TIDMWTB

RNS Number : 6221L

Whitbread PLC

14 January 2021

Q3 FY21 Trading Update

14 January 2021

Market share gains in the UK and expanding estate in Germany

despite challenging market conditions

Q3 summary (13 weeks to 26 November 2020)

-- Government COVID-19 restrictions continued to create very

challenging hotel market conditions

-- As a result, total UK accommodation sales were down 55.2% with occupancy at 49.3%

-- Despite this, a resilient operational performance resulted in:

o the vast majority of our hotels remaining open during the

quarter

o Premier Inn UK's total accommodation sales performance being

8.9pp ahead of the M&E market(1) with total market share growth

of 4.1pp to 11.4% (2)

-- Continued focus on operational excellence, health and safety

measures, efficiencies and managing cashflows

-- Accelerated estate growth in Germany, with an open and

committed hotel pipeline now at 68 hotels following the successful

completion of the acquisition of 13 hotels from the Centro

Group

-- Cash outflow for the quarter was in line with previous sensitivity guidance

-- The Group is well positioned to continue its outperformance

versus the market and to emerge in a strong position in the

long-term

Current operational and financial position

-- Improved demand for business travel, and some leisure travel,

resulted in the majority of our UK hotels remaining open during the

first half of December, with demand levels falling as the

Government's tier restrictions tightened in the second half of

December and through into the New Year

-- Following the updated UK Government restrictions announced on

4 January 2021, that only permit essential business and keyworker

accommodation, around two-thirds of our hotels remain open, while

all our restaurants are closed

-- With the increased restrictions, total UK accommodation sales

were down 66.4% for the 5 weeks to 31 December 2020 with occupancy

at 31.1%

-- 21 of our 29 operational hotels in Germany remained open but

under severe restrictions, and therefore similar to the overall

German hotel market, recorded low levels of occupancy. These

restrictions have been extended until at least the end of

January

-- The Group's balance sheet remains strong with a net cash

position at 31 December 2020 of approximately GBP40.0m compared to

GBP196.4m at the end of H1. Capital spend was GBP98.4m in the four

months to 31 December 2020. The Group also had cash on deposit of

GBP814.9m and access to a GBP900.0m undrawn revolving credit

facility, and up to GBP300.0m available under the Government's

Covid Corporate Financing Facility (CCFF) scheme

Comment from Alison Brittain, CEO:

"Since the start of the COVID crisis, we have responded quickly

and robustly to the changing restrictions and have learnt to

rapidly adapt our operations as required. This is testament to the

efforts of our colleagues who continue to work tirelessly to

maintain our very high operating standards, customer service and

high levels of health and safety. This response has enabled us to

continue to deliver strong market share gains in the UK,

demonstrating the benefits of our strong brand, direct

distribution, and our unique operating model.

We expect the current travel restrictions in the UK and Germany

to remain until at the very least the end of our financial year.

With the vaccination programme underway, we look forward to the

potential gradual relaxation of restrictions from the Spring,

business and leisure confidence returning, and our market

recovering over the rest of the year.

We are well placed to continue to outperform the increasingly

constrained budget branded and independent competitor sets, by

leveraging the benefits of our unique operating model. We expect to

see increasing opportunities to develop in both the UK and Germany

and are pleased to have accelerated our growth in Germany with the

recent acquisition of 13 hotels, taking the open and committed

pipeline to 68 hotels, a major step on our path to achieving a

nation-wide footprint with representation in most major towns and

cities.

We continue to protect our liquidity through the careful

management of our cash position, and to take actions to ensure that

we exit the crisis as a leaner, stronger and more resilient

business. Our strong balance sheet also provides the opportunity to

take full advantage of the enhanced structural opportunities that

we are already seeing in the market."

Q3 Financial Performance

The Group's financial performance in the quarter reflects the

impact of the ongoing COVID-19 Government restrictions in the UK

and Germany. The year-to-date performance also reflects the impact

of the closure of hotels and restaurants for the majority of the

first half of the financial year.

