TIDMPMI

RNS Number : 6405V

Premier Miton Group PLC

05 December 2023

Embargoed until 7.00am 5 December 2023

PREMIER MITON GROUP PLC

FULL YEAR RESULTS FOR THE YEARED 30 SEPTEMBER 2023

Robust investment performance despite market volatility.

Premier Miton Group plc ('Premier Miton', 'Company' or 'Group'),

the AIM quoted fund management group, today announces its final

results for the year ended 30 September 2023.

Highlights

-- GBP9.8 billion closing Assets under Management (4) ('AuM') (2022: GBP10.6 billion)

-- Strong investment performance with 73% of funds in the first

or second quartile of their respective sectors since launch or fund

manager tenure

-- Net outflows of GBP1,147 million for the year (2022: GBP1,076 million outflow)

-- Adjusted profit before tax (1,4) of GBP15.7 million (2022: GBP24.3 million)

-- Adjusted earnings per share (2,4) of 8.80 pence (2022: 13.79 pence)

-- Profit before tax (3) of GBP5.9 million (2022: GBP14.9 million)

-- Cash balances were GBP37.9 million at 30 September 2023 (2022: GBP45.8 million)

-- Final proposed dividend of 3.0 pence per share (2022: 6.3 pence per share)

-- Total proposed dividend for the year of 6.0 pence per share (2022: 10.0 pence per share)

-- Significant continued investment in fund management and

distribution talent to help create a modern, active asset

management business positioned for future growth

Post period end

-- On 1 November the Group announced the acquisition of

Tellworth Investments LLP, a leading UK equity boutique with AuM of

GBP559m as at 30th September 2023

-- Tellworth offers both long/short and long only strategies to

wholesale and institutional clients with potential for

institutional distribution, building on Premier Miton's developing

presence in that market

-- A continued focus on inorganic opportunities alongside our clear organic growth strategy

Notes

(1) Adjusted profit before tax is calculated before the

deduction of taxation, amortisation, share-based payments, merger

related costs and exceptional costs. Reconciliation included within

the Financial Review section.

(2) Adjusted earnings per share is calculated before the

deduction of amortisation, share-based payments, merger related

costs and exceptional costs.

(3) Merger related costs totalled GBP0.1 million during the year

(2022: GBP0.1 million).

(4) These are Alternative Performance Measures ('APMs').

Mike O'Shea, Chief Executive Officer of Premier Miton Group,

commented:

"The general market backdrop for asset management businesses in

the UK has remained challenging during the period. Despite making

good progress in certain areas of the business and delivering

strong long term performance, the Group saw AuM fall by 7% ending

at GBP9.8 billion. With interest rates in the UK at multi-year

highs and more geopolitical uncertainty than we have seen for many

years, investors have been taking a more cautious approach. Despite

this difficult backdrop, we remain a financially robust business

and have a diversified range of products delivering excellent

outcomes for our clients over the medium to long term. Our fund

management team is experienced and respected and we have a product

suite that is fit for purpose. Across our fund range, our relative

investment performance remains attractive, with 73% of our funds in

the first or second quartile of their respective sectors since

manager inception. We are also well placed to take advantage of

inorganic opportunities as they arise and our recently announced

acquisition of Tellworth is a good example of this.

"Whilst we had withdrawals from our equity funds, we continued

to see growing net sales into our fixed income funds - up by 88%

year on year. We continue to have confidence that our fixed income

business will grow as the sector returns to popularity with

investors after many years of being out of favour. We also saw

inflows into our 'Diversified' multi-asset funds were up by 19%

year on year, and which remain a popular option for advisers and

their clients.

"The changes we have made to our distribution team over the past

twelve months have laid the groundwork to deliver growth as and

when confidence returns. We continue to maintain high levels of

visibility by participating in numerous fund manager roadshows and

events and showcasing the breadth and depth of our investment

talent.

"Our business has the operational infrastructure to manage a

multiple of the assets it currently looks after and we have built

the necessary distribution and marketing platform to capitalise on

this opportunity. We will continue to assess opportunities that can

add talented investment teams, or which allow us to access new

markets or product capabilities."

S

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Investec Bank plc (Nominated Adviser and

Broker)

Bruce Garrow / Ben Griffiths / Virginia

Bull / Harry Hargreaves 020 7597 4000

Edelman Smithfield Consultants (Financial

PR) 07785 275665 /

John Kiely / Latika Shah 07950 671948

Notes to editors:

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

Chairman's Statement

We have a clear purpose in actively managing our assets for the

benefit of our clients and take a long-term view of how we do this.

We believe in the value of active asset management and are

committed to delivering this for the benefit of our clients. Our

strategy is designed to support this purpose.

Results

Our financial results for 2023 reflect the ongoing challenges

facing investment markets in general and the UK's savings industry

in particular. Whilst we saw withdrawals from our equity funds, we

saw strong growth in our fixed income and multi-asset business,

showcasing the benefits of our diversified fund range.

Investment businesses are by their nature cyclical and financial

results are driven by markets, performance and flows. While we have

a well-diversified range of funds and a strong long-term

performance track record, the near-term challenges have been

difficult. However, we are confident in the fundamental strengths

of our business and the abilities of our teams. Of course, we must

and indeed are managing our costs to reflect the requirements of

the business and to align interests as closely as possible. This is

receiving full management attention.

Sector background

These are challenging times for the UK's domestic asset

management industry and for market participants. The causes of this

are complex and are receiving plenty of industry, media and,

increasingly, political attention.

At its core are several deep-seated structural issues particular

to the UK affecting the creation, intermediation and allocation of

long-term savings and capital, alongside several, probably more

temporary, market and sector adjustment factors. No company or

business involved is immune from the consequences of this and all

need to consider carefully what will be the future shape of the

UK's savings and capital markets sectors and their positioning

within these.

The consequences of further weakening of the UK-centred

investment industry would be deeply uncomfortable for our country,

and we believe most importantly would reduce the resilience and

capacity of the UK to create wealth and to build and sustain the

type of society we need. The creation of domestic long-term savings

and their allocation into productive domestic investments is an

essential feature of a successful modern economy and we are proud

to play a part in this. Alongside many other firms, organisations

and individuals, we also have sought to influence public policy

decisions to address these structural issues in a positive way.

The debate about the value of active and passive asset

management is ongoing.

We believe that both have a place to play in the investment

sector and that genuinely active investing has a core and important

role for savers and investors. Our approach is to have a range of

genuinely active funds with strategies that have a clear place in

the investment landscape. There are times when some funds may

underperform and then we seek to ensure that recovery is achievable

and that, through management action if needed, we have confidence

in a return to positive long term performance.

Strategy

Against this complex background, over the year we have closely

considered our own strategy to ensure that it remains achievable,

mindful of the need to manage our resources and processes as

smartly as possible for the long-term interests of the business as

a whole. We are focusing on a range of commercial, tactical and

strategic opportunities. We continue to review our product range to

ensure it has relevance in our chosen markets. We are also actively

looking to access the pools of capital, within and outside the UK,

that welcome our investment skills and capabilities, and what

arrangements we need to structure to secure these. These strategic

priorities and careful management of our existing business may

involve organic and inorganic investment.

