit before tax of $13.8 million (H1 2018: $17.6 million)

-- Stable earnings per share of $0.06 in volatile market conditions

-- Interim dividend of $5.8 million or 3.1584 cents per share

(H1 2018: 3.0040 cents per share) - maintaining the Group's

progressive dividend policy

-- Strong balance sheet with $43.1 million of cash and

short-term investments at 30 June 2019(3)

Operating highlights

-- Continued diversification of assets underpinned by record

performance from the Group's personal finance division, now

representing 14% of Group revenue (H1 2018: 7%)

-- US gambling market continues to develop positively

o The Company's subsidiary, XLMedia US Limited, was accepted

last week as an authorized Gaming Service Provider by the

Pennsylvania Gaming Control Board for online advertising of online

sports betting and casino brands in the state of Pennsylvania

o Currently implementing ongoing organic investment programme

while developing the Group's presence and existing assets for this

market

-- Execution of strategy to focus on higher margin publishing

activities and discontinue some of the media activities. In August

the Company announced the sale of the Group's mobile apps marketing

subsidiary;

-- Industry wide regulatory headwinds continue to be felt in

2019. Key Swedish, German, UK and Swiss markets creating near term

challenges for the Group, specifically;

o Newly regulated

-- New gambling regulation in Sweden impacting both volumes and

customer sign ups - the Group believes the market will stabilise in

the mid-term, but revenues from this market may not return to

previous volumes in the midterm. So far the decrease is 23% as the

market adjusts to the new regulatory framework

-- New regulatory regime of the Swiss online casino market

resulting in many operators exiting the market, including most of

the Group's existing clients in the region

o Ongoing regulation - Evolving UK regulatory landscape

continues to put pressure on revenues

o To be regulated - German regulatory uncertainty within the

online casino market - decreased our revenues by 36% in this

market

-- Announced the appointment of Stuart Simms as Chief Executive

Officer on 29 July 2019, effective 2 October 2019, with Ory Weihs

remaining on the Board as a Non-executive Director of the

Company

Trading update

-- Despite underlying trading in the first half year

stabilising, regulatory headwinds highlighted above continue to

create trading uncertainty for the Group which has led to

weaker-than-expected performance in July and August

-- The combination of this performance and a slowdown in the

Group's acquisition activity this year, alongside reviewing all

strategic investments, means the Board is today revising market

guidance for the year ended 31 December 2019

-- The Board now expects the Group to deliver revenues of circa

US $80 million and adjusted EBITDA to be circa US $34 million, for

the year ending 31 December 2019

Ory Weihs, Chief Executive Officer of XLMedia, commented:

"This year has proven to be challenging for both XLMedia and the

industry as a whole, as the gaming industry changes and regulates.

However, this does result in the Group having greater visibility,

more sustainable revenues and stable earnings. Whilst we expect

this disruption to continue in the midterm, we remain committed to

our stated strategy, focusing on publishing. We continue to

diversify our asset base, specifically developing our US gambling

strategy and the personal finance sector, in which we continue to

make good progress with this sector now accounting for 14% of the

Group's revenues.

"As my last address as CEO of XLMedia, I would like to wish

Stuart every success and firmly believe that with the support of

the Board and management team he will lead the business back to

sustainable growth."

A webcast of our results presentation will be available on our

website later this week at the following link:

https://www.xlmedia.com/investor-relations/webcasts/

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulation (EU)

No. 596/2014. Upon the publication of this Announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

For further information, please contact:

XLMedia plc Ory Weihs www.xlmedia.com Via Vigo Communications

Vigo Communications Jeremy Garcia / Fiona Tel: 020 7390 0233

Henson / Simon Woods www.vigocomms.com

Cenkos Securities plc (Nomad and Joint Tel: 020 7397 8900

Broker) Giles Balleny / Max Gould www.cenkos.com

Berenberg (Joint Broker) Chris Bowman Tel: 020 3207 7800

/ Mark Whitmore / Simon Cardron www.berenberg.com

Strategy

The Group has started the year with stabilised rankings to our

major assets, however, regulatory headwinds have slowed progress

and delayed expected recovery of performance in some of our

markets, mainly as gambling operators cease their activities in

certain markets or are limiting the deposits they can accept from

players.

