TIDMNWG TIDMTTM

RNS Number : 5139U

NatWest Group plc

01 August 2022

NATWEST GROUP PLC AND NATWEST MARKETS N.V. COMMENCE SEPARATE

CASH TER OFFERS FOR CERTAIN OF THEIR RESPECTIVE OUTSTANDING

NOTES

NatWest Group plc ("NatWest Group") and NatWest Markets N.V.

("NWM N.V.") (each an "Offeror" and, together, the "Offerors") have

each launched today separate tender offers to purchase for cash

(with respect to the tender offers launched by NatWest Group, the

"NatWest Group Offer", and with respect to the tender offers

launched by NWM N.V., the "NWM N.V. Offer", and collectively, the

"Offers") any and all of certain series of their respective U.S.

dollar denominated notes set out in the table below (collectively,

the "Notes", and each a "Series").

The NatWest Group Offer is being made on the terms and subject

to the conditions set out in NatWest Group's offer to purchase

dated August 1, 2022 and the related Notice of Guaranteed Delivery

(the "NatWest Group Offer to Purchase"), and the NWM N.V. Offer is

being made on the terms and subject to the conditions set out in

NWM N.V.'s offer to purchase dated August 1, 2022 and the related

Notice of Guaranteed Delivery (the "NWM N.V. Offer to Purchase"

and, together with the NatWest Group Offer to Purchase, the "Offers

to Purchase"). Capitalized terms with respect to the NatWest Group

Offer not otherwise defined in this announcement have the same

meaning as in the NatWest Group Offer to Purchase and capitalized

terms with respect to the NWM N.V. Offer not otherwise defined in

this announcement have the same meaning as in the NWM N.V. Offer to

Purchase.

Purpose of the Offers

Each Offeror is providing the holders of its Notes with an

opportunity to have their Notes repurchased while maintaining a

responsible approach to the management of its capital position and,

in the case of NatWest Group, its MREL (minimum requirement for own

funds and eligible liabilities) position. Each Offeror will

continue to meet all of its capital requirements and, in the case

of the NatWest Group, MREL requirements, irrespective of the

outcome of its Offer.

Terms of the Offers

NatWest Group is offering to purchase for cash, on the terms and

conditions described in the NatWest Group Offer to Purchase, any

and all of the outstanding Notes set out in the table below:

Hypothetical

Principal Principal Fixed Reference Bloomberg Purchase

Title of Amount Amount Spread U.S. Treasury Reference Price

Security Issuer ISIN/CUSIP Issued Outstanding (bps) Security Maturity Page (Illustrative)(1)

------------- --------- ------------- -------------- -------------- ------ -------------- --------- --------- -----------------

The Royal 1.625%

6.125% Bank of U.S. Treasury

Subordinated Scotland due December

Tier 2 Group US780099CE50 15, 2022

Notes due plc / (ISIN: December $1,010.40

2022 (2) 780099CE5 $2,250,000,000 $1,303,830,000 +40 US912828YW42) 15, 2022 FIT T/0-1 per $1,000

0.250%

The Royal U.S. Treasury

6.100% Bank of Security

Subordinated Scotland due June

Tier 2 Group US780097AY76 15, 2023

Notes due plc / (ISIN: June $1,018.04

2023 (2) 780097AY7 $1,000,000,000 $465,426,000 +90 US912828ZU76) 10, 2023 FIT T/0-1 per $1,000

3.000%

U.S. Treasury

6.000% The Royal Security

Subordinated Bank of due June

Tier 2 Scotland US780097AZ42 30, 2024

Notes due Group / (ISIN: December $1,023.97

2023 plc(2) 780097AZ4 $2,000,000,000 $1,396,278,000 +125 US91282CEX56) 19, 2023 FIT1 per $1,000