An example of this is our announcement after the year end of the

acquisition of Tellworth, a leading UK-based equities boutique with

some GBP559m of AuM, running long/short and long only strategies

for wholesale and institutional clients. The acquisition expands

our product offering and brings in a highly regarded investment

team delivering good, consistent investment performance and scope

for significant asset growth when supported by our distribution

team.

Dividend

In our interim report I set out the Board's approach to dividend

payments. Our stated policy is to pay a dividend in the range of

50-65% of adjusted profit after tax. We are willing to exceed this

if appropriate and within the bounds of prudence. We are highly

reluctant to pay an uncovered dividend except in exceptional

circumstances, in which both the market and business outlook are

obviously both clearer and brighter. While we remain confident

about the longer-term prospects for our business, I am sure

shareholders will understand that we must act prudently and always

in the interests of the business as a whole when making decisions

on capital allocation, ensuring that we safeguard our strong

financial position.

Accordingly, alongside the interim dividend of 3p we have

decided to recommend a final dividend of 3p, bringing the total

dividend for the year to 6p, equal to approximately 68% of adjusted

EPS of 8.8p.

People

Our people are what make our business succeed and I thank all of

them for their hard work and efforts last year. Our leadership team

has many years of experience at managing businesses in our sector

through both good and challenging times and understands the

importance of maintaining good communication and a positive

culture.

We continue to evolve our reward models across the firm to

ensure that we are competitive for talent and that we align

stakeholder interests in the business as closely as possible. In

particular, and as in prior years, we aim to ensure that for our

key employees who drive shareholder value creation, that their

compensation framework reflects both the position of the business

and keeping a focus on long-term behaviours and securing

performance for investors in our funds. All of this needs to be

managed in a framework that aligns with and provides suitable and

attractive rewards for our shareholders as the owners of our

business.

The Board has continued to be highly engaged and supportive and

I am grateful to each of the members for their ongoing commitment.

During the year David Barron left the Board and I would like to

thank him for his valued contribution, both as Chief Executive of

Miton Group plc for many years and subsequently as a Non-Executive

Director bringing a huge depth of experience and business

understanding to our deliberations and decisions.

Outlook

There are many reasons to be concerned about the current

condition of the UK's economy and our domestic long-term savings

markets, as well as the state of geopolitics and the pace of

societal and technological change. Equally, the business of

managing savings and capital allocation is an important one for our

country and it too is changing. Through all of this, there are and

will continue to be attractive opportunities for Premier Miton's

business. As a Board, a leadership team and across our business, we

are determined to tackle these with vigour, clear sightedness and a

commitment to doing as well as we can for our clients. By doing

this to the best of our abilities, our shareholders and other

stakeholders should also benefit over time. We remain resilient and

flexible, optimistic and ambitious, as well as long-term in our

approach to running Premier Miton.

Robert Colthorpe

Chairman

04 December 2023

Chief Executive Officer's Statement

It has been a challenging landscape for the industry. The

Group's AuM ended the period at GBP9.8 billion, a fall of 7% on the

opening position for the year. With interest rates in the UK at

multi-year highs and more geopolitical uncertainty than we have

seen for many years, investors have simply stayed away from equity

funds.

Performance

The year was characterised by investors taking a more cautious

approach to new investments rather than accelerating their

withdrawals. We saw a reduction in demand for equity funds, which

were down by 37% on financial year 2022, but the level of

redemptions from these funds were only down by 9% year on year.

On the positive side, we continued to see growing net sales into

our fixed income funds - up by 88% year on year - and into our

'Diversified' multi-asset funds which were up by 19% year on year.

We continue to have confidence that our fixed income funds can

continue to grow as the sector returns to popularity with investors

after many years of being out of favour.

We have a strong investment team who have delivered good

investor outcomes during their three years with the firm and fixed

income remains a key focus for our distribution team.

The net management fee margin (the retained revenue of the firm

after deducting the costs of OCF caps, direct research costs and

any enhanced fee arrangements), was 61.7bps compared with 64.6bps

last year. The adjusted operating margin decreased from 30.0% to

23.5% reflecting the lower level of AuM and reduced fees earned.

The Group generated GBP15.7 million of adjusted profit before tax

for the year and had a closing cash position of GBP37.9

million.

Investment performance has remained good with 73% of our funds

delivering performance ahead of median since manager inception and

62% over the three-year period.

Strategy

The changes we made last year to our distribution team have

bedded in well. We now have well-regarded distribution and

marketing teams committed to high levels of activity targeting

those strategies that are currently in demand from investors, such

as fixed income, money market and multi-asset. We are also laying

the groundwork for when there is a renewed risk appetite for

equities. We continue to maintain high levels of visibility by

participating in numerous fund manager roadshows and events

servicing existing clients and showcasing the breadth and depth of

our investment talent to prospective clients, whilst increasing

advertising and press activity.

Given the more difficult market backdrop, there has been an

ongoing focus on ensuring costs within the business are fully

aligned with revenue expectations. Good progress has been made in

this regard with several restructuring changes completed during the

year the benefit of which will come through partially in FY23 with

full impact in FY24.

One notable feature of the more difficult market conditions is

that we are seeing more potential acquisition opportunities. This

is a feature of the market that we expect will continue for some

time. With our strong operational and distribution platform and

robust balance sheet, we are keen to take advantage of

opportunities that can add talented investment teams to our

portfolio or which allow us to access new markets or product

capabilities.

In that context, shortly after the end of the period we were

pleased to announce the acquisition of Tellworth Investments LLP

('Tellworth'), a leading UK equities boutique with AuM of GBP559

million as at 30 September 2023.

The acquisition, which remains subject to FCA approval, is in

line with our stated inorganic strategy, of buying complementary

asset management platforms that bring industry expertise and

product diversification as part of a wider commitment to continue

to invest in growth opportunities.

The acquisition broadens our offering into liquid alternatives

with the addition of long / short strategies and further

strengthens our existing UK equity franchise. Tellworth's

institutional client base also enhances our developing presence in

that market. The core investment team of Tellworth, including

co-founders Paul Marriage and John Warren will be joining us after

completion, bringing with them long track records of working in UK

equities with established industry reputations and strong networks

of contacts. The investment team's strong, consistent investment

performance across its strategies provides scope for significant

asset growth when supported by PMI's well-resourced distribution

team.

Outlook

I mentioned in my full year report to shareholders last year

that the world had changed and that the forces of globalisation

that helped drive down inflation and interest rates during the

first two decades of the century had dissipated. I continue to

believe that this will result in lower growth and that investors

will ultimately have to work much harder to both keep pace with

inflation and achieve their financial objectives.

Governments around the world have incurred significant amounts

of debt since the financial crisis in 2008/9 and this burden has

increased markedly since the COVID-19 pandemic. Excessive debt can

act as a drag on economic growth as interest costs crowd out

productive investment. It is also tempting for governments to allow

inflation to remain above long-term trends to deflate the value of

the debt. Ultimately, therefore, holding cash on deposit is not a

sustainable investment strategy in this inflationary environment.

Equities, however, have a long history of providing returns in line

with, or ahead of, inflation and in due course, we are confident

that investors will return to buying equity funds.

As I mention above, we are in a market environment that will

create opportunities for inorganic growth and we are keen to use

our platform to take advantage of this. Tellworth is one such

example but there are several further opportunities under review

that could bring new teams, additional AuM or new products allowing

us to access new markets. Whilst there is no certainty around these

opportunities, we will continue to appraise them diligently and

pursue them where it is appropriate to do so.

