TIDMSHOE

RNS Number : 4765Z

Shoe Zone PLC

16 May 2023

Shoe Zone PLC

("Shoe Zone" or the "Company")

Interim results for the 26 weeks to 1 April 2023

Shoe Zone PLC is pleased to announce its interim results for the

26 weeks to 1 April 2023, (the "Period").

Financial highlights

-- Revenue of GBP75.4m (2022 H1: GBP69.9m) +7.9%

o Store revenue GBP61.1m (2022 H1: GBP57.2m) +6.8%

o Digital revenue GBP14.3m (2022 H1: GBP12.7m) +12.7%

-- Contribution of GBP11.1m (2022 H1: GBP11.6m)

o Store contribution of GBP7.9m

o Digital contribution of GBP3.2m

-- Profit before tax of GBP1.5m (2022 H1: GBP3.1m)

-- Adjusted profit before tax of GBP2.5m (2022 H1: GBP3.1m)*

-- Earnings per share of 3.1p (2022 H1: 5.7p )

-- Net cash of GBP12.9m (2022 H1: GBP13.9m) at Period end

-- Proposed interim dividend of 2.5 pence per share (2022 H1: 2.5 pence)

Operational highlights

-- 336 stores at Period end (2022 FY: 360) comprising:

o 44 Big Box (2022 FY: 45)

o 66 Hybrid (2022 FY: 44)

o 226 Original (2022 FY: 271)

-- 17 stores opened, 6 refits, 41 closed

-- Capital expenditure of GBP5.3m (2022 H1: GBP2.3m)

-- Annualised lease renewal savings of GBP0.4m, an average reduction of 27%

-- Average lease length of 2.1 years (2022 FY: 1.8 years)

-- Digital returns rate of 11.9% (2022 H1: 11.8%) - 12 months average

* Adjusted items 2023 H1 GBP1.3m forex loss offset by GBP0.3m

profit on sale of freehold. (2022 H1: Forex loss GBP0.3m, property

gain GBP0.3m)

For further information please call:

Shoe Zone PLC Tel: +44 (0) 116 222 3001

Anthony Smith (Chief Executive)

Terry Boot (Finance Director)

Zeus (Nominated Adviser and Broker) Tel: +44 (0) 203 829

5000

David Foreman, James Hornigold, Ed Beddows (Investment

Banking)

Dominic King (Corporate Broking)

Chief Executive's statement

Introduction

Shoe Zone delivered a robust and positive performance in the

Period against a backdrop of consumer uncertainty and macroeconomic

volatility. Total revenues increased by 7.9% having traded out of

52 fewer stores compared to 12 months ago and digital revenue

within this increased by 12.7%. The performance further

demonstrates the resilience of our business and the success of our

ongoing strategy.

Trading over all channels was positive with total revenues of

GBP75.4m (2022 H1: GBP69.9m), store revenues were GBP61.1m (2022

H1: GBP57.2m), Digital revenues were GBP14.3m (2022 H1: GBP12.7m)

with strong performance across all online channels with additional

growth from our online exclusive range and range extensions.

Adjusted profit before tax was GBP2.5m (2022 H1: GBP3.1m), which

is slightly above management expectations for the Period. The

reduction on the comparable period last year is due to inflationary

cost increases, mainly National Living Wage increases.

We ended the Period trading out of 336 stores, which is a

reduction of 52 compared to 12 months ago and 24 from last year

end. In the first half we closed 39 'Original' stores, opened 16

Hybrids, refitted 6 'Original' stores to our Hybrid format, closed

2 Big Box stores and opened 1 new Big Box. In total we are now

trading out of 226 'Original' stores, 66 Hybrids and 44 Big Box. We

are actively working to relocate and refit further stores in the

second half of the year, together with a number of stores currently

in the pipeline, opening before Christmas.

Our average lease length is 2.1 years (2022 FY: 1.8 years),

giving us the opportunity and flexibility to respond to changes in

any retail location at short notice. Property supply continues to

outstrip demand and we continue to take advantage of this and

significantly improve our property portfolio over the medium

term.

Strategy Update

We have accelerated our refit and relocation programme along

with further investment in our digital and head office

infrastructure. All of these are key to our strategy, and we expect

to spend approx. 3-4% of revenue annually on capital projects.