3.000%

U.S. Treasury

5.125% The Royal Security

Subordinated Bank of due June

Tier 2 Scotland US780099CH81 30, 2024

Notes due Group / (ISIN: May 28, $1,013.01

2024 plc(2) 780099CH8 $2,250,000,000 $1,241,175,000 +145 US91282CEX56) 2024 FIT1 per $1,000

3.000%

U.S. Treasury

The Royal Security

3.875% Bank of due June

Senior Scotland 30, 2024

Notes due Group US780097BD21 (ISIN: September $1,002.23

2023 plc(2) / 780097BD2 $2,650,000,000 $2,650,000,000 +75 US91282CEX56) 12, 2023 FIT1 per $1,000

(1) For illustrative purposes only, a hypothetical Purchase

Price for each Series is set out in the table above, based on a

hypothetical Price Determination Time of 2.00 p.m. New York City

time, on July 29, 2022. Holders should note that the actual

Purchase Price for each Series determined in the manner described

herein and in the relevant Offer to Purchase could differ

significantly from the hypothetical Purchase Price for each Series

set out in the table above.

(2) Currently NatWest Group plc.

NWM N.V. is offering to purchase for cash, on the terms and

conditions described in the NWM N.V. Offer to Purchase, any and all

of the outstanding Notes set out in the table below:

Hypothetical

Principal Principal Fixed Reference Bloomberg Purchase

Title of Amount Amount Spread U.S. Treasury Reference Price

Security Issuer ISIN/CUSIP Issued Outstanding (bps) Security Maturity Page (Illustrative)(1)

------------- -------- ------------- ------------ ------------ ------ ------------- -------- --------- -----------------

7.750% 0.125%

Subordinated U.S. Treasury

Deposit Security

Notes, due May

Series NatWest 15, 2023

B, due Markets US00077TAA25 (ISIN: May 15, $1,029.92

2023 N.V.(2) / 00077TAA2 $250,000,000 $135,566,000 +75 US912828ZP81) 2023 FIT T/0-1 per $1,000

7.125% 2.250%

Subordinated U.S. Treasury

Deposit Security

Notes, due February

Series NatWest 15, 2052

B, due Markets US00077TAB08 (ISIN: Oct 15, $1,656.99

2093 N.V.(2) / 00077TAB0 $150,000,000 $150,000,000 +120 US912810TD00) 2093 FIT1 per $1,000

(1) For illustrative purposes only, a hypothetical Purchase

Price for each Series is set out in the table above, based on a

hypothetical Price Determination Time of 2.00 p.m. New York City

time, on July 29, 2022. Holders should note that the actual

Purchase Price for each Series determined in the manner described

herein and the relevant Offer to Purchase could differ

significantly from the hypothetical Purchase Price for each Series

set out in the table above.

(2) NatWest Markets N.V. (formerly known as ABN AMRO Bank N.V.,

of which ABN AMRO Bank N.V., New York Branch, was a part).

Each Offer will expire at 5:00 p.m., New York City time, on

August 8, 2022, unless it is extended (such date and time, as the

same may be extended, the "Expiration Deadline") or earlier

terminated.

Purchase Price; Accrued Interest

Purchase Price

The purchase price (in respect of each Series, the "Purchase

Price") for each $1,000 principal amount of the Notes of the

relevant Series validly tendered and not validly withdrawn at or

prior to the relevant Expiration Deadline received by the Tender

Agent at or prior to the relevant Expiration Deadline or the

relevant Guaranteed Delivery Date (as defined herein), as the case

may be, and accepted for purchase by the relevant Offeror, will be

equal to an amount (rounded to the nearest cent) that would

reflect, as of the relevant Settlement Date (as defined herein), a

yield to the maturity date of such Series equal to the sum of (i)

the Reference Yield (as defined in the relevant Offer to Purchase)

for such Series, plus (ii) the fixed spread in respect of such

Series set forth in the relevant table above (in respect of each

Series, the "Fixed Spread"). Specifically, the relevant Purchase

Price will equal (i) the value of all remaining payments of

principal and interest on the Notes of the relevant Series up to

and including the scheduled maturity of the relevant Series,

discounted to the relevant Settlement Date, at a discount rate

equal to (x) the relevant Reference Yield (as defined in the

relevant Offer to Purchase) plus (y) the relevant Fixed Spread,

minus (ii) any Accrued Interest in respect of the Notes of the

relevant Series, in each case calculated in the manner set out in

the relevant Annex to the relevant Offer to Purchase.