As a business, we have a well-diversified range of genuinely

active funds managed by a respected and experienced fund management

team with a proven track record of delivering strong investor

outcomes.

From the feedback we receive through our staff surveys as well

as feedback from advisers and clients, Premier Miton has a strong

culture that puts clients first and within which people are

respected, and work well together. Our collaborative and collegiate

environment makes Premier Miton a good home for talented investment

professionals and dedicated support teams. We have the operational

infrastructure in place to manage significantly more assets than we

do currently. If we are successful in attracting these assets as

market condition improve, the operational gearing inherent in our

business will work for the benefit of shareholders. In the

meantime, we will keep our costs aligned with our revenues and will

concentrate on our primary goal of delivering superior investment

returns for the clients who have entrusted us with their

savings.

Mike O'Shea

Chief Executive Officer

04 December 2023

Financial Review

Financial performance

Profit before tax decreased to GBP5.9 million (2022: GBP14.9

million).

Adjusted profit before tax*, which is after adjusting for

amortisation, share-based payments, merger related costs and

exceptional costs decreased to GBP15.7 million (2022: GBP24.3

million).

Adjusted profit and profit before tax

2023 2022 %

GBPm GBPm Change

-------------------------------- ------ ------ -------

Net revenue 66.9 81.2

Administrative expenses (51.4) (56.8)

Finance Income 0.2 -

-------------------------------- ------ ------ -------

Adjusted profit before tax * 15.7 24.3 (35)

-------------------------------- ------ ------ -------

Adjusted operating margin (4) * 23.5% 30.0% (22)

Amortisation (4.8) (4.8)

Share-based payments (4.7) (4.5)

Merger related costs (0.1) (0.1)

Exceptional costs (0.2) -

-------------------------------- ------ ------ -------

Profit before tax 5.9 14.9 (60)

-------------------------------- ------ ------ -------

* These are Alternative Performance Measures ('APMs').

Assets under Management * ('AuM')

A combination of net outflows totalling GBP1,147 million and

market performance resulted in the AuM ending the year at GBP9,821

million (2022: GBP10,565 million), a decrease of 7%. The Average

AuM for the year decreased by 14% to GBP10,845 million (2022:

GBP12,615 million).

Net revenue

2023 2022 %

GBPm GBPm Change

------------------------------------ ------ ------ -------

Management fees 74.4 90.6

Fees and commission expenses (7.6) (9.1)

Net management fees (1 *) 66.8 81.5 (18)

Other income / (loss) 0.1 (0.3)

------------------------------------ ------ ------ -------

Net revenue 66.9 81.2 (18)

------------------------------------ ------ ------ -------

Average AuM (2) 10,845 12,615 (14)

Net management fee margin (3) (bps) 61.7 64.6 (4)

------------------------------------ ------ ------ -------

1 Being management fee income less trail/rebate expenses and the

cost of capping any OCFs, and direct research costs.

2 Average AuM for the year is calculated using the daily AuM

adjusted for the monthly closing AuM invested in other funds

managed by the Group.

3 Net management fee margin represents net management fees

divided by the average AuM.

4 Adjusted profit before tax divided by net revenue.

The Group's revenue represents management fees generated on the

assets being managed by the Group.

Net management fees decreased to GBP66.8 million from GBP81.5

million last year, a 18% decrease reflecting both the decrease in

the Group's average AuM and net management fee margin.

The Group's net management fee margin for the year was 61.7bps.

The decrease is driven by the change in our business mix, and the

impact of flows and markets on our existing business.

Administration expenses

Administration expenses (excluding share-based payments)

totalled GBP51.4 million (2022: GBP56.8 million), a decrease of

10%.

Staff costs continue to be the largest component of

administration expenses, these consist of both fixed and variable

elements.

The fixed staff costs, which include salaries and associated

National Insurance, employers' pension contributions and other

indirect costs of employment increased to GBP22.8 million (2022:

GBP20.4 million). The rise predominantly reflects annual salary

increases and GBP1.0 million of staff related restructuring costs

completed in the year.

The average headcount for the year has decreased, from 164 to

163. At the year end the full time equivalent headcount was 159

(2022: 166). Variable staff costs totalled GBP9.7 million (2022:

GBP17.3 million). These costs move with the net revenues of the

Group and the adjusted profit before tax, hence the decrease

against the comparative period.

Included within this are general discretionary bonuses, sales

bonuses and bonuses in respect of the fund management teams, plus

associated employers' national insurance.

Overheads and other costs were broadly flat on the previous year

at GBP18.1 million (2022: GBP17.9 million). The Group continues to

assess the cost base and will make efficiencies where possible

whilst ensuring the platform remains positioned for growth when

sentiment returns.

Exceptional costs

During the year the Group incurred exceptional costs, net of

associated income, totalling GBP0.2 million following the cessation

of the development of the Group's online portal 'Connect'.

Administration expenses

2023 2022 %

GBPm GBPm Change

---------------------------- ----- ----- -------

Fixed staff costs 22.8 20.4 12

Variable staff costs 9.7 17.3 (44)

Overheads and other costs 18.1 17.9 1

Depreciation - fixed assets 0.3 0.6 (50)

Depreciation - leases 0.5 0.6 (17)

Administration expenses 51.4 56.8 (10)

---------------------------- ----- ----- -------

Share-based payments

The share-based payment charge for the year was GBP4.7 million

(2022: GBP4.5 million). Of this charge, GBP4.0 million related to

nil cost contingent share rights ('NCCSR') (2022: GBP4.3

million).

At 30 September 2023 the Group's Employee Benefit Trusts

('EBTs') held 9,452,500 ordinary shares representing 6% of the

issued ordinary share capital (2022: 12,356,304 shares).

At the year end the outstanding awards totalled 9,324,749 (2022:

11,015,578). The decrease reflects 1,577,500 NCCSR awards issued

during the year (2022: 1,902,500) offset by 3,268,629 NCCSR awards

being exercised (2022: 1,628,284).

On 13 January 2023, the Group granted 2,651,034 long-term

incentive plan ('LTIP') awards (2022: 4,182,569). The costs of the

awards is the estimated fair value at the date of grant of the

estimated entitlement to ordinary shares. At each reporting date

the estimated number of ordinary shares that may be ultimately

issued is assessed.

Balance sheet and cash

Total shareholders' equity as at 30 September 2023 was GBP121.1

million (2022: GBP126.8 million).

At the year end the cash balances of the Group totalled GBP37.9

million (2022: GBP45.8 million).

The Group has no external bank debt.

Capital management

Dividends totalling GBP13.6 million were paid in the year (2022:

GBP14.7 million).

The Board is recommending a final dividend payment of 3p per

share, bringing the total dividend payment for 2023 to 6p per share

(2022: 10.0p).

If approved by shareholders at the Annual General Meeting on 7

February 2024, the dividend will be paid on 16 February 2024 to

shareholders on the register at the close of business on 19 January

2024.

The Group's dividend policy is to target an annual ordinary

dividend pay-out of approximately 50 to 65% of profit after tax,

adjusted for exceptional costs, share-based payments and

amortisation.

Going concern

The Directors assessed the prospects of the Group considering

all the factors affecting the business when deciding to adopt a

going concern basis for the preparation of the accounts.

