TIDMOCDO

RNS Number : 1710Y

Ocado Group PLC

02 May 2023

RESULT OF AGM

OCADO GROUP PLC

2 May 2023

Ocado Group plc

Annual General Meeting 2023 Results

Ocado Group plc ("Ocado") held its Annual General Meeting (the

"AGM") on 2 May 2023.

Resolutions 1 to 21 (inclusive) were passed as ordinary

resolutions; resolutions 22 to 25 (inclusive) were passed as

special resolutions. Results of the poll for each resolution are

shown in the table below.

Resolutions For Against Total Votes

Votes Withheld

Votes % Votes %

------------ ------- ------------ -------

To receive the

Annual Report

1. and Accounts 700,216,039 99.99% 26,267 0.01% 700,242,306 7,478,139

------------------------- ------------ ------- ------------ ------- ------------ -----------

To approve the

Directors' Remuneration

2. Report 492,647,838 69.86% 212,534,897 30.14% 705,182,735 2,537,710

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Rick Haythornthwaite

as a Director

3. of the Company 661,546,130 93.55% 45,627,630 6.45% 707,173,760 546,685

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Tim Steiner

as a Director

4. of the Company 705,764,832 99.73% 1,931,541 0.27% 707,696,373 24,072

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Stephen Daintith

as a Director

5. of the Company 692,929,139 98.10% 13,391,893 1.90% 706,321,032 1,399,413

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Neill Abrams

as a Director

6. of the Company 701,003,947 99.25% 5,312,713 0.75% 706,316,660 1,403,785

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Mark Richardson

as a Director

7. of the Company 705,618,023 99.71% 2,077,575 0.29% 707,695,598 24,847

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Luke Jensen

as a Director

8. of the Company 705,603,121 99.70% 2,090,941 0.30% 707,694,062 26,383

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Jörn Rausing

as a Director

9. of the Company 683,907,582 98.05% 13,634,097 1.95% 697,541,679 10,178,766

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Andrew Harrison

as a Director

10. of the Company 582,467,798 82.31% 125,217,444 17.69% 707,685,242 35,203

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Emma Lloyd as

a Director of

11. the Company 662,670,304 93.64% 45,018,425 6.36% 707,688,729 31,716

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Julie Southern

as a Director

12. of the Company 649,863,050 91.83% 57,822,140 8.17% 707,685,190 35,255

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

John Martin

as a Director

13. of the Company 699,154,855 98.79% 8,532,904 1.21% 707,687,759 32,686

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Michael Sherman

as a Director

14. of the Company 698,767,656 98.74% 8,917,499 1.26% 707,685,155 35,290

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Nadia Shouraboura

as a Director

15. of the Company 699,045,861 98.78% 8,640,896 1.22% 707,686,757 33,688

------------------------- ------------ ------- ------------ ------- ------------ -----------

To appoint Julia

M. Brown as

a Director of

16. the Company 705,137,760 99.62% 2,696,885 0.38% 707,834,645 35,218

------------------------- ------------ ------- ------------ ------- ------------ -----------

To re-appoint

Deloitte LLP

as auditor of

17. the Company 706,302,832 99.99% 32,490 0.01% 706,335,322 1,385,123

------------------------- ------------ ------- ------------ ------- ------------ -----------

To authorise

the Directors

to determine

the auditor's

18. remuneration 707,671,840 99.99% 26,122 0.01% 707,697,962 22,483

------------------------- ------------ ------- ------------ ------- ------------ -----------

Authority for

political donations

and political

19. expenditure 696,712,879 98.45% 10,990,136 1.55% 707,703,015 17,430

------------------------- ------------ ------- ------------ ------- ------------ -----------

Authority to

allot shares

up to one-third

of issued share

20. capital 701,493,413 99.12% 6,213,042 0.88% 707,706,455 13,990

------------------------- ------------ ------- ------------ ------- ------------ -----------

Authority to

allot shares

in connection

with a pre-emptive

21. offer only 700,869,660 99.03% 6,831,903 0.97% 707,701,563 18,882

------------------------- ------------ ------- ------------ ------- ------------ -----------

General authority

to disapply

pre-emption

22. rights* 588,686,107 83.18% 119,006,533 16.82% 707,692,640 27,805

------------------------- ------------ ------- ------------ ------- ------------ -----------

Additional authority

to disapply

pre-emption

23. rights* 582,634,560 82.33% 125,060,230 17.67% 707,694,790 25,655

------------------------- ------------ ------- ------------ ------- ------------ -----------

Authority to

purchase own

24. shares* 662,905,815 93.68% 44,706,891 6.32% 707,612,706 107,739

------------------------- ------------ ------- ------------ ------- ------------ -----------

Notice of general

25. meetings* 697,998,679 98.63% 9,714,815 1.37% 707,713,494 6,951

------------------------- ------------ ------- ------------ ------- ------------ -----------

* Special Resolution

Board response to Resolution 2 (the Directors' Remuneration

Report)

The Board notes that all resolutions were duly passed and would

like to thank shareholders for their continued support. The Board

notes the outcome of the shareholder votes against Resolution 2

(the Directors' Remuneration Report).

