TIDMUKCM

Guernsey: 14/04/2022

LEI: 213800JN4FQ1A9G8EU25

UK Commercial Property REIT Limited

("UKCM" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2021

About Us

UK Commercial Property REIT Limited ("UKCM") is a listed Real Estate Investment

Trust (REIT) with a net asset value of £1.3 billion as at 31 December 2021.

UKCM is one of the largest diversified REITs in the UK and is a component of

the FTSE 350 index made up of the largest 350 companies with a primary listing

on the London Stock Exchange.

Objective

The objective of the Company is to provide ordinary shareholders with an

attractive level of income, together with the potential for capital and income

growth from investing in a diversified portfolio of UK commercial properties.

This objective is achieved by:

. Constructing a portfolio that is diversified across the four main commercial

property sectors - Industrial, Offices, Retail and Alternatives.

. Investing in assets with a strong earnings and income focus.

. Delivering value through a proactive approach to acquisitions, sales and

asset management.

. Selectively developing or funding developments, mostly pre-let.

. Employing modest levels of gearing.

. Considering Environmental, Social and Governance factors as integral parts of

the investment process.

Board & Management

The Company has a Board of five experienced Non-Executive Directors who have

significant expertise in property, accounting, risk and tax (see page 48-49 for

further details). UKCM is managed by abrdn, a top 20 global real estate manager

that manages over 1,300 properties in 23 countries.

Visit our website at: ukcpreit.com to learn more

2021 FINANCIAL REVIEW AND KEY PERFORMANCE INDICATORS

· NET ASSET VALUE

NAV of £1.3 billion as at 31 December 2021 (2020: £1.1 billion) representing a

NAV total return* in the year of 21.5% (2020: -0.9%) as valuations recovered

strongly in the sectors where the Company is strongly positioned. Over the

longer term (10 years) the Company has delivered a NAV total return of 114.9%

(2020: 85.6%) compared to the Association of Investment Companies ("AIC") peer

group of 54.6% (2020: 32.4%).

· EPRA EARNINGS PER SHARE

EPRA Earnings per Share of 2.65p* (2020: 2.71p) as earnings were impacted by

the timing of transactions with rent reduced through strategic sales in late

2020 / early 2021 and reinvestment during the final third of 2021.

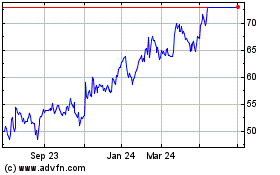

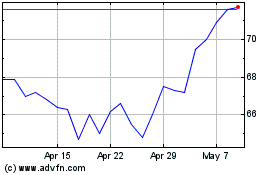

· SHARE PRICE TOTAL RETURN

A total return of 12.5%* (2020: -19.7%) as the share prices of diversified

REITs improved during the year.

· WELL-POSITIONED PORTFOLIO

Industrial weighting of 63% (Benchmark: 34%). Portfolio strategy continues to

be implemented with the portfolio well aligned to sectors which are expected to

outperform.

· INCREASING LEVERAGE

Gearing* of 13.5% (2020: 6.4%) following net acquisitions in the year, with

additional resources available to increase gearing levels further.

· FURTHER RESOURCES AVAILABLE

£88 million* at the year-end (2020: £218 million) to invest into the portfolio

and enhance earnings, reflecting the undrawn revolving credit facilities net of

development commitments.

· IFRS EARNINGS PER SHARE

IFRS Earnings per Share of 18.18p (2020: -0.79p) following the strong capital

gains achieved on the portfolio.

· PORTFOLIO TOTAL RETURN*

Portfolio produced a total return of 21.4% (2020: 1.1%), significantly

outperforming the 16.8% (2020: -0.9%) from the MSCI benchmark as the Company's

portfolio positioning provided continued outperformance.

· EPC BY ERV

75% (2020: 66%) of the property portfolio's Estimated Rental Value ("ERV") has

an Energy Performance

Certificate ("EPC") rating of A, B or C, where subject to the Minimum Energy

Efficiency Standards.

· ACQUISITIONS

£180 million (2020: £74m) of acquisitions that are accretive and will generate

secure income.

· RENT COLLECTION*

Rent collection of 97% in 2021 (compared to 83% for 2020) as rent collection

rates normalise to pre-COVID-19 levels.

· OCCUPANCY RATE

Occupancy rate of 97.9% (2020: 93.5%), with voids a third of the prior year

level and the portfolio has a stable income expiry profile. Also compares

favourably to the MSCI benchmark occupancy rate of 92.3% (2020: 92.6%).

· NET ZERO CARBON TARGET 2030

for landlord operational emissions.

· NET ZERO CARBON TARGET 2040

for all emissions.

* Alternative Performance Measures (see page 6 and glossary on pages 116-117

for further details)

PERFORMANCE SUMMARY

CAPITAL VALUES AND GEARING 31 December 31 December % Change

2021 2020

Total assets less current liabilities (excl Bank 1,573,554 1,324,825 18.8%

loan) £'000

IFRS Net asset value (£'000) 1,325,228 1,126,976 17.6%

Net asset value per share (p) 102.0 86.7 17.6%

Ordinary Share Price (p) 74.7 69.0 8.3%

Discount to net asset value (%) (26.8) (20.4) n/a

Gearing (%)*: 13.5 6.4 n/a

1 year 3 year 5 year

% return % return % return

TOTAL RETURN

NAV ? 21.5 20.6 41.5

Share Price ? 12.5 0.6 7.8

UKCM Direct Portfolio 21.4 24.4 47.9

MSCI Benchmark 16.8 17.7 38.8

FTSE Real Estate Investment Trusts Index 29.4 41.8 39.3

FTSE All-Share Index 18.3 27.2 30.2

31 December 31 December

2021 2020

EARNINGS AND DIVIDS

Net profit/(loss) for the year £'000 236,233 (10,282)

EPRA Earnings per share (p) 2.65 2.71

IFRS Earnings per share (p) 18.18 (0.79)

Dividends declared per ordinary share (p) 2.923 2.3

Dividend Yield (%)# 3.9 3.3

MSCI Benchmark Yield (%) 4.1 4.7

FTSE Real Estate Investment Trusts Index Yield (%) 2.6 3.1

FTSE All-Share Index Yield (%) 3.1 3.4

ONGOING CHARGES AND VACANCY RATE

As a % of average net assets including direct 1.3 1.5

property costs

As a % of average net assets excluding direct 0.8 0.8

property costs

Vacancy rate (%) 2.1 6.5

* Calculated, under AIC guidance, as gross borrowings less cash divided by

portfolio value.

See alternative performance measures on page 116 for further details.

? Assumes re-investment of dividends excluding transaction costs.

# Based on dividend paid in 2021 of 2.923p and the share price at 31 December

2021.

Alternative Performance Measures are defined in the glossary on pages 116 and

117, and include: Discount to net asset value, Gearing, NAV and Share price

total returns, EPRA Earnings per share, Dividend yield, Ongoing charges and

Vacancy rate.

Sources: abrdn, MSCI

CHAIR'S STATEMENT

Dear Shareholder,

UKCM delivered a NAV total return of 21.5% for the year and once again

outperformed the benchmark as we carefully managed the portfolio throughout the

pandemic, further strengthened the Company's balance sheet and continued

disposing of early stage risk assets. Importantly, we also deployed the

Company's remaining cash, investing in a number of significant strategic

acquisitions that are well aligned to the fundamentals of the UK economy.

The Company has also announced a further increase in its dividend to reflect

the Board's optimism about the outlook for the business. The economic recovery

has created stark differences in the UK commercial real estate market. It has

been well documented that the industrial sector is performing well, a sector in

which UKCM has positioned itself strongly over the past few years. However

structural splits are prominent within the other property sectors with, for

example, the positive performance of retail warehousing versus the challenges

faced by many shopping centres being a clear case in point.