Accrued Interest

In addition to the relevant Purchase Price, holders of the Notes

accepted for purchase pursuant to the relevant Offer(s) will also

receive, on the relevant Settlement Date, accrued and unpaid

interest on each $1,000 principal amount of such Notes (rounded to

the nearest cent) from, and including, the last interest payment

date up to, but not including, the relevant Settlement Date

("Accrued Interest"). Holders whose Notes are tendered and accepted

for purchase pursuant to the Guaranteed Delivery Procedures will

not receive payment in respect of any interest for the period from

and including the relevant Settlement Date to the relevant

Guaranteed Delivery Settlement Date. Accrued Interest for each

$1,000 principal amount of such Notes validly tendered and accepted

for purchase will be rounded to the nearest $0.01, with $0.005

being rounded upwards, in accordance with the conditions of such

Notes.

Settlement

Unless an Offer is extended, reopened or earlier terminated,

payment of the relevant Purchase Price, plus any Accrued Interest

to holders of Notes that are validly tendered and not withdrawn and

accepted for purchase in such Offer is expected to be made on

August 10, 2022 (in respect of each Offer, the "Settlement Date")

or, in the case of Notes accepted for purchase pursuant to the

Guaranteed Delivery Procedure, on August 11, 2022 (in respect of

each Offer, the "Guaranteed Delivery Settlement Date").

Offer Conditions

Each Offer is not conditional upon any minimum amount of Notes

being tendered. However, each Offer is conditional upon the

satisfaction or waiver of certain conditions described in the

relevant Offer to Purchase.

An Offeror's obligation to accept for purchase and pay for the

Notes that are validly tendered and not withdrawn in the relevant

Offer is not conditioned upon the outcome of the other Offeror's

Offer.

Withdrawal Rights

Notes tendered pursuant to an Offer may be withdrawn at any time

before the relevant Withdrawal Deadline. In addition, if the

relevant Offer is extended, the related Withdrawal Deadline will be

extended to the earlier of (i) the relevant Expiration Deadline (as

extended) and (ii) the 10th Business Day after the commencement of

the relevant Offer (in respect of each Offer, the "Commencement

Date"). Notes tendered pursuant to an Offer may also be withdrawn

at any time after the 60th Business Day after the relevant

Commencement Date if, for any reason, that Offer has not been

consummated within 60 Business Days of the relevant Commencement

Date. If the relevant Offer is terminated without any Notes being

purchased thereunder, the Notes tendered pursuant thereto will be

promptly returned to the tendering holders.

The relevant deadline set by DTC or any intermediary for the

submission of Tender Instructions may be earlier than the deadlines

set out herein.

Indicative Timetable

The following table sets out the expected dates and times of the

key events relating to each Offer. This is an indicative timetable

and is subject to change.

Events Dates and Times

----------------------------------------- -------------------------------------

Commencement Date

Commencement of the Offers upon August 1, 2022

the terms and subject to the conditions

set forth in the relevant Offer

to Purchase.

Price Determination Time

The time in respect of each Offer, 2:00 p.m., New York City time,

at which the Reference Yield for on August 8, 2022, unless otherwise

each Series of Notes will be determined extended in respect of the

by the relevant Dealer Managers. relevant Offer

Withdrawal Deadline

The deadline in respect of each 5:00 p.m., New York City time,

Offer for holders to validly withdraw on August 8, 2022, unless otherwise

Notes tendered before this date extended in respect of the

and time, unless otherwise extended relevant Offer

as described herein.