Based on the areas highlighted by proxy advisers, the Board

considers votes against the Directors' Remuneration Report to

predominantly relate to: (i) the outturn of the FY22 Annual

Incentive Plan (the "AIP"); and (ii) the creation of the third

Tranche of the Value Creation Plan (the "VCP"). The Board continues

to believe that the implementation of the current Directors'

Remuneration Policy (the "Policy"), which was approved at the 2022

annual general meeting, offers the best way to incentivise

management and drive exceptional and sustainable long-term growth

of the Group while also rewarding short-term operational and

strategic decisions.

Each year, the Remuneration Committee (the "Committee") sets

performance measures and targets under the AIP that are closely

aligned to the delivery of the Group's strategic objectives for

that year. In line with the current Policy, the performance

measures for the FY22 AIP were a mix of financial, strategic and

operational targets for Ocado. Given that the only long-term

incentive, the VCP, is based entirely on a single financial

measure, Total Shareholder Return, the Committee is cognisant of

the need to ensure that the AIP incentivises and motivates

executive directors to focus on all aspects of our strategy, both

financial and non-financial. As such, the Committee is satisfied

that the chosen metrics for the 2022 financial year remained core

to delivery of Ocado's ongoing growth strategy and that the overall

outturn is appropriate in the context of overall business

performance, including strong performance in the efficiency of the

Ocado Smart Platform (a cost-related measure), progress against the

technology goals, and the high satisfaction of our customers.

The Committee is committed to ensuring that remuneration at

Ocado continues to be aligned to the business strategy and

achievement of planned business goals and intends to keep under

review the weighting and nature of financial measures in the AIP in

the future, noting that the proportion of financial measures in the

FY23 AIP has increased relative to FY22.

The creation of the third VCP tranche following the capital

raise in June 2022 is in line with: (i) the VCP plan rules; (ii)

the approach taken following the June 2020 capital raise; and (iii)

the approach to how a variation in capital would be treated, which

shareholders requested us to adopt when the VCP was first

implemented. The creation of a new tranche does not involve the

issuance of new share awards, but it does allow part of the

existing award to be tested against a hurdle where the starting

price is equal to the placing price under the capital raise.

In accordance with the UK Corporate Governance Code (the "Code")

and in line with past practice, the Board will continue to consult

and engage with shareholders on executive remuneration matters and

is committed to understanding their perspectives and concerns. An

update statement will be provided within six months of the AGM, in

accordance with the Code, with a final summary to be included in

the Company's 2023 annual report and accounts.

Board changes become effective

As previously announced on 20 October 2022, following the

conclusion of the 2023 AGM, a number of changes to Board Committee

composition have taken effect. Julie Southern has assumed the role

of Remuneration Committee Chair from Andrew Harrison, who will

carry on as a member of the Remuneration Committee and chairman of

the People Committee. Further, John Martin has become Chair of the

Audit Committee as Julie Southern has stepped down from this

position but remains a member of this Committee.

As required by the Listing Rules of the Financial Conduct

Authority, a copy of certain resolutions have been submitted to the

Financial Conduct Authority via the National Storage Mechanism.

This document will be available shortly for viewing at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

A copy of the Annual General Meeting results will be available

on Ocado's website: www.ocadogroup.com .

Person responsible for arranging the release of this

announcement:

Neill Abrams

Group General Counsel and Company Secretary

Ocado Group plc

Buildings One & Two, Trident Place,

Mosquito Way,

Hatfield

Hertfordshire, AL10 9UL

+ 44 1707 228 000

company.secretary@ocado.com

Ocado Group plc LEI: 213800LO8F61YB8MBC74

Notes:

(i) Votes 'withheld' are not votes under English law and so have

not been included in the calculation of whether a resolution is

carried. Percentages have been rounded to two decimal places.

(ii) As at 7.00am on 2 May 2023, the Company's issued share

capital was 826,565,574 ordinary shares of 2p each admitted to

trading. The Company does not hold any ordinary shares in treasury.

Each ordinary share carries the right to one vote in relation to

all circumstances at general meetings of the Company. Of these

issued ordinary shares: (1) 2,086,416 shares are held by Solium

Trustee (UK) Limited, the trustee for the Company's employee Share

Incentive Plan, who must vote, at the request of a participant, in

respect of ordinary shares held by the trustee on behalf of that

participant; (2) 563,738 shares are held by Wealth Nominees

Limited, and 9,917,035 shares are held by Winterflood Client

Nominees Limited, both on behalf of Ocorian Limited (formerly known

as Estera Trust (Jersey) Limited), the independent company which is

the trustee of Ocado's Employee Benefit Trust (the "EBT Trustee").

The EBT Trustee has waived its right to exercise its voting rights

and to receive dividends in respect of 9,917,035 ordinary shares,

although it may vote in respect of 563,738 ordinary shares which

have vested under the joint share ownership scheme and remain in

the trust, at the request of a participant. The total of 10,480,773

ordinary shares held by the EBT Trustee are treated as treasury

shares in the group's consolidated balance sheet in accordance with

IAS 32 "Financial Instruments: Presentation". As such, calculations

of earnings per share for Ocado exclude the 10,480,773 ordinary

shares held by the EBT Trustee.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGUPUWWAUPWGAP

(END) Dow Jones Newswires

May 02, 2023 11:38 ET (15:38 GMT)

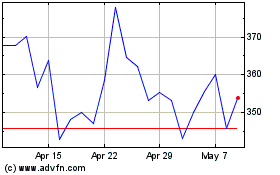

Ocado (LSE:OCDO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ocado (LSE:OCDO)

Historical Stock Chart

From Jul 2023 to Jul 2024