RNS Number:9855F

TriVest VCT PLC

03 December 2004

TRIVEST VCT PLC

Chairman's Statement

I am pleased to present the preliminary results of the Company for the year

ended 30 September 2004.

Net Asset Value

At 30 September 2004, the Company's Net Asset Value (NAV) per share had risen to

80.02 pence (2003: 72.56 pence), a rise of just over 10%. This is a particularly

pleasing and welcome outcome. The Company, including the proposed final dividend

of 1.25 pence per share detailed below, will have distributed accumulated

dividends of 5.45 pence per share since the Company's launch. This compares with

the initial NAV (after the launch expenses of the issue) of 94.5 pence per

share.

Economic Background

The environment in which venture capital managers have worked over the last six

months has not been easy. The widely anticipated economic recovery has not

really occurred and, where it has, it has been uncertain and rather weaker than

expected. Stock markets have been affected by the continuing worldwide security

issues and by the rise in the price of oil. The new issues market, an important

possible exit route for venture capital investments, after a high level of

activity in the first six months of 2004, is now much more selective.

Nevertheless, this difficult environment has thrown up several interesting new

investments for TriVest and the Board remains hopeful that the improvement in

the performance of the portfolio will continue in the short to medium term.

Portfolio

At present, VCF LLP trading as Foresight Venture Partners Limited (Foresight)

manage some 50% of the portfolio with Matrix Private Equity Partners (MPEP)

managing nearly 40% and Nova Capital Management Limited (Nova) the balance. By

market sector, the portfolio is dominated by investments in technology companies

at nearly 60%, with manufacturing companies at 14%, construction and building

materials at just over 11% and the balance in a variety of other sectors. When

the portfolio is considered by stage of development, the portfolio is more

evenly spread with over 41% invested in MBO / MBI situations, over 28% in

development capital companies, nearly 22% in early stage investments with over

8% of the portfolio being quoted (primarily in AIM stocks).

Within the MPEP portfolio the performance of HWA Limited (trading as Holloway

White Allom) has been notable. In April 2004, following strong trading, that

company redeemed TriVest's Preference Shares for over #1m together with a

Preference Dividend of over #28,000. The company continues to trade strongly. In

May 2004, The Hunter Rubber Company Limited, a recent investment by TriVest,

which is also trading well, acquired another company in a similar business. In

June 2004, TJ Brent was sold to May Gurney Limited, an East Anglian based

contracting business. TriVest's share of the proceeds was #2.1m. Two new

investments have been made with #1m being invested into OA Acquisition Limited

(trading as Original Additions), a distributor of false nails and eyelashes and

depilatory products, and with #750,000 being invested into Tottel Publishing

Limited, a publisher of legal and other specialist books (this latter investment

was made after the year end).

Nova continues to work hard to recapture and create value from the portfolio

they inherited. An additional investment of #220,000 was made into IDOX plc

(formerly i-documentsystems group plc). Zynergy Group Limited was placed into

liquidation and it is still not clear whether TriVest will receive any

recoveries.

The Foresight portfolio has seen an active period. In July 2004, a new

investment of #50,000 was made into Aigis Engineering Solutions Limited, a

manufacturer of protective products in the security industry. Additional

investments were made in May 2004 into Sarantel Limited of #52,000 and in

October 2003 and June 2004 into Broadreach Networks Limited (and its subsidiary

Broadreach Train Services Limited) totaling #1,000,000. Also in June 2004, loans

of over #50,000 were approved to Alaric Systems Limited. In September 2004,

further investments of #200,000 and #153,732 were agreed to be made into

SmartFOCUS Group plc (formerly SmartFOCUS Holdings Limited) and Sarantel Limited

respectively, the former of which was linked to an IPO. That company is now

listed on AIM. In addition, several of the investments within the Foresight

portfolio are expected to be possible IPO candidates within the next twelve

months.

Board of Directors

In my recent Interim Report, I referred to Helen Sinclair's decision to resign

from the Board due to a possible perceived conflict of interests. The Board

continues to seek a suitably qualified replacement. This is at a final stage. In

the meantime, Helen continues to provide her services to the Company as

previously agreed with her.