Expiration Deadline

The deadline in respect of each 5:00 p.m., New York City time,

Offer for holders to tender Notes on August 8, 2022, unless otherwise

pursuant to the relevant Offer extended in respect of the

in order to qualify for payment relevant Offer

of the relevant Purchase Price

plus any Accrued Interest.

Each Offeror will issue a press

release announcing the principal

amount of each Series accepted

for purchase pursuant to the relevant

Offer promptly after the relevant

Expiration Deadline.

Guaranteed Delivery Date

The deadline in respect of each 5:00 p.m. New York time, on

Offer for holders using the Guaranteed the second Business Day following

Delivery Procedures described the relevant Expiration Deadline

in the relevant Offer to Purchase

to deliver their Notes.

Settlement Date

Payment in respect of each Offer Expected on August 10, 2022,

of the relevant Purchase Price, the second Business Day following

plus any Accrued Interest for the relevant Expiration Deadline

all Notes validly tendered and

not validly withdrawn and accepted

for purchase pursuant to the relevant

Offer (other than the Notes tendered

in either Offer pursuant to the

Guaranteed Delivery Procedures).

Guaranteed Delivery Settlement

Date

Payment in respect of each Offer Expected on August 11, 2022,

of the relevant Purchase Price the third Business Day following

plus any Accrued Interest for the relevant Expiration Deadline

all Notes validly tendered and

not validly withdrawn and accepted

for purchase pursuant to the Guaranteed

Delivery Procedures.

The times and dates above are subject, where applicable, to the

right of each Offeror to extend, re-open, amend, limit, terminate

or withdraw its respective Offers, subject to applicable law.

Accordingly, the actual timetable in respect of either or both

Offers may differ significantly from the expected timetable set out

above.

Holders should confirm with the bank, securities broker or any

other intermediary through which they hold their Notes whether such

intermediary needs to receive instructions from a holder before the

deadlines specified above in order for that holder to be able to

participate in, or withdraw their instruction to participate in,

the Offers.

FURTHER INFORMATION

Copies of each Offer to Purchase are available at the following

web address: https://deals.is.kroll.com/natwest

Requests for assistance or additional copies of an Offer to

Purchase may be directed to the Tender Agent and any questions

regarding the terms of the Offer may be directed to the relevant

Dealer Managers listed below:

Tender Agent in respect of each Offer

Kroll Issuer Services Limited Email: natwest@is.kroll.com

Arlind Bytyqi / Jacek Kusion Telephone: +44 20 7704 0880

NatWest Treasury Markets

Scott Forrest Email: Scott.Forrest@Natwest.com

Head of Treasury DCM Telephone: +44 7747 455969

Investor Relations

Paul Pybus Email: paul.pybus@natwest.com

Head of Debt Investor Relations Telephone: +44 776 916 1183

250 Bishopsgate

London EC2M 4AA

Global Arranger and Lead Dealer Manager in respect of each

Offer

NatWest Markets Telephone: +44 20 7678 5222 (UK)

Telephone: +1 203 897 6166 (U.S.)

Telephone: +1 866 884 2071 (U.S. Toll Free)

Email: liabilitymanagement@natwestmarkets.com

Attn: Liability Management

Dealer Managers with respect to the NatWest Group Offer

Merrill Lynch International Telephone: +44 207 996 5420

(Europe)

Telephone: +1 (980) 387-3907 (U.S.)

Telephone: +1 (888) 292-0070 (U.S. Toll Free)

Email: DG.LM-EMEA@bofa.com

Attn: Liability Management Group

Morgan Stanley & Co. LLC Telephone: +44 20 7677 5040 (Europe)

Telephone: +1 212 761 1057 (U.S.)

Telephone: +1 800 624 1808 (U.S. Toll Free)

Email: liabilitymanagement@morganstanley.com

Attn: Liability Management (in the U.S.)

