NatWest, Ireland's Finance Minister Raise EUR110.5 Million From Permanent TSB Shares Sale

June 02 2023 - 2:53AM

Dow Jones News

By Elena Vardon

NatWest Group and the Minister for Finance of Ireland raised

110.5 million euros ($118.9 million) from the sale of shares they

held in Permanent TSB Group Holdings, the bank said on Friday.

The British group had said on Thursday that it intended to sell

part of its shareholding in the Dublin-listed lender,

simultaneously with the Ireland's Finance Minister Michael McGrath,

via a share placing to institutional investors.

The placing price was EUR2.025 a Permanent TSB share, NatWest

said. This represents an 8% discount to Thursday's closing price of

EUR2.20.

They each disposed of 27.3 million shares in Permanent TSB--54.6

million shares in total, representing 10% of the Irish bank's

issued share capital. The placing was originally estimated to

comprise around 33 million of Permanent TSB shares, or 6% of its

share capital.

McGrath and NatWest will get EUR55.2 million of gross proceeds

each, the bank said.

NatWest's shareholding will be reduced to 63.6 million ordinary

shares, or 11.7% of Permanent TSB's share capital, from 16.7%

previously, it said. The disposal will have an immaterial impact on

the bank's CET1 ratio and tangible net asset value per share, it

added.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

June 02, 2023 02:38 ET (06:38 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

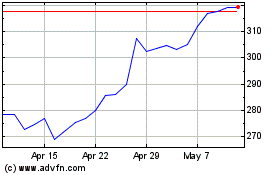

Natwest (LSE:NWG)

Historical Stock Chart

From Sep 2024 to Oct 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Oct 2023 to Oct 2024