TIDMSDI

RNS Number : 2038C

Scientific Digital Imaging Plc

15 January 2015

Scientific Digital Imaging plc

("SDI", the "Company" or the Group)

(AIM: SDI)

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS TO 31 OCTOBER

2014

The Board of Scientific Digital Imaging plc, the AIM quoted

group focused on the application of digital imaging technology for

use in life sciences, healthcare, astronomy, and art conservation,

is pleased to announce its unaudited interim results for the six

months ended 31 October 2014.

Highlights

-- Opus Instruments contributed sales revenue and profitable trading

-- Adjusted operating loss* of GBP20,000 (2013: loss GBP45,000)

-- The Board expects trading improvements in the second half of

the year with the reorganisation of Synoptics completed in 2014

-- Artemis CCD continuing to report sales and profitability above budget

" *Adjusted operating loss is operating loss before aborted

transaction costs, reorganisation costs and share based

payments"

Ken Ford, Chairman of SDI, commented:

"The Board anticipates that Opus Instruments and Artemis CCD

will continue to make positive contributions to SDI. The new

Synoptics products released in the last quarter of 2014, together

with our other Group subsidiaries are expected to provide a sound

base to make further acquisitions in due course."

Enquiries

Scientific Digital Imaging plc 01223 727144

Ken Ford, Chairman

Mike Creedon, CEO

www.scientificdigitalimaging.com

finnCap Ltd 020 7220 0500

Ed Frisby/Simon Hicks - Corporate Finance

Mia Gardner- Corporate Broking

Copies of the interim report are being sent to shareholders and

can also be viewed on the Company's website:

www.scientificdigitalimaging.com

About SDI:

Scientific Digital Imaging plc designs and manufactures digital

imaging technology for use in the life sciences, healthcare,

astronomy, and art conservation through Synoptics brands (Syngene,

Synoptics Health, Synbiosis and Syncroscopy), the Artemis CCD

company brands (Atik Cameras and Artemis CCD Cameras) and the Opus

Instruments brand (Osiris).

SDI plans to grow through its own technology advancements as

well as strategic, complementary acquisitions.

Interim highlights

-- Operating loss GBP20,000 (2013: loss GBP45,000) before

aborted transaction costs, reorganisation costs and share based

payments.

-- The Board expects trading improvements in the second half of

the year with the reorganisation of Synoptics completed in 2014,

which provides a significant reduction in the cost base

-- New acquisition, Opus Instruments contributed sales revenue and profitable trading

-- Syngene launched a mid-range gel documentation system,

T:Genius featuring an integrated tablet PC

-- Synbiosis launch ProtoCOL 3 Chromogenic ID software for the

Rapid Microbiology Market in October 2014

-- Artemis CCD continuing to report sales and profitability above budget

Synoptics

Synoptics designs and manufactures special-purpose, innovative

instruments and systems for use in the life science industry. The

Company exploits digital imaging technologies for a range of

disciplines and offers its products through four brands:

-- Syngene - produces equipment for life scientists to image and

analyse electrophoresis gels used for DNA and protein analysis

-- Synbiosis - produces equipment for microbiologists to automate microbial colony counting

-- Syncroscopy - provides systems that apply digital imaging

techniques to microscopy applications, such as life and material

sciences

-- Synoptics Health - focuses on imaging techniques within the

hospital and clinical environments using their ProReveal

product

Artemis CCD

Artemis designs and manufactures high sensitivity cameras for

deep-sky astronomical and life science imaging under the Atik and

Artemis CCD brands.

Opus Instruments

Opus designs and manufactures an infrared camera, Osiris, which

is used to examine works of art, utilising infrared camera

technology with other potential digital imaging applications.

Chairman's statement

OVERVIEW

In the six month period ended 31 October 2014 the new

acquisition, Opus Instruments, made a positive impact on trading

alongside our established Artemis CCD Division which reported

increased sales revenue.

During the period, we were also involved in reverse acquisition

negotiations that were ultimately unsuccessful.

SDI revenue was GBP3.2m in the six months to 31 October 2014

(reduction of GBP349,000, relative to revenue GBP3.5m for the six

months to 31 October 2013). The reduction in SDI revenue arose from

Synoptics, whose revenue reduced due to falling sales in North and

South America. We have addressed this by introducing a new

mid-range competitive unit, T:Genius. Additionally we have invested

in Synoptics US by recruiting a new VP for Sales and Marketing in

November 2014.