The Directors confirm that they have a reasonable expectation

that the Group will continue to operate and meet its liabilities,

as they fall due, comprising a period of at least 12 months from

the date of this report.

The Directors' assessment has been made with reference to the

Group's current position and strategy, the Board's appetite for

risk, the Group's financial forecasts, and the Group's principal

risks and how these are managed, as detailed in the Strategic

Report.

The Directors have also reviewed and examined the financial

stress testing inherent in the Internal Capital Adequacy and Risk

Assessment ('ICARA'). The forecast considers the Group's

profitability, cash flows, dividend payments and other key

variables. Sensitivity analysis is also performed on certain key

assumptions used in preparing the forecast, both individually and

combined, in addition to scenario analysis that is performed as

part of the ICARA process, which is formally approved by the

Board.

Alternative Performance Measures ('APMs')

The Directors use the following APMs in evaluating the

performance of the Group and for planning, reporting and

incentive-setting purposes.

Aligned

Used in management with shareholder Strategic

Unit appraisals returns KPI

Adjusted profit before tax

Definition: Profit before taxation, amortisation,

share-based payments, merger related costs

and exceptional items.

Purpose: Except for the noted costs, this

encompasses all operating expenses in the

business, including fixed and variable staff

cash costs, except those incurred on a non-cash,

non-business as usual basis. Provides a proxy

for cash generated and is the key measure

of profitability for management decision making. GBP -- -- --

---- ------------------ ----------------- ---------

Adjusted operating margin

Definition: Adjusted profit before tax (as

above) divided by net revenue.

Purpose: Used to determine the efficiency

of operations and the ratio of operating expenses

to revenues generated in the year. % -- -- --

---- ------------------ ----------------- ---------

Cash generated from operations

Definition: Profit before taxation adjusted

for the effects of transactions of a non-cash

nature, any deferrals or accruals and items

of income or expense associated with investing

or financing cash flows.

Purpose: Provides a measure in demonstrating

the amount of cash generated from the Group's

ongoing regular business operations. GBP --

---- ------------------ ----------------- ---------

AuM

Definition: The value of external assets that

are managed by the Group.

Purpose: Management fee income is calculated

based on the level of AuM managed. The AuM

managed by the Group is used to measure the

Group's size relative to the industry peer

group. GBP -- -- --

---- ------------------ ----------------- ---------

Net management fee

Definition: The net management fee revenue

of the Group. Calculated as gross management

fee income, less the cost of external Authorised

Corporate Directors ('ACD'), OCF caps, direct

research costs and any enhanced fee arrangements.

Purpose: Provides a consistent measure of

the profitability of the Group and its ability

to grow and retain clients, after removing

amounts paid to third parties. GBP --

---- ------------------ ----------------- ---------

Net management fee margin

Definition: Net management fees divided by

average AuM.

Purpose: A measure used to demonstrate the

blended fee rate earned from the AuM managed

by the Group. A basis point ('bps') represents

one hundredth of a percent. This measure is

used within the asset management sector and

provides comparability of the Group's net

revenue generation. bps -- --

---- ------------------ ----------------- ---------

Adjusted earnings per share (basic)

Definition: Adjusted profit after tax divided

by the weighted average number of shares in

issue in the year.

Purpose: Provides a clear measure to shareholders

of the operating profitability and cash generation

of the Group from its underlying operations

at a value per share. The exclusion of amortisation,

share-based payments, merger related costs

and exceptional items provides a consistent

basis for comparability of results year on

year. p -- -- --

---- ------------------ ----------------- ---------

Financial Statements

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2023

2023 2022

Notes GBP000 GBP000

------------------------------------ --------------------------- -------- --------

Revenue 3 74,550 90,233

Fees and commission expenses (7,612) (9,062)

------------------------------------ --------------------------- -------- --------

Net revenue 66,938 81,171

Administrative costs (51,357) (56,818)

Share-based payment expense 16 (4,721) (4,505)

Amortisation of intangible assets 10 (4,861) (4,861)

Merger related costs 4 (51) (51)

Exceptional items 4 (250) -

------------------------------------ --------------------------- -------- --------

Operating profit 5 5,698 14,936

Finance income / (expense) 7 168 (23)

------------------------------------ --------------------------- -------- --------

Profit for the year before taxation 5,866 14,913

Taxation 8 (2,190) (5,346)

------------------------------------ --------------------------- -------- --------

Profit for the year after taxation

attributable to equity holders

of the parent 3,676 9,567

------------------------------------ --------------------------- -------- --------

pence pence

--------------------------- ----- -----

Basic earnings per share 9 2.50 6.54

--------------------------- ----- -----

Diluted earnings per share 9 2.35 6.12

--------------------------- ----- -----

No other comprehensive income was recognised during 2023 or

2022. Therefore, the profit for the year is also the total

comprehensive income.

All of the amounts relate to continuing operations.

Consolidated Statement of Changes in Equity

For the year ended 30 September 2023

Own shares

held Capital

Share Merger by an redemption Retained Total

capital reserve EBT reserve earnings Equity

Notes GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

At 1 October 2021 60 94,312 (15,790) 4,532 49,110 132,224

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

Profit for the year - - - - 9,567 9,567

Purchase of own shares held

by EBTs - - (4,492) - - (4,492)

Exercise of options - - 3,538 - (3,538) -

Share-based payment expense 16 - - - - 4,505 4,505

Deferred tax direct to equity - - - - (344) (344)

Equity dividends paid 17 - - - - (14,696) (14,696)

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

At 30 September 2022 60 94,312 (16,744) 4,532 44,604 126,764

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

Profit for the year - - - - 3,676 3,676

Purchase of own shares held

by EBTs - - (381) - - (381)

Exercise of options - - 4,457 - (4,457) -

Share-based payment expense 16 - - - - 4,721 4,721

Other amounts direct to equity - - - - (78) (78)

Deferred tax direct to equity - - - - (38) (38)

Equity dividends paid 17 - - - - (13,601) (13,601)

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

At 30 September 2023 60 94,312 (12,668) 4,532 34,827 121,063

------------------------------- ----- -------- -------- ---------- ----------- --------- --------

Consolidated Statement of Financial Position

As at 30 September 2023

2023 2022

Notes GBP000 GBP000

---------------------------------------------- ----- --------- ---------

Non-current assets

Goodwill 10 70,688 70,688

Intangible assets 10 17,655 22,516

Other investments 100 100

Property and equipment 518 1,192

Right-of-use assets 2,724 908

Deferred tax asset 8(d) 1,147 1,928

Finance lease receivables - 77

Trade and other receivables 11 482 1,081

---------------------------------------------- ----- --------- ---------

93,314 98,490

Current assets

Financial assets at fair value through profit

and loss 1,207 2,089

Finance lease receivables 77 197

Trade and other receivables 11 124,467 136,052

Cash and cash equivalents 12 37,942 45,764

---------------------------------------------- ----- --------- ---------

163,693 184,102

---------------------------------------------- ----- --------- ---------

Total assets 257,007 282,592

---------------------------------------------- ----- --------- ---------

Current liabilities

Trade and other payables 13 (128,553) (148,820)

Provisions 14 - -

Lease liabilities (265) (887)

---------------------------------------------- ----- --------- ---------

(128,818) (149,707)