It is within these other sectors that investment has to be more discerning, and

we believe that the existing portfolio is well-positioned against this context.

As we head into the year with a feeling of cautious optimism, we remain alert

to the challenges that remain. The spectre of COVID-19 still looms large,

despite the continued easing of many restrictions, and the effects of the

pandemic - not just economic, but personal, social and political - will be with

us for years to come. That said, the position in which we find ourselves is

significantly improved from that of a year ago, and that gives cause for

confidence as we move forward. We are also witnessing the harrowing scenes from

the war in the Ukraine. Apart from the human tragedy and upheaval which is

unfolding, the effect on energy costs and higher commodity prices will increase

inflationary pressure for some time to come.

Portfolio Activity

As stated in our Interim Report, the Company has a clear portfolio strategy of

reducing specific retail exposure and realising profits on properties where

successful asset management initiatives have been completed, while reinvesting

in assets that will provide attractive but secure levels of income.

During 2021, the Company sold £74 million of property, disposing of its final

high street retail exposure as well as of Kew Retail Park, the latter at a

price which reflected the residential opportunity presented on this site. UKCM

also took the opportunity to sell two offices - Hartshead House, Sheffield and

Network House, Hemel Hempstead, due to concerns around tenant covenant, and to

remove the largest void that existed within the portfolio

Portfolio Weighting

63.4% Industrial

14.3% Offices

12.1% Retail

10.2% Alternatives

Using the proceeds generated, together with existing available resources, the

Company has committed £216 million through five acquisitions which were

completed during the year. The market is becoming increasingly competitive in a

narrower range of asset classes but the Company has been able to source deals

off-market as well as creating value through forward-funding development

acquisitions. At the year end, the Company has three ongoing developments; two

student residential developments in Exeter and Edinburgh, as well as an

industrial development near Gatwick. All are expected to be completed in the

second half of 2022. These assets have been accretive to the performance of the

Company and are expected to provide sustainable income streams for the years

ahead.

Further details on all investment transactions and significant lettings are

given in the Investment Manager Review.

Portfolio and Corporate Performance

UKCM has continued to outperform against its MSCI UK Balanced Portfolios

Quarterly Index benchmark across all time periods.

For 2021, the Company's portfolio total return significantly outperformed the

benchmark of 16.8%. This performance was driven by the strategic positioning of

the portfolio, which is well aligned to those parts of the economy that are

supported by strong structural drivers. UKCM has a 63.4% holding in the

industrial sector against the benchmark of 33.9%, a sector where returns have

been particularly strong. The Company has also grown its holdings in retail

warehousing to 9.9% which has also delivered strong returns in 2021 and is

expected to be a top performer in the medium term. Further details on the

Company's portfolio performance are given in the Investment Manager Review.

The strength of the portfolio performance was the main driver behind the 21.5%

NAV total return for the period. The share price return, taking into account

dividends paid over the period, was 12.5%.

The Board also monitors the discount at which the Company's shares trade versus

their net asset value, which increased from 20.4% at the end of December 2020

to 26.8% at 31 December 2021. Whilst noting our Q4 2021 NAV performance was our

strongest in the year, the Board are actively considering options to narrow the

discount.

Over the longer term, the Company has outperformed the AIC peer group on both a

NAV and share price total return basis, delivering 114.9% and 75.1%

respectively over ten years, compared to the 54.6% and 40.9% returns from the

peer group.

Financial Resources

UKCM has built up a strong balance sheet, with a NAV as at 31 December of £1.3

billion and gearing growing to 13.5% though it still remains one of the lowest

geared companies in the AIC peer group and the wider REIT sector. At the year

end, the Company had fully invested its free cash but still had available

resources of £88 million due to the £100 million which remains undrawn of its

low cost, flexible revolving credit facility and will allow UKCM to grow its

gearing levels further.

Through its Investment Manager, the Company is always looking at transaction

opportunities in order to deploy these resources. However, acquisitions must be

aligned to the portfolio strategy as we look to invest our available funds

carefully.

The Company continues to be comfortably within the covenants on its three debt

facilities, and has more than £462 million of unencumbered assets which provide

further significant headroom and flexibility with respect to the Company's

covenants and overall gearing strategy.

Rent Collection

The Board has taken its role as a responsible landlord very seriously

throughout the pandemic and is pleased that we are now seeing the positive

outcomes from working with our tenants. During 2020, and continuing into 2021,

tenant requests for rental assistance were considered on a case-by-case basis,

and also with a view to securing a future benefit for the Company. As a result,

UKCM has put in place a number of rent deferrals and monthly lease payment

structures for tenants which were designed to assist both the tenant and the

Company, with a number of these leading to lease renegotiations, creating value

through securing longer lease commitments in return for short-term rent

incentives/support.

The Board is pleased that, by the end of 2021, rent collection levels were

starting to normalise and returning to levels of 97% for the four quarters of

2021, in line with pre-pandemic numbers.

The Company has a bad debt provision of £5.3 million as at 31 December 2021,

having undertaken a prudent review of its arrears, but will pursue collection

of all arrears by continuing to work closely with its tenants.

Dividends

The Board remains cognisant that the payment of an attractive, sustainable

dividend is of primary importance to many shareholders. In our 2020 Annual

Report, we stated that there was the potential for progressive dividend growth

as we deployed our available resources and the impact of COVID-19 began to

stabilise.

We have increased the dividend from the 0.46p per share paid in February 2021

to 0.644p per share from Q1 2021, before announcing a further increase to 0.75p

per paid in February 2022, representing a 63% increase over the period.

Additionally, we paid out a top-up dividend in respect of 2020 of £6.9 million.

This increase is against a backdrop of 111% dividend cover, 91% when including

the impact of the top-up dividend.

The Board considers the new dividend level of 0.75p per share to be sustainable

but with the aim to grow as earnings increase as the Company deploys its

remaining capital and we start to see the completion of ongoing developments

within the portfolio.

Environmental, Social and Governance ("ESG")

ESG is embedded within the processes of UKCM and underpins every Board

discussion and decision.

As highlighted on rent collection, we have engaged with tenants and sought to

balance their circumstances with those of the Company in order to secure

long-term, mutually beneficial outcomes.

The Company has announced two significant targets as part of its Net Zero

Carbon Strategy following a bottom-up asset-level review across the entire

portfolio. By 2030, we aim to achieve Net Zero Carbon for landlord operational

emissions and extend this to all emissions by 2040. These targets are in

advance of the UK Government's target of 2050 but we are committed to setting a

target which we consider to be both challenging and achievable, and we look

forward to providing progress updates against these targets going forward.

Investment Management Fee

The Board notes the Investment Manager's continued commitment of resources to

the Company, particularly as seen throughout the pandemic. It is particularly

appreciative, therefore, to have negotiated a reduction in the investment

management fee. From 1 April 2022, the annual fee charged to the Company will

be reduced from a rate of 0.60% of Total Assets up to £1.75 billion, to 0.525%

of Total Assets. The rate of 0.475% remains unchanged for Total Assets above £

1.75 billion. In addition, the Company will not be charged for fees on

excessive cash balances.

Board Composition

During the year, Robert Fowlds and Sandra Platts retired from their roles as

Non-Executive Directors having served the Company for three and eight years

respectively. During this time, they made an invaluable contribution to the

Board and both leave with our sincere thanks and best wishes for the future.

As part of our continuing Board succession programme, we were delighted that

Fionnuala Hogan joined the Board as a Non-Executive Director in August 2021.