In September 2004, Christopher Moore was appointed Chairman of Oxonica Limited,

one of TriVest's investee companies.

Revenue Account

Total income received fell by #294,518. Net income has also fallen from #569,961

to #414,172, a fall of #155,789. This was mainly due to there being no income

from the higher income yielding Cazenove fixed-interest portfolio (#634,186

earned last year), which was liquidated during last year. The resulting funds

were moved into lower income-yielding OEIC money-market funds, which earned

#313,817 (2003: #167,914). The fall in income from funds pending investment was

partially offset by an increase in dividends and loan stock interest from

investments this year.

Fund management fees fell by #163,835, due to the fall in the percentage charged

from 2% to 1.6% of each Manager's portion of the portfolio.

Dividend

The Company's revenue return per Ordinary Share was 0.99 pence per share (2003:

1.37 pence per share). Your Board will be recommending a final dividend of 1.25

pence per Ordinary Share in respect of the year under review at the Annual

General Meeting to be held on 26 January 2005. The dividend will be paid on 4

February 2005 to shareholders on the Register on 7 January 2005.

Share buy-backs

During the year ended 30 September 2004, the Company continued to implement its

buy-back policy and, accordingly, bought back 467,282 Ordinary Shares

(representing 1.13% of the shares in issue at the period end) at a total cost of

#280,566 (net of expenses). These shares were subsequently cancelled by the

Company.

Colin Hook

Chairman

2 December 2004

STATEMENT OF TOTAL RETURN

(Incorporating the Revenue Account of the Company) for the year ended 30

September 2004

Year ended 30 September 2004 Year ended 30 September 2003

Revenue Capital Total Revenue Capital Total

# # # # # #

Unrealised losses on - 2,774,109 2,774,109 - (1,270,291) (1,270,291)

investments

Realised losses on investments - 666,281 666,281 - (261,901) (261,901)

Income 1,163,180 - 1,163,180 1,457,698 - 1,457,698

Investment management fees (152,171) (456,512) (608,683) (193,129) (579,389) (772,518)

Other expenses (441,468) - (441,468) (451,401) - (451,401)

------------ ------------ ------------ ------------ ------------ ------------

Return on ordinary

activities before taxation 569,541 2,983,878 3,553,419 813,168 (2,111,581) (1,298,413)

Tax on ordinary activities (155,369) 131,914 (23,455) (243,207) 182,120 (61,087)

------------ ------------ ------------ ------------ ------------ ------------

Return on ordinary

activities after taxation 414,172 3,115,792 3,529,964 569,961 (1,929,461) (1,359,500)

Dividend (515,996) - (515,996) (521,837) - (521,837)

------------ ------------ ------------ ------------ ------------ ------------

Transfer (from)/to reserves (101,824) 3,115,792 3,013,968 48,124 (1,929,461) (1,881,337)

------------ ------------ ------------ ------------ ------------ ------------

Return per Ordinary

Share - basic and diluted 0.99p 7.48p 8.47p 1.37p (4.63)p (3.26)p

All revenue and capital items in the above statement derive from continuing

operations.

No operations were acquired or discontinued in the period.

BALANCE SHEET

AS AT 30 SEPTEMBER 2004

as at 30 September 2004 as at 30 September 2003

# # # # # #

Fixed Assets

Investments 20,746,041 15,867,353

Current Assets

Debtors and prepayments 424,795 304,694

Current investments 7,926,941 6,750,709

Cash at bank 4,633,219 8,136,664

------------ ------------

12,984,955 15,192,067

Creditors: amounts falling

due within one year

Corporation tax 24,456 97,918

Other creditors 546,681 542,930

Accruals 128,131 126,346

------------ ------------

(699,268) (767,194)

Net current assets ------------ 12,285,687 ------------ 14,424,873

------------ ------------

Net assets 33,031,728 30,292,226

------------ ------------

Capital and reserves

Called up share capital 412,797 417,470

Capital redemption reserve 5,218 545

Special reserve 38,777,875 39,059,851

Capital reserve - realised (3,215,081) (3,267,224)

Capital reserve - unrealised (3,152,837) (6,223,996)

Revenue reserves 203,756 305,580

------------ ------------

Total equity shareholders' 33,031,728 30,292,226

funds

------------ ------------

Net asset value per

Ordinary Share - basic and 80.02p 72.56p

diluted

CASH FLOW STATEMENT

for the year ended 30 September 2004

Year ended Year ended

30 September 30 September

2004 2003

# # # #

Operating activities

Investment income received 912,272 1,634,004

Dividend income 115,857 81,892

Investment management

Fees paid (601,168) (717,189)

Other cash payments (415,146) (398,022)

------------ ------------

Net cash inflow from

operating activities 11,815 600,685

Taxation

UK Corporation tax paid (96,917) (232,355)

Financial investment

Acquisition of investments (4,589,395) (18,230,872)

Disposal of investments 3,151,097 30,825,561

-------------- --------------

(1,438,298) 12,594,689

Dividends

Payment of equity dividend (521,837) (731,009)

-------------- --------------

Cash (outflow)/inflow

before financing and

liquid resource

management (2,045,237) 12,232,010

Management of liquid

resources

(Increase) in monies held

pending investment (1,176,232) (4,099,551)

Financing

Purchase of own shares (281,976) (13,820)

-------------- --------------

(281,976) (13,820)

-------------- --------------

(Decrease)/increase in

cash for the year (3,503,445) 8,118,639

-------------- --------------

INVESTMENT PORTFOLIO SUMMARY

Cost Valuation Valuation

At at at % of

30 September 30 September 30 September portfolio

2004 2003 2004 by value

Foresight Venture Partners

Limited

Sarantel Limited 1,460,952 1,175,405 2,156,625 10.40%

Developer and manufacturer of

antennae for mobile phones

and other wireless devices

Oxonica Limited 1,677,389 900,033 1,677,389 8.08%

Specialist in the design, manipulation

and engineering of

properties of materials at the

nano-scale

ANT Limited

Provider of embedded browser/email 1,097,200 490,500 1,323,106 6.38%

software for consumer

electronics and Internet appliances

Broadreach Networks Limited 1,143,000 250,000 1,143,000 5.51%

Public access WLAN and fixed line

Internet Service Provider

- Broadreach Train Services Limited 107,000 n/a 107,000 0.52%

Camwood Limited 1,000,000 1,000,000 1,000,000 4.82%

Provider of software repackaging

Services

SmartFOCUS Group plc 500,000 500,000 893,333 4.31%

(formerly SmartFOCUS Holdings Limited)