Attn: Liability Management Group (in Europe)

Wells Fargo Securities, LLC Telephone: +44 (0) 203 942 9680

(Europe)

Telephone: +1 (704) 410-4756 (U.S.)

Telephone: +1 (866) 309-6316 (U.S. Toll Free)

Email: LiabilityManagement@wellsfargo.com

Attn: Liability Management Group

Dealer Managers with respect to the NWM N.V. Offer

BofA Securities Europe SA Telephone: +33 1 877 01057 (Europe)

Telephone: +1 (980) 387-3907 (U.S.)

Telephone: +1 (888) 292-0070 (U.S. Toll Free)

Email: DG.LM-EMEA@bofa.com

Attn: Liability Management Group

Morgan Stanley & Co. LLC Telephone: +44 20 7677 5040 (Europe)

Telephone: +1 212 761 1057 (U.S.)

Telephone: +1 800 624 1808 (U.S. Toll Free)

Email: liabilitymanagement@morganstanley.com

Attn: Liability Management (in the U.S.)

Attn: Liability Management Group (in Europe)

Wells Fargo Securities, LLC Telephone: +44 (0) 203 942 9680

(Europe)

Telephone: +1 (704) 410-4756 (U.S.)

Telephone: +1 (866) 309-6316 (U.S. Toll Free)

Email: LiabilityManagement@wellsfargo.com

Attn: Liability Management Group

DISCLAIMER

This announcement and each Offer to Purchase (including the

documents incorporated by reference therein) contain important

information which should be read carefully before any decision is

made with respect to the relevant Offer. If you are in any doubt as

to the contents of this announcement or the relevant Offer to

Purchase or the action you should take, you are recommended to seek

your own financial and legal advice, including as to any tax

consequences, immediately from your stockbroker, bank manager,

solicitor, accountant or other independent financial or legal

adviser. Any individual or company whose Notes are held on its

behalf by a broker, dealer, bank, custodian, trust company or other

nominee or intermediary must contact such entity if it wishes to

participate in the Offers. None of the Offerors, the Dealer

Managers, the Tender Agent, the fiscal agent or the trustee (as

applicable) with respect to the Notes (or any of their respective

directors, employees or affiliates) make any recommendation as to

whether holders should tender Notes pursuant to the Offers.

OFFER RESTRICTIONS

European Economic Area ("EEA")

The communication of this announcement, the Offers to Purchase

and any other documents or materials relating to the Offers do not

constitute an offer of securities to the public for the purposes of

Regulation (EU) 2017/1129 (as amended, the "Prospectus Regulation")

and accordingly the requirement to produce a prospectus under the

Prospectus Regulation does not apply to the Offers.

United Kingdom

The communication of this announcement, the Offers to Purchase

and any other documents or materials relating to the Offers are not

being made, and such documents and/or materials have not been

approved, by an authorized person for the purposes of section 21 of

the Financial Services and Markets Act 2000 (the "FSMA").

Accordingly, this announcement, the Offers to Purchase and such

other documents and/or materials are not being distributed to, and

must not be passed on to, the general public in the United Kingdom.

The communication of the Offers to Purchase and such other

documents and/or materials is exempt from the restriction on

financial promotions under section 21 of the FSMA on the basis that

they are only being distributed to and are only directed at persons

to whom they can lawfully be circulated outside the United Kingdom

or to: (i) persons in the United Kingdom having professional

experience in matters relating to investments falling within the

definition of investment professionals (as defined in Article 19(5)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (as amended, the "Order")); (ii) persons

falling within Article 43 of the Order; or (iii) any other persons

to whom the relevant Offer to Purchase and such other documents

and/or materials may otherwise lawfully be communicated under the

Order (all such persons together being referred to as "relevant

persons"). This announcement and the Offers to Purchase and such

documents and/or materials are directed only at relevant persons

and must not be acted on or relied on by persons who are not

relevant persons. Any investment or investment activity to which

this announcement and the Offers to Purchase relate is available

only to relevant persons and will be engaged in only with relevant

persons.