---------------------------------------------- ----- --------- ---------

Non-current liabilities

Provisions 14 (374) (374)

Deferred tax liability 8(d) (4,414) (5,485)

Lease liabilities (2,338) (262)

---------------------------------------------- ----- --------- ---------

Total liabilities (135,944) (155,828)

---------------------------------------------- ----- --------- ---------

Net assets 121,063 126,764

---------------------------------------------- ----- --------- ---------

Equity

Share capital 15 60 60

Merger reserve 94,312 94,312

Own shares held by Employee Benefit Trusts (12,668) (16,744)

Capital redemption reserve 4,532 4,532

Retained earnings 34,827 44,604

---------------------------------------------- ----- --------- ---------

Total equity shareholders' funds 121,063 126,764

---------------------------------------------- ----- --------- ---------

Consolidated Statement of Cash Flows

For the year ended 30 September 2023

2023 2022

Notes GBP000 GBP000

----------------------------------------------------- ----- -------- --------

Cash flows from operating activities:

Profit for the year 3,676 9,567

Adjustments to reconcile profit to net cash flow

from operating activities:

- Tax on continuing operations 8(a) 2,190 5,346

- Finance (income) / expense 7 (168) 23

- Interest payable on leases 27 60

- Depreciation - fixed assets 335 580

- Depreciation - leases 525 621

- Gain on derecognition of right-of-use asset - (115)

- Receivable for the net investment in sub-lease - 334

- (Gain) / loss on revaluation of financial assets

at fair value through profit and loss (82) 345

- Loss on disposal of property and equipment 250 171

- Amortisation of intangible assets 10 4,861 4,861

- Share-based payment expense 16 4,721 4,505

- Decrease in trade and other receivables 11,807 10,800

- Decrease in trade and other payables (20,267) (14,403)

Cash generated from operations 7,875 22,695

Income tax paid (2,043) (5,352)

----------------------------------------------------- ----- -------- --------

Net cash flow from operating activities 5,832 17,343

----------------------------------------------------- ----- -------- --------

Cash flows from investing activities:

Interest received / (paid) 188 (23)

Acquisition of assets at fair value through profit

and loss (140) (85)

Proceeds from disposal of assets at fair value

through profit and loss 1,104 1,180

Purchase of property and equipment (160) (207)

Proceeds from disposal of property and equipment 250 -

----------------------------------------------------- ----- -------- --------

Net cash flow from investing activities 1,242 865

----------------------------------------------------- ----- -------- --------

Cash flows from financing activities:

Lease payments (914) (931)

Purchase of own shares held by EBTs (381) (4,492)

Equity dividends paid 17 (13,601) (14,696)

Net cash flow from financing activities (14,896) (20,119)

----------------------------------------------------- ----- -------- --------

Decrease in cash and cash equivalents (7,822) (1,911)

Cash and cash equivalents at the beginning of

the year 45,764 47,675

----------------------------------------------------- ----- -------- --------

Cash and cash equivalents at the end of the year 12 37,942 45,764

----------------------------------------------------- ----- -------- --------

Selected notes to the Consolidated Financial Statements

For the year ended 30 September 2023

1. Authorisation of financial statements and statement of

compliance with IFRS

The Consolidated Financial Statements of Premier Miton Group plc

(the 'Company') and its subsidiaries (the 'Group') for the year

ended 30 September 2023 were authorised for issue by the Board of

Directors on 4 December 2023 and the Consolidated Statement of

Financial Position was signed on the Board's behalf by Mike O'Shea

and Piers Harrison.

The Company is a public limited company incorporated and

domiciled in England and Wales. The Company's ordinary shares are

traded on the Alternative Investment Market ('AIM').

These Consolidated Financial Statements were prepared in

accordance with UK-adopted international accounting standards in

conformity with the requirements of the Companies Act 2006. The

Consolidated Financial Statements are presented in Sterling and all

values are rounded to the nearest thousand pounds (GBP000) except

when otherwise indicated.

The principal accounting policies adopted by the Group are set

out in note 2.

2. Accounting policies

Basis of preparation

The Consolidated Group Financial Statements for the year ended

30 September 2023 have been prepared in accordance with UK-adopted

International Financial Reporting Standards ('IFRS'). The

Consolidated Financial Statements have been prepared on a going

concern basis, under the historical cost convention, as modified by

the revaluation of financial assets and financial liabilities

measured at fair value through profit or loss. Costs are expensed

as incurred.

The Directors have assessed the prospects of the Group

considering all the factors affecting the business when deciding to

adopt a going concern basis for the preparation of the accounts.

The Directors confirm that they have a reasonable expectation that

the Group will continue to operate and meet liabilities, as they

fall due, comprising a period of at least 12 months from the date

of this report. This assessment has been made after considering the

impact of recent geopolitical events and Ukraine crisis on the

business. The Directors note that the Group has no external

borrowings and maintains significant levels of cash reserves.

The Directors' assessment has been made with reference to the

Group's current position and strategy, the Board's appetite for

risk, the Group's financial forecasts, and the Group's principal

risks and how these risks are managed, as detailed in the Strategic

Report. The Directors have also reviewed and examined the financial

stress testing inherent in the Internal Capital Adequacy and Risk

Assessment ('ICARA'). The forecast considers the Group's

profitability, cash flows, dividend payments and other key

variables. Sensitivity analysis is also performed on certain key

assumptions used in preparing the forecast, both individually and

combined, in addition to scenario analysis that is performed as

part of the ICARA process, which is formally approved by the Board.

This analysis demonstrates that even after modelling materially

lower levels of assets under management ('AuM') associated with a

reasonably plausible downside scenario, the business remains cash

generative.

3. Revenue

Revenue recognised in the Consolidated Statement of

Comprehensive Income is analysed as follows:

2023 2022

GBP000 GBP000

--------------------- ------- -------

Management fees 74,450 90,570

Commissions 3 4

Other income/ (loss) 97 (341)

Total revenue 74,550 90,233

--------------------- ------- -------

All revenue is derived from the UK and Channel Islands.

4. Exceptional items and merger related costs

Recognised in arriving at operating profit from continuing

operations:

2023 2022

GBP000 GBP000

------------------------ ------- -------

Closure of connect 250 -

Total exceptional costs 250 -

------------------------ ------- -------

Merger related costs 51 51

Total merger related costs 51 51

---------------------------

Exceptional items are those items of income and expense, which

are considered not to be incurred in the normal course of business

of the Group's operations, and because of the nature of the events

giving rise to them, merit separate presentation to allow

shareholders to understand better the elements of financial

performance in the year.

In accordance with the accounting policy for exceptional items

these costs have been treated as exceptional.

Exceptional items, net of associated income were incurred in

relation to the cessation of the development of the Group's online

portal 'Connect'. This resulted in net expenditure of

GBP250,000.

Merger related costs in the year totalling GBP51,132 (2022:

GBP51,132) represented legal and professional fees associated with

the merger with Miton Group plc.