Financial highlights

Q3 Q3 YTD

--------------------- ---------------------------- ----------------------------

UK Germany Total UK Germany Total

--------------------- -------- -------- -------- -------- -------- --------

Sales growth:

Accommodation (55.2)% 5.9% (54.5)% (70.1)% 32.3% (69.5)%

Food & beverage (53.9)% (41.1)% (53.8)% (68.9)% (27.7)% (68.8)%

Total (54.7)% (2.3)% (54.3)% (69.7)% 21.5% (69.2)%

-------- -------- -------- -------- -------- --------

Like-for-like sales

growth:

Accommodation (56.0)% (68.5)% (56.2)% (70.7)% (65.6)% (70.7)%

Food & beverage (54.4)% (74.9)% (54.4)% (69.3)% (77.1)% (69.3)%

Total (55.5)% (69.5)% (55.6)% (70.2)% (67.5)% (70.2)%

-------- -------- -------- -------- -------- --------

Premier Inn UK total sales were 54.7% down in Q3 reflecting the

ongoing Government restrictions on the operations of hotels and

restaurants. Throughout the quarter, our operations team responded

quickly to changes in these restrictions, enabling the majority of

our hotel estate to remain open, and combined with our strong

brand, direct distribution and best-in-class operating model, drove

an 8.9pp outperformance of the midscale and economy market(1) .

Premier Inn's share of the total hotel market by revenue grew by

4.1pp to 11.4%(2) .

Occupancy levels reached 58% in September, driven by relatively

strong leisure demand in tourist locations and business demand

recovering from a very low base. These trends continued into the

first half of October ahead of the implementation of tiered

restrictions in England and firebreak restrictions in Wales,

helping October occupancy levels to 52%. The implementation of a

national lockdown in England from 5 November to 2 December, which

effectively permitted only essential business travel, saw occupancy

levels fall to 35% in November. Throughout the quarter, demand

remained stronger in the regions, with demand in metropolitan

areas, and in particular in London, remaining weak.

The Government restrictions had a greater impact on the

operations of our restaurants, with both the national lockdowns and

the restriction in the highest tiers forcing restaurant closures.

On average, 82% of our restaurants were open during the quarter,

and combined with reduced capacity in each restaurant and subdued

market demand, total food and beverage sales were 53.9% behind

year-on-year.

We continue to take action to ensure our cost base is reflective

of the current demand environment, including completing the

restructure of our hotel and restaurant operations teams that has

resulted in c1,500 colleagues leaving the business. This is less

than the maximum number of redundancies previously ind icated

(6,000), however targeted cost savings were still achieved as a

result of a greater proportion of colleagues accepting a reduction

in maximum contracted hours.

Premier Inn Germany

The increased size of the open estate in Germany (23 operational

hotels by the end of Q3, compared to 5 at the same time last year)

drove strong total sales growth in September of 58%, where customer

trends were similar to those in the UK. However, the impact of more

onerous travel restrictions in October and in November in

particular, resulted in a year-on-year decline in total sales for

the quarter of 2.3%.

Subsequent to the quarter end, the Group completed the

acquisition of 13 hotels (6 open, 7 pipeline) from the Centro Group

taking the total operational estate to 29 hotels, and a total open

and committed pipeline of 68 hotels. We have taken advantage of the

ongoing restrictions and the resultant subdued demand, to

temporarily close the six acquired open hotels and accelerate their

refurbishment and rebranding to Premier Inn.

Current trading

The further tightening of the COVID-19 restrictions in the

second half of December resulted in significant travel restrictions

and the closing of the majority of restaurants and pubs across the

UK. As a result, in the five weeks ended 31 December 2020, total UK

accommodation sales year-on-year were down 66.4% representing a

continued outperformance of the hotel market of 11.1pp, with total

UK sales down 73.4%.

Following the updated UK Government restrictions announced on 4

January 2021, that only permit essential business and keyworker

accommodation, around two-thirds of our hotels remain open, while

all our restaurants are closed.

The Government restrictions on the German hotel market are

similar to those in the UK with limited business to business travel

and no leisure travel permitted. As in the UK, this is impacting

our performance, with total Germany sales down 54.7% in the five

weeks to 31 December 2020. Total Group sales were down 73.3% in the

same period.