The communication of this announcement, the Offers to Purchase

and any other documents or materials relating to the Offers do not

constitute an offer of securities to the public for the purposes of

s of Regulation (EU) 2017/1129 (as amended) as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (EUWA) (the "UK Prospectus Regulation") and

accordingly the requirement to produce a prospectus under the UK

Prospectus Regulation does not apply to the Offers.

Belgium (in respect of the NatWest Group Offer only)

Neither this announcement (in so far as it relates to the

NatWest Group Offer), the NatWest Group Offer to Purchase nor any

other documents or materials relating to the NatWest Group Offer

have been submitted to or will be submitted for approval or

recognition to the Financial Services and Markets Authority

(Autorité des services et marchés financiers / Autoriteit voor

financiële diensten en markten) and, accordingly, the NatWest Group

Offer may not be made in Belgium by way of a public offering, as

defined in Articles 3 and 6 of the Belgian Law of April 1, 2007 on

public takeover bids as amended or replaced from time to time.

Accordingly, the NatWest Group Offer may not be advertised and the

NatWest Group Offer will not be extended, and neither this

announcement, the NatWest Group Offer to Purchase nor any other

documents or materials relating to the NatWest Group Offer

(including any memorandum, information circular, brochure or any

similar documents) have been or shall be distributed or made

available, directly or indirectly, to any person in Belgium other

than "qualified investors" in the sense of Article 2(e) of the

Prospectus Regulation, acting on their own account. This

announcement (in so far as it relates to the NatWest Group Offer)

and the NatWest Group Offer to Purchase have been issued only for

the personal use of the above qualified investors and exclusively

for the purpose of the NatWest Group Offer. Accordingly, the

information contained in this announcement (in so far as it relates

to the NatWest Group Offer) and the NatWest Group Offer to Purchase

may not be used for any other purpose or disclosed to any other

person in Belgium.

France

This announcement, the Offers to Purchase and any other

documents or offering materials relating to the Offers may not be

distributed in the Republic of France except to qualified investors

(investisseurs qualifiés) as defined in Article 2(e) of the

Prospectus Regulation. This announcement and the Offers to Purchase

have not been and will not be submitted for clearance to the

Autorité des marchés financiers.

Italy

None of the Offers, this announcement, the Offers to Purchase or

any other documents or materials relating to the Offers has been or

will be submitted to the clearance procedure of the Commissione

Nazionale per le Società e la Borsa ("CONSOB"), pursuant to

applicable Italian laws and regulations.

The Offers are being carried out in the Republic of Italy

("Italy") as an exempted offer pursuant to article 101-bis,

paragraph 3-bis of the Legislative Decree No. 58 of February 24,

1998, as amended (the "Financial Services Act") and article 35-bis,

paragraph 4 of CONSOB Regulation No. 11971 of May 14, 1999, as

amended (the "Issuers' Regulation"). The Offers are also being

carried out in compliance with article 35-bis, paragraph 7 of the

Issuers' Regulation.

Holders or beneficial owners of the Notes located in Italy can

tender the Notes through authorized persons (such as investment

firms, banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Financial Services Act,

CONSOB Regulation No. 20307 of February 15, 2018, as amended from

time to time, and Legislative Decree No. 385 of September 1, 1993,

as amended) and in compliance with applicable laws and regulations

or with requirements imposed by CONSOB or any other Italian

authority.

Each intermediary must comply with the applicable laws and

regulations concerning information duties vis-à-vis its clients in

connection with the Notes and the Offers.

General

The Offers do not constitute an offer to buy or the solicitation

of an offer to sell Notes (and offers to sell will not be accepted

from the holders) in any circumstances in which such offer or

solicitation is unