St James House PLC Trading Statement (8122D)

October 30 2020 - 10:30AM

UK Regulatory

TIDMSJH

RNS Number : 8122D

St James House PLC

30 October 2020

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

30 October 2020

ST. JAMES HOUSE PLC

("SJH", the "Group" or the "Company")

Trading Update

The Board of Directors of the Company (the "Board") is pleased

to provide the following trading statement and update on recent

developments.

Trading Update

Payments Division

The payments division, having rolled out multicurrency accounts,

has seen improvements in sales through September and October. After

the relatively quiet month of August, September saw an increase in

Euro handle of 29%, however GBP handle was down 37%. There was

however a significant increase in October as clients adopted the

new services seeing a month-on-month increase in Euro handle of

304% and an increase in GBP of 487%.

Feedback from these early adopters of the new service is very

encouraging, with new account openings being turned around in two

days for companies and under a day for individuals. Once an account

is open, further currency accounts for that client take just a few

minutes to configure and push live. A targeted sales and marketing

campaign will launch in November supported by a dedicated client

onboarding team ensuring fast turnaround of applications for

individual and business applicants.

Growth in Prepaid Card Products has improved from the 2% growth

previously reported in August, and similar levels in September,

with growth rising to 19% in October. Two managed card programmes

have placed further orders for card stock in October which are

estimated will translate to a 200% increase in active cards over

the coming months. Average daily spending levels, which decreased

significantly in August, have recovered to the prior levels through

September and October.

The merchant services team has now completed the deployment of a

new gateway which gives access to 25 acquiring banks, the major

ecommerce checkout/shopping carts, and the major alternative

payment methods including PayPal, Amazon Pay, Apple Pay, Android

Pay and Google Pay. The new system is also integrated into a range

of EPOS systems meaning that we can service any type of merchant in

virtually any market. The impact of COVID-19 continues to disrupt

visits to potential merchants, an important part of the sales cycle

however the company has also deployed an online application and

verification process reducing the need for face to face meetings in

order to verify the business activities of merchants.

Lottery Business

Prize Provision Services ("PPS") continues to see stability in

the number of weekly entries into the lotteries it administers,

despite ongoing COVID-19 restrictions. The 19 October 2020 draw saw

another lucky lottery player scoop the GBP25,000 jackpot. The Safe

Haven for Donkeys supporter was the second player to win the

jackpot in six weeks, following a Kirkby Lonsdale RUFC supporter's

win on the 7 September.

The second win offers PPS a further opportunity to extol the

virtues of lotteries to players and societies alike. As the jackpot

is insured, the pay outs do not affect the profitability of

PPS.

Claims Management Business

The claims management business, St Francis House Ltd ("St

Francis"), is fully operational and is managing some 130 cases with

a work in progress value of approximately GBP300,000, and 15-20

cases being added weekly since the Company's previous trading

statement (23 September 2020). St Francis has seen early cases

already reaching settlement phase and the Board expects it to

deliver positive cashflow from November.

Group

As announced on 27 October 2020, the Board confirms that the

Company's ordinary shares of 1 pence each will be suspended from

trading on the AIM market of the London Stock Exchange ("AIM") with

effect from 0730 on 2 November 2020 (the "Suspension"). The Company

continues to work diligently with its auditors to complete its

annual report and accounts for the year to 31 January 2020, and

currently expects to complete this process during November;

following their publication the Board will seek a lifting of the

Suspension.

Graeme Paton, Chief Executive, commented, "The uptake of the new

named multi-currency accounts is extremely encouraging, as is the

progress made by the Claims Management team in Liverpool who have

hit the ground running and are making a positive impact on the

Group's overall performance with predicable, measurable and

scalable positive income that the Group requires. The company is

well placed now for future growth with two jackpot winners showing

that even the smallest of societies can benefit and offer

attractive jackpots for lottery members, new banking and FX

products which are proving popular with customers and, importantly,

a valuable new steady income stream in the claims management

business."

For further information, contact:

St. James House PLC

Roger Matthews

Website www.sjhplc.com 020 3655 5000

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZBLFXBBLBFBV

(END) Dow Jones Newswires

October 30, 2020 10:30 ET (14:30 GMT)

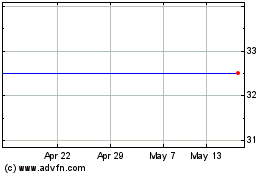

Tintra (LSE:TNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

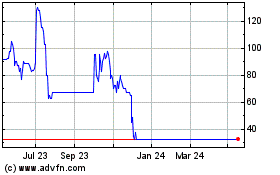

Tintra (LSE:TNT)

Historical Stock Chart

From Nov 2023 to Nov 2024