The effect of the shortfall in revenue has meant that SDI

reported an operating loss of GBP20,000 before aborted transaction

costs, reorganisation costs and share based payments (2013: loss

GBP45,000).

Basic and fully diluted losses per share were both 0.82p (2013:

basic and fully diluted loss 0.33p)

The Group's cash position reduced by GBP223,000 to GBP316,000

over the period, mainly due to reduced sales revenue from the

Synoptics Group during the financial period.

PRODUCT PORTFOLIO

Syngene remains the largest of the Synoptics brands. Over the

past year, Syngene has experienced aggressive pricing competition

in the DNA imaging sector, especially in North America, the largest

life sciences market. This issue is being addressed by Syngene with

the introduction of a number of new products.

In the period, the new ProtoCOL 3 Chromogenic ID software for

identification of colonies on CHROMagar was launched. This new

software is stimulating interest in ProtoCOL 3 within the rapid

microbiology identification market, especially in the food

microbiology sector and Synbiosis believes this will translate into

sales growth in 2015.

In the past six months, Synoptics Health has continued to

develop ProReveal, a fluorescence test to detect proteins on

surgical instruments for the cleaning validation market and has

appointed a new dealer in North America. In October, ProReveal was

reviewed by the UK Government's Rapid Review Panel (RRP) and

recommended for use in NHS England for optimising cleaning

protocols, endorsing the technology as a validation tool. With 30

ProReveal systems demonstrated in the UK and internationally, the

test continues to be purchased by companies and institutes in the

decontamination equipment sector. ProReveal is not yet being

adopted by the larger hospital sterile service departments due to

statutory decontamination standards not yet being in place. SDI has

revised its investment and promotional strategy for this product in

2015 with further emphasis being placed on bringing down the price

point of the hardware in order to widen the immediate addressable

market.

Since acquiring Opus Instruments in 2014 and introducing a touch

screen version of the Osiris camera, sales growth for the division

has been positive. With interest in this new camera growing, the

Board believes Opus Instruments will continue to achieve sales

forecasts, making a positive contribution to SDI's trading in

2015.

Artemis CCD introduced a new scanning camera in the period.

Artemis is maintaining its strategy of selling cameras to OEM

customers. This is helping Artemis CCD to make an increasing

contribution to the SDI Group thanks to both intra-group revenues

from Synoptics and growth in its OEM sales.

BUSINESS OPERATIONS

We have actively reduced our cost base. Administrative costs in

the period were GBP1.8m, down 13% compared to GBP2.1m in the same

period last year. We have further reviewed costs in the last three

months and additional cost savings will be realised in the second

half of the financial year.

The North American life science market is recovering and to

capitalise on this, SDI is investing in the Synoptics US group with

the appointment of a new US VP Sales and Marketing, as well as

increased sales and product training to ensure that our Syngene and

Synbiosis US dealer representative network is being fully utilised

in this large market. This will result in a better coverage of the

US, where Syngene and Synbiosis products have previously sold well.

The Synoptics Health Division has also appointed a North American

distributor, which is actively promoting the product and means it

will be easier for many decontamination equipment suppliers to

assess the technology in this major market.

Investing in our US operations and focusing our promotional

efforts on the established Syngene and Synbiosis brands means SDI

is well placed to increase sales revenue in its Synoptics Division

in 2015.

ACQUISITIONS

SDI is actively seeking profitable scientific and technology

based companies. Acquisitions in the GBP1m to GBP10m range would be

appropriate and are currently being sought.

OUTLOOK

Renewed commercial efforts in North America and the introduction

of new systems to appeal to this market are expected to help the

Synoptics division return to sales growth in 2015. The Board

anticipates that Opus Instruments and Artemis CCD will continue to

make positive contributions to SDI. The new Synoptics products

released in the last quarter of 2014, together with a focused sales

strategy are expected to result in sales and profit growth in

2015.Profitable stable current subsidiaries should then provide a

sound base to make further acquisitions in due course.

Ken Ford, Chairman

15 January 2015

Consolidated income statement

Unaudited for the six months ended 31 October 2014

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2014 2013 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------- ----- ------------ ------------ ----------

Revenue 3,188 3,537 7,037

----------

Costs of sales (1,353) (1,436) (3,021)

------------------------- ----- ------------ ------------ ----------

Gross profit 1,835 2,101 4,016

----------

Currency exchange

loss (12) (22) (66)

----------

Administrative expenses (1,843) (2,124) (3,893)

----------

Share based payments (5) (5) (6)

----------

Acquisition costs - - (28)

----------

Aborted transaction (131) - -

costs

----------

Reorganisation costs (51) - (22)

------------------------- ----- ------------ ------------ ----------

Total administrative

expenses (2,042) (2,151) (4,015)

------------------------- ----- ------------ ------------ ----------

Operating (loss)/profit (207) (50) 1

----------

Financial income - - -

----------

Financial expenses (20) (24) (39)

------------------------- ----- ------------ ------------ ----------

(Loss)/Profit before

taxation (227) (74) (38)

----------

Income tax expense - - -

------------------------- ----- ------------ ------------ ----------

(Loss)/profit for

the period (227) (74) (38)

------------------------- ----- ------------ ------------ ----------

Earnings per share

----------

Basic (loss)/earnings

per share 2 (0.82p) (0.33p) (0.16p)

------------------------- ----- ------------ ------------ ----------

Diluted (loss)/earnings

per share (0.82p) (0.33p) (0.16p)

------------------------- ----- ------------ ------------ ----------

Consolidated statement of comprehensive income

Unaudited for the six months ended 31 October 2014

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

(Loss)/profit for the period (227) (74) (38)

----------

Other comprehensive income

Items that will be reclassified

subsequently

to profit and loss

----------

Exchange differences on translating

foreign operations 38 (30) (75)

------------------------------------- ------------ ------------ ----------

Total comprehensive (loss)/profit

for the period (189) (104) (113)

------------------------------------- ------------ ------------ ----------

Consolidated balance sheet

Unaudited at 31 October 2014

31 October 31 October 30 April

2014 2013 2014

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

----------------------------- ----- ----------- ----------- ---------

Assets

---------

Non-current assets

---------

Property, plant and

equipment 379 392 419

Intangible assets 2,064 884 2,085

Deferred tax asset 99 125 99

----------------------------- ----- ----------- ----------- ---------

2,542 1,401 2,603

Current assets

Inventories 1,059 1,061 1,117

Trade and other receivables 1,344 1,327 1,286

Current tax assets - - 16

Cash and cash equivalents 316 541 539

----------------------------- ----- ----------- ----------- ---------

2,719 2,929 2,958

----------------------------- ----- ----------- ----------- ---------

Total assets 5,261 4,330 5,561

----------------------------- ----- ----------- ----------- ---------

Liabilities

---------

Current liabilities

---------

Trade and other payables 1,527 1,213 1,427

---------

Provisions for warranty 17 17 17

---------

Borrowings 3 143 115 199

---------

Current tax payable - - 35

----------------------------- ----- ----------- ----------- ---------

1,687 1,345 1,678

---------

Non-current liabilities

---------

Borrowings 3 198 35 272

---------

Trade and other payables 138 - 189

---------

Deferred tax liability 169 164 169

----------------------------- ----- ----------- ----------- ---------

505 199 630

----------------------------- ----- ----------- ----------- ---------

Total liabilities 2,192 1,544 2.308

----------------------------- ----- ----------- ----------- ---------

Net assets 3,069 2,786 3,253

----------------------------- ----- ----------- ----------- ---------

Equity

---------

Share capital 278 250 278

Merger reserve 3,030 2,606 3,030

Share premium account 1,063 1,040 1,063

Foreign exchange

reserve (71) (64) (109)

Own shares held by

Employee Benefit

Trust (85) (85) (85)

Other reserves 70 105 65

Retained earnings (1,216) (1,066) (989)

----------------------------- ----- ----------- ----------- ---------

Total equity 3,069 2,786 3,253

----------------------------- ----- ----------- ----------- ---------

Consolidated statement of cash flows

Unaudited for the six months ended 31 October 2014

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2014 2013 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ----------

Operating activities

----------

(Loss)/profit for the

period (227) (74) (38)

Depreciation and amortisation 282 252 595

Finance costs and income 20 24 39

Taxation expense in the

income statement - - -

Exchange difference - (38) -

Employee share based payments 5 5 6

-------------------------------- ------------ ------------ ----------

Operating cash flow before

movement in working capital 80 169 602

Increase in inventories 58 (114) (88)

Changes in trade and other

receivables (52) 140 199

Changes in trade and other

payables 103 (210) (190)

-------------------------------- ------------ ------------ ----------

Cash (used in)/generated

from operations 189 (15) 523

Interest paid (20) (24) (26)

Income taxes (received)/paid (35) - 7

-------------------------------- ------------ ------------ ----------

Cash (used in)/generated

from operating activities 134 (39) 504

Cash flows from investing

activities

Capital expenditure on

fixed assets (62) (96) (257)

Expenditure on development

and other intangibles (159) (121) (540)

Acquisition of subsidiaries,

net of cash - - (273)

Proceeds from sale of

property, plant and equipment - - 64

-------------------------------- ------------ ------------ ----------

Net cash used in investing

activities (221) (217) (1,006)

Cash flows from financing

activities

Movement in finance leases (12) 17 (34)

Loan stock repayment - (243) (204)

Issue of shares net of

costs - 635 636

Repayment of borrowings (118) - (27)

Proceeds from bank borrowings - 8 300

-------------------------------- ------------ ------------ ----------

Net cash (used in)/from

financing activities (130) 417 671

-------------------------------- ------------ ------------ ----------

Net changes in cash and

cash equivalents (217) 161 169

Cash and cash equivalents,

beginning of period 539 388 388

Foreign currency movements

on cash balances (6) (8) (18)

-------------------------------- ------------ ------------ ----------

Cash and cash equivalents,

end of period 316 541 539

-------------------------------- ------------ ------------ ----------

Consolidated statement of changes in equity

Unaudited for the six months ended 31 October 2014

6 months to 31 October Own shares

2014 - unaudited Share Merger Share held Other Foreign Retained

capital reserve premium by EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2014 278 3,030 1,063 (85) 65 (109) (989) 3,253

Share based payments - - - - 5 - - 5

Transactions with owners - - - - 5 - - 5

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Profit for the period - - - - - - (227) (227)

Foreign exchange on

consolidation

of subsidiary - - - - - 38 - 38

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income

for the period - - - - - 38 (227) (189)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 31 October

2014 278 3,030 1,063 (85) 70 (71) (1,216) 3,069

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

6 months to 31 October Own shares

2013 - unaudited Share Merger Share held Other Foreign Retained

capital reserve premium by EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2013 194 2,606 335 (85) 100 (34) (992) 2,124

Share based payments - - - - 5 - - 5

Shares issue 56 - 705 - - - - 761

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Transactions with owners 56 - 705 - - - - 766

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Profit for the period - - - - - - (74) (74)

Foreign exchange on

consolidation

of subsidiary - - - - - (30) - (30)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income

for the period - - - - - (30) (74) (104)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 31 October

2013 250 2,606 1,040 (85) 105 (64) (1,086) 2,786

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

12 months to 30 April Own shares

2014 Share Merger Share held Other Foreign Retained

- audited capital reserve premium by EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2013 194 2,606 335 (85) 100 (34) (992) 2,124

Shares issued 84 424 728 - - - - 1,236

Share based payments - - - - 6 - - 6

Transfer of equity on

consolidation

of shares - - - - (41) - 41 -

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Transactions with owners 84 424 728 - (35) - 41 1,242

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Loss for the year - - - - - - (38) (38)

---------

Foreign exchange on

consolidation

of subsidiaries - - - - - (75) - (75)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income - - - - - (75) (38) (113)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 30 April 2014 278 3,030 1,063 (85) 65 (109) (989) 3,253

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Notes to the interim financial statements

Unaudited for the six months ended 31 October 2014

The accompanying accounting policies and notes form an integral

part of these interim financial statements.

Reporting entity

Scientific Digital Imaging plc (the "Company"), a public limited

company, is the Group's ultimate parent. It is registered in

England and Wales. The consolidated interim financial statements of

the Company for the period ended 31 October 2014 comprise the

Company and its subsidiaries (together referred to as the

"Group").

Basis of preparation

The unaudited consolidated interim financial statements are for

the six months ended 31 October 2014. These interim financial

statements have been prepared using the recognition and measurement

principles of International Accounting Standards, International

Financial Reporting Standards and Interpretations adopted for use

in the European Union (collectively EU IFRS). The financial

information for the year ended 30 April 2014 is based upon the

audited statutory accounts for that year.

The consolidated interim financial information has been prepared

on the historical cost basis.

The consolidated interim financial statements are presented in

British pounds (GBP), which is also the functional currency of the

ultimate parent company.

