TIDMTW.

RNS Number : 6119X

Taylor Wimpey PLC

27 April 2023

27 April 2023

Taylor Wimpey plc

Trading statement for the period covering 1 January 2023 to

today

Signs of improving customer confidence, full year 2023 guidance

reiterated

Taylor Wimpey plc is holding its Annual General Meeting (AGM)

today at 10:30am at the Crowne Plaza Hotel in Gerrards Cross, where

the following comments will be made regarding current trading,

financial performance, and outlook for the financial year.

Jennie Daly, Chief Executive, commented:

"We have seen continued recovery in demand from the low levels

experienced towards the end of 2022, supported by good mortgage

availability, and have seen an incremental improvement in sales

rate as the Spring selling season has progressed. While we remain

cautious of continued macroeconomic uncertainty, Taylor Wimpey is a

strong and agile business differentiated by our high-quality

landbank and experienced teams who have a sharp focus on

operational discipline."

"On behalf of the wider management team, I would like to also

take this opportunity to thank Irene Dorner who today steps down as

Chair. We look forward to welcoming Robert Noel into the role, who

brings with him more than 30 years' experience in the property

sector."

UK current trading

As the seasonally strong Spring selling season has progressed,

we have seen an increase in the overall year to date sales rate

compared to that announced on 2 March and pricing has remained

resilient.

Whilst challenges remain for our customers, particularly first

time buyers, targeted marketing spend has enabled us to maintain

customer interest at healthy levels. There is a continued

commitment by mortgage providers to lend with good levels of

product availability and with rates reduced from the highs of Q4

2022. We continue to focus on addressing the needs of our

customers, evolving our offering and prioritising improvements in

customer service leveraging our customer relationship management

system.

Our net private sales rate for the year to 23 April 2023 was

0.75 (2022: 0.97), with a cancellation rate of 15% (2022: 14%).

Sales in the period include planned bulk deals and, excluding bulk

deals, our net private sales rate for the year to 23 April 2023 was

0.66. As at 23 April 2023, our total order book value stood at

GBP2,379 million (2022: GBP3,027 million). This represents 8,576

homes (2022: 11,119 homes).

Prevailing annualised build cost inflation remains high but is

beginning to moderate from the 9-10% we reported in March, a trend

we expect to continue as the year progresses.

High-quality landbank

Our high-quality landbank continues to be a differentiator. At

the end of March 2023, our short term landbank stood at c.86k plots

(2022: c.87k plots) and our strategic land pipeline stood at c.140k

potential plots (2022: c.145k plots).

We remain highly selective in our land additions. As a result,

in the year to date we have approved fewer than 500 new plots, but

we remain agile and active in reviewing opportunities.

The planning backdrop remains difficult, as we have previously

noted, with a lack of resource and well-known bottlenecks at

various stages in the planning process.

Against this backdrop our strategic pipeline is an important

benefit, and we have made good progress with the conversion of c.5k

plots in the period.

Proactive actions through changing market conditions

We continue to focus on operational discipline having tightened

all areas of our operations with strict work in progress control,

restricted discretionary spend and significantly reduced

landbuying.

We completed our consultation (announced in January) on a series

of business changes, delivering annualised cost savings of GBP19

million, with the cost to achieve these GBP8 million in 2023. These

changes will not affect our existing market coverage, ability to

provide high-quality product and service to our customers or

ability to take advantage of market opportunities should they

emerge.

Dividend

As previously announced, we intend to pay a 2022 final ordinary

dividend of 4.78 pence per share on 12 May 2023 (2021 final

dividend: 4.44 pence per share), subject to shareholder approval at

today's AGM, in line with our Ordinary Dividend Policy to return

c.7.5% of net assets annually, in two equal instalments.

Outlook

Although industry sales rates remain at lower levels than in

recent years, customer interest has continued to recover from the

weak conditions experienced in the final quarter of 2022. We

continue to expect 2023 completions to be in the range of 9,000 to

10,500, broadly equivalent to an annual net sales rate assumption

of 0.5 to 0.7, with completions more weighted to the second

half.

As outlined in the full year announcement, value over volume

remains our key priority, together with tight cost management and

WIP control. Our focus on building a strong order book will allow

us to optimise price going into 2024, and, as a result, not all

reservations taken between now and the end of September will be for

completion in 2023.

Looking ahead, while we remain mindful of wider macroeconomic

uncertainties, our business is well placed with a clear strategy

focused on operational excellence and delivering value from our

high-quality landbank.

Note:

2022 relates to the equivalent trading period, unless stated

-Ends-

For further information please contact:

Taylor Wimpey plc Tel: +44 (0) 1494 885656

Chris Carney, Group Finance Director

Debbie Archibald, Investor Relations

Andrew McGeary, Investor Relations

FGS Global TaylorWimpey@fgsglobal.com

Faeth Birch

Anjali Unnikrishnan

James Gray

Notes to editors:

Taylor Wimpey plc is a customer-focused residential developer,

operating at a local level from 22 regional businesses across the

UK. We also have operations in Spain.

For further information, please visit the Group's website:

www.taylorwimpey.co.uk/corporate

Follow us on Twitter via @TaylorWimpeyplc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIASAIRFIV

(END) Dow Jones Newswires

April 27, 2023 02:00 ET (06:00 GMT)

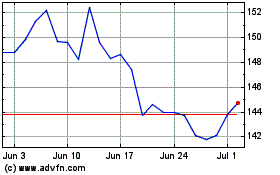

Taylor Wimpey (LSE:TW.)

Historical Stock Chart

From Oct 2024 to Oct 2024

Taylor Wimpey (LSE:TW.)

Historical Stock Chart

From Oct 2023 to Oct 2024