Sensitivity and outlook

The short-term trading environment remains challenging, and

given the ongoing and fast-changing nature of the COVID-19

situation, visibility of expected revenue and cost trends remains

very limited.

FY21 cash and profit sensitivities remain broadly consistent

with those articulated at our interim results in October.

In Germany, we are executing our strategy to drive long-term

value through the acceleration of our expansion, and investment to

build a platform of scale, both organically and through the

acquisition of assets at good prices. This, combined with the

ongoing impact of the COVID-19 restrictions, which we expect to

delay the sales maturity of our operating hotels by 12-18 months,

will suppress short-term performance, meaning that losses will

increase in FY22 and continue into FY23. The recent acquisition in

December of 13 hotels from the Centro Group will result in a loss

in Germany next year of cGBP10m whilst these sites are refurbished

and rebranded to Premier Inn. In addition, in FY22 the impact of

every 1% decline in Germany RevPAR vs our pre COVID-19 Germany

RevPAR expectation of c GBP60 w ill result in a GBP1m reduction in

profit before tax.

Notes:

1: STR data, full inventory basis, M&E market excludes

Premier Inn

2: STR data, revenue share of total UK hotel market

For more information please contact:

Investor queries | Whitbread | investorrelations@whitbread.com

Media queries | Tulchan Communications, David Allchurch / Jessica Reid | +44 (0) 20 7353 4200

A live Q&A teleconference for investors and analysts will be

held at 8:30am GMT on 14 January 2021. Details to join are noted

below. An on-demand version of this will be made available on the

website (

www.whitbread.com/investors/results-reports-and-presentations )

shortly after.

United Kingdom : 0800 640 6441

United Kingdom (Local) : 020 3936 2999

All other locations: +44 203 936 2999

Participant access code: 491008

Appendix:

1) Premier Inn UK key performance indicators

Sept Oct Nov Q3 Q3 YTD

=================================== ======== ======== ======== ========= =========

Room capacity open (average) 97% 98% 78% 91% 58%

Occupancy (full inventory) 58.3% 52.0% 35.3% 49.3% 29.9%

Average room rate GBP44.95 GBP48.85

Revenue per available room GBP22.15 GBP14.62

Total accommodation sales

growth (46.9)% (53.1)% (69.0)% (55.2)% (70.1)%

=================================== ======== ======== ======== ========= =========

Restaurants open (average) 99% 99% 43% 82% 48%

Total food and beverage

sales growth (35.2)% (49.9)% (83.1)% (53.9)% (68.9)%

=================================== ======== ======== ======== ========= =========

Total sales growth (43.0)% (52.0)% (73.9)% (54.7)% (69.7)%

Outperformance vs M&E market(1) 8.2pp 8.5pp 10.6pp 8.9pp 2.4pp

Market share gains(2) 3.7pp 3.7pp 6.2pp 4.1pp 2.7pp

=================================== ======== ======== ======== ========= =========

2) Premier Inn Germany key performance indicators

Sept Oct Nov Q3 Q3 YTD

================================ ====== ======== ======== ========= =========

Room capacity open (average) 100% 100% 100% 100% 79%

Occupancy (full inventory) 42.5% 33.0% 12.6% 29.5% 28.3%

Average room rate GBP43.26 GBP41.03

Revenue per available room GBP12.75 GBP11.62

Total accommodation sales

growth 65.0% 12.9% (59.2)% 5.9% 32.3%

================================ ====== ======== ======== ========= =========

Total food and beverage

sales growth 21.1% (62.9)% (74.5)% (41.1)% (27.7)%

================================ ====== ======== ======== ========= =========

Total sales growth 58.0% (1.9)% (61.8)% (2.3)% 21.5%

================================ ====== ======== ======== ========= =========

Notes:

1: STR data, full inventory basis, M&E market excludes

Premier Inn

2: STR data, revenue share of total UK hotel market

3) UK Quarterly sales & RevPAR growth

FY20 FY21

==== ========================== =========================================== ======================================

Q1 Q2 Q3 Q4 Q4 YTD Q1 Q2 Q3 Q3 YTD

================================ ======= ======= ======= ======= ======= ======== ======== ======== ========