The consolidated interim financial information was approved by

the Board of Directors on 15 January 2015.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The figures for the year ended 30 April 2014

have been extracted from the statutory financial statements of

Scientific Digital Imaging plc which have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498(2) or 498(3) of the Companies Act 2006, but did contain

an emphasis of matter paragraph outlining the existence of a

material uncertainty which may cast significant doubt over the

group's ability to continue as a going concern. The financial

information for the six months ended 31 October 2014 and for the

six months ended 31 October 2013 has not been audited or reviewed

by the auditors.

1. Principal accounting policies

The principal accounting policies adopted in the preparation of

the condensed consolidated interim information are consistent with

those followed in the preparation of the Group's financial

statements for the year ended 30 April 2014.

The accounting policies have been applied consistently

throughout the Group the purposes of preparation of these interim

financial statements.

2. Earnings per share

The calculation of the basic (loss)/earnings per share is based

on the (losses)/profits attributable to the shareholders of

Scientific Digital Imaging plc divided by the weighted average

number of shares in issue during the year, excluding shares held by

the Synoptics Employee Benefit Trust. All (loss)/profit per share

calculations relate to continuing operations of the Group.

Basic

(Loss)/Profit (loss)/earnings

attributable Weighted per share

to average amount

shareholders number of in

GBP'000 shares pence

----------------- -------------- ----------- -----------------

Period ended 31

October 2014 (227) 27,777,308 (0.82)

-----------------

Period ended 31

October 2013 (74) 22,098,744 (0.33)

-----------------

Year ended 30

April 2014 (38) 24,471,226 (0.16)

----------------- -------------- ----------- -----------------

The calculation of diluted earnings per share is based on the

profits attributable to the shareholders of Scientific Digital

Imaging plc divided by the weighted average number of shares in

issue during the year, as adjusted for dilutive share options.

Diluted

(loss)/earnings

per share

amount

in

pence

------------------------------ -----------------

Period ended 31 October 2014 (0.82)

-----------------

Period ended 31 October 2013 (0.33)

-----------------

Year ended 30 April 2014 (0.16)

------------------------------ -----------------

The reconciliation of average number of ordinary shares used for

basic and diluted earnings is as below:

31 October 30 October 30 April

2014 2013 2014

--------------------------- ----------- ----------- -----------

Weighted average number

of ordinary shares used

for basic earnings per

share 27,777,308 22,098,744 24,471,226

Weighted average number

of ordinary shares under

option 933,000 1,004,233 993,000

--------------------------- ----------- ----------- -----------

Weighted average number

of ordinary shares used

for diluted earnings

per share 28,710,308 23,102,977 25,464,226

--------------------------- ----------- ----------- -----------

Due to the loss generated in the period ended 31 October 2014,

the diluted loss per share for that period is based on the

undiluted loss per share.

3. Borrowings

31 October 31 October 30 April

2014 2013 2014

GBP'000 GBP'000 GBP'000

--------------------------- ----------- ----------- ---------

Within one year:

---------

Bank finance 100 84 168

Finance leases 43 31 31

143 115 199

--------------------------- ----------- ----------- ---------

After one year and within

five years:

Bank finance 133 - 183

Other loan 50 - 50

Finance leases 15 35 39

--------------------------- ----------- ----------- ---------

198 35 272

--------------------------- ----------- ----------- ---------

Total borrowings 341 150 471

--------------------------- ----------- ----------- ---------

The Group utilises short-term facilities to finance its

operation. The Group has one principal banker with an invoice

discounting facility of up to GBP500,000. At the end of the period

the Group had utilised GBP80,668 of this facility.

Scientific Digital Imaging plc

Beacon House

Nuffield Road

Cambridge

CB4 1TF

UK

Telephone: +44 (0)1223 727144

Fax: +44 (0)1223 727101

Email: info@scientificdigitalimaging.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGMMRDNGKZM

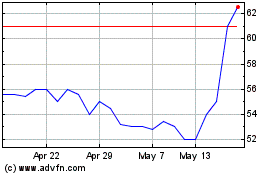

Sdi (LSE:SDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

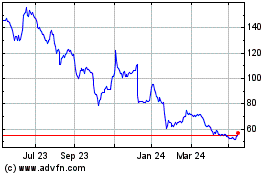

Sdi (LSE:SDI)

Historical Stock Chart

From Jul 2023 to Jul 2024