5. Operating profit

(a) Operating profit is stated after charging:

Notes 2023 2022

GBP000 GBP000

--------------------------------------- ----- ------- -------

Auditor's remuneration 5(b) 694 592

Staff costs 6 35,798 41,072

Interest - leases 27 60

Amortisation of intangible assets 10 4,861 4,861

Exceptional items - closure of Connect 4 250 -

Merger related costs 4 51 51

Loss on disposal of fixed assets - 171

Depreciation - fixed assets 335 580

Depreciation - leases 525 621

--------------------------------------- ----- ------- -------

(b) Auditor's remuneration

The remuneration of the auditor is analysed as follows:

2023 2022

GBP000 GBP000

--------------------------------------- ------- -------

Audit of Company 178 114

Audit of subsidiaries 272 193

---------------------------------------- ------- -------

Total audit 450 307

---------------------------------------- ------- -------

Audit-related assurance services 244 285

Total audit-related assurance services 244 285

---------------------------------------- ------- -------

Total fees 694 592

---------------------------------------- ------- -------

6. Staff costs and Directors' remuneration

Staff costs during the year were as follows:

2023 2022

GBP000 GBP000

---------------------- ------- -------

Salaries and bonus 26,373 31,141

Social security costs 3,628 4,436

Share-based payments 4,721 4,505

Other pension costs 1,076 990

----------------------- ------- -------

Total staff costs 35,798 41,072

----------------------- ------- -------

The average monthly number of employees of the Group during the

year was made up as follows:

2023 2022

number number

---------------------- ------- -------

Directors 8 8

Investment management 56 55

Sales and marketing 36 36

Finance and systems 11 11

Legal and compliance 12 12

Administration 40 42

----------------------- ------- -------

Total employees 163 164

----------------------- ------- -------

7. Finance expense

2023 2022

GBP000 GBP000

------------------------------- ------- -------

Interest receivable (234) (21)

Interest payable 66 44

-------------------------------- ------- -------

Net finance (income) / expense (168) 23

-------------------------------- ------- -------

8. Taxation

(a) Tax recognised in the Consolidated Statement of

Comprehensive Income

2023 2022

GBP000 GBP000

--------------------------------------------------------- ------- -------

Current income tax:

UK corporation tax 2,531 4,262

--------------------------------------------------------- ------- -------

Current income tax charge 2,531 4,262

--------------------------------------------------------- ------- -------

Adjustments in respect of prior periods (12) (59)

--------------------------------------------------------- ------- -------

Total current income tax 2,519 4,203

--------------------------------------------------------- ------- -------

Deferred tax:

Origination and reversal of temporary differences (329) 1,128

Adjustments in respect of prior periods - 15

--------------------------------------------------------- ------- -------

Total deferred tax (income) / expense (329) 1,143

--------------------------------------------------------- ------- -------

Income tax charge reported in the Consolidated Statement

of Comprehensive Income 2,190 5,346

--------------------------------------------------------- ------- -------

(b) Reconciliation of the total income tax charge

The tax expense in the Consolidated Statement of Comprehensive

Income for the year is higher than the standard rate of corporation

tax in the UK of 22% (2022: 19%). The differences are reconciled

below:

2023 2022

GBP000 GBP000

------------------------------------------------------ ------- -------

Profit before taxation 5,866 14,913

------------------------------------------------------ ------- -------

Tax calculated at UK standard rate of corporation tax

of 22% (2022: 19%): 1,290 2,833

- Other differences 1 2,042

- Share-based payments 1,564 777

- Expenses not deductible for tax purposes 20 20

- Amortisation not deductible - 125

- Income not subject to UK tax - 5

- Tax relief on vested options (683) (418)

- Fixed asset differences 10 6

- Adjustments in respect of prior periods (12) (44)

------------------------------------------------------ ------- -------

Income tax charge in the Consolidated Statement of

Comprehensive Income 2,190 5,346

------------------------------------------------------ ------- -------

(c) Change in corporation tax rate

In the Spring Budget 2021, the Government announced that from 1

April 2023 the corporation tax rate will increase to 25% from 19%.

This was substantively enacted on 24 May 2021. The deferred tax

balances included within the Consolidated Financial Statements have

been calculated with reference to the rate of 25% to the relevant

balances from 1 April 2023.

(d) Deferred tax

The deferred tax included in the Group's Consolidated Statement

of Financial Position is as follows:

2023 2022

GBP000 GBP000

----------------------------------------------------- ------- -------

Deferred tax asset:

----------------------------------------------------- ------- -------

- Fixed asset temporary differences 32 8

- Accrued bonuses 315 556

- Share-based payments 800 1,364

Deferred tax disclosed on the Consolidated Statement

of Financial Position 1,147 1,928

----------------------------------------------------- ------- -------

2023 2022

GBP000 GBP000

----------------------------------------------------- ------- -------

Deferred tax liability:

----------------------------------------------------- ------- -------

- Arising on acquired intangible assets 2,764 3,543

- Arising on historic business combination 1,650 1,940

- Fixed asset temporary differences - 2

Deferred tax disclosed on the Consolidated Statement

of Financial Position 4,414 5,485

----------------------------------------------------- ------- -------

2023 2022

GBP000 GBP000

------------------------------------------------------------ ------- -------

Deferred tax in the Consolidated Statement of Comprehensive

Income:

------------------------------------------------------------ ------- -------

- Origination and reversal of temporary differences (329) (938)

- Arising on historic business combination - 2,066

- Adjustments in respect of prior periods - 15

------------------------------------------------------------ ------- -------

Deferred tax (income) / expense (329) 1,143

------------------------------------------------------------ ------- -------

All movements in deferred tax balances relate to profit and loss

except for the GBP38,000 that is included in equity.

2023 2022

GBP000 GBP000

------------------------------------------ ------- -------

Unprovided deferred tax asset:

------------------------------------------ ------- -------

- Non-trade loan relationship losses 2,593 1,971

- Excess management expenses 67 51

- Non-trade intangible fixed asset losses 525 399

------------------------------------------ ------- -------

Unprovided deferred tax asset 3,185 2,421

------------------------------------------ ------- -------

9. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to ordinary equity shareholders of the

Parent Company by the weighted average number of ordinary shares

outstanding at the year end.

The weighted average of issued ordinary share capital of the

Company is reduced by the weighted average number of shares held by

the Group's EBTs. Dividend waivers are in place over shares held in

the Group's EBTs.

In calculating diluted earnings per share, IAS 33 'Earnings Per

Share' requires that the profit is divided by the weighted average

number of ordinary shares outstanding during the year plus the

weighted average number of ordinary shares that would be issued on

conversion of all the dilutive potential ordinary shares into

ordinary shares during the period.

(a) Reported earnings per share

Reported basic and diluted earnings per share has been

calculated as follows:

2023 2022

GBP000 GBP000

---------------------------------------------------- -------- --------

Profit attributable to ordinary equity shareholders

of the Parent Company for basic earnings 3,676 9,567

---------------------------------------------------- -------- --------

Number Number

000 000

---------------------------------------------------- -------- --------

Issued ordinary shares at 1 October 157,913 157,913

- Effect of own shares held by an EBT (10,778) (11,677)

Weighted average shares in issue 147,135 146,236

---------------------------------------------------- -------- --------

- Effect of movement in share options 9,606 10,184

---------------------------------------------------- -------- --------

Weighted average shares in issue - diluted 156,741 156,420

---------------------------------------------------- -------- --------

Basic earnings per share (pence) 2.50 6.54

Diluted earnings per share (pence) 2.35 6.12

---------------------------------------------------- -------- --------

(b) Adjusted earnings per share

Adjusted earnings per share is based on adjusted profit after

tax, where adjusted profit is stated after charging interest but

before amortisation, share-based payments, merger related costs and

exceptional items.

