Target Healthcare REIT Limited Acquisition of care home at Sutton-in-Ashfield (0068P)

November 14 2016 - 2:00AM

UK Regulatory

TIDMTHRL

RNS Number : 0068P

Target Healthcare REIT Limited

14 November 2016

Target Healthcare REIT Limited

RNS Announcement

14 November 2016

Acquisition of care home at Sutton-in-Ashfield,

Nottinghamshire

Target Healthcare REIT Limited and its subsidiaries ("the

Group"), the only listed specialist investor in UK care homes, is

pleased to announce that it has exchanged contracts to acquire a

purpose-built care home located in the town of Sutton-in-Ashfield,

Nottinghamshire. The home will be acquired for approximately GBP5.6

million including acquisition costs. The transaction is expected to

conclude by April 2017 once the build has been completed and the

home has been fitted out to the Group and Operator's

specifications.

The home is being constructed to the highest standards and will

offer 66 bedrooms over three floors, all with en-suite wetrooms.

Air conditioning will be provided to all communal areas and all

floors will have large lounge / dining areas and quiet rooms. The

resident balconies on both the first and second floors together

with the landscaped gardens at ground floor level will enable all

residents to easily access secure outdoor space.

Upon completion, the property will be leased to Oakdale Care

Group ("Oakdale"), a newly established care home operator, and will

be subject to a 35-year lease with RPI-linked cap and collar.

Oakdale will become the Group's 16(th) tenant, thereby further

diversifying the Group's tenant base. The net initial yield on the

transaction is consistent with the overall average of the Group's

portfolio.

Kenneth MacKenzie, Managing Partner of Target Advisers LLP,

commented on the acquisition:

"We are very pleased to announce this exchange of contracts

which once again demonstrates our ongoing commitment to improving

the elderly care home offering by investing in new, purpose-built

homes. Once completed this high-quality home in a location of

strong demand will further complement our existing portfolio. This

transaction also demonstrates our willingness to support proven

management teams who evidence a strong care ethos.

The transaction brings our total funds committed since our May

2016 fundraise to c. GBP75 million. We continue to progress other

opportunities."

All enquiries:

Kenneth MacKenzie

Target Advisers LLP 01786 845 912

Martin Cassels

R&H Fund Services Limited 0131 550 3760

Fiona Harris / Sam Emery 020 7466 5058 / 020 7466

Quill PR 5056

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQFFIFDFFMSEEF

(END) Dow Jones Newswires

November 14, 2016 02:00 ET (07:00 GMT)

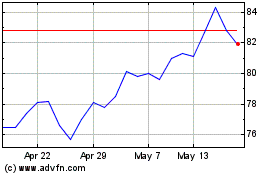

Target Healthcare Reit (LSE:THRL)

Historical Stock Chart

From Apr 2024 to May 2024

Target Healthcare Reit (LSE:THRL)

Historical Stock Chart

From May 2023 to May 2024