Fionnuala brings over 25 years' experience of corporate advisory, investment

and financing, with a particular emphasis on commercial real estate and

innovation, and we are very pleased to welcome her to the Company. Fionnuala's

wealth of knowledge and range of key skills have already proven to be a

valuable addition to the Board.

I have now served just over nine years on the Board and would be due to retire

this year. The Board however, as outlined in the Corporate Governance Report on

page 55, have asked me to continue in my role as Chair for a limited time,

which I have agreed to subject to my election at the AGM, while it considers

and completes its succession planning. This more flexible approach to my tenure

as Chair will help manage the Company's succession plans in the short term and

achieve a sensible balance between continuity and re-invigoration in compliance

with the AIC Code for investment companies.

Outlook

2022 has begun with a successful COVID-19 vaccine booster programme, and an

ongoing easing of restrictions necessary to navigate the pandemic. At the same

time, the situation in Ukraine, the ongoing pandemic and the spectre of

inflation and Brexit, present additional layers of uncertainty.

It is expected that the divergence in UK commercial property performance will

be prevalent both across and within the property sectors. The extremely strong

capital growth achieved by industrials is unlikely to continue at the same

level, but total returns are expected to remain robust for the year ahead. The

bifurcation within the office market is expected to deepen over the course of

2022 with a clear distinction between the best, with strong ESG credentials,

and the rest. Retail performance is showing signs of improvement, but this will

be driven by retail warehouse assets, particularly discount-led schemes.

The expected UK commercial property trends show UKCM to be in an excellent

position, with its significant holdings in the sectors, and sub-sectors, that

are expected to remain amongst the best performing. The Company has further

available resources, with scope to increase gearing and a strong pipeline of

developments which are due to complete in 2022 and enhance earnings further.

Overall, the Company is strongly positioned with its clear investment strategy

delivering a well-structured portfolio and solid financial footing as we aim to

increase earnings, drive shareholder value and enhance UKCM's status as one of

the UK's largest diversified REITs.

Ken McCullagh

Chair

13 April 2022

INVESTMENT MANAGER REVIEW

2021 Review

2021 was a year once again characterised by the COVID-19 pandemic, but the key

theme for the year was recovery. As the year progressed and the vaccine roll

out continued apace, economic positivity returned, despite temporary periods of

hiatus with the emergence of the Delta variant, and then the Omicron variant

towards the end of the year. However, the economy did recover and, by November

2021, UK GDP was above the level seen pre-pandemic. Overall, the UK economy

grew by 7.5% over the course of the year.

The UK real estate market also recovered in 2021, with a total return of 16.5%

according to the MSCI Quarterly Index (this is different from the Company's

benchmark which is the MSCI UK Balanced Portfolios Quarterly Property Index

benchmark), a level of performance not seen since 2014. Transaction volumes

reached £73.9 billion over the course of the year, which was 37% ahead of 2019

(prior to the outbreak of the pandemic). Indeed, the fourth quarter of 2021 was

the strongest quarter since the same period in 2019. However, this recovery was

highly polarised and the spread between the best and worst performing sectors

is now at the highest level on record.

The industrial and logistics sector again produced the best performance,

achieving total returns of 36.4%, whereas shopping centres achieved a total

return of -5.2% and was the worst performing sector over the course of 2021.

The office sector continued to underperform, achieving 5.3% total return as

structural sector concerns persist. However, best in class office assets

continued to generate positive sentiment, particularly with overseas investors.

Cross-border capital remained a dominant force in the UK market and accounted

for 58% of all investment in the UK market during the year.

Following a poor year in 2020, the FTSE UK REIT index returned to positive

territory and recorded a strong total return of 28.9% in 2021. This

outperformed the FTSE UK All-Share Index, which recorded a total return of

18.3%, demonstrating that the UK real estate market remains an attractive

investment destination. Following a significant sell off in September 2021, UK

REITs broadly recovered and finished the year at, or close to, all-time highs.

The hierarchy of favoured sectors again remains broadly the same, with the

industrial and logistics sector leading the way. However, overall sentiment was

positive for all sectors towards the end of the year, with the exception of

secondary offices with which there are broad structural concerns. New capital

raising has predominantly been tilted towards the industrial sector and,

increasingly, the alternatives sector. Environmental, Social & Governance

("ESG") issues continued to grow in prominence in investor and occupier

decision-making and this trend will no doubt continue.

Within the UK real estate market, retail continues to be the sector most

negatively affected by the pandemic, as restrictions and changing consumer

habits have accelerated the pace of structural change already present prior to

the outbreak. However, whilst high street and discretionary based retailers

have struggled, retail warehouse assets showed a significant recovery in the

latter half of the year. Polarisation within sectors is evident elsewhere,

including within the office sector. As occupiers and investors have become more

mindful of ESG considerations, their focus has increasingly narrowed on

best-in-class assets and, as a result, we have seen demand for secondary

accommodation weaken. While we are hopefully now coming to the end of the

pandemic, it is likely we will be living with the structural changes it has

expedited for many years to come.

Review by Sector

21.5% NAV TOTAL RETURN in 2021

Office

The office sector delivered a total return of 5.3% to December 2021 according

to the MSCI Quarterly Index, an improvement on the -1.7% recorded in 2020.

However, office capital values were relatively stagnant over the course of

2021, with growth of just 1.3%. The most profound fall occurred in the North

East office market, with capital values falling by -3.6%. Once again, the

performance of the office market was significantly impacted by the COVID-19

pandemic. As restrictions eased over the course of 2021, occupiers had begun

returning to workplaces. However, the outbreak of the Omicron variant and the

subsequent reintroduction of working from home guidance has further emphasised

the pressure which the sector faces.

The rise of hybrid working has led occupiers to revaluate their office

accommodation requirements and, whilst vacancy rates did begin to show signs of

stabilisation, levels of occupation remain far below pre-pandemic levels.

Central London availability by Q3 2021 remained 64% higher than the 10-year

average, at 25.2m sq ft versus the 10-year average of 15.4m sq ft, although

take up in Central London did recover with 7.4m sq ft let in the year to

November 2021. This was 54% above the annual total for 2020, but down 22% on

the long-term average. However, polarisation within the sector is becoming ever

more apparent as occupier focus narrows on best-in-class assets with strong ESG

and wellbeing credentials. Second hand availability in Central London has

almost doubled from pre-pandemic levels and in Q3 2021 accounted for nearly 75%

of total office supply. As a result, we expect this trend to drive an

increasing wedge between rental value growth for the best, and the rest with

investor appetite following a similar pattern, and those assets not meeting

current occupational demand at risk of significant value erosion.

Retail

After a number of years of poor performance, the retail sector showed some

signs of recovery in 2021 despite continued structural headwinds. However, we

believe this to be primarily driven by market factors and a product of the

market cycle, rather than sector-specific confidence. As a result, performance

was highly polarised within the sector.

As was expected, those assets deemed as essential retail use showed strong

performance over the year, whereas discretionary retailers and those

susceptible to greater online penetration, once again struggled against the

backdrop of the pandemic. Whilst retail warehouse assets underwent a strong

recovery, particularly in the second half of the year, recording a total return

of 21.9% for retail parks, shopping centres continued to drag on the sector and

provided a total return of -5.2% in 2021.

High street shops also showed continued poor performance as retailers struggled

with ongoing restrictions and a consumer shift to e-commerce. Capital values

for retail assets within Central London fell by 5.8%, continuing the trend seen

in 2020. The reintroduction of restrictions towards the end of the year also

put further pressure on high streets causing another fall in footfall.

Supermarkets, however, once again provided a robust performance due to an

increase in consumer spending and their relative insulation from online

shopping. Supermarkets provided a total return of 15.7%, predominantly driven

by yield compression, as investors were attracted by secure, index linked, long

income.

