TIDMSHOE

RNS Number : 0873B

Shoe Zone PLC

31 May 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 to the extent it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended by virtue of the European Union

(Withdrawal Agreement) Act 2020). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Shoe Zone plc

("Shoe Zone" or the "Company")

Share Buyback Programme

Shoe Zone announces that it intends to conduct a share buyback

programme of ordinary shares of GBP0.01 each in the capital of the

Company ("Ordinary Shares") up to a maximum aggregate consideration

of GBP2,250,000 ("Maximum Amount") (the "Buyback Programme").

The Company entered into an irrevocable and non-discretionary

arrangement with its broker, Zeus Capital Limited ("Zeus"), on 30

May 2023 to enable Zeus to conduct the Buyback Programme on its

behalf on a broker-managed basis, with trading decisions being

taken independently of the Company albeit subject to certain

limitations (including in respect of the maximum price payable per

Ordinary Share).

The Buyback Programme commences today and ends on 28 June 2023

or, if earlier, the date upon which the aggregate consideration

paid for Ordinary Shares reaches the Maximum Amount (the "Buyback

Period"). During the Buyback Period the Company has no power to

invoke any changes to the authority and any purchases will be

undertaken by Zeus, acting independently of, and uninfluenced by,

the Company.

The Buyback Programme is in accordance with the terms of the

Company's authority to make market purchases of its own Ordinary

Shares granted to it by shareholders on 9 March 2023 (the

"Authority"), including that the maximum price paid per Ordinary

Share shall not exceed the higher of: (a) 105 per cent. of the

average trading price of the Ordinary Shares as derived from the

middle market quotations for an Ordinary Share on the London Stock

Exchange Daily Official List for the five trading days immediately

preceding the date on which an Ordinary Share is contracted to be

purchased; and (b) the higher of the price of the last independent

trade and the highest current independent bid on the trading venue

where the purchase is carried out.

Any Ordinary Shares acquired as a result of the Buyback

Programme will be initially held in treasury and then cancelled

periodically.

Due to the limited liquidity in the issued Ordinary Shares, the

purchase by the Company of Ordinary Shares pursuant to the

Authority on any trading day is likely to represent a significant

proportion of the daily trading volume in the Ordinary Shares on

AIM and is likely to exceed 25 per cent. of the average daily

trading volume, being the limit laid down in Article 5(1) of

Regulation (EU) No 596/2014 (to the extent it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended by virtue of the European Union

(Withdrawal Agreement) Act 2020)) and, accordingly, the Company

will not benefit from the exemption contained in such Article.

No Ordinary Shares will be sold by any member of the Board or

their connected parties (including, in particular, by or on behalf

of Slawston Investments Limited ("SIL") or Sheepy Magna Investments

Limited ("SMIL"), being companies connected with Anthony Smith and

Charles Smith respectively) as part of the Buyback Programme.

SIL and SMIL, in aggregate, are interested in over 50 per cent.

of the total issued Ordinary Shares (with SIL being interested in

approximately 31.6 per cent. and SMIL being interested in

approximately 25.3 per cent. of the total issued Ordinary Shares

(excluding Ordinary Shares held in treasury) as at the date of this

announcement). However, as announced on 29 July 2022, the Panel has

previously confirmed that, pursuant to Note 1 of Rule 37.1 of the

Takeover Code, SIL did not, and neither SIL nor SMIL will, incur an

obligation to make a mandatory offer pursuant to Rule 9 of the

Takeover Code should either of their respective interests in the

Company exceed 30 per cent. of the total issued Ordinary Shares or

increase above 30 per cent. of the total issued Ordinary Shares (as

applicable), in each case as a result of any share purchases

conducted through a share buyback programme.

The Company will make further announcements in due course

following any share purchases conducted through the Buyback

Programme.

The Company confirms that it currently has no unpublished price

sensitive information.

For further information please call:

Shoe Zone PLC Tel: +44 (0) 116 222 3000

Anthony Smith (Chief Executive)

Terry Boot (Finance Director)

Zeus (Nominated Adviser and Broker) Tel: +44 (0) 203 829

5000

David Foreman, James Hornigold, Ed Beddows (Investment

Banking)

Dominic King (Corporate Broking)

About Shoe Zone

Shoe Zone is a Town Centre, Retail Park and Digital footwear

retailer, offering low price and high quality footwear for the

whole family.

Shoe Zone operates from a portfolio of 330 stores and has

approximately 2,450 employees across the UK.

The store portfolio consists of 216 original high street stores

containing the core Shoe Zone product range and 70 hybrid high

street stores and 44 Big Box, larger retail park stores which also

have additional brands such as Skechers, Hush Puppies and

Kickers.

Shoezone.com, combined with the store network, ensures a full

multi-channel offering for great customer service.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSBIGDUSBXDGXG

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

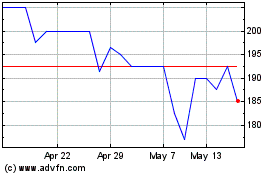

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Dec 2023 to Dec 2024