Interim Management Statement

October 13 2011 - 2:00AM

UK Regulatory

TIDMPNS

13 October 2011

Panther Securities PLC

("Panther" or "Group")

Interim management statement for the three month period ended 30 September 2011

Panther is pleased to publish its Interim Management Statement for the three

month period ended 30 September 2011. The results for the six months ended 30

June 2011 were announced on 23 August 2011 and posted to shareholders shortly

thereafter. These interim results included extensive information on post

balance sheet events which overlap with the period we are now reporting upon

(as all material post items were already announcement). For clarity we are

repeating this information but in a slightly abbreviated version.

The main transactions and eventsof the period have been:

Finance

* In July 2011 we finally completed our refinancing package. This is a new 5

year club loan facility of GBP75,000,000 provided equally both by HSBC and

Santander. This replaced a facility of GBP42,500,000 with HSBC with whom we

have had an excellent banking relationship for over 30 years.

* The additional finance has already allowed us to expand and make several

purchases.

* Financial derivatives show a combined liability of GBP17.5 million as at 30

September 2011. This is compared to the combined liability of GBP9.3 million

as at 31 December 2010 being the last audited results and GBP10.0 million as

shown in our half year accounts ended 30 June 2011. As mentioned previously

by the Board, the valuations of financial derivatives are based on market

estimations of future interest rates, which have in recent times been very

erratic over short periods. It has been considerably more volatile in the

last few months due to the economic outlook across Europe. The Board

believes that these are an effective `cash' hedge for the GBP60 million drawn

borrowings of the Group. It is unlikely that the Group would willingly pay

the estimated premium to exit these financial instruments.

These Purchases

* Five Department Stores. In July 2011, we purchased five freehold properties

which were owned and formerly occupied by the Anglia Regional Co-operative

Society ("ARCS") Limited trading as Westgate Stores. The majority of the

trade and assets of Westgate Stores were recently acquired by Beale PLC, a

fully listed department store group in which Panther holds just under 20

per cent. of the issued share capital. The Company paid approximately GBP

7,330,000 (including stamp duty) for the following five properties. 80

Newgate Street, Bishop Auckland, County Durham; 49 Low Street, Keighley,

West Yorkshire; 53-57 High Street, St Neots, Cambs; Market Place/ Bridge

Street, Spalding, Lincolnshire; and 8 Market Place, Diss, Norfolk.

* Apart from 80 Newgate Street, Bishop Auckland which as a one year rent free

period (ends on 21 May 2012), these four other stores have a two year rent

free period which ends on 21 May 2013. The total rent to be received from

Beale PLC on the expiration of the rent free periods will be GBP675,000 per

annum.

* Templegate House, 115-123 High Street, Orpington. This property was

purchased in July 2011 and is a long leasehold (94 years remaining at a

peppercorn) modern building which contains five shops and 17,000 sq ft of

office space over the three floors above. The property is almost fully let

and produces rent of GBP276,000 per annum. The price we paid of GBP1,300,000

(including stamp duty) reflects the fact that two of the larger tenants'

leases expire towards the end of this year. The property was purchased from

an LPA receiver.

* 79/97 Commercial Street, Batley. This freehold property also purchased in

July 2011 is well positioned in the town and was purchased for GBP1,380,000

(including stamp duty). The property currently produces GBP143,000 per annum,

excluding the potential income from two vacant shops. The tenants include

Boots, the Card Factory, Coral Estates, TUI UK and Kirkwood Hospice.

* The Mill and Warehourse, Upper Mills Trading Estate, Bristol Road,

Stonehouse. In August 2011, we purchased this 13,000 sq ft office, with

adjoining 12,000 sq ft warehouse building for our 75% owned subsidiary MRG

Systems Ltd for GBP489,000 (including stamp duty).

* Bentalls Complex, Colchester Road, Heybridge, Maldon, Essex. In August

2011, we purchased via a sale and lease back this 200,000 sq ft freehold

industrial building set on 8.5 acres for GBP3,900,000 (including stamp duty).

The property is let for 10 years to Wyndeham Group Ltd for GBP500,000 per

annum, with a one year rent free period.

* Lyceum Building, Bold Street, Liverpool. In August 2011, we completed the

acquisition of this prime, iconic listed building let to the Post Office

with 3.5 years remaining on their lease. The rent reserved is GBP500,000 per

annum. The tenant is not in occupation but has sublet part of the building

to the Co-operative Building Society. The purchase price was GBP2,964,000

(including stamp duty).

* 34 Marine Terrace, Margate, Kent. This freehold property was purchased in

August 2011 for GBP190,000 (including stamp duty). The property has food use

and is let for GBP21,000 a year.

General trading update

The Group has been very busy organising its refinancing and evaluating likely

property investments in the first half of the year, which created a backlog of

properties that were mainly completed in July and August 2011 (as described

above). We now have a good base for rental income of GBP10.5 million going

forward (even though GBP1.2 million of this is subject to rent free periods of

between one and two years), this is compared to annual rents of GBP7.7 million

reported in the prior year, to cover the larger loan with its increased costs

as well as fund future investment.

Of our new financing package of GBP75 million, following the above acquisitions,

we have an undrawn revolving facility of GBP15 million. This element of our

financing is un-hedged and whilst rates remain low, if this can be invested in

high yielding properties, it provides the opportunity to obtain healthy margins

above our borrowing costs.

As ever we remain upbeat about Panther's future prospects.

I believe that a long term investment in property has always protected the

holder against inflation and I see no reason why despite the present economic

uncertainty it will not remain so.

Other than as stated above, there has been no significant change in the Group's

financial position since 30 June 2011.

Andrew Perloff

Chairman

For further information contact:

Panther Securities PLC 01707 667 300

Andrew Perloff - Chairman

Simon Peters - Finance Director

END

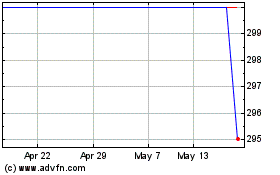

Panther Securities (LSE:PNS)

Historical Stock Chart

From Sep 2024 to Oct 2024

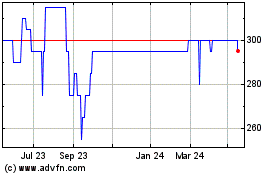

Panther Securities (LSE:PNS)

Historical Stock Chart

From Oct 2023 to Oct 2024