Although regulation has had a negative impact on performance, we

do believe that in the medium and longer term it provides

sustainable opportunities for XLMedia, as we leverage our strong

asset base, vast experience, know how and advanced unique

technology which positions XLMedia as a top publishing group in the

gaming sector.

Going forward we will continue our focus on publishing, and

focus on diversifying our investments in the following:

-- Pursuit of growth opportunities in North America to both

build and develop a comprehensive portfolio of online assets for

the US gambling market

-- Continue developing the Group's core technology to retain competitive advantage

-- Ongoing expansion of the Group's publishing portfolio in

other regulated European gambling markets

-- Seeking to acquire earnings accretive publishing assets,

leveraging benefits of scale and technology

All new sites being developed will help bolster the Group's

asset base, expanding and enhancing its existing geographical

footprint.

The Group started the year with the strategic decision to focus

on publishing and discontinue some of its media activities. As a

result, in August 2019 the Group announced the sale of Webpals

Mobile Ltd ("Mobile"), the Group's subsidiary which was focused on

the promotion of apps which are not in the Group's core verticals

of gambling and personal finance.

Under the terms of the agreement, Mobile repaid $1.9 million of

inter-company balances to the Group on completion of the

transaction. There will be a final settlement to be made based on

the assets and liabilities of Mobile as at completion following the

preparation of final accounts. In 2018, Mobile delivered nil

contribution at EBITDA level. The net proceeds from the sale will

be used by the Group in the furtherance of its strategy of

developing its publishing assets.

Regulation

As previously disclosed, the Group has seen a number of

regulatory headwinds, namely new gambling legislation in Sweden

currently impacting all market participants and uncertainty within

the online German casino sector with brands pausing activity. The

Swiss market has also slowed significantly following the adoption

of a new regulatory regime which has significantly limited the

number of online licenses. The UK regulatory landscape continues to

evolve with ongoing downward pressure on revenues remaining.

Despite this, strong online ranking across key sites, including

freebets.com, remains.

Ongoing regulation

United Kingdom

Increased compliance demands on operators, including more

stringent age verification and Know-Your-Customer rules, continue

to slow down our conversion rate for new depositing customers

across a number of our gambling clients. As of April 2019, the UK

online casino tax has increased from 15% to 21%. Despite our

rankings remaining high, the Group has experienced an impact on

ARPU (average revenue per user).

Europe - other countries

The Group continues to seek opportunities to expand its presence

in other European countries which have already undergone

regulation, affording the Group greater visibility of market

conditions and quality of earnings.

To be regulated

Germany

The German online casino market remains in a state of flux with

regulatory uncertainty around online casino activity. Some clients

continue to operate as usual while others have paused all activity

in the market.

Newly regulated

United States

The US market continues to present a mid to long term

opportunity as the number of States in various stages of regulating

sports betting continues to grow, with very few, including New

Jersey and Pennsylvania, which are already live. The Company's

subsidiary, XLMedia US Limited, was last week accepted as an

Authorized Registered Gaming Service provider by the Pennsylvania

Gaming Control Board for online advertising of online sports

betting and casino brands in the state of Pennsylvania. The Company

remains committed to investing US $7 million over the next three

years.

Sweden

At the start of 2019, a new regulatory regime became effective

in Sweden, requiring casino operators in Sweden to apply for a

license from the Swedish Gambling Authority ("SGA"). This change

was followed by the introduction of tough monitoring and

sanctioning by the SGA of licensed operators, affecting conversion

rates and overall performance, causing uncertainty in the

market.

These changes will undoubtedly take time to bed down, and the

short term impact has been lower than expected player values

overall, and some operators struggling.