We have continued to invest in our portfolio with more

'Original' Shoe Zone stores converted to Hybrid formats. The

results continue to be very positive, and we continue to look for

further opportunities to roll these formats out as planned. Our

ultimate goal is a doubling of Big Box locations to approximately

100 and an increase in Hybrid stores to 200 in the medium term. We

anticipate trading from a similar retail square footage, albeit

from a reduced number of locations. Digital revenues grew by 12.7%

as we continue to invest in new product lines and additional brands

as well as enhancing our platform with the introduction of a new

return's portal, the development of a mobile App and adding new

payment options, all of which will improve customer experience.

Part of the success of our digital operation is our very

efficient returns process which is complemented by our extensive

network of stores. We have a returns rate of 11.9%% and the vast

majority of these are returned to store, hence why our physical

store network is critical to our future success.

Dividend

The Board proposes an interim dividend of 2.5p per share, which

will become payable on 16 August 2023 to those shareholders on the

Company's register as at the close of business on the record date

14 July 2023. The ex-dividend date will be 13 July 2023.

Financial Review

Profit before tax was GBP1.5m, adjusted to GBP2.5m (2022 H1:

GBP3.1m (reported and adjusted)). The adjustments include foreign

exchanges losses and profit on one freehold property sale. The

GBP0.6m reduction year on year reflects inflationary increases,

mainly National Living Wage, and a lower margin achieved percentage

due to higher container prices and a weak sterling to dollar.

In the Period total revenues were GBP75.4m (2022 H1: GBP69.9m).

Store revenues increased by GBP3.9m even though we ended the Period

trading out of 52 fewer stores than 12 months ago. Digital sales

increased by GBP1.6m to GBP14.3m (2022 H1: GBP12.7m). Digital gross

margins reduced to 58.0% (2022 H1: 58.5%) due to higher container

prices and contribution was GBP3.2m (2022 H1: GBP2.7m).

One freehold property went to auction, resulting in a profit on

sale of GBP0.3m. A further property will be auctioned in the second

half which will conclude our freehold sales.

Gross profit in the Period was GBP13.6m, the same as the

comparable period last year (2022 H1: GBP13.6m), with gross profit

margin at 18.1% (2022 H1: 19.5%). The percentage reduction was due

to the underlying product margin being lower this Period (2023 H1:

60.1%, 2022 H1: 60.8%), due to the impact of higher container

prices, particularly in Q1 and a weak sterling to dollar exchange

rate. Subsequent to this, container prices have dropped to below

pre pandemic levels, the benefit of which will start to flow

through in the second half of this year. Depreciation charge

increased due to higher capital spend.

Administration expenses increased by GBP1.6m to GBP9.1m (2022

H1: GBP7.5m) due to GBP1.0m additional foreign exchange losses this

year, a higher head office depreciation charge and an additional

cost of living bonus paid to all staff in February.

Distribution costs increased by GBP0.2m to GBP2.6m (2022 H1:

GBP2.4m) due to the impact of the National Living Wage increase and

inflationary cost increases on transport expenses.

Our energy prices are fixed until September 2023. All our

electricity consumption is from 100% renewable sources, we have

started to monitor energy consumption and have a programme to

insulate ceilings and to install more energy efficient lighting in

a number of stores. During the Period, we have added electric and

more hybrid vehicles to our fleet and have changed all of our

warehouse lighting to more energy efficient LED.

Stock at the Period end was GBP3.0m lower at GBP28.1m (2022 H1:

GBP31.1m). This reflects our positive trading over the last 12

months, a more normalised intake pattern and the selling through of

prior seasons boot product that we previously reported as an over

stock.

The Company ended the Period with a net cash balance of GBP12.9m

(2022 H1: GBP13.9m). The reduction is due to GBP8.2m of dividends

paid in the last 12 months, GBP2.9m of shares bought back and

additional capital spend, offset by the positive trade in the

Period and lower stock levels.

The share buy-back programme continues and as at the Period end,

we had re-purchased 1.8m shares at a total cost of GBP3.5m (average

priced paid of GBP1.93). We have cancelled 1.5m shares with 0.3m

held in treasury to date. (with 1.0m shares cancelled in the

Period).

Capital expenditure in the Period was GBP5.3m (2022 H1: GBP2.3m)

which is returning to our long-term target of approx. 3-4% of

revenue. Expenditure in the Period included new stores, refits and

relocations, which are partly funded by Landlord rent free periods,

IT expenditure and infrastructure works in head office and

distribution centre, which will be continued through the second

half of the year.

The Shoefayre Limited Pension and Life Assurance Scheme moved

into a deficit of GBP2.0m (2022 FY: GBP1.8m surplus). This was due

to a fall in bond yields which led to a lower assumed discount rate

and therefore a higher value being placed on the scheme's

liabilities. The Shoe Zone Pension Schemes' surplus reduced to

GBP1.3m (2022 FY: GBP7.1m surplus) The main reason for this was due

to the purchase of the buy-in contract with Rothesay. Specifically,

the value of the scheme's uninsured liabilities as at 2 March 2023

was lower than the actual premium paid to secure members' benefits

with Rothesay.

Earnings per share were 3.1p (2022 H1: 5.7p per share).

Full year results in line with market expectations.

Unaudited consolidated income statement ( 52 weeks audited )

26 Wks 26 Wks 52 Wks

end end end

1 Apr 2 Apr 1 Oct

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue 75,391 69,864 156,164

Cost of sales (61,752) (56,247) (119,764)

---------- ---------- -----------

Gross Profit 13,639 13,617 36,400

Administration

expenses (9,100) (7,508) (16,620)

Distribution costs (2,668) (2,448) (5,104)

---------- ---------- -----------

Profit from Operations 1,871 3,661 14,676

Finance income 0 0 0

Finance expense (342) (599) (1,113)

---------- ---------- -----------

Profit before

Tax 1,529 3,062 13,563

Taxation 0 (197) (2,718)

Profit after Tax 1,529 2,865 10,845

========== ========== ===========

Earnings per Share 3.1p 5.7p 21.7p

Unaudited consolidated statement of total comprehensive income (

52 weeks audited)

26 Wks 26 Wks 52 Wks

end end end

1 Apr 2 Apr 1 Oct

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit/(Loss)

for the period 1,528 2,865 10,845

--------- --------- ---------

Items that will not be reclassified

subsequently to the

income statement

DB pension scheme (1,973) 3,110 5,798

Movement in deferred tax on

pension schemes (57) (560) (1,505)

Share buy back (1,849) 0 (966)

Cash flow hedges

Fair value movements in other comprehensive

income (776) 682 1,129

Tax on cash flow

hedges 0 (109) (226)

--------- --------- ---------

Other comprehensive (expense)/Income

for the period (4,655) 3,123 4,230

Total comprehensive (expense)/Income

for the period (3,127) 5,988 15,075

========= ========= =========

attributable to equity holders

of the parent

Unaudited consolidated statement of financial position (52 weeks

audited )

26 Wks 26 Wks 52 Wks

end end end

1 Apr 2 Apr 1 Oct

2023 2022 2022

Assets GBP'000 GBP'000 GBP'000

Non-current

Assets

Property, plant and

equipment 15,859 13,555 12,582

Right of use

assets 25,454 28,526 25.581

Deferred tax

asset 902 2,490 720

---------- ---------- ----------

Total Non-current

Assets 42,215 44,571 38,883

Current Assets

Inventories 28,117 31,096 32,188

Trade and other receivables 3,007 3,450 6,071

Derivative financial

assets 0 456 0

Cash and cash equivalents 12,870 13,872 24,427

---------- ---------- ----------

Total Current

Assets 43,994 48,874 62,686

Total Assets 86,029 93,445 101,569

Current Liabilities

Trade and other payables (17,281) (19,484) (22,801)

Lease liabilities (13,562) (14,016) (14,870)

Derivative financial

liabilities (603) 0 0

Provisions (2,575) (1,727) (1,108)

Corporation tax liability (289) (317) (1,910)

---------- ---------- ----------

Total Current Liabilities (34,310) (35,544) (40,689)

Non-current Liabilities

Lease liabilities (21,349) (23,554) (20,975)

Provisions (1,508) (2,084) (2,662)

Employee benefit liability (1,973) (2,857) 0

---------- ---------- ----------

Total Non-current

Liabilities (24,830) (28,495) (23,637)

Total Liabilities (59,140) (64,039) (64,326)

Net Assets 27,069 29,406 37,243

========== ========== ==========

Equity attributable to equity

holders of the company

Called up share capital 485 500 495

Merger res/Cap

red 2,677 2,662 2,667

Cash flow hedge reserve (123) 323 653

Retained earnings 24,030 25,921 33,428

---------- ---------- ----------

Total Equity and

Reserves 27,069 29,406 37,243

========== ========== ==========

Unaudited consolidated statement of changes

in Equity ( prior years audited)

Cash

Share Share Capital flow Retained Total

Capital Premium Redemp. Hedge Earnings

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At October 2021 500 2,662 0 (250) 20,506 23,418

--------- --------- --------- --------- ---------- ---------

Profit for the period 0 0 0 0 2,865 2,865

Defined benefit pension movements 0 0 0 0 3,110 3,110

cash flow hedge movements 0 0 0 682 0 682

Deferred tax on other comp.

income 0 0 0 (109) (560) (669)

--------- --------- --------- --------- ---------- ---------

Total comprehensive income

for the period 0 0 0 573 5,415 5,988

Dividends paid 0 0 0 0 0 0

--------- --------- --------- --------- ---------- ---------

Contributions by and distrib.

to owners 0 0 0 0 0 0

As at April 2022 500 2,662 0 323 25,921 29,406

--------- --------- --------- --------- ---------- ---------

At October 2021 500 2,662 0 (250) 20,506 23,418

--------- --------- --------- --------- ---------- ---------

Impact of transition to IFRS-16 0 0 0 0 10,845 10,845

Profit for the period 0 0 0 0 5,798 5,798

cash flow hedge movements 0 0 0 1,129 0 1,129

Share buy-back (5) 0 5 0 (966) (966)

Deferred tax on other comp.

income 0 0 0 (226) (1,505) (1,731)

--------- --------- --------- --------- ---------- ---------

Total comprehensive income

for the period (5) 0 5 903 14,172 15,075

Dividends paid 0 0 0 0 (1,250) (1,250)

--------- --------- --------- --------- ---------- ---------

Contributions by and distrib.

to owners 0 0 0 0 (1,250) (1,250)

As at October 2022 495 2,662 5 653 33,428 37,243

--------- --------- --------- --------- ---------- ---------

At October 2022 495 2,662 5 653 33,428 37,243

--------- --------- --------- --------- ---------- ---------

Profit for the period 0 0 0 0 1,528 1,528

Defined benefit pension movements 0 0 0 0 (1,973) (1,973)

cash flow hedge movements 0 0 0 (776) 0 (776)

Share buy-back (10) 0 10 0 (1,849) (1,849)

Deferred tax on other comp.

income 0 0 0 0 (57) (57)

--------- --------- --------- --------- ---------- ---------

Total comprehensive income

for the period (10) 0 10 (776) (2,351) (3,127)

Dividends paid 0 0 0 0 (7,047) (7,047)

--------- --------- --------- --------- ---------- ---------

Contributions by and distrib.

to owners 0 0 0 0 0 0

As at April 2023 485 2,662 15 (123) 24,030 27,069

--------- --------- --------- --------- ---------- ---------

Unaudited consolidated statement of cash flows ( 52 weeks

audited )

26 Wks 26 Wks 52 Wks

end end end

1 Apr 2 Apr 1 Oct

2023 2022 2022

GBP'000 GBP'000 GBP'000

Operating activities

Profit after tax 1,529 2,865 10,845

Corporation tax 0 197 2,718

Finance income 0 0 0

Finance expense 342 599 1,113

Depreciation of property, plant

and machinery 1,737 1,514 4,118

Fixed asset impairment and loss

on disposal of property, (111) 1,457 (1,075)

plant and machinery

Right of use asset on profit, depreciation

& impairment 6,977 7,217 13,016

Pension contributions paid 0 0 0

---------- ---------- ----------

10,474 13,849 30,735

Decrease/(increase) in trade and

other receivables 3,064 2,007 627

Decrease/(increase) in foreign

exchange contracts (412) (357) (527)

Decrease/(increase) in inventories 4,071 (5,965) (7,057)

(Decrease)/increase in trade and

other payables (5,520) 3,154 6,361

Increase in provisions 313 386 345

---------- ---------- ----------

1,516 (775) (251)

---------- ---------- ----------

Cash generated from operations 11,990 13,074 30,484

Net corporation tax paid (1,738) (653) (1,214)

