S & U PLC AGM Statement and Trading Update (4846O)

May 18 2018 - 2:00AM

UK Regulatory

TIDMSUS

RNS Number : 4846O

S & U PLC

18 May 2018

18 May 2018

S&U plc ("S&U" or "the Group")

AGM Statement and Trading Update

S&U, the motor finance and bridging lender, issues a trading

update for the period 1 February 2018 to 17 May 2018, prior to its

AGM being held today.

Trading at Advantage Finance, S&U's motor finance business,

remains strong following previous record expansion of both

customers and receivables. We continue to focus on debt quality

which will underpin the consistency and sustainability of

anticipated future profits. New loan transactions during the period

were at similar levels to last year's record performance.

Loan applications have reached record levels of over 80,000 per

month, of which c.25% are accepted and c.10% of acceptances are

transacted. The successful introduction of Advantage's paperless

Dealflo system has been well received by customers, improves

service and allows a greater focus on quality whilst maintaining

comparable volumes year-on-year. Advantage's net receivables book

has grown to GBP258m, which comprises over 56,000 customers, an

increase of 21% on last year.

Although rolling 12 months impairment to revenue has increased

slightly to 25.8% versus 24.6% at year-end, this is still

comfortably within the average for the previous ten years of 26.4%.

New customer quality and early repayment performance continues to

improve and we anticipate this will lead to a reduction in

impairment to revenue in due course. April's monthly collections

increased by 22% to GBP11.4m compared to the same month last

year.

Our bridging finance pilot, Aspen Bridging, continues to confirm

our confidence in its launch. Aspen's net receivables book has

increased to GBP14m from GBP11m at year-end, with early repayments

on track. Aspen's current profitability and growing reputation

amongst its broker partners bodes well for a successful future. We

look forward to updating the market with a full report on future

plans for Aspen in H2 2018.

Demand for the Group's products and the quality of our

businesses is reflected in a further GBP8.5m investment in the

first quarter, taking Group borrowing to GBP113.5m. An additional

GBP20m of banking facilities arranged in the period brought total

committed facilities to GBP135m and provides headroom for further

expansion.

Commenting on S&U's trading and outlook, Anthony Coombs,

S&U Chairman, said:

"Despite a slowing UK economy, the value used car and

residential markets in which we operate remain strong and

resilient. Our continuing focus on customer selection and excellent

service gives us great confidence for sustainable future

growth."

Enquiries:

S&U plc c/o Newgate Communications

Anthony Coombs

Newgate Communications

Bob Huxford, James

Ash,

Imogen Humphreys 020 7653 9848

Peel Hunt LLP

Adrian Trimmings, Rishi

Shah 020 7418 8900

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGMUBUVRWVAVAAR

(END) Dow Jones Newswires

May 18, 2018 02:00 ET (06:00 GMT)

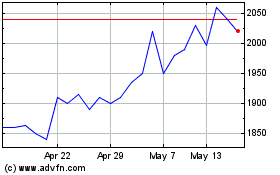

S & U (LSE:SUS)

Historical Stock Chart

From Apr 2024 to May 2024

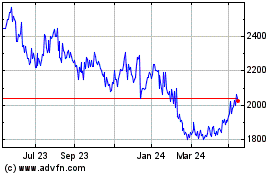

S & U (LSE:SUS)

Historical Stock Chart

From May 2023 to May 2024