TIDMVLE

RNS Number : 1021D

Volvere PLC

01 March 2022

1 March 2022

Volvere plc

(the "Group" or "Volvere")

Trading Update and Notice of Final Results

Volvere plc (AIM: VLE), the growth and turnaround investment

company, is pleased to provide the following trading update for the

financial year ended 31 December 2021. All data in this

announcement is unaudited, although the comparative information for

the year ending 31 December 2020 has been extracted from audited

data for that year.

The Group's trading operations include Shire Foods Limited

("Shire"), the Group's 80 per cent. owned frozen pastry products

manufacturer, and Indulgence Patisserie Limited ("Indulgence"),

which was acquired in February 2020 and manufactures frozen

desserts.

Financial Performance

The Group expects to report revenue from continuing operations

of approximately GBP35.58 million (2020: GBP30.81 million) and an

overall profit before tax of GBP0.07 million (2020: loss before tax

of GBP0.55 million).

Operating Businesses

Overview

Shire performed extremely well in the period, and Indulgence

made steady, satisfactory progress. This was achieved despite both

businesses facing significant headwinds including labour, raw

material and energy cost increases, and with suppliers - both

materials suppliers and logistics partners - being at times unable

to meet our requirements. However, with the flexibility and

commitment of both staff and customers, we have been able to

mitigate the effects of these challenges.

Shire Foods

Shire continued to grow in 2021, with revenues increasing by

approximately 12.6% to a new high of GBP30.61 million (2020:

GBP27.19 million) and a solid profit before tax, intra-group

interest and management charges* of approximately GBP2.14 million

(2020: GBP1.81 million). Profit before tax was GBP1.89 million

(2020: GBP1.61 million) - with the difference being intra-group

interest and management charges. During 2021 Shire provided

operational and commercial support to Indulgence and this has

resulted in some costs being recharged which would otherwise have

been borne by Shire.

Indulgence Patisserie Limited

Indulgence achieved revenue of GBP4.97 million, representing

growth of approximately 21% compared with the prior period on an

annualised basis (2020: period 7 February - 31 December 2020

GBP3.62 million). The loss before tax, intra-group interest and

management charges* was approximately GBP1.01 million (2020: loss

GBP1.02 million). The loss before tax was GBP1.08 million (2020:

loss GBP1.02 million) - with the difference being intra-group

interest and management charges.

During the year there was an increase in activity in the food

service sector but, with many customers remaining affected by the

pandemic restrictions, a return to normal trading was frustrated.

However, the retail customer base grew substantially and we expect

this will continue.

During the year, we have invested in new plant and machinery and

we have strengthened the management team. We expect that the

business's performance will improve this year as we launch new

products.

The Group has continued to fund the initial purchase, working

capital and trading losses by way of intra-Group loans.

Group Net Assets per Share and Net Assets

The Group expects to report year-end consolidated net assets per

share (excluding non-controlling interests) of approximately

GBP13.53 (31 December 2020: GBP13.65) and Group net assets of

approximately GBP37.2 million (31 December 2020: GBP37.2

million).

Of the Group net assets, cash represented approximately GBP21.87

million (31 December 2020: GBP23.71 million).

The reduction in Group cash principally reflects the positive

trading in Shire, offset by central costs, capital expenditure in

new plant and the trading losses at Indulgence.

Current Trading

The challenges experienced in 2021 in relation to cost increases

and labour availability continue in 2022 but we are working hard to

protect margins and retain staff, whilst seeking growth

opportunities in food manufacturing.

More generally, we believe the environment for turnaround

investing is improving and we continue to review targets for

acquisition or investment. The Group's high liquidity puts it in a

strong position to capitalise on such opportunities.

As ever, what we have achieved in 2021 would not have been

possible without the extraordinary efforts of our staff, amongst

whom there are many heroes. We are grateful to all of them for

their hard work and continuing commitment to our success.

* profit before intra-group interest and management charges is

considered to be a relevant, useful interpretation of the trading

results of the business such that its performance can be understood

on a basis which is independent of its ownership by the Group.

Notice of Final Results

Volvere expects to announce its full year results for the year

ended 31 December 2021 on or around 27 May 2022.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information:

Volvere plc

Jonathan Lander, CEO Tel: +44 (0) 1926 335700

www.volvere.co.uk

Cairn Financial Advisers LLP (Nominated Adviser)

Sandy Jamieson/James Lewis Tel: + 44 (0) 207 213 0880

Canaccord Genuity Limited (Joint Broker) Tel: + 44 (0) 207 523 8000

Bobbie Hilliam/Alex Aylen/Georgina McCooke

Hobart Capital Markets LLP (Joint Broker)

Lee Richardson Tel: + 44 (0) 207 070 5691

Notes to editors:

Volvere plc (AIM: VLE), is a growth and turnaround investment

company. The Group's current trading businesses are involved in

food manufacturing. The Group currently employs approximately 260

people.

For further information, please visit www.volvere.co.uk .

Forward-looking statements:

This announcement may contain certain statements about the

future outlook for Volvere plc. Although the directors believe

their expectations are based on reasonable assumptions, any

statements about future outlook may be influenced by factors that

could cause actual outcomes and results to be materially

different.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEMFWAEESEIE

(END) Dow Jones Newswires

March 01, 2022 02:00 ET (07:00 GMT)

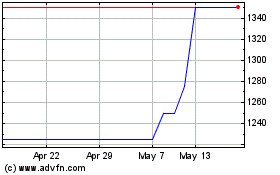

Volvere (LSE:VLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

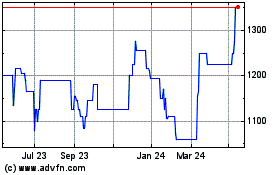

Volvere (LSE:VLE)

Historical Stock Chart

From Nov 2023 to Nov 2024