---------- ---------- ----------

Net cash flows from operating

activities 10,252 12,421 29,270

---------- ---------- ----------

Investing activities

Purchase of property, plant and

machinery (5,314) (2,299) (5,225)

Proceeds from Sale of Freeholds 411 0 3,590

---------- ----------

Net cash used in investing activities (4,903) (2,299) (1,635)

---------- ---------- ----------

Share buy-back (1,849) 0 (966)

Repayment of CLBILS loan 0 (4,400) (4,400)

Capital element of lease repayments (8,196) (10,790) (15,584)

Interest 186 (75) (23)

Dividends paid during year (7,047) 0 (1,250)

---------- ----------

Net cash used in financing activities (16,906) (15,265) (22,223)

---------- ---------- ----------

Net inc/(dec) in cash and cash

equivalents (11,557) (5,143) 5,412

Cash and cash equivalents at beginning

of period 24,427 19,015 19,015

Cash and cash equivalents at end

of period 12,870 13,872 24,427

========== ========== ==========

Notes to the financial statements for the 26 weeks ended 1 April

2023

Basis for preparation

The consolidated interim financial statements of the company for

the 26 weeks ended 1 April 2023, which are unaudited, have been

prepared in accordance with the same accounting policies,

presentations and methods of computation followed in the condensed

set of financial statements as applied in the group's latest

audited financial statements. A copy of those accounts has been

delivered to the Registrar of Companies.

The financial information for the 26 weeks ended 1 April 2023,

contained in this interim report, does not constitute the full

statutory accounts for that period. The independent Auditors'

report on the Annual Report and Financial Statements for 2022 was

unqualified, did not draw attention to any matters by way of

emphasis. And did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

The consolidated interim financial statements have neither been

audited nor reviewed pursuant to guidance issued by the Auditing

Practices Board.

The condensed consolidated interim financial statements have

been prepared on a going concern basis and under the historic cost

convention, as modified by the revaluation of derivative financial

instruments to far value.

The condensed consolidated interim financial statements are

presented in sterling and have been rounded to the nearest thousand

(GBP'000).

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amount of assets and liabilities at the date of the

financial statements and the reported amount of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events ultimately may differ from those

estimates.

1. Accounting policies

In preparing these interim financial statements, the significant

judgements made by management in applying the group's accounting

policies and the key sources of estimation uncertainty were the

same as those applied to the consolidated financial statements

reported in the latest annual audited financial statements for the

52 weeks ended 1 Oct 2022.

Going Concern

At the balance sheet date the company had a good cash balance

and a strong net asset position. At the time of reviewing these

accounts, the Directors have considered the effect of COVID-19 on

the ongoing position, and consider that this does indicate that the

company will continue to trade for a period of at least 12 months

from the date of publishing these accounts. Based on the cash

forecasts prepared by the Directors, these financial statements

have been prepared on a going concern basis.

2. Segmental Information

The group complies with IFRS 8 'Operating Segments' which

determines and presents operating segments based on information

provided to the chief operating decision maker. The chief decision

maker has been identified as the management team including the

Chief Executive and Finance Director. The Board considers that each

store is an operating segment but there is only one reporting

segment as the stores qualify for aggregation, as defined under

IFRS 8.

26 Wks 26 Wks 52 Wks

end end end

1 Apr 2 Apr 1 Oct

2023 2022 2022

External revenue by location

of customers: GBP'000 GBP'000 GBP'000

United Kingdom 60,776 56,855 128,664

Digital 14,347 12,726 26,967

Other 268 283 533

75,391 69,864 156,164

========= ========= =========

3. Taxation

The taxation charge of zero for the 26 weeks ended 1 April 2023

is based on the assumption that the capital allowances available on

our estimated capital spend will reduce the expected charge for the

full year.

4. Earnings per share

26 Wks

end 26 Wks end 52 Wks end

1 Apr 2 Apr 1 Oct

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit in the period and earnings

used in basic

diluted earnings

per share 1,529 2,865 10,845

3.1p 5.7p 21.7p

========= ============ ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUWPAUPWGQA

(END) Dow Jones Newswires

May 16, 2023 02:00 ET (06:00 GMT)

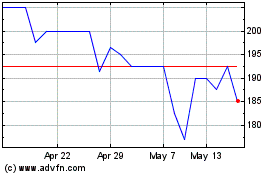

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Dec 2023 to Dec 2024