St James House PLC Trading Update (0785J)

April 07 2020 - 8:00AM

UK Regulatory

TIDMSJH

RNS Number : 0785J

St James House PLC

07 April 2020

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

7 April 2020

ST. JAMES HOUSE PLC

("SJH", the "Group" or the "Company")

Trading Update

The Board of Directors of the Company (the "Board") is pleased

to provide the following trading statement and update on recent

developments.

Payments Division

The payments division continues to make progress in all areas,

but particularly in non-card payments. EURO IBAN account openings

have increased a further 12% in the two week period to 3 April 2020

and growth of GBP accounts was in excess of 20%, in the same

period; again the Board will be able to present more meaningful

data as growth patterns emerge in the coming months. Transaction

volumes continue to steadily increase across our non-card payment

services in line with account opening growth.

In card payment services, in the last fourteen days, we have

added one new card programme (where we manage a card programme for

a client on a white label basis) taking the total number of card

programmes to 19. Transaction volume continues to grow steadily;

however, we have seen a decrease in card activations despite

despatch, which seem to indicate a delay in postal services among

other things.

The merchant services team have continued the merchant approval

process with a broad pipeline of suitable candidates having applied

for services from a range of medium to high-risk industries.

Due to the nature of the business of the Payments Division and

the way it operates, COVID-19 is to date having a minimal impact on

its operations.

Lottery Business

The operations of Prize Provision Services Ltd ("PPS") have been

largely unaffected by the COVID-19 pandemic with all External

Lottery Management activity taking place as normal. Whilst it is

too early to identify any trends on the number of entries into the

lotteries which PPS administers, the overall impact is currently

expected to be low. Positively, lotteries themselves are being

shown to be an excellent method of fundraising during the crisis

thanks to the reliable nature of a subscription fundraising

model.

The overall number of lines played during March 2020 was

approximately 24% higher than during March 2019.

Group

Working capital remains constrained and an area of focus,

however the Board believes the improving operating performance will

alleviate the position gradually. The completion of the

subscription for new shares and capitalisation of existing

liabilities (as announced on 31 January 2020), will assist

substantially with the working capital position, and the Board is

confident that the revised completion date of 30 April 2020 (as

announced on 24 March 2020) will be achieved.

A detailed reply has been sent by the Company's legal adviser to

a letter before action from lawyers acting for a third party

claiming an historic equity share in Market Access Limited

(formerly A N Other Ops Limited, whose acquisition was announced on

23 May 2019). SJH strongly denies the claims and has provided

notice of its intention not only to defend any proceedings but also

to counterclaim for large sums which it believes are owed by the

Claimant to Market Access Limited.

Operations at Astro Kings, the joint venture 5-a-side football

centre located in Nottingham, remain suspended. The facility will

remain closed until the restrictions are lifted under the

Government's requirement for all outdoor recreation facilities to

close. During the closure, Astro Kings will apply for the

appropriate COVID-19 support from the Government. Astro Kings does

not and will not have a material financial impact on the

Company.

Chief Executive Graeme Paton commented, "Despite these unusual

times, progress on our plan of delivering full-service,

banking-style capabilities continues. We have seen some minor

impact due to the current COVID-19 outbreak and the consequences of

the restrictions we all have to abide with the closure of Astro

Kings five a side football centre, but to date there is no material

impact on the core payment and lottery businesses. The Board will

continue to monitor the situation and update shareholders as

necessary."

For further information, contact:

St. James House PLC

Roger Matthews

Website www.sjhplc.com 020 3655 5000

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSSSFFWESSELL

(END) Dow Jones Newswires

April 07, 2020 08:00 ET (12:00 GMT)

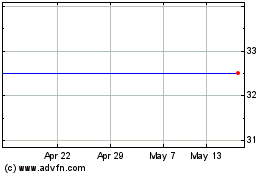

Tintra (LSE:TNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

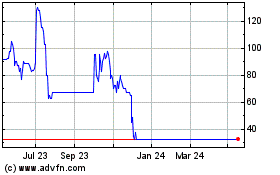

Tintra (LSE:TNT)

Historical Stock Chart

From Nov 2023 to Nov 2024