Provider of analytic software to

support targeting and

execution of marketing campaigns

Aquasium Technology Limited 600,000 600,000 600,000 2.89%

Business engaged in the design,

manufacturing and marketing

of bespoke electron beam welding

and vacuum furnace equipment

Alaric Systems Limited 588,059 557,413 588,059 2.83%

Software developer and provider of

support services in the

credit/debit card authorisation and

payments market

Blue Curve Limited 500,000 396,666 396,666 1.91%

Provider of software for automating

the production and

distribution of research information

by banks and fund managers

DCG Datapoint Group Limited 250,000 n/a 250,000 1.21%

Design, supply and integration of data

storage solutions

Wire-e Limited 500,000 225,000 250,000 1.21%

Provider of mobile data

communication services

Monactive Limited 339,285 218,749 218,749 1.05%

Provider of software management

tools that monitor usage

of software versus licences held

Aigis Engineering Solutions

Limited 50,000 n/a 50,000 0.24%

Specialist blast containment materials

company

Other investments in the portfolio 250,000 Nil Nil 0.00%

Total 10,062,885 6,313,766 10,653,927 51.36%

Cost Valuation Valuation

At At At % of

30 September 30 September 30 September portfolio

2004 2003 2004 by value

Matrix Private Equity Partners

Limited

HWA Limited (trading as

Holloway White Allom Limited) 138,319 1,811,687 2,198,247 10.60%

Refurbishment, restoration and

construction of notable public

building and top-end residential

dwellings in and around London

Brookerpaks Limited 500,000 500,000 1,140,503 5.50%

Importer and distributor of garlic and

vacuum-packed vegetables to

supermarkets and the wholesale

trade

Image Source Group Limited 1,000,000 1,000,000 1,041,902 5.02%

Royalty free picture library

OA Acquisition Limited (Original

Additions) 1,000,000 n/a 1,000,000 4.82%

Manufacturer and distributor of

beauty products

Letraset Limited 1,000,000 1,098,050 967,367 4.66%

Manufacturer and worldwide

distributor of graphic art

products

Special Mail Services Limited 1,303,571 562,500 651,786 3.14%

Specialist, secure credit card

delivery business

The Hunter Rubber Company

Limited 500,000 n/a 500,000 2.41%

Manufacturer of Wellington boots,

safety footwear and diving suits

BBI Holdings plc 369,890 n/a 393,500 1.90%

Manufacturer of gold conjugate for

the medical diagnostics industry

BG Consulting Group Limited 1,000,000 1,000,000 125,000 0.60%

Technical training business

Inca Interiors Limited 350,000 300,000 100,000 0.48%

Design, supply and installation

of quality kitchens to house

developers

Other investments in the portfolio Nil 1,557,950 Nil 0.00%

Total 7,161,780 7,830,187 8,118,305 39.13%

Cost Valuation Valuation

At At at % of

30 September 30 September 30 September portfolio

2004 2003 2004 by value

Nova Capital Management

Limited

I-DOX (formerly

i-documentsystems group plc) 737,625 458,333 764,000 3.68%

Provider of document storage

systems

Tikit Group plc 517,624 521,738 623,912 3.01%

Provider of consultancy, services and

software solutions for law firms

DriveTec (UK) Limited 500,000 417,750 408,570 1.97%

Developer of transmissions

technologies for applications

in the automotive, construction and

industrial sectors

Watkins Books Limited 500,000 112,500 112,500 0.54%

Supplier of books in alternative

sciences, health, philosophy

and related sectors

Biomer Technology Limited 50,000 50,000 50,000 0.24%

Developer of biomaterials for

medical devices

Stortext Group Limited 380,435 18,079 14,827 0.07%

Integrated outsourced document

storage business

Other investments in the portfolio 3,988,529 50,000 Nil 0.00%

Total 6,674,213 1,628,400 1,973,809 9.51%

Total 23,898,878 15,722,353 20,746,041 100.00%

Notes

1. The revenue column of the statement of total return is the

profit and loss account of the Company.

2. In accordance with the policy statement published under

"Management and Administration" in the Company's Prospectus dated 13 October

2000, the Directors have charged 75% of the investment management expenses to

capital reserve.

3. The basic revenue return per Ordinary Share is based on

the net revenue from ordinary activities after taxation of #414,172 (2003:

#569,961) and is based on 41,647,506 (2003: 41,754,219) Ordinary Shares, being

the weighted average number of Ordinary Shares in issue during the year.

4. The basic capital return per Ordinary Share is based on

net realised capital return of #3,115,792 (2003: loss #1,929,461) and on

41,647,506 (2003: 41,754,219) Ordinary Shares, being the weighted average number

of Ordinary Shares in issue during the year.

5. The financial information set out in these statements does

not constitute the Company's statutory accounts for the year ended 30 September

2004 but is derived from those accounts. Statutory accounts will be delivered

to the Registrar of Companies after the Annual General Meeting.

6. The Company proposes to pay a final dividend of 1.25p

(2003: 1.25p) per share on 4 February 2005 to all shareholders on the Register

on 7 January 2005.

7. The Annual General Meeting will be held at 11.00 am on 26

January 2005 at 1 Jermyn Street, London SW1Y 4UH.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UUGCWPUPCURW

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

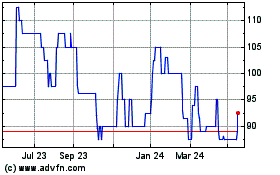

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024