Placing and update

May 22 2012 - 6:30AM

UK Regulatory

TIDMCMI

CERES MEDIA INTERNATIONAL PLC

("Ceres" or the "Company" or the "Group")

Placing, update and grant of options

Placing

The board announces that the Company, through its broker First Columbus LLP,

has placed 21,000,000 new ordinary shares at a price of 1 pence per share ("the

Placing Price") raising GBP210,000 of funds before expenses ("the Placing").

The proceeds of the Placing will be used for general working capital purposes

and to support further development of the business.

The Company currently has authority to issue 10,324,556 new ordinary shares for

cash and will therefore execute the Placing in two tranches.

The first tranche of 10,000,000 new ordinary shares will occur with immediate

effect. Application has been made to the London Stock Exchange for the

10,000,000 new ordinary shares to be admitted to trading on AIM. Trading in

these shares is expected to occur on or around 28 May 2012.

Admission of the remaining 11,000,000 new ordinary shares will occur in a

second tranche, subject to shareholder approval of further authorities to issue

new ordinary shares in the Company for cash. A circular convening a general

meeting of the Company ("the General Meeting") will shortly be posted to

shareholders seeking, inter alia, such authority.

Proposed Directors' Dealing

The directors of the Company are participating in the second tranche of the

Placing, details of each of the directors' participation in the Placing are set

out in the table below.

In addition to their participation in the Placing, the directors have agreed to

convert certain accrued remuneration costs and unpaid expenses of GBP84,000 in to

8,400,000 new shares in the Company at the Placing Price ("the Conversion").

Details of the Conversion are set out in the table below. The Conversion will

constitute a related party transaction pursuant to the AIM Rules. Shareholders

consent in relation to the Conversion will be sought at the General Meeting. A

further announcement detailing the related party disclosure will be made

subsequent to the General Meeting.

Conditional on shareholder approval at the General Meeting the Company will

issue a further 2,000,000 shares in the Company, at the Placing Price, to

certain other creditors in lieu of balances totalling GBP20,000 ("Creditor

Conversion").

Director Number of Number of Number of Number of % of

existing shares Conversion shares enlarged

shares held subscribed shares following issued share

for in the Placing and capital*

Placing Conversion

A Dowdeswell 3,527,342 2,617,000 3,000,000 9,144,342 14.9%

L Barber 403,089 300,000 4,500,000 5,203,089 8.5%

C Garston 379,938 283,000 900,000 1,562,938 2.5%

*assuming the Placing, Conversion and Creditor Conversion occur

Application for admission to trading on AIM of the second tranche of the

Placing, the Conversion shares and the Creditor Conversion shares, totalling

21,400,000 new ordinary shares, will occur following the General Meeting.

Following the Placing, Conversion and Creditor Conversion, the so enlarged

issued share capital of the Company will comprise 61,373,961 ordinary shares of

1 pence each.

Update

The directors are encouraged by the Group's trading performance since 31

January 2012. As announced on 30 April 2012, the directors remain cautiously

optimistic evidenced by the gradual increase in turnover recorded to date in

2012. Orders received in April 2012 were in excess of the total revenues for

the 6 months to 31 January 2012.

Sales of NatureWovenTM, ChorusTM and GossypTM, whilst still small by comparison

to what the directors believe is their potential, have continued to customers

in both the USA and Europe. Additional orders have been received for Nature

Netting, the Company's new screening product, for high profile events taking

place in the UK during the summer and beyond.

The directors believe that the technical issues surrounding the physical fixing

process for the Group's TierraFilmTM Window Cling product have been resolved

and this upgraded product is expected to be available in the UK and the USA in

June 2012.

Advanced stage testing of the TierraFilmTM Backlit product continues with major

`Out of Home' media owners and the Company anticipates approvals shortly. This

product boasts excellent print quality combined with superior light diffusion

characteristics compared to existing materials used.

Leslie Barber, Chairman, commented: "The indications are that the Company's

product portfolio now meets the quality, usage and price requirements of the

marketplace and the relevant user base. Distribution gains in the USA and

Europe are beginning to show through in sales and the response to

NatureNettingTM and BackLit products in the UK is encouraging. The Company

looks poised to exploit its unique compostable, recyclable and bio-degradable

products in its core markets."

Grant of options

Since the Company's admission to AIM on 13 September 2011, it has agreed to

grant options over 960,000 shares ("Admission Options") to directors and key

senior management. The terms of the Admission Options are set out below:

Vesting period: None

Exercise period: Any time until 13 September 2020

Exercise price: 1p

Performance criteria: Company's share price in excess of 5 pence per share

Directors' participation in the Admission Options is set out in the table

below.

In December 2011, the Company agreed in principal to issue further options to

non-executive directors ("Further Options") with the objective of conserving

cash resources. Conditional on the granting of the Further Options, the

non-executive directors have agreed to waive the cash element of their

remuneration and convert existing remuneration liabilities into shares in the

Company.

The terms of the Further Options are set out below:

Vesting period: None

Exercise period: Any time until 13 September 2020

Exercise price: 1p

Performance criteria: None

Directors' participation in the Further Options is set out in the table below.

Director Admission Further Total

Options Options

A Dowdeswell 500,000 nil 500,000

L Barber 300,000 2,500,000 2,800,000

C Garston nil 1,000,000 1,000,000

Others 160,000 nil 160,000

With the exception of the options granted to C Garston, which are issued by way

of an unapproved scheme, all other options are issued under an EMI scheme.

The grant of the Admission Options and Further Options to directors is a

related party transaction pursuant to the AIM Rules. Shareholder consent in

relation to the grant of the Admission Options and Further Options will be

sought at the General Meeting. A further announcement detailing the related

party disclosure in relation to the options will be made subsequent to the

General Meeting.

For further information, please contact:

Ceres Media International PLC Tel: 020 3178 5622

Alex Dowdeswell / Leslie Barber

Nominated Adviser - Cairn Financial Advisers LLP Tel: 020 7148 7900

Jo Turner / Liam Murray

Broker - First Columbus LLP Tel: 020 3002 2070

Chris Crawford / Kelly Gardiner

END

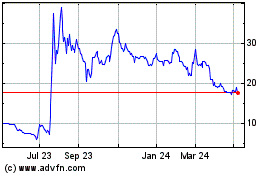

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Sep 2023 to Sep 2024