Adjusted profit for calculating adjusted earnings per share:

2023 2022

GBP000 GBP000

---------------------------------------------------------- ------- -------

Profit before taxation 5,866 14,913

Add back:

- Share-based payment expense 4,721 4,505

- Amortisation of intangible assets 4,861 4,861

- Merger related costs 51 51

- Exceptional items 250 -

---------------------------------------------------------- ------- -------

Adjusted profit before tax 15,749 24,330

---------------------------------------------------------- ------- -------

Taxation:

---------------------------------------------------------- ------- -------

- Tax in the Consolidated Statement of Comprehensive

Income (2,190) (5,346)

---------------------------------------------------------- ------- -------

- Tax effects of adjustments (610) 1,176

---------------------------------------------------------- ------- -------

Adjusted profit after tax for the calculation of adjusted

earnings per share 12,949 20,160

---------------------------------------------------------- ------- -------

Adjusted earnings per share was as follows using the number of

shares calculated at note 9(a):

2023 2022

pence pence

------------------------------------ ------ ------

Adjusted earnings per share 8.80 13.79

Diluted adjusted earnings per share 8.26 12.89

------------------------------------ ------ ------

10. Goodwill and other intangible assets

Cost amortisation and net book value of intangible assets are as

follows:

Goodwill Other Total

Year to 30 September 2023 GBP000 GBP000 GBP000

---------------------------------------- -------- ------- -------

Cost:

At 1 October 2022 and 30 September 2023 77,927 81,025 158,952

Amortisation and impairment:

At 1 October 2022 7,239 58,509 65,748

Amortisation during the year - 4,861 4,861

---------------------------------------- -------- ------- -------

At 30 September 2023 7,239 63,370 70,609

---------------------------------------- -------- ------- -------

Carrying amount:

---------------------------------------- -------- ------- -------

At 30 September 2023 70,688 17,655 88,343

---------------------------------------- -------- ------- -------

At 30 September 2022 70,688 22,516 93,204

---------------------------------------- -------- ------- -------

Goodwill Other Total

Year to 30 September 2022 GBP000 GBP000 GBP000

-------------------------------------------- -------- ------- -------

Cost:

At 1 October 2021 and 30 September 2022 77,927 81,025 158,952

Amortisation and impairment:

At 1 October 2021 7,239 53,648 60,887

Amortisation and impairment during the year - 4,861 4,861

-------------------------------------------- -------- ------- -------

At 30 September 2022 7,239 58,509 65,748

-------------------------------------------- -------- ------- -------

Carrying amount:

-------------------------------------------- -------- ------- -------

At 30 September 2022 70,688 22,516 93,204

-------------------------------------------- -------- ------- -------

At 30 September 2021 70,688 27,377 98,065

-------------------------------------------- -------- ------- -------

Impairment tests for goodwill

The Group has determined that it has a single group of CGUs in

relation to asset management for the purposes of assessing the

carrying value of goodwill. In line with IAS 36, 'Impairment of

Assets', a full impairment review was undertaken as at 30 September

2023. The recoverable amount within the fund management CGU was

determined by assessing the value-in-use using long-term cash flow

projections for the CGU. The Group operates as a single CGU for the

purposes of monitoring and assessing goodwill for impairment. This

reflects one operating platform, into which acquired businesses are

fully integrated and from which acquisition-related synergies are

expected to be realised. Senior management receive and review

internal financial information as one single entity, with no

disaggregation for segments or geography.

Data for the explicit forecast period of 2024-2028 is based on

the 2024 budget and forecasts for 2025-2028. AuM levels were

determined by assuming net flows, per fund, over this five-year

period based on two key metrics - the first being the momentum of

net flows over the preceding two years, and the second being the

investment performance of the fund against its sector. The Group

believes these two factors are key when making assumptions about

the growth of AuM in the future, and hence expected future cash

flows. Net revenue margins per fund have been assumed at current

levels, unless sufficient reasons exist to deviate, for example

share class consolidation.

The projected operating margin moves in line with the Group's

AuM levels and its overall product mix each year. Increases in

operating costs have been taken into account and include assumed

new business volumes. No cost allowance has been made for future

acquisitions, nor any acquired levels of AuM. The Group's

commitment to responsible investing has also been considered

(within headcount over the forecast period) and the impact to its

cash flows on a longer-term basis, particularly in light of the

possible actions of regulators, customers and suppliers. Cash flows

beyond the explicit forecast period are extrapolated using a

long-term terminal growth rate of 1.7% (2022: 1.7%). To arrive at

the net present value, cash flows have been discounted using a

discount rate of 14.5% (2022: 13%) determined using the capital

asset pricing model (post-tax). The Group engaged valuation

specialists in determining the inputs to calculate the appropriate

discount rate, including current assessments of comparative betas,

long-term economic growth rates and the equity risk premiums

published and observed in the wider industry. The increase in the

discount rate from the prior year is largely due to the increase in

the long-term risk-free rate which was based on 30-year gilts (the

2053 maturity) yielding 4.6% (2022: 3.2%). The Group's pre-tax

discount rate was calculated to be 18% (2022: 16%).

The value-in-use amount calculated was greater than the carrying

value and hence no impairment charge was recognised. As noted

above, the most material assumptions used in determining this

conclusion were the discount rate and compound annual AuM growth

rate. As an additional consideration the Group compares its

value-in-use amount and net assets to market multiples within the

UK asset management sector.

Sensitivity analysis

Management have performed a sensitivity analysis as at 30

September 2023 and established that an increase in the post tax

discount rate to 19% would be required before an impairment of

goodwill would be considered necessary. This would require the

long-term risk-free rate and equity risk premium to be at

significantly higher levels than at present. Analysis was also

completed using materially lower levels of AuM and the

corresponding impact on projected cash flows within the impairment

assessment. The base case annual growth rate for AuM is assumed at

10.3% over the forecast period. Due to the cash generative nature

of the business, and that a large proportion of costs are linked to

the net revenues and underlying profitability of the Group, this

rate would need to remain under 5.5% per annum over the entire

five-year period before any impairment was identified. This also

assumes no material change to the Group's cost base during this

five year period as well as the discount rate to remain unchanged.

Management note the average annual return for the MSCI World Index

(in GBP) over the past 25 years was approximately 7%. The base case

annual growth rate of 10.3% is a combination of both this market

beta movement and an assumption of fund inflows into the Group's

product suite.

The sensitivity analysis established that an increase in the

discount rate by 3% (to 17.5%) would not have a material impact on

the Group's results. We conclude no reasonable change in

assumptions would trigger an impairment to goodwill. The Group is,

however, mindful of the current uncertainty that exists in markets

including the threat posed by recent geopolitical events and that

extreme movements may be cause for further examination into the

possibilities of impairment in the future.

Change required to reduce headroom to zero %

------------------------------------------- ---

Increase in discount rate by 4.5% to: 19

Reduction in the CAGR over the entire five

year period by 4.8% to: 5.5

Other intangible assets

The Group's other intangible assets comprise of investment

management agreements ('IMAs') purchased by the Group. The carrying

amount above relates to two historic transactions, the largest

being the merger with Miton Group plc with a carrying value of

GBP11,055,890 and a remaining amortisation period of three years

(2022: GBP14,596,097 and a remaining amortisation period of four

years). The remaining balance relates to a transaction completed in

2007 to acquire IMAs which now have a carrying value of

GBP6,599,618 and a remaining amortisation period of five years

(2022: GBP7,920,267 and a remaining amortisation period of six

years).