Consumer habits have changed over the course of the pandemic and it is clear

from footfall data that many now prefer to visit units which provide 'drive to

convenience' and perceived safety from COVID-19. As a result, investor

attention also turned to retail warehouse accommodation, with those assets led

by discount or DIY operators of principal interest. In response, yields within

this sector have moved in between 150-250bps during 2021. However, schemes with

significant exposure to fashion-led retailers have generated less interest as

occupational concerns remain. From an occupational perspective, the situation

remains fragile as government support is withdrawn and the risk of further

retailer defaults remains elevated. With the rate of inflation also expected to

continue to rise in 2022, there is likely to be pressure on consumer disposable

income in the short/medium term, further impacting on retailer trading

performance, particularly for luxury/ discretionary goods and services. As a

result, the prospect for rental growth across the sector is considered remote.

Moving forward, the sector is likely to remain highly polarised but overall

retail sector performance is anticipated to improve when compared to 2021 as

shopping centres and high street retail stabilise.

Industrial

Once again, the industrial and logistics market retained its position as the

best performing UK commercial real estate sector. The sector delivered a total

return of 36.4%, which compares to an all property total return over the same

period of 16.5%.

Sentiment remained extremely positive over the course of the year as investors

were attracted by a strong supply-demand imbalance and subsequent rental value

growth across the sector. This is most keenly felt in supply constrained

locations such as London, which remained the best performing market, with total

return for London industrial achieving 43.1% over the year. As investors have

sought to buy into the sector, transactional volumes totalled £20.8 billion,

the highest level ever recorded and 117% higher than the total transacted in

2020. As a result, transactions involving the sector accounted for 28.3% of

total UK real estate investment activity.

From an occupational perspective, demand for accommodation remains extremely

high, with take up in 2021 totalling over 55m sq ft, another all-time record.

Distribution and online retailers continue to dominate take up and, with the UK

wide vacancy rate now below 2.0%, the market fundamentals remain supportive for

continued strong rental value growth.

Moving forward, rental value growth is likely to be the predominant driver of

returns as further yield compression, which has been the key driver over the

course of 2021, is unsustainable and particularly so in the prime sector of the

market. Yields moved in between 50-125bps during 2021 across the sector, and

prime London estates are now commanding yields of around 3.0%. Sentiment

remains very strong for the industrial and logistics market and the sector is

well placed structurally to see continued robust growth.

Alternatives

The UK real estate alternative sector, or "Other Property" as it is categorised

by MSCI, represents real estate which falls outside the traditional 'Retail',

'Office' or 'Industrial' definitions. Investor interest in the alternatives

sector has increased and a total of £22.3 billion was recorded to have

transacted over the course of 2021, which was up 34.3% on 2020 and 39.9% above

the 10-year average. Total return within this sector was 9.2% which, whilst

below the all property total return of 16.5%, was a significant improvement on

the total return achieved in 2020 of -5.3%. The reasons for this are largely as

a result of ongoing restrictions and a change in consumer habits as a result of

the COVID-19 pandemic.

The leisure and hotel sectors, which form a large component of the "other

property" sector within the MSCI sample, suffered at the beginning of 2020 due

to strict government restrictions, with many operators not reopening until Q2

at the earliest. However, over the remainder of the year the sectors underwent

gradual recovery and regional hotels in particular experienced record bookings,

as international travel restrictions boosted the demand for domestically driven

'staycations'. As a result, total returns in the hotel and leisure sectors for

2021 were 7.7% and 7.8% respectively.

Healthcare also finished the year in a strong position and recorded a total

return of 9.5%. Investor appetite for the Build to Rent (BTR) residential

sector also continued its strong trajectory and a record of £4.1 billion was

invested into the sector over the course of 2021, beating the previous record

of £3.5 billion achieved in 2020.

The Purpose Built Student Accommodation (PBSA) sector also performed well in

2021, despite a muted start to the year. Large platform deals have placed

further downward pressure on yields, with those assets with index linked leases

now commanding yields of 3.0% according to CBRE. However, performance is

polarised, with those assets serving the UK's top universities best placed to

outperform.

Moving forward, the 'alternatives' sector is likely to become more 'mainstream'

as it grows in prominence in investor thinking due to continued resilient

performance.

Market Outlook

It is clear that we have entered 2022 in a period of uncertainty, as

geopolitical concerns weigh on the global economy. Whilst it appears we have

now passed the worst of the COVID-19 pandemic, the outbreak of conflict in

Ukraine in February 2022 has sent shockwaves throughout the world. Whilst the

conflict has not materially altered our outlook for UK real estate in 2022, new

considerations have emerged as a result. The initial impacts on UK commercial

real estate of the Russian invasion of Ukraine, and the subsequent sanctions

placed on the Russian economy, are expected to be negligible, primarily as a

result of Russian capital having little exposure to UK commercial real estate.

This should mean there is a limited impact on market liquidity and a low risk

of depressed asset values as a result. In fact, due to increased volatility in

other financial markets, UK real estate may benefit due to being viewed as a

'safe haven' investment destination.

However, the Ukraine conflict is likely to have wider consequences and the

position of UK real estate must be set in the context of the macroeconomic

environment. Prior to the outbreak of conflict, the year was already likely to

be dominated by concerns over inflation and subsequent changes to monetary

policy, and the conflict has skewed risks to the upside. The rate of inflation

reached 6.2% in February and is likely to continue to grow throughout the first

half of 2022, before peaking at around 8% as rising energy prices and supply

chain issues take hold.

We forecast that the UK CPI rate for 2022 will be roughly 6.2%, illustrating

that inflationary pressures are likely to moderate in the latter half of the

year, but remain significantly above the Bank of England's target rate. There

are also significant risks that inflation could remain higher for a more

prolonged period of time, particularly as the war in Ukraine, and sanction

measures on the Russian economy, impact on pricing in the energy sector and on

key raw materials. The high inflation environment is likely to have an effect

on households across the UK and we expect consumer sentiment and real wage

growth to suffer as a result; however, a build-up in household savings over the

course of the previous two years will help to cushion this impact. That said,

the distribution of these savings tends to be very heavily skewed towards high

income households, with increased pressure on low income households possibly

translating to weakening overall consumer consumption.

In response to these inflationary factors, the Bank of England increased the

base rate to 0.75% in March 2022 and is expected to continue tightening

monetary policy over the course of the year, with the base rate expected to

reach 1.25% by the end of 2022. The base rate is then expected to peak at 1.75%

in 2023, but there is an elevated risk that this could surprise the upside and

peak above 2.00%. Although low in a historical context, base rates and the feed

through to the bond market has the potential to act as a natural cap on any

further yield compression, particularly for the lower yielding areas of the

real estate market. Despite this, a healthy margin between bonds and real

estate will be maintained, and we believe investors will continue to view UK

real estate as an attractive investment destination, but will become more

selective when approaching investment decisions at both the sector and asset

level.

There are sectors which are more negatively exposed to the cost-push inflation

we are experiencing in the UK at present, in particular the retail sector,

given the increasing squeeze on household disposable incomes. There is also

evidence to suggest that material cost inflation in the UK is resulting in the

delay of some development projects. This could be viewed as negative, but for

some sectors this may be beneficial. In the industrial and logistics sector,

for example, national vacancy is approximately 3% and project delays are likely

to stifle any supply response, supporting continued rental growth.

In general, UK commercial real estate has a much looser link with inflation and

a much stronger correlation with economic growth. Although we are experiencing

elevated levels of inflation at present as a result of cost-push factors, we do

expect inflation to subside from April 2022 onwards, but remain significantly

above the target rate.

