PayPoint plc : Director/PDMR Shareholding

November 25 2024 - 5:51AM

UK Regulatory

PayPoint plc : Director/PDMR Shareholding

25 November 2024

PayPoint plc ("the Company")

Notifications of transactions by Persons

Discharging Managerial Responsibilities

(together “PDMRs”)

The PayPoint plc Share Incentive

Plan

This announcement includes details in respect of

the monthly acquisition of Partnership Shares and award of Matching

Shares under the PayPoint plc Share Incentive Plan (“SIP”) made on

22 November 2024, in respect of those PDMRs who are participants in

the SIP, as set out below, including the following Executive

Directors:

|

PDMR |

Partnership Shares Purchased

Award Date: 22/11/2024

Purchase Price: £7.920 |

Matching Shares

Award Date: 22/11/2024

Allotment Price: £0.00333 |

|

Nicholas Wiles |

16 |

16 |

|

Rob Harding |

16 |

16 |

The Notification of Dealing Forms can be found below.

This Notification is made in accordance with the

requirements of the UK Market Abuse Regulation.

ENQUIRIES:

PayPoint

plc

Julia Herd, on behalf of Indigo Corporate

Secretary Limited, Company Secretary

+44 (0)7542 031173

Steve O'Neill, Chief Marketing and Corporate

Affairs Officer

+44 (0)7919 488066

LEI: 5493004YKWI8U0GDD138

http://corporate.paypoint.com/

|

1 |

Details of the person discharging managerial

responsibilities/person closely associated |

|

a) |

Name |

1. Simon Coles |

|

2. Benjamin Ford |

|

3. Rob Harding |

|

4. Mark Latham |

|

5. Tanya Murphy |

|

6. Stephen O’Neill |

|

7. Christopher Paul |

|

8. Anthony Sappor |

|

9. Josephine Toolan |

|

10. Katy Wilde |

|

11. Nicholas Wiles |

|

12. Nicholas Williams |

|

2 |

Reason for the notification |

|

a) |

Position/status |

- PDMR

- PDMR

- Chief Financial Officer

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- Chief Executive

- PDMR

|

|

b) |

Initial notification/Amendment |

Initial notification |

|

3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer, or auction

monitor |

|

a) |

Name |

PayPoint plc |

|

b) |

LEI |

5493004YKWI8U0GDD138 |

|

4 |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument

Identification code |

Ordinary shares of 1/3 pence

ISIN: GB00B02QND93

|

|

b) |

Nature of the transaction |

Shares purchased pursuant to the PayPoint plc Share Incentive

Plan.

|

|

c) |

Price(s) and volume(s) |

|

Price(s) |

Volume(s) |

|

1. |

£7.920 |

16 |

|

2. |

£7.920 |

16 |

|

3. |

£7.920 |

16 |

|

4. |

£7.920 |

16 |

|

5. |

£7.920 |

16 |

|

6. |

£7.920 |

16 |

|

7. |

£7.920 |

15 |

|

8. |

£7.920 |

16 |

|

9. |

£7.920 |

15 |

|

10. |

£7.920 |

16 |

|

11. |

£7.920 |

16 |

|

12. |

£7.920 |

12 |

|

d) |

Aggregated information

- Volume

- Price

- Total |

|

Aggregate Volume(s) |

Aggregate Price(s) |

Aggregate Total |

|

1. |

16 |

£7.920 |

£126.72 |

|

2. |

16 |

£7.920 |

£126.72 |

|

3. |

16 |

£7.920 |

£126.72 |

|

4. |

16 |

£7.920 |

£126.72 |

|

5. |

16 |

£7.920 |

£126.72 |

|

6. |

16 |

£7.920 |

£126.72 |

|

7. |

15 |

£7.920 |

£118.8 |

|

8. |

16 |

£7.920 |

£126.72 |

|

9. |

15 |

£7.920 |

£118.8 |

|

10. |

16 |

£7.920 |

£126.72 |

|

11. |

16 |

£7.920 |

£126.72 |

|

12. |

12 |

£7.920 |

£95.04 |

|

e) |

Date of the transaction |

22 November 2024 |

|

f) |

Place of the transaction |

XLON |

|

1 |

Details of the person discharging managerial

responsibilities/person closely associated |

|

a) |

Name |

1. Simon Coles |

|

2. Benjamin Ford |

|

3. Rob Harding |

|

4. Mark Latham |

|

5. Tanya Murphy |

|

6. Stephen O’Neill |

|

7. Christopher Paul |

|

8. Anthony Sappor |

|

9. Josephine Toolan |

|

10. Katy Wilde |

|

11. Nicholas Wiles |

|

12. Nicholas Williams |

|

2 |

Reason for the notification |

|

a) |

Position/status |

- PDMR

- PDMR

- Chief Financial Officer

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- PDMR

- Chief Executive

- PDMR

|

|

b) |

Initial notification/Amendment |

Initial notification |

|

3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer, or auction

monitor |

|

a) |

Name |

PayPoint Plc |

|

b) |

LEI |

5493004YKWI8U0GDD138 |

|

4 |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument

Identification code |

Ordinary shares of 1/3 pence

ISIN: GB00B02QND93

|

|

b) |

Nature of the transaction |

Matching shares issued pursuant to the PayPoint plc Share Incentive

Plan. |

|

c) |

Price(s) and volume(s) |

|

Price(s) |

Volume(s) |

|

1. |

£0.00333 |

16 |

|

2. |

£0.00333 |

16 |

|

3. |

£0.00333 |

16 |

|

4. |

£0.00333 |

16 |

|

5. |

£0.00333 |

16 |

|

6. |

£0.00333 |

16 |

|

7. |

£0.00333 |

15 |

|

8. |

£0.00333 |

16 |

|

9. |

£0.00333 |

15 |

|

10. |

£0.00333 |

16 |

|

11. |

£0.00333 |

16 |

|

12. |

£0.00333 |

12 |

|

d) |

Aggregated information

- Volume

- Price

- Total |

|

Aggregate Volume(s) |

Aggregate Price(s) |

Aggregate Total |

|

1. |

16 |

£0.00333 |

£0.05 |

|

2. |

16 |

£0.00333 |

£0.05 |

|

3. |

16 |

£0.00333 |

£0.05 |

|

4. |

16 |

£0.00333 |

£0.05 |

|

5. |

16 |

£0.00333 |

£0.05 |

|

6. |

16 |

£0.00333 |

£0.05 |

|

7. |

15 |

£0.00333 |

£0.05 |

|

8. |

16 |

£0.00333 |

£0.05 |

|

9. |

15 |

£0.00333 |

£0.05 |

|

10. |

16 |

£0.00333 |

£0.05 |

|

11. |

16 |

£0.00333 |

£0.05 |

|

12. |

12 |

£0.00333 |

£0.04 |

|

e) |

Date of the transaction |

22 November 2024 |

|

f) |

Place of the transaction |

Outside of a trading venue |

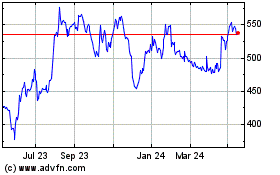

Paypoint (LSE:PAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

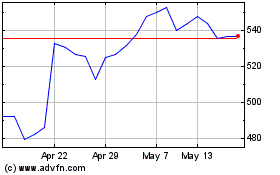

Paypoint (LSE:PAY)

Historical Stock Chart

From Dec 2023 to Dec 2024