Switzerland

A new gambling regulatory regime came into effect in Switzerland

in January 2019. Under the new regime, licenses for online gambling

are only granted to a limited number of operators, mainly

consisting of existing land-based casino operators. As a result,

most of our customers have exited the market, negatively affecting

the Group's performance in the market.

General Regulation

The Group continues to monitor regulations worldwide, responding

to changing regulatory environments and new compliance needs in the

gambling advertising sector. The Group aims to continue to build

its asset portfolio across regulated markets globally in both the

gambling and personal finance sectors, by investing in developing

assets organically and acquiring selected targets.

Financial review

H1 2019 H1 2018 Change

($'000s) ($'000s)

---------- ---------- -------

Revenues 42,459 47,183 -10%

========== ========== =======

Gross Profit 28,838 31,688 -9%

========== ========== =======

Operating expenses 14,514 13,649 +6%

========== ========== =======

Operating income 14,324 18,039 -21%

========== ========== =======

Adjusted EBITDA 18,616 21,601 -14%

========== ========== =======

Profit Before Tax 13,795 17,584 -22%

========== ========== =======

The financial performance reflects continued operations

excluding discontinued media activities following strategic

decision to focus on higher margin publishing activities and

discontinue some of the media activities.

In the six months ended 30 June 2019, the Company delivered

revenues of $42.5 million (H1 2018: $47.2 million) and adjusted

EBITDA of $18.6 million (H1 2018: $21.6 million).

The first half of 2019 was impacted by the regulatory trends and

other operational issues which resulted in revenues of $42.5

million, a decrease of 10% compared to the same period last year.

The decrease is from the Group's core gaming activity affected by

regulatory headwinds, for example new regulation in Sweden which

impacted more than expected and the revenues in this territory

decreased 23%. The Group's revenues from its personal finance

assets in H1 2019 increased to $6.0 million or 14% of the Group's

revenues (H1 2018: $3.1 million, 7%).

Gross profit was $28.8 million or 68% of revenues, representing

a 1% increase compared to the same period last year (H1 2018: $31.7

million, 67%). High gross margins reflect the Group's strategic

decision to focus on its publishing activities.

Operating expenses during the first six months of the year were

$14.5 million, an increase of 6% compared to the same period last

year (H1 2018: $13.6 million). The increase is mainly from

increased general and administration costs relating to changes in

management and increased amortization of capitalized R&D

costs.

Operating expenses include the first implementation of IFRS 16 -

a new accounting principle which requires a lessee to recognise

assets and liabilities for leases with a term of more than 12

months. As a result, the Group recorded increased amortization

expenses of $0.7 million, increased financing expenses of $0.9

million and reduced rent expenses of $0.7 million.

Operating expenses included $0.7 million of research and

development expenses, similar to the same period last year. These

expenses are in addition to investments in technology and internal

systems developed during the period of $4.1 million (H1 2018: $4.3

million). Total R&D spend together with capitalised costs was

$4.8 million compared to $5.8 million in H1 2018. We see technology

as a key driver to increasing revenues and profit for the coming

years, and the majority of the spend is invested for future

business development.

Adjusted EBITDA(4) reached $18.6 million or 44% of revenues,

reflecting a decrease of 14% relative to the same period last year

(H1 2018: $21.6 million, 46%).

As a result of the reduced revenues and gross profit as compared

to the same period last year, profit before tax decreased by 22% to

$13.8 million (H1 2018: $17.6 million). Net income for the period

was $12.2 million, reflecting a decrease of 14% (H1 2018: $14.1

million). Net income included Income from discontinued

operations(5) of $0.08 million and non-controlling interest of $0.4

million.

As at 30 June 2019 we had $43.1 million of cash and short-term

investments compared to $43.7 million as at 31 December 2018. The

cash amount included $3.0 million within Mobile classified as

assets held for sale in the balance sheet, and which was later

settled prior to the disposal of Mobile.