Prior to the Russian invasion of Ukraine, GDP growth was forecast to be closer

to 4.4% in 2022 but we now expect the rate of economic growth to slow to 3.8%

for the year. This leads to the possibility that we face an environment of

weakening economic growth at a time when inflation is running considerably

above target. Such an environment is likely to impact more heavily on,

particularly, the office and retail sectors as a result of depressed job growth

and falling disposable incomes.

As such, the bifurcation of the office sector is likely to become more

pronounced. Demand for prime assets should remain robust but weaken for

secondary accommodation. Those office assets not deemed to be "future fit" are

likely to see limited occupational and investor demand as ESG considerations

become ever more prominent in investor decision making. The industrial and

logistics market is anticipated to remain robust in 2022 but unlikely to match

the extremely strong performance achieved over the course of 2021. The prospect

of further yield compression, particularly on prime assets, is limited and

rental growth is expected to be the main driver of performance in this sector.

Demand continues to outstrip supply and, although there has been a pickup in

supply in the sector, increasing land values, a shortage of suitable

development sites, and increasing build costs mean there are no signs of a

correction in the short term.

We still expect the recovery in the retail sector to continue, primarily driven

by market factors rather than sector specific confidence. Demand will remain

focused on discount and food-led retail warehouse schemes whilst the

occupational market will continue to be heavily impacted by the

pandemic-induced change in consumer habits and the continued growth of

e-commerce. As discussed, the impact of inflation on household disposable

incomes is also likely to weigh heavily on the retail sector, and particularly

on discretionary-based retailers, throughout the course of 2022 and the

prospect of rental value growth remains remote. The alternatives sector will

build on strong transactional volumes achieved in 2021 and will grow more

prominent in investor focus. We expect the hotel sector to recover over the

course of 2022 as restrictions ease. The PBSA and Build-to-Rent residential

sectors should also continue their positive momentum.

Overall, we expect a positive year for UK real estate but the spread in

performance seen in 2021 is unlikely to be repeated and sector performance will

begin to converge in 2022, predominantly as a result of where we are in the UK

real estate cycle. Geopolitical events, inflationary and base rate pressures

are likely to weigh and, as a result, more care will be required when assessing

any investment decisions in the year ahead.

Portfolio Performance

During the reporting period the Company's portfolio delivered strong

outperformance against its benchmark with a total return of 21.4% versus 16.8%

for its MSCI benchmark, predominantly attributable to the Company's overweight

industrial position.

Since inception and over one, three and five years, the Company's portfolio has

also outperformed its MSCI benchmark.

The adjacent table sets out the components of these returns for the year to 31

December 2021 with all valuations undertaken by the Company's external valuer,

CBRE Limited.

Weighting Total Return Income Return Capital Growth

%

Fund % Benchmark UKCM % Benchmark UKCM % Benchmark

% % %

Industrial 63.4% 31.7 36.4 3.5 3.9 27.3 31.4

Office 14.3% -4.2 6.0 5.3 3.8 -9.0 2.1

Retail 12.1% 24.3 11.7 6.0 5.7 17.4 5.7

Alternatives 10.2% 3.2 8.4 3.0 4.1 0.1 4.2

Total 100% 21.4 16.8 4.0 4.3 16.8 12.0

Source: MSCI UK Balanced Portfolios Quarterly Property Index

MSCI calculation note: Multi-period capital growth and income return may not

sum perfectly to total return due to the cross

product that occurs as income is assumed to be reinvested on a monthly basis

and is subject to capital value change.

Total Capital Growth

16.8% UKCM

12.0% Benchmark

Industrial

A key driver of the portfolio's outperformance over the last 12 months was its

structural overweight position towards the industrial sector which was, again,

the strongest performing sector of the market, continuing a theme we have

witnessed as we have built up this portfolio over the last few years. The

portfolio has a 63% exposure to the industrial sector at the end of Q4 2021,

comparing favourably to 34% for the benchmark. The portfolio industrial

weighing has increased over the period from 58% at the end of Q4 2020.

The industrial assets delivered a strong performance of 31.7% over 2021 albeit

this was behind the benchmark return of 36.4%. This was primarily due to lower

capital growth in the portfolio than the benchmark.

The largest contributor to portfolio performance over the year was the Dolphin

Industrial Estate in Sunbury-on-Thames which delivered a total return of 40.8%

and saw capital growth of 36.5%. All of the top five assets by weighted

contribution to portfolio performance were industrial assets. In addition to

Dolphin Industrial Estate, the others were the multi-let industrial estate at

Ventura Park, Radlett, Hannah Close Neasden, which is let to Amazon, X Dock 377

at Magna Park, Lutterworth let to Armstrong Logistics and the Ocado

distribution unit in Hatfield.

Office

The Company's office portfolio had a disappointing year delivering a total

return of -4.2% compared to the benchmark return of 6.0%. Although the income

return was significantly ahead of the benchmark, this was offset by a capital

decline of 9.0%. Three of the largest detractors to the wider portfolio

performance were office buildings which reflects CBRE's prudent approach, as

our valuers, where income is at risk. This is particularly illustrated in the

performance of The White Building, a Grade A office in Reading, where a

significant proportion of income was potentially at risk due to tenant break

options and the capital value declined by 11% as the valuer penalised this

short income. In reality we have not seen the majority of break options

exercised and we would expect to see some of this capital loss recovered. The

other two assets within the bottom five performers in 2021 were 9 Colmore Row,

Birmingham and Central Square, Newcastle. Given the shift in occupier demands

which has been accelerated by the COVID-19 pandemic, all the office assets are

subject to a detailed review against strict criteria to ensure they are

future-proofed. Furthermore, there is an expectation that high-quality regional

office assets will benefit from changing working habits.

The Company sold Network House in Hemel Hempstead within the period. The asset

was not of sufficient quality to justify the necessary capital expenditure to

re-let it and once the tenant had vacated the asset was the largest void in the

portfolio. We disposed of the property for residential redevelopment, finishing

the year with a low exposure of 14% to the office sector, compared to 27% in

the benchmark.

Retail

Performance of the Company's retail portfolio, which made up 12% of the total

by value at the year end, significantly outperformed the benchmark delivering a

total return of 24.3% while the benchmark was 11.7%.

This reflects the composition of the Company's retail portfolio being bulky

goods and discount-led retail warehouses and supermarkets. These assets have

proven to be resilient during the COVID-19 pandemic and have attracted very

strong investor attention leading to yield compression.

The strong performance of the retail warehouse sector is reflected in the

returns generated at the Company's two retail parks held throughout the period

being Junction 27, Leeds and St George's Retail Park, Leicester, which

generated returns of 36.4% and 42.8% respectively. Both have been subject to

significant asset management and now have the attractive fundamentals investors

are focussed upon, namely strong locations, rents rebased to the current market

level and robust tenants fit for their catchment. These same characteristics

can be applied to the newly acquired Trafford Retail Park in Manchester which

saw an 11% capital uplift from purchase in September to 31 December 2021.

UKCM has no shopping centres and no pure high street retail exposure.

Alternatives

The Company's alternative sector assets delivered a positive total return of

3.2%. This was behind the benchmark return of 8.4% but showed a recovery from

the strongly negative returns of 2020 reflecting the stabilisation of the

sector and the reopening of the economy.

The alternatives portfolio is dominated by three cinema-anchored leisure

schemes - The Rotunda in Kingston, Cineworld in Glasgow and Regent Circus in

Swindon. These assets have been largely out of favour with investors but the

stabilisation of the sector has translated into improved rent collection rates

within the portfolio.

The Company's 10% weighting to the sector is forecast to increase with the

completion of two student housing schemes being developed in Exeter and

Edinburgh, which are both due to complete in time for the new academic term in

August 2022.

Investment Activity

The year saw strong activity in relation to transactions, selling out of risk

assets and recycling into accretive assets. Taking care to invest only in

compelling and accretive opportunities the majority of sales took place in the

first third of the year and, the majority of purchases occurred in the final

third. Four sales totalling £74m completed and five purchases completed,

committing a total of £216 million.

Sales

In February, Hartshead House, an office building let entirely to Capita on the

fringes of Sheffield City Centre, was sold to Arella Property Holding Limited

for £17 million in line with its valuation. The sale reflected our concerns

over the durability of the income stream as well as the potential for long-term

disruption in many parts of the office sector as a result of COVID-19.

The most significant disposal of the year was the sale in March of Kew Retail

Park in Richmond for £41 million to a leading London residential developer.

Securing an unconditional sale at this level represented an excellent exit

opportunity from the 4.7 acres the Company owned out of the complete 10-acre

Retail Park.

The Company's element comprised 61,765 sq ft of gross lettable area across five

units which were let at the time on short leases to a range of tenants

including Boots, Sports Direct, Gap and TK Maxx.

For some time, given its location and neighbouring residential use, despite any

formal planning consent, this asset had been valued with an eye to its

underlying residential conversion value and therefore provided a very low

income return. The Company would not undertake a development of this scale and

nature itself and therefore sought to maximise value through a sale to a

credible purchaser. The price agreed was marginally behind its latest valuation

at the time but well ahead of its value for retail warehouse use and at a

strong level in the context of the residential market.

Shortly after, in April, the Company sold its last pure high street retail

asset at 140-146 King's Road, London, for £9.9 million in line with its

valuation. Predominantly let to French Connection, a tenant that had

experienced issues in its performance which we believed were likely to increase

and, exacerbated by COVID-19, it presented significant risk of income

disruption. This, coupled with the potential for non-accretive capital

expenditure alongside our pessimistic outlook for the high street fashion

sector, led us to sell.

Finally, in September, Network House, Hemel Hempstead, a standalone and vacant

office pavilion, was sold for £6.3 million taking advantage of interest for

residential development and significantly reducing the Company's overall

vacancy rate.

Purchases

The five acquisitions completed over the year were varied by sector, income and

risk profile and show a blended net initial yield of 5.0%.

As reported last year, we exchanged on the purchase of a site in Edinburgh,

which completed in January, and entered into a development funding agreement to

create a 230-bed purpose built student accommodation scheme. The property is

very well-located for both Edinburgh and Napier Universities and is on track

for completion ahead of the 2022/2023 academic year.

At the end of September, we purchased Trafford Retail Park in Manchester for £

33 million at a net initial yield of 6.9%. It is strategically located, close

to the Trafford Centre and a motorway junction. The park is anchored by a

robust line up of food and discount anchored retailers and extends to 142,000

sq ft, providing good critical mass. It is let at rebased, sustainable rents

and is therefore well-placed for growth.

Through the funding of a development known as Sussex Junction, close to Gatwick

airport, the Company is creating three well-specified units totalling 107,000

sq ft with strong ESG credentials, adding to its heavy industrial exposure at

an attractive yield, compared to that of an up-and- let investment. Following

the pre-letting of two units to CGG Services, a global leader in geoscience

technology, the site was purchased in early November and the development is due

for completion in Q3 2022. When fully let, the investment is expected to yield

over 5.0%.

The £35 million purchase of an office on Hanger Lane, London completed at the

end of November. It is a 2.8-acre site prominently situated in an area

designated as a Strategic Industrial Location, close to Park Royal, one of

Europe's largest urban industrial areas. The medium term business plan is to

redevelop the site to create high quality industrial product but, in the

meantime, the Company benefits from a robust and growing income stream by

virtue of a 10-year lease of the existing 98,000 sq ft office building let to

Kantar, a global data consulting company. It currently yields 5.1% and is

subject to a five year rent review linked to CPI.

In December, we purchased a multi-faceted investment with a life sciences and

technology focus in Leamington Spa. It comprises two refurbished distribution

warehouses totalling 380,000 sq ft, let to The Secretary of State for the

Department of Health and Social Care and Iron Mountain plc. A 65,000 sq ft

refurbished office building is let to Tata Consulting Services Limited and a

global social network provider while the asset also comprises an oven-ready

development site with planning consent for 68,000 sq ft of flexible industrial

accommodation. The income-producing industrial and office properties are

delivering a net initial yield of 4.3% and the development of the new units is

underway, with an expected development yield of 4.8%.

Asset Management Activity

The reopening of the economy and return to strong growth has been reflected in

our rent collection rates which are approaching normalised pre-COVID-19 levels

and have improved on a quarter-by-quarter basis throughout the year.

A summary of rent collection for the year to 31 December 2021, as at 28

February 2022, is provided below and includes those tenants who have paid, by

agreement, on a monthly basis:

March 2021 95%

June 2021 96%

September 2021 98%

December 2021 98%

TOTAL 97%

Additionally, significant progress has been made on collecting arrears incurred

in previous quarters. Within last year's report and accounts up to 31 December

2020 we reported a rent collection rate of 83% for the year. This 2020 figure

has since increased to 94%. We continue to engage proactively with tenants

which have incurred rental arrears.

The average weighted unexpired lease term of the portfolio has decreased

slightly to 8.3 years compared to 9.0 years at 31 December 2020. This compares

to the benchmark unexpired term of 9.3 years. At 31st December 2021, 26% of

portfolio income was subject to either index linked rental uplifts or fixed

increases.

The following asset management activity, grouped by sector with percentage

occupancy shown as at 31 December 2021, represents a summary of noteworthy

transactions:

Industrial / Logistics Distribution - 97% occupied

Ventura Park, Radlett

A flurry of leasing activity in the first quarter of the year produced five

lettings which secured £2.45 million of annual rent in aggregate, 4.4% ahead of

the combined units Estimated Rental Value ("ERV"). In detail, Unit 7 and Unit B

have been let to an existing global occupier on the park on two year leases at

a rent of £1,234,000 per annum. Unit A, 34,502 sq ft, was let to GL Events at a

new rent of £373,000 per annum, secured for a five-year term certain with a

nine-month lease incentive given as reduced rent for a two-year period. Unit 6A

has been let to Stand & Deliver, a subsidiary company of an existing occupier,

Forward Trucking Services Limited, for a 10-year term certain at a rent of £

480,879 per annum. A lease incentive of 10 months' rent free was granted on

this 44,734 sq ft unit. Unit E has been let to Planners Services & Sundries on

a 10-year lease at a rent of £357,400 per annum.

In early summer, as part of its ongoing ESG initiatives, the Company welcomed

several hundred new tenants to the park in the form of bees. Two bee hives were

installed and in addition to their positive environmental impact, honey

produced will be sold to raise funds for charity.

Newton's Court, Dartford

In the first quarter a new five-year lease was agreed with MedDeX Solutions

Limited at Unit 2, Newton's Court, Dartford at a rent of £165,000 per annum, 2%

ahead of the ERV of the unit. And then in the final quarter of the year, a

letting of the 6,643 sq ft Unit 7 to Dartford & Gravesham NHS Trust Unit

completed. The NHS Trust committed to a 10-year term with a break option at

year five at a rent of £84,111 per annum.

Dolphin Trading Estate, Sunbury-on-Thames

Several significant deals completed in quarter four at Dolphin Industrial

Estate, the Company's multi-let industrial estate in Sunbury-on-Thames. Trans

Global Freight Management Limited let 10,000 sq ft at Unit A2 on a new 5-year

lease at a rent of £140,000 per annum, ahead of the unit's ERV. At the same

time Trans Global extended its existing lease over Units D1/2 (63,900 sq ft) on

a coterminous basis with Unit A2 securing an annual rent of £704,000 until the

new lease expiry in October 2026. The rent over Units D1/2 is subject to review

in June 2023.