The determination of useful lives, and hence amortisation

period, used for other intangible assets requires an assessment of

the length of time the Group expects to derive benefits from the

asset. This depends on a number of factors, the most significant

being the duration of customer investment timeframes and the type

of underlying fund (for example the asset classes specified by the

fund's investment objectives will give insight into its usual

life).

An assessment is performed at each reporting period for each

intangible asset for indicators of impairment. There are two core

metrics used in this assessment - the first being the comparison of

AuM levels at the period end with those included in the original

intangible asset valuation and the second being the investment

performance of each individual fund against its comparable peers

and benchmarks. In addition, both internal and external factors

affecting the funds are considered such as current net margin,

potential regulatory changes and future demand for its asset class.

For each intangible asset mentioned above, if required, further

analysis is performed on a fund management team basis, and the

estimated aggregate cashflows generated by each team. These

estimated cashflows are modelled based on the current level of AuM

for the funds managed by each team and are compared against the

original basis used to value the intangible at the acquisition date

and their remaining amortisation period. Despite the recent

fluctuations in AuM, no indicators of impairment were noted when

analysing at a fund management team level. Notably, the largest

other intangible asset is more than halfway through its

amortisation period of 7 years, resulting in the carrying amount

being less than half of its original value on inception. The

long-term investment performance for all investment teams assessed

were above the relevant sector average, reflecting the quality of

the investment process.

11. Trade and other receivables

2023 2022

Current GBP000 GBP000

---------------------------------------------------------------- ------- -------

Due from trustees/investors for open end fund redemptions/sales 113,310 122,339

Other trade debtors 374 526

Fees receivable 5,180 6,132

Prepayments 2,099 2,662

Corporation tax 1,299 1,794

Other receivables 2,205 2,599

---------------------------------------------------------------- ------- -------

Total trade and other receivables 124,467 136,052

---------------------------------------------------------------- ------- -------

Non-current

---------------------------------------------------------------- ------- -------

Other receivables 482 1,081

---------------------------------------------------------------- ------- -------

Trade and other receivables are all current and any fair value

difference is not material. Trade and other receivables are

considered past due once they have passed their contracted due

date.

Non-current other receivables represent deferred compensation

awards with maturities greater than 12 months after Consolidated

Statement of Financial Position date. Deferred compensation awards

are released in accordance with the employment period to which they

relate.

12. Cash and cash equivalents

2023 2022

GBP000 GBP000

-------------------------------- ------- -------

Cash at bank and in hand 37,863 45,682

Cash held in EBTs 79 82

-------------------------------- ------- -------

Total cash and cash equivalents 37,942 45,764

-------------------------------- ------- -------

13. Trade and other payables

2023 2022

GBP000 GBP000

------------------------------------------------------------------ ------- -------

Due to trustees/investors for open end fund creations/redemptions 112,541 122,334

Other trade payables 1,297 1,542

Other tax and social security payable 1,765 3,031

Accruals 11,496 20,021

Pension contributions 116 9

Other payables 1,338 1,883

Total trade and other payables 128,553 148,820

------------------------------------------------------------------ ------- -------

Trade creditors and accruals principally comprise amounts

outstanding for trade purchases and ongoing costs. The Group has

financial risk management policies in place to ensure that all

payables are paid within the pre-agreed credit terms.

Other payables relate predominantly to amounts due to outsource

providers for administrative services provided to the Group's

funds.

The Directors consider that the carrying amount of trade

payables approximates to their fair value.

14. Provisions

2023 2022

GBP000 GBP000

--------------------- ------- -------

At 1 October 374 389

Movement in the year - (15)

--------------------- ------- -------

At 30 September 374 374

Current - -

Non-current 374 374

--------------------- ------- -------

374 374

--------------------- ------- -------

Provisions relate to dilapidations for the offices at 6th Floor,

Paternoster House, London, the lease on this property runs to 28

November 2028 and the provision for dilapidations on this office

has been disclosed as non-current. This provision is based on

prices quoted at the time of the lease being taken on.

15. Share capital

Ordinary

shares Deferred

2023 allotted, called up and fully paid: 0.02 pence shares

Number of shares each Number Number

----------------------------------------- ------------ --------

At 1 October 2022 157,913,035 1

Movement in the year - -

----------------------------------------- ------------ --------

At 30 September 2023 157,913,035 1

----------------------------------------- ------------ --------

Ordinary

shares Deferred

2022 allotted, called up and fully paid: 0.02 pence shares

Number of shares each Number Number

----------------------------------------- ------------ --------

At 1 October 2021 157,913,035 1

Movement in the year - -

----------------------------------------- ------------ --------

At 30 September 2022 157,913,035 1

----------------------------------------- ------------ --------

Ordinary shares Deferred Total

2023 allotted, called up and fully paid: 0.02 pence each shares shares

Value of shares GBP000 GBP000 GBP000

----------------------------------------- ---------------- -------- -------

At 1 October 2022 31 29 60

Movement in the year - - -

----------------------------------------- ---------------- -------- -------

At 30 September 2023 31 29 60

----------------------------------------- ---------------- -------- -------

Ordinary shares Deferred Total

2022 allotted, called up and fully paid: 0.02 pence each shares shares

Value of shares GBP000 GBP000 GBP000

----------------------------------------- ---------------- -------- -------

At 1 October 2021 31 29 60

Movement in the year - - -

----------------------------------------- ---------------- -------- -------

At 30 September 2022 31 29 60

----------------------------------------- ---------------- -------- -------

The deferred share carries no voting rights and no right to

receive a dividend.

16. Share-based payments

The total charge to the Consolidated Statement of Comprehensive

Income for share-based payments in respect of employee services

received during the year to 30 September 2023 was GBP4,720,721

(2022: GBP4,504,620), of which GBP3,953,896 related to nil cost

contingent share rights (2022: GBP4,314,386).

17. Dividends declared and paid

2023 2022

GBP000 GBP000

------------------------------------------------------- ------- -------

Equity dividends on ordinary shares:

- Interim dividend: 3.0 (2022: interim 3.7) pence

per share 4,454 5,427

- Final dividend for 2022: 6.3 (2021 final 6.3) pence

per share 9,147 9,269

------------------------------------------------------- ------- -------

Dividends paid 13,601 14,696

------------------------------------------------------- ------- -------

The Directors recommend a final dividend of 3p per share (2022:

6.3p) payable on 16 February 2024 to shareholders on the register

as at 19 January 2024.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DBBDDBDGDGXS

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

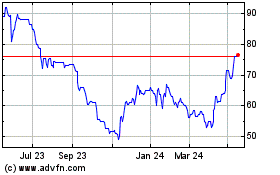

Premier Miton (LSE:PMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

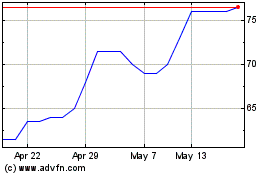

Premier Miton (LSE:PMI)

Historical Stock Chart

From Dec 2023 to Dec 2024