Current assets as at 30 June 2019 were $55.5 million (31 Dec

2018: $60.0 million). Assets held for sale(6) were $6.2 million (31

Dec 2018: $9.3 million) and non-current assets were $138.0 million

(31 Dec 2018: $127.2 million). The increase in non-current assets

of $10.0 million is attributed to the implementation of IFRS 16 as

at 1 January 2019 as mentioned above.

Total equity as at 30 June 2019 was $161.5 million, or 81% of

total assets (31 Dec 2018: 85%). During H1 the Company executed its

buyback programmes and bought shares in a total amount of $9.7

million. Also, during H1 we repaid $1.4 million of bank loans and

recognized a lease liability of $1.7 million (IFRS 16 - see

explanation above). The strong balance sheet combined with cash and

short-term investments of $43.1 million ensures the Group is well

positioned to continue to execute its strategic plan.

Dividend, Share Buyback & Tender Offer

On 18 December 2018, the Company instigated a share buyback

programme with repurchased shares being held in treasury. To date,

the Company has purchased 13.5 million shares for an aggregate sum

of $10.8 million.

In addition, the Company further capitalised on its strong cash

position, and highly cash generative business model by completing a

GBP15.7 million Tender Offer in August 2019, acquiring 19.7 million

Ordinary Shares at 80 pence per share. The repurchased shares are

held in treasury and the number of Shares in issue carrying voting

rights reduced accordingly.

The Board is declaring an interim dividend of $5.8 million or

3.1584 cents per share, to be paid in Pound Sterling 2.5328 pence

per share 1 November 2019 to shareholders on the register at 4

October 2019. The ex-dividend date is 3 October 2019.

Board changes

On 29 July 2019, the Company announced the appointment of Stuart

Simms as Chief Executive Officer with effect from 2 October 2019.

Ory Weihs will continue in his role as Chief Executive Officer

until Stuart's arrival and thereafter will remain a supporter of

the business through his role on the Board as a Non-executive

Director of the Company. Stuart has been working closely with Ory

to ensure an orderly hand-over of responsibilities whilst

conducting a full review of the business.

Stuart has significant experience in technology companies, and

specifically the performance marketing sector, and joins having

previously held several Board and senior executive positions,

including as Chief Executive Officer of Rakuten Marketing

("Rakuten"), one of the world's largest performance marketing

companies with revenues in excess of $1 billion. During his tenure

at Rakuten, Stuart oversaw a substantial transformation and

re-structuring of the business, resulting in a return to growth.

Stuart implemented a clear strategy to utilise inhouse technology

and integrate acquisitions, accelerating both revenue and profit

growth.

Outlook

As highlighted earlier in the announcement, both H1 and the full

year results will be impacted by regulatory developments across

Sweden, Germany, Switzerland and the UK. This, alongside no

acquisition activity, which was expected to deliver additional

EBITDA in the full year results, has impacted expected performance

for the year.

Accordingly, the Board now expects the Group to deliver revenues

of circa US $80 million and adjusted EBITDA to be circa US $34

million, for the year ending 31 December 2019.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

30 June 31 December

--------- -----------

2019 2018

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

Assets

Current assets:

Cash and cash equivalents 40,273 44,627

Short-term investments 2,805 2,996

Trade receivables 9,410 16,112

Other receivables 2,992 5,502

55,480 69,237

Assets held for sale (Note 4) 6,187 -

--------- -----------

Total current assets 61,667 69,237

--------- -----------

Non-current assets:

Long-term investments 668 633

Property and equipment 10,891 1,296

Goodwill 23,652 23,652

Domains and websites 92,226 92,053

Other intangible assets 10,574 9,146

Deferred taxes - 99

Other assets 372 435

138,383 127,314

--------- -----------

200,050 196,551

========= ===========

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

30 June 31 December

--------- -----------

2019 2018

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

Liabilities and equity

Current liabilities:

Current maturity of long-term bank loans 4,216 5,585

Lease liability 1,729 -

Trade payables 2,660 6,416

Other liabilities and accounts payable 7,346 7,058

Income tax payable 10,090 9,049

26,041 28,108

--------- -----------

Liabilities attributed to assets held for sale:

(Note 4) 3,431 -

--------- -----------

Total current liabilities 29,472 28,108

Non-current liabilities:

Lease liability 8,762 -

Long- term bank loans - 1,380

Deferred taxes 193 -

Other liabilities 146 248

--------- -----------

9,101 1,628

--------- -----------

Total liabilities 38,573 29,736

--------- -----------

Equity:

Share capital *) *)

Share premium 112,352 112,224

Capital reserve from share-based transactions 3,233 2,590

Capital reserve from transactions with non-controlling

interests (2,445) (2,445)

Treasury shares (10,121) (468)

Retained earnings 58,167 54,623

--------- -----------

Equity attributable to equity holders of the Company 161,186 166,524

Non-controlling interests 291 291

--------- -----------

Total equity 161,477 166,815

--------- -----------

200,050 196,551

========= ===========

*) Lower than USD 1 thousand.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

22 September,

2019

-------------------- ------------------- --------------- ---------------

Date of approval Chris Bell Ory Weihs Yehuda Dahan

of the

financial statements Chairman of the Chief Executive Chief Financial

Board of Directors Officer Officer

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND

OTHER COMPREHENSIVE INCOME

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

--------- ------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

(except per share data)

Revenues 42,459 47,183 93,502

Cost of revenues 13,621 15,495 30,133

--------- ------- ------------

Gross profit 28,838 31,688 63,369

Research and development expenses 696 733 1,043

Selling and marketing expenses 2,646 2,563 5,044

General and administrative expenses 11,172 10,353 20,597

--------- ------- ------------

14,514 13,649 26,684

--------- ------- ------------

Operating profit 14,324 18,039 36,685

--------- ------- ------------

Finance expenses (1,212) (556) (837)

Finance income 683 101 300

--------- ------- ------------

Finance expenses, net (529) (455) (537)

--------- ------- ------------

Profit before taxes on income 13,795 17,584 36,148

Taxes on income 1,723 2,616 4,089

--------- ------- ------------

Income from continuing operations 12,072 14,968 32,059

Income (loss) from discontinued operations,

net (Note 4) 79 (916) (11,284)

Net income 12,151 14,052 20,775

========= ======= ============

Net income and other comprehensive income 12,151 14,052 20,775

========= ======= ============

Attributable to:

Equity holders of the Company 11,770 13,553 19,818

Non-controlling interests 381 499 957

--------- ------- ------------

12,151 14,052 20,775

========= ======= ============

Earnings per share attributable to equity

holders of the Company:

Basic and Diluted earnings per share

from continuing operation (in USD) 0.06 0.06 0.14

========= ======= ============

Basic and Diluted loss per share from

discontinuing operation (in USD) (*) (*) (0.05)

========= ======= ============

Weighted average number of shares used

in computing basic earnings per share

(in thousands) 209,329 214,466 215,441

========= ======= ============

Weighted average number of shares used

in computing diluted earnings per share

(in thousands) 209,596 217,854 217,330

========= ======= ============

(*) less than 0.01 USD.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Cash flows from operating activities:

Net income 12,151 14,052 20,775

-------- -------- ------------

Adjustments to reconcile net income to

net cash provided by operating activities:

Adjustments to the profit or loss items:

Depreciation, amortisation and impairment 3,618 2,788 6,503

Finance (income) expense, net 1,311 (1,584) (1,577)

Gain from sale of property - - (10)

Loss from write down to fair value less

selling costs of the discontinued operation - - 9,938

Cost of share-based payment 674 774 1,667

Taxes on income 1,782 2,738 4,387

Exchange differences on balances of cash

and cash equivalents (492) 329 954

-------- -------- ------------

6,893 5,045 21,862

-------- -------- ------------

Changes in asset and liability items:

Decrease in trade receivables 3,858 1,174 2,838

Decrease (increase) in other receivables 620 (2,789) (509)

