Premier Miton Group PLC Acquisition of Tellworth Investments LLP (0605S)

November 01 2023 - 7:23AM

UK Regulatory

TIDMPMI

RNS Number : 0605S

Premier Miton Group PLC

01 November 2023

NOT FOR RELEASE PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE UK MARKET ABUSE REGULATIONS.

FOR IMMEDIATE RELEASE.

1 November 2023

Premier Miton Group plc

('Premier Miton' or the 'Company')

Acquisition of Tellworth Investments LLP

Premier Miton Group plc (AIM: PMI) is pleased to announce the

acquisition of Tellworth Investments LLP ("Tellworth"), a leading

UK equity boutique with assets under management ("AuM") of GBP559m

as at 30(th) September 2023. Tellworth, which offers both

long/short and long only strategies to wholesale and institutional

clients, was established in 2017 by Paul Marriage and John Warren,

with the support of a minority shareholder, BennBridge Hold Co Ltd

("the Exiting Shareholder").

The acquisition is in line with Premier Miton's stated inorganic

strategy of buying complimentary asset management platforms with

industry expertise and product diversification as part of a wider

commitment to continue to invest in growth opportunities.

The acquisition expands Premier Miton's offering into liquid

alternatives with the addition of long/short strategies and further

strengthens Premier Miton's existing UK equity franchise. The

business also offers strategies with potential for institutional

distribution, building on Premier Miton's developing presence in

that market. Tellworth's core investment team, including

co-founders Paul Marriage and John Warren, will move across to

Premier Miton, bringing with them long track records of working in

UK equities with established industry reputations and strong

networks of contacts. The acquisition adds an investment team which

is delivering good, consistent investment performance across its

strategies giving scope for significant asset growth when supported

by Premier Miton's well-resourced distribution team.

The initial consideration for Tellworth will be based on AuM at

completion. At the current AuM this will be GBP5.5m but this can

vary between GBP3.5m and GBP6m depending on AuM at completion.

Initial consideration will be payable 75% to Paul Marriage and John

Warren (the "Continuing Shareholders") (this 75% will be split 25%

in cash and 75% in PMI shares) and 25% in cash to the Exiting

Shareholder. The consideration shares issued to Continuing

Shareholders will have selling restrictions, namely 25% must be

held for one year and 75% must be held for two years (from the date

of completion).

An additional consideration of up to GBP3m may be payable

depending on AuM growth between completion and the first

anniversary of completion with the maximum amount payable if AuM at

the first anniversary date exceeds GBP850m. This will be payable

95% to Continuing Shareholders in PMI shares or cash (at Premier

Miton's discretion) and 5% payable in cash to the Exiting

Shareholder. Any shares issued as part of the additional

consideration are to be held until three years from the date of

completion. In the year to March 2023, Tellworth generated a profit

before tax, members' remuneration or profit shares of GBP2.07m and

had net assets of GBP1.09m at 31 March 2023.

The acquisition is subject to customary approval by the

Financial Conduct Authority and is expected to complete in early

2024. The Tellworth business will transition onto the Premier Miton

platform in the second half of 2024. The acquisition is expected to

be earnings enhancing in the first full year of ownership post

transition.

Mike O'Shea, Chief Executive Officer of Premier Miton,

commented:

"We continue to explore inorganic opportunities alongside our

clear organic growth strategy, and are pleased to announce this new

acquisition, which we believe is complementary to our existing

business and further strengthens our longer-term growth plans. We

will now be able to offer our clients access to an even broader

range of UK equity investment solutions, bringing the specific

proven experience and expertise of Paul Marriage and John Warren,

to work alongside our own specialist UK investment team; the team

have proven track records of delivering good investment outcomes

for investors."

"In addition, Tellworth's existing presence in the institutional

market will further strengthen our distribution strategy as we look

to grow our footprint in this market."

"We continue to enhance our existing investment capabilities,

which included launching a new Emerging Markets Sustainable Fund

earlier this year, and we are delighted to be welcoming the

Tellworth team to Premier Miton, to help grow our business across

different client channels and offer a range of high performing,

differentiated products."

Helme Harrison, Chief Executive Officer of Tellworth

commented:

"We are really excited to join the Premier Miton team. We see a

strong cultural fit with Premier Miton's highly regarded and

well-respected investment managers, who share our passion for

investment excellence and delivering superior long-term client

outcomes. Premier Miton recognises the value of both our brand and

our longstanding expertise in uncovering mispriced opportunities

within the underappreciated UK market."

ENDS

For further information, please contact:

Enquiries:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Investec Bank plc (Nominated Adviser and

Broker)

Bruce Garrow / Ben Griffiths / Virginia

Bull / Harry Hargreaves 020 7597 4000

Edelman Smithfield Consultants (Financial

PR) 07785 275665/

John Kiely / Latika Shah 07950 671948

Notes to editors:

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAFFFEAFDFFA

(END) Dow Jones Newswires

November 01, 2023 07:23 ET (11:23 GMT)

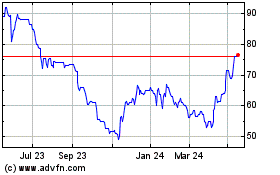

Premier Miton (LSE:PMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

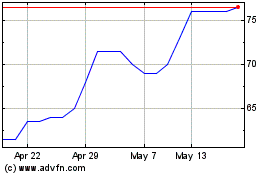

Premier Miton (LSE:PMI)

Historical Stock Chart

From Dec 2023 to Dec 2024