Howard Tenens Limited extended its lease over the 49,000 sq ft Unit B on a new

10-year lease, subject to a break option in year five, ahead of ERV at a rent

of £628,702 per annum.

Unit C1 was re-let to Goldstar Heathrow following the insolvency of the

previous tenant. No void period occurred between the old and new tenant and

Goldstar have signed a 10-year lease, subject to a break option in Year 5, at a

rent of £306,733 per annum for the 21,000 sq ft unit.

Office - 98% occupied

9 Colmore Row, Birmingham

The Company has a relatively low exposure to the office sector. In the first

quarter, the completion of new cycle and shower facilities at this building

helped facilitate a new 10-year lease to be signed with Clarke Wilmott. The

lease covers the entire 4,222 sq ft 7th floor at a rate of £26.50 psf, with a

five year break option and a £150,000 landlord capital contribution to complete

fit out.

Network House, Hemel Hempstead

As mentioned under the section on sales, the successful disposal of the

Company's 68,300 sq ft vacant office in Hemel Hempstead, Network House, removed

what would otherwise have been a difficult vacancy allowing proceeds to be

productively reallocated.

Retail & Leisure - Retail 99% occupied / Leisure 98% occupied

Encouraging progress was made over the year on both the leisure and retail

elements of the portfolio. Focused on the first half of the year, but

continuing into the second, the Company had a string of successes securing new

tenants to its large-format leisure properties reflecting growing optimism of

sustained recovery in the sector. This momentum moved into the retail park

portion of the Company's portfolio in the second half of the year with multiple

accretive new lettings reflecting the positioning of assets primarily in

non-fashion and convenience-led segments of the market.

Regent Circus, Swindon

In the second quarter of the year a significant letting was secured to Boom

Battle Bars, a specialist operator in competitive socialising. The 15,000 sq ft

letting will see units 4, 5, 7 & 8 let on a new 15-year lease at an annual rent

of £150,000 per annum in line with the units' combined ERV. In addition, Unit 3

was let to DSM Holdings Limited t/a Korean BBQ on a new 15-year lease. The

restaurant extends to approximately 3,500 sq ft and the agreed rental equates

to an average rent of £45,000 per annum over the first five years of the lease.

Moving into the third quarter, Unit 1 was let to pizza restaurant Dough & Co on

a 15-year lease at an annual rent of £75,000 per annum ahead of the unit's ERV.

As a result of this significant leasing activity the asset was 99% let by the

final quarter of the year.

The Rotunda, Kingston upon Thames

In the second quarter the Company secured a new restaurant tenant for Unit 6 at

the Rotunda signing Aegon Limited, trading as Kung Fu, on a 10-year lease at a

base rent of £80,000 per annum, ahead of ERV, with a 10% turnover top up.

St George's Retail Park, Leicester

Next entered into a new five-year lease over Unit 3 in the third quarter

agreeing a turnover based rent which is expected to provide the Company with

approximately £150,000 of annual rent. The store, a Next clearance outlet, will

further improve the Park's tenant mix and is expected to drive footfall.

Two new 10-year leases were signed in the fourth quarter. The first, which is

subject to break options, was agreed to One Below, a discount retailer, over

unit 8A at a rent of £100,000 per annum, exceeding the unit's ERV by over 5%.

An Agreement for Lease was also exchanged over Unit 11 with Belron UK Limited,

trading as Autoglass, at a rent of £52,000 per annum, again in excess of the

unit's ERV.

Trafford Retail Park, Manchester

Shortly after purchase in September the Company completed a new 15-year lease

with fast food operator Five Guys over a former Carphone Warehouse unit at an

annual rent of £66,000 per annum. The restaurant will significantly enhance the

already strong F&B offering this asset provides.

Junction 27 Retail Park, Leeds

In the final quarter of the year a new 10-year lease was agreed with existing

tenant Currys Group Limited at a new rent of £806,440 per annum, more than 30%

ahead of ERV. Currys is a key anchor tenant at this property, as well as its

largest tenant by contracted rent, and its unbroken 10-year lease commitment

reflects the retail park's strength and its importance to this valuable anchor.

Environmental, Social and Governance (ESG)

Whilst real estate investment provides valuable economic benefits and returns

for investors it has - by its nature - the potential to affect environmental

and social outcomes, both positively and negatively. The Company adopts the

Investment Manager's expansive policy and approach to integrating ESG in all

areas of its investment process, and this has been used as the basis for

establishing the Company's ESG objectives. Both the Investment Manager and

Board view ESG as a fundamental part of their business.

Given the significance, and at times quite technical content of ESG and its

application, we have dedicated a separate section of our report to the topic

which follows. This covers our commitments and process in detail together with

some interesting practical examples of the application of our ESG principles.

Perhaps most significant is our response to climate change with our twin new

commitments to achieve Net Zero Carbon following work completed in 2021:

2030 - Achieve Net Zero Carbon across all portfolio emissions under the control

of the Company as landlord.

2040 - Achieve Net Zero Carbon across all portfolio emissions - both those

controlled by the Company as landlord and all the emissions of its tenants and

embodied carbon from development activity.

Further details of our Net Zero Carbon Strategy can be found on page 24.

It is also worth noting that Energy Performance Certificates (EPCs), which each

property receives, form a powerful regulatory stick by which government can

encourage the UK property industry to decarbonise. Draft legislation applying

to England and Wales indicates that by 2027 all property must have an EPC of

class A, B, or C and A or B by 2030. The legislation and rating scale in

Scotland is different and there are currently no similar minimum standards

based on EPC rating. Currently 75% of the Company's portfolio by ERV in England

(it does not own in Wales) attracts an A, B, or C rating and, whilst a good

figure today, it is one which we, and the Board, keep under constant review to

ensure we are on track to comply with the expected legislation. This statistic

is anticipated to grow through the completion of the Company's developments in

Exeter, Sussex Junction and Leamington Spa which are all being delivered

throughout 2022 and to a high energy-efficiency standard, as well as through

other ongoing refurbishment projects within the portfolio.

KEY STRATEGIC GOALS

PURCHASE DISPOSAL PROTECT & CREATE VALUE

- Use debt facility to - Exit risk assets - Grow income

purchase accretive assets - Potential to - Generate

- Target basket of profit-take through outperformance

assets with range of selected sales - Review quality of

investment characteristics office assets

and a variety of income and

risk profiles

- Lot size £30m-150m

EMBEDDED ESG STRATEGY

Portfolio Strategy

Following significant reshaping over the last few years, the Company has a high

conviction portfolio, heavily weighted to the industrial sector and underweight

to the retail sector, in particular shopping centres and traditional high

street, where the exposure is nil. Due to the extreme polarisation between the

sectors in recent years, this portfolio positioning has been very beneficial to

performance.

The bulk of the portfolio comprises a solid bedrock of assets with strong

fundamentals, durable income streams and a low risk profile. This affords us

the ability to purchase assets that have opportunities for the team to add

value through active management and development, to help drive superior

returns. The Company has available funds for further investment via its

low-cost Revolving Credit Facility and will target a basket of assets with a

range of income and risk profiles across sectors that are accretive and

complementary to the existing portfolio. We anticipate that purchases will be

opportunity led although they are likely to emerge from within the recovering

hotel sector, discount and food-led retail warehousing and best-in-class

offices.