Accommodation (1.5)% 0.1% (0.4)% 1.9% (0.1)% (79.1)% (76.6)% (55.2)% (70.1)%

Food & Beverage (0.4)% 1.6% 1.9% 2.1% 1.3% (80.1)% (72.6)% (53.9)% (68.9)%

UK total sales

growth (1.1)% 0.6% 0.3% 2.0% 0.4% (79.5)% (75.2)% (54.7)% (69.7)%

================================ ======= ======= ======= ======= ======= ======== ======== ======== ========

Regions (2.4)% (1.9)% (2.0)% 0.6% (1.6)% (79.2)% (73.2)% (48.0)% (66.7)%

London 1.7% 8.2% 4.8% 6.0% 5.2% (78.7)% (88.6)% (77.8)% (81.8)%

UK accom. sales

growth(1) (1.5)% 0.1% (0.4)% 1.9% (0.1)% (79.1)% (76.6)% (55.2)% (70.1)%

================================ ======= ======= ======= ======= ======= ======== ======== ======== ========

Accommodation (4.5)% (2.7)% (2.1)% 0.2% (2.4)% (79.4)% (77.1)% (56.0)% (70.7)%

Food & Beverage (2.1)% (0.2)% 0.4% 0.6% (0.3)% (80.5)% (72.8)% (54.4)% (69.3)%

UK LFL total

sales growth (3.6)% (1.9)% (1.3)% 0.4% (1.7)% (79.8)% (75.6)% (55.5)% (70.2)%

================================ ======= ======= ======= ======= ======= ======== ======== ======== ========

Regions (6.6)% (5.9)% (5.4)% (2.9)% (5.3)% (79.8)% (73.8)% (48.8)% (67.5)%

London (6.4)% 1.2% (0.2)% 0.5% (1.2)% (79.5)% (89.0)% (78.4)% (82.4)%

UK RevPAR growth(1) (6.3)% (4.3)% (4.1)% (2.0)% (4.3)% (79.7)% (77.2)% (55.9)% (70.9)%

================================ ======= ======= ======= ======= ======= ======== ======== ======== ========

Regions (6.3)% (5.6)% (4.9)% (2.3)% (5.0)% (79.7)% (73.9)% (49.1)% (67.5)%

London (4.3)% 1.7% 0.6% 1.6% (0.1)% (79.1)% (88.8)% (78.3)% (82.2)%

UK LFL RevPAR

growth(1) (6.0)% (4.2)% (3.6)% (1.3)% (3.9)% (79.6)% (77.2)% (56.2)% (70.9)%

-------------------------------- ------- ------- ------- ------- ------- -------- -------- -------- --------

Regions (1.9)% (0.9)% (1.2)% 0.8% (0.9)% (77.6)% (72.9)% (53.3)% (67.9)%

London 3.3% 7.1% 3.7% 3.6% 4.5% (79.3)% (87.4)% (80.0)% (82.4)%

M&E market total

sales growth(2) (0.4)% 1.2% 0.1% 1.7% 0.6% (78.1)% (76.5)% (61.0)% (71.8)%

-------------------------------- ------- ------- ------- ------- ------- -------- -------- -------- --------

Regions (5.0)% (4.0)% (3.6)% (1.4)% (3.6)% (77.7)% (72.6)% (52.9)% (67.7)%

London (0.7)% 4.7% 1.8% 0.9% 1.7% (79.8)% (87.6)% (80.4)% (82.7)%

M&E market total

RevPAR growth(2) (3.7)% (1.8)% (2.2)% (0.7)% (2.2)% (78.2)% (76.4)% (60.9)% (71.7)%

-------------------------------- ------- ------- ------- ------- ------- -------- -------- -------- --------

Notes:

1: FY20 Regions/London split restated to STR definition

2: STR data, M&E market includes Premier Inn

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKXLFFFFLLBBF

(END) Dow Jones Newswires

January 14, 2021 02:00 ET (07:00 GMT)

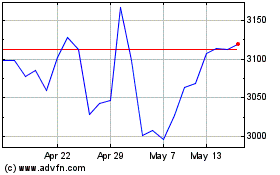

Whitbread (LSE:WTB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Whitbread (LSE:WTB)

Historical Stock Chart

From Nov 2023 to Nov 2024