AIM Schedule 1 - Trakm8 Holdings plc (9764P)

October 08 2013 - 4:49AM

UK Regulatory

TIDMTRAK

RNS Number : 9764P

AIM

08 October 2013

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

-------------------------------------------------------------------------------

COMPANY NAME:

-------------------------------------------------------------------------------

Trakm8 Holdings PLC ("Trakm8" or the "Company")

-------------------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

-------------------------------------------------------------------------------

Lydden House

Wincombe Business Park

Shaftesbury

Dorset

SP7 9QJ

-------------------------------------------------------------------------------

COUNTRY OF INCORPORATION:

-------------------------------------------------------------------------------

England and Wales

-------------------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

-------------------------------------------------------------------------------

www.trakm8.com/investors

-------------------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

-------------------------------------------------------------------------------

Trakm8 Holdings plc is a Shaftesbury, Dorset based provider

of fleet management solutions. Trakm8 has its main operations

in the UK and its subsidiaries (the "Group") distribute their

hardware and software internationally through a network of

distributors. In addition the Group provides vehicle monitoring

and tracking services direct to the B2B market. Trakm8's products

allow vehicles and drivers to be monitored, allowing organisations

to manage deliveries and services, or track stolen vehicles

and plant equipment. Over the past 10 years Trakm8 has sold

in excess of 175,000 units worldwide. Trakm8 has been extending

its range of fleet management solutions beyond the Swift tracking

product into fuel saving, such as its driver behaviour package

"eco(N) ", and also logistics routing, scheduling and tachograph

data integration. These solutions generate recurring revenue.

Trakm8 has conditionally agreed to purchase the entire issued

share capital of BOX Telematics Limited ("BOX") for an initial

cash consideration of GBP3.5 million (the "Acquisition"). Following

Admission, the Company will also procure the repayment by BOX

of a director's loan of GBP750,000. The Acquisition constitutes

a reverse takeover under AIM Rule 14 and accordingly, Trakm8

will be seeking readmission of its shares to trading on the

AIM Market of the London Stock Exchange.

BOX, a vehicle telematics business, was founded in 1989 and

began to focus on vehicle telematics in 2000. It has since

become one of the leading providers of fleet management systems

in the UK. BOX provides in-house telematics design, manufacturing,

and services and has delivered OEM telematic solutions for

several blue-chip clients. In addition BOX provides non-telematic

third party contract manufacturing services.

BOX's products include BOXoptions, a customisable range of

end-to-end telematic and vehicle tracking solutions; BOXtracker

INSIGHT and BOXtrackerEco, vehicle tracking solutions; BOXsolo,

a water resistant tracking device; iSpot, a smartphone based

GPS tracker; and SpotOn, a data collection system.

-------------------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

-------------------------------------------------------------------------------

28,823,821 ordinary shares of 1p each ("Ordinary Shares").

370,000 Ordinary Shares in treasury.

-------------------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED

MARKET CAPITALISATION ON ADMISSION:

-------------------------------------------------------------------------------

The Company is raising GBP2,069,999.80 upon Admission by the

issue of new Ordinary Shares at a price of 22p per Ordinary

Share (the "Issue Price"). Anticipated market capitalisation

of the Company at the Issue Price is GBP6.3m.

-------------------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

-------------------------------------------------------------------------------

55.7%

-------------------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM COMPANY HAS APPLIED OR AGREED TO HAVE ANY OF ITS SECURITIES

(INCLUDING ITS AIM SECURITIES) ADMITTED OR TRADED:

-------------------------------------------------------------------------------

None.

-------------------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

-------------------------------------------------------------------------------

John Ferris Watkins - Executive Chairman

James Killingworth Hedges - Finance Director

Keith Evans - Non Executive Director

Madeline Joanna Cowley - Chief Technical Officer

Timothy Adam Cowley - Engineering Director

Paul Wilson - Sales Director

-------------------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

-------------------------------------------------------------------------------

Name Percentage Percentage

of issued of issued

share capital share capital

before Admission after Admission

John Ferris Watkins 23.6 22.2

Edric Property & Investment Company

/ Edmund and Richard Clarke 11.6 11.7

Timothy Adam Cowley 7.9 6.6

Hargreave Hale Limited - 7.6

James Killingworth Hedges 7.6 7.5

Madeline Joanna Cowley 6.5 5.4

Miton Capital Partners LTD - 4.1

Barclayshare Nominees 4.0 2.7

Dawson Buck 3.3 2.2

HSDL Nominees Limited 3.2 2.2

L R Nominees Limited 3.0 2.0

-------------------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

-------------------------------------------------------------------------------

There are no such persons.

-------------------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

-------------------------------------------------------------------------------

(i) 31 March

(ii) In relation to Trakm8: 31 March 2013. In relation to BOX:

30 June 2013

(iii) 31 December 2013 (six month unaudited results to 30 September

2013); 30 September 2014 (12 month audited full year accounts

to 31 March 2014); 31 December 2014 (six month unaudited accounts

to 30 September 2014).

-------------------------------------------------------------------------------

EXPECTED ADMISSION DATE:

-------------------------------------------------------------------------------

25 October 2013

-------------------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

-------------------------------------------------------------------------------

finnCap Ltd

60 New Broad Street

London

EC2M 1JJ

-------------------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

-------------------------------------------------------------------------------

finnCap Ltd

60 New Broad Street

London

EC2M 1JJ

-------------------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

-------------------------------------------------------------------------------

www.trakm8.com/investors

The Admission Document will contain full details about the

Company and the admission of its securities.

-------------------------------------------------------------------------------

DATE OF NOTIFICATION:

-------------------------------------------------------------------------------

8 October 2013

-------------------------------------------------------------------------------

NEW/ UPDATE:

-------------------------------------------------------------------------------

New

-------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

PAAVVLBBXBFZFBV

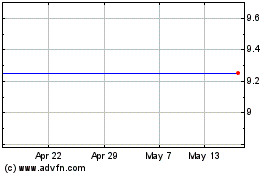

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Jun 2024 to Jul 2024

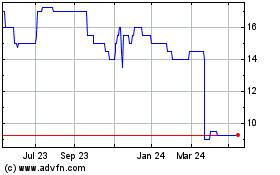

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Jul 2023 to Jul 2024