Looking forward we expect the divergence in returns to narrow and, whilst we

intend to maintain a strong weighting to the industrial sector, the focus of

new investment will be in other areas of the market that are benefitting from

the structural changes seen in the economy and society. We do, however, expect

to continue to see polarisation within the sectors, much of which is being

accelerated by the COVID-19 pandemic. A recent example of this is the

considerable change in fortunes of retail warehousing, which saw significant

yield compression last year, although not uniformly across the sector. We are

attracted to those parks in strong locations with rebased rents, let to

convenience and discount-led retailers, most of whom were open during lockdowns

and are trading profitably, thereby delivering sustainable income streams.

Whilst the office sector is in a state of flux due to the changing ways in

which businesses occupy buildings, bringing uncertainty over the impact on the

various occupational markets, we see opportunity to invest in best-in-class

offices with strong ESG and wellness credentials, as well as good technological

capability. We believe that occupiers will be very discerning in their choice

of building and demand will be focused on a very narrow area of the market,

where high-quality product is scarce and the prospects for rental growth

strong. In light of these changes, the Company is also rigorously reviewing its

own office holdings to ensure they meet, or could economically meet, these high

standards. If they cannot, we are likely to exit them alongside the small

number of assets we consider pose risk to future performance or are at an

optimal point in their life cycle to crystallise profits.

Given the increased demand from both occupiers and investors for the biomedical

industry, which was further fuelled by the pandemic, we may seek to add to our

life sciences exposure where we can do so in a manner that is prudent and

accretive to the portfolio. We are seeing opportunities in the regions as well

as the leading markets of Oxford, Cambridge and London.

With UK real estate becoming more operational, we are keen to continue to

partner with reputable and experienced operators to widen the universe of

investments available to us in the alternative sector, particularly student

accommodation and hotels. In the operational space we can obtain enhanced

returns versus traditional leasing models and have taken exposure through our

student housing developments. We expect to grow this exposure in the short to

medium term.

In tandem with execution of our ESG strategy, the key priorities within the

current portfolio are to continue to grow income and to generate capital

outperformance. At the end of 2021 the portfolio had a void rate of only 2.1%

and so, in addition to letting the limited vacancy, the focus for income growth

is on capturing the reversionary potential of the portfolio and to target

future rental improvements.

This is particularly the case for the Company's industrial assets given that we

believe there is limited scope for further yield compression across the sector

in aggregate and that future returns will be driven by rental growth.

We believe the industrial sector is best placed in the current inflationary

environment as we have seen rental growth significantly outstrip inflation in

strong locations. Alongside this, 26% of the portfolio's income benefits from

index-linked or fixed rental increases.

There are several opportunities being explored across the portfolio where asset

management should drive outperformance, such as the development of the site

acquired within Precision Park, Leamington Spa, which has consent for 68,000 sq

ft of industrial space. At the end of the year the Company was also underway on

three developments - student housing projects in Edinburgh and Exeter, and an

industrial development at Sussex Junction, Bolney, south of Gatwick. We believe

that selective development of high-quality real estate, which is well placed in

its market, offers the opportunity for the Company to access best-in-class real

estate whilst offering returns in excess of those received from standing

investments. We will therefore continue to explore further such development

opportunities.

The Company has invested the majority of its available funds over the last year

and expects to utilise the remainder of its revolving bank facility to invest

in accretive assets. Gearing is amongst the lowest in the context of the

Company's peers. We believe that the Company's well-let portfolio of scale,

heavily weighted towards performing sectors, and with good share liquidity,

should have a broad reaching appeal and is well placed to continue delivering

strong performance with good potential for future earnings growth.

Will Fulton & Kerri Hunter

abrdn

13 April 2022

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

Approach to ESG

The Company adopts the Investment Manager's policy and approach to integrating

ESG and this has been used as the basis for establishing the Company's ESG

objectives. The Investment Manager and Board view ESG as a fundamental part of

their business. Whilst real estate investment provides valuable economic

benefits and returns for investors it has - by its nature - the potential to

affect environmental and social outcomes, both positively and negatively.

The Investment Manager's approach is underpinned by the following three

over-arching principles:

- Transparency, Integrity and Reporting: being transparent in the ways in

which we communicate and discuss the strategy, approach and performance with

investors and stakeholders.

- Capability and Collaboration: drawing together and harnessing the

capabilities and insights of platforms, with those of our investment, supply

chain and industry partners.

- Investment Process and Asset Management: integrating ESG into

decision-making, governance, underwriting decisions and asset management

approach. This includes the identification and management of material ESG risks

and opportunities across the portfolio.

A key element of the Investment Manager's approach is the employment of its ESG

Impact Dial which is a proprietary research framework supporting investment

strategies and asset management. Four major themes have been identified and

provide the basis of the Dial - Environment & Climate, Governance & Engagement,

Demographics and Technology & Infrastructure. Together with the Dial's scoring

system, assessing each asset based on its ESG characteristics across 21

indicators, these provide a framework against which the Company can set its ESG

objectives and monitor progress over time, as well as guiding the assessment of

materiality.

Of particular focus is responding to climate change, both in terms of

resilience to climate impacts and in reducing emissions from the Company's

activities. The Company has recently announced its pathway to achieving Net

Zero Carbon following work completed in 2021:

- 2030: achieve Net Zero Carbon across all portfolio landlord emissions

(Scope 1 & 2)

- 2040: achieve Net Zero Carbon across all portfolio emissions (Scope 1, 2 &

3).

Scopes 1 and 2 cover emissions that directly result from the landlord's

activities where there is operational control, either through the purchase and

consumption of energy or refrigerant losses. Scope 3 emissions are those that

occur in our supply chains and downstream leased assets (tenant spaces) over

which we have a degree of influence but limited control.

The Company's strategy for achieving Net Zero Carbon is fully detailed under

the heading, Net Zero Carbon - Energy efficiency and decarbonisation, on page

24.

THEME COMMITMENT CURRENT STATUS NEXT STEPS

Carbon reduction and Net Zero Carbon Carbon baseline Fully embed Net Zero

energy efficiency established. Target Carbon across asset

Net Zero Carbon in management,

2030 for landlord acquisition and

emissions and development/

2040 for all refurbishment

portfolio emissions. processes.

Improve tenant 25% data coverage in Seek to increase to

energy data coverage 2021 at least 50% in 2022

through targeted

engagement with key

occupiers and 'smart

meter' roll out.

Maximise solar Numerous feasibility Deliver on Company

PV capacity studies and surveys projects and

completed and key continue

target assets dialogue with

identified. tenants for occupied

Renewables included buildings.

within

refurbishments

and development

projects where

feasible.

EPC legislation - Detailed portfolio Make asset-level

plan for minimum review has been interventions at

B rating by 2030 completed appropriate lease

and every asset has events.

a plotted course to

compliance.

Resilience and Undertake scenario Study of all Review asset-level

physical analysis to better standing assets results in detail

climate risk understand future completed Q1 22 to and

risk establish value at define appropriate

risk under RCP8.5 next steps to

climate scenario. improve

climate resilience.

Land and water Maintain low The environmental Continue to review

contamination contamination risk status of properties environmental

is information as part

reviewed as part of of acquisition due

acquisition. Due diligence.

diligence and

records are

maintained on

current portfolio.

Value to society Implement house Work is in progress Review results and

methodology and to test and refine define actions to

report our improve social value

on progress by June methodology for generated by the

2022 social value based portfolio.

on the

ESG Impact Dial. We

now expect results

to be

available by H2

2022.

ESG Commitments

Within the Company's 'Dialling up the Integration of ESG' paper published in

2020 a number of key commitments were outlined. These fall under four broad

themes which form the basis for our actions at portfolio level. The four themes

are:

- Carbon reduction and energy efficiency

- Reliance and physical climate risk

- Land and water contamination

- Value to society

The preceding table presents an update on progress against these commitments

and ongoing activities.