TIDMNWG

RNS Number : 4110B

NatWest Group plc

01 June 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION INTO OR IN

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA, SWITZERLAND

OR ANY OTHER STATE OR JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE

IMPORTANT NOTICE AT THE END OF THIS ANNOUNCEMENT

NatWest Group plc

1 June 2023

Intention to sell shares in Permanent TSB Group Holdings PLC

NatWest Group plc ("NatWest") today announces its intention to

sell part of its shareholding, held through the wholly owned

subsidiary RBS AA Holdings (UK) Limited, in Permanent TSB Group

Holdings PLC ("PTSB"), concurrently with The Minister for Finance

of Ireland, Michael McGrath TD (the "Minister"), (together, the

"Selling Shareholders").

The disposal of these shares (the "Placing Shares") will be by

way of a placing to institutional investors (the "Placing"). The

price at which the Placing Shares are sold (the "Placing Price")

will be determined by way of an accelerated book building process.

The book will open with immediate effect following this

announcement.

Th e Placing is expected to comprise approximately 33 million of

PTSB's ordinary sha res , representing approximately 6.0 % of the

issued ordinar y cap ital of PTSB , with the Minister and NatWest

both expected to dispose of 3.0% of issued ordinary capital each.

As a resu l t of the Placing , the overall size of the Minister's

sha reholding i n PTSB will be reduced from 62.4% to 59.4 % and

NatWest's shareholding in PTSB will be reduced from 16.7% to

13.6%.

The Selling Shareholders have also undertaken not to sell f

urther shares i n PTSB for a period of 90 calendar days following

the comp l etion of the Pl a cing ( subject to waiver by one of the

co-bookrunners and certain customary exceptions).

Details of the Placing Price and the exact number of Placing

Shares will be announced in due course.

Further information:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Disclaimer

IMPORTANT NOTICE

The distribution of this announcement and the offer and sale of

the Placing Shares in certain jurisdictions may be restricted by

law. The Placing Shares may not be offered to the public in any

jurisdiction in circumstances which would require the preparation

or registration of any prospectus or offering document relating to

the Placing Shares in such jurisdiction. No action has been taken

by NatWest or any of its respective affiliates that would permit an

offering of the Placing Shares or possession or distribution of

this announcement or any other offering or publicity material

relating to such securities in any jurisdiction where action for

that purpose is required. Persons into whose possession this

announcement comes are required to inform themselves about and to

observe any such restrictions.

This announcement is for information purposes only and does not

constitute or form a part of an offer to sell or a solicitation of

an offer to purchase any security of PTSB in the United States or

in any other jurisdiction where such offer or solicitation is

unlawful. The securities of PTSB described in this announcement

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the "Securities Act"), or any applicable

state or foreign securities laws and may not be offered or sold in

the United States absent registration or an exemption from the

registration requirements of the Securities Act. There shall be no

public offering of securities in the United States.

In member states of the European Economic Area, this

announcement and any offer if made subsequently is directed

exclusively at persons who are 'qualified investors' within the

meaning of Regulation (EU) 2017/1129 (the "Prospectus Regulation")

("Qualified Investors"). In the United Kingdom this announcement is

directed exclusively at persons who are 'qualified investors'

within the meaning of the Prospectus Regulation (as it forms part

of United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018) (i) who have professional experience in

matters relating to investments falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the "Order"), or (ii) who fall within Article

49(2)(a) to (d) of the Order, or (iii) to whom it may otherwise

lawfully be communicated (all such persons together being referred

to as "Relevant Persons"). This Announcement must not be acted on

or relied on by persons who are not Relevant Persons, if in the

United Kingdom, or Qualified Investors, if in a member state of the

European Economic Area.

No Placing Shares will be available to any investor whose

purchase of such Placing Shares, whether on its own account or as a

fiduciary or agent for one or more investor accounts, would require

regulatory consent in any jurisdiction (including, without

limitation, under the UK Financial Services and Markets Act 2000 or

the United States Bank Holding Company Act of 1956).

Forward-looking statements

This document may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest's future economic results, business plans and

strategies and the successful completion of the placing. In

particular, this document may include forward-looking statements

relating to NatWest in respect of, but not limited to: its economic

and political risks, its regulatory capital position and related

requirements, its financial position, profitability and financial

performance (including financial, capital, cost savings and

operational targets), the implementation of its purpose-led

strategy, its environmental, social and governance and climate

related targets, its access to adequate sources of liquidity and

funding, increasing competition from new incumbents and disruptive

technologies, its exposure to third party risks, its ongoing

compliance with the UK ring-fencing regime and ensuring operational

continuity in resolution, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, the transition of LIBOR and IBOR rates to

replacement risk free rates and NatWest's exposure to operational

risk, conduct risk, cyber, data and IT risk, financial crime risk,

key person risk and credit rating risk. Forward-looking statements

are subject to a number of risks and uncertainties that might cause

actual results and performance to differ materially from any

expected future results or performance expressed or implied by the

forward-looking statements. Factors that could cause or contribute

to differences in current expectations include, but are not limited

to, future growth initiatives (including acquisitions, joint

ventures and strategic partnerships), the outcome of legal,

regulatory and governmental actions and investigations, the level

and extent of future impairments and write-downs, legislative,

political, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

interest and exchange rate fluctuations, general economic and

political conditions and the impact of climate-related risks and

the transitioning to a net zero economy. These and other factors,

risks and uncertainties that may impact any forward-looking

statement or NatWest's actual results are discussed in NatWest's

2022 Annual Report on Form 20-F, NatWest's Interim Management

Statement for Q1 2023 on Form 6-K and its other filings with the US

Securities and Exchange Commission. The forward-looking statements

contained in this document speak only as of the date of this

document and NatWest does not assume or undertake any obligation or

responsibility to update any of the forward-looking statements

contained in this document, whether as a result of new information,

future events or otherwise, except to the extent legally

required.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISUPUGPQUPWGQG

(END) Dow Jones Newswires

June 01, 2023 12:24 ET (16:24 GMT)

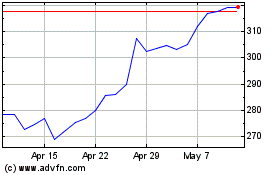

Natwest (LSE:NWG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Nov 2023 to Nov 2024