Increase (decrease) in trade payables (1,419) 113 (3,397)

Increase (decrease) in other accounts

payable 1,080 (2,459) (4,571)

Increase in other long-term liabilities - 24 47

------------

4,139 (3,937) (5,592)

------------

Cash paid and received during the period

for:

Interest paid (356) (215) (469)

Interest received 89 99 196

Taxes paid (1,167) (2,195) (5,544)

Taxes received 2,058 556 557

------------

624 (1,755) (5,260)

-------- -------- ------------

Net cash provided by operating activities 23,807 13,405 31,785

-------- -------- ------------

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Cont.)

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Cash flows from investing activities:

Purchase of property and equipment (111) (421) (553)

Proceeds from sale of assets and property - 150 270

Acquisition of and additions to domains,

websites, technologies and other intangible

assets (4,311) (43,756) (55,516)

Short- term and long-term investments,

net 139 (4,964) 1,735

------------

Net cash used in investing activities (4,283) (48,991) (54,064)

-------- -------- ------------

Cash flows from financing activities:

Share capital issuance, net of issuance

costs - 42,618 42,618

Dividend paid to equity holders of the

Company (8,226) (8,000) (14,362)

Repayment of lease liabilities (703) - -

Acquisition of treasury shares (9,653) - (468)

Dividend paid to non-controlling interests (319) (499) (1,285)

Exercise of options 117 641 976

Repayment of long and short-term liability (2,750) (1,250) (4,000)

Receipt of long-term loan from bank - 5,965 5,965

------------

Net cash provided from (used in) financing

activities (21,534) 39,475 29,444

-------- -------- ------------

Exchange differences on balances of cash

and cash equivalents 526 (329) (954)

-------- -------- ------------

Increase (decrease) in cash and cash equivalents (1,484) 3,560 6,211

Cash and cash equivalents at the beginning

of the period 44,627 38,416 38,416

-------- -------- ------------

Cash and cash equivalents at the end of

the period 43,143 41,976 44,627

======== ======== ============

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1: GENERAL

XLMEDIA PLC and its subsidiaries (The Group) are online

performance marketing companies.

The Group attracts users through online marketing techniques

(such as publications and advertisements) which are then directed,

by the Group, to its customers in return for a share of the revenue

generated by such user, a fee generated per user acquired, fixed

fees or a hybrid of any of these three models.

NOTE 2: SUPPLEMENTARY INFORMATION

The Board of the Company has approved a buyback programme (the

"Programme") to buy back up to USD 10 million of the Company's

Ordinary shares (the "Shares").

The Programme ran from 18 December 2018 to the conclusion of the

2019 annual general meeting of the Company. At the 2019 annual

general meeting another buyback programme was approved to buy back

up to additional USD 10 million of the Company's Shares.

The Programmewas funded from the Company's existing cash

balances and did not affect the Company's stated dividend policy of

paying out at least 50 per cent of retained earnings.

During 2018 the Company acquired 492,302 Shares at a cost of USD

468 thousand.

In the reporting period the Company acquired 12,211,138 Shares

in total amount of USD 9,653 thousand. Subsequent to the reporting

period the Company acquired 845,303 Shares in total amount of USD

716 thousands.

On 16 July, 2019 the Company ceased the buyback programme and

published a tender offer, which was accepted on 16 August 2019 and

following the Company purchased 19,675,000 Shares at 80 pence per

share and at a cost of USD 20,034 thousand including transaction

expenses.

NOTE 3:- DISCONTINUED OPERATIONS

a. In February, 2019, the Company's Board of directors decided

to reduce certain parts of its Media activities (comprising one

CGU) which have lower profit margins. Subsequent to the reporting

period, in August 2019, the Company completed the sale of Webpals

Mobile Ltd ("Mobile") which is a substantial component of the CGU.

Under the terms of the agreement Mobile repaid USD 1.9 million of

inter-company balances to the Group on completion. The repayment

amount is subject to further adjustments. The gain deriving from

the sale will be in the range of USD 1-1.6 million.

Prior to the classification of the CGU as a disposal group, the

recoverable amount of the sold assets was calculated as fair value

less expected selling costs, and based on that the Group recorded

in 2018, a write down loss in the amount of USD 9,938 thousand.

NOTE 3: DISCONTINUED OPERATIONS (Cont.)

b. Below are the main groups of assets and liabilities classified as held for sale:

June 30,

----------------

2019

----------------

Unaudited

----------------

USD in thousands

----------------

Assets:

Cash and cash equivalents 2,870

Short-term investments 144

Accounts receivable 2,844

Other accounts receivable 252

Property, plant and equipment 77

Assets held for sale 6,187

================

Liabilities:

Accounts payable 2,337

Other liabilities and account payables 1,094

Liabilities attributed to assets held

for sale 3,431

----------------

Net assets held for sale 2,756

================

c. Below is data of the operating results attributed to the discontinued operation:

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Revenues from sales 8,082 11,905 24,364

Cost of sales 6,409 10,072 19,789

-------- -------- ------------

Gross profit 1,673 1,833 4,575

Selling, general and administrative

expenses and research and development

expenses 1,459 2,594 5,573

Loss from write down to fair

value less selling costs of

the discontinued operation - - 9,938

-------- -------- ------------

Operating income (loss) 214 (761) (10,936)

Financial expenses, net (76) (33) (50)

-------- -------- ------------

Income (Loss) before income

taxes from discontinued operation 138 (794) (10,986)

Taxes on income 59 122 298

Income (loss) from discontinued

operation, net 79 (916) (11,284)

======== ======== ============

NOTE 3: DISCONTINUED OPERATIONS (Cont.)

d. Below is data of the net cash flows provided by (used in) the discontinued operation:

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

------- --------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

---------------------------------

Operating activities (166) 407 (9)

======= ========= ============

Investing activities - (1,001) (1,407)

======= ========= ============

NOTE 4: OPERATING SEGMENTS

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance.

As of 30 June, 2019 the main part of the Group's Media

activities were classified as discontinued activity and other Media

activities were integrated to the Publishing segment activities.

The Group now has one operating segment - Publishing, which

consists the operation of over 2,300 owned informational websites

in 18 languages. These websites refer potential customers to online

businesses. The sites' content, written by professional writers, is

designed to attract online traffic which the Group then directs to

its customers online businesses.

NOTE 5: OTHER INFORMATION

Revenues classified by geographical areas based on internet user

location:

Six months ended Year ended

30 June 31 December

------------------ ------------

2019 2018 2018

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Scandinavia 18,594 20,654 42,362

Other European countries 11,604 13,983 26,804

North America 9,302 7,772 14,510

Asia 146 - 56

Oceania 814 791 1,668

Other countries 298 1,208 2,191

------------

Total revenues from identified

locations 40,758 44,408 87,591

Revenues from unidentified locations 1,701 2,775 5,911

------------

Total revenues 42,459 47,183 93,502

======== ======== ============

- - - - - - - - - - - - - - - -

(1) Financial performance reflects continued operations

excluding discontinued media activities following strategic

decision to focus on publishing activities

(2) Earnings before interest, taxes, depreciation and

amortization adjusted to exclude share based payments

(3) Excluding cash and short term investments attributed to the

media activity that are classified under held for sale assets

(4) Earnings before interest, taxes, depreciation and

amortization adjusted to exclude share based payments

(5) Discontinued operations resulting from the decision to

reduce media activities and the disposal of Mobile subsidiary

(6) The discontinued media activities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FLLLLKKFZBBF

(END) Dow Jones Newswires

September 23, 2019 02:01 ET (06:01 GMT)

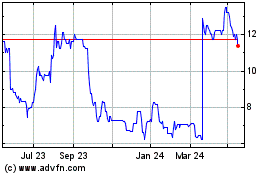

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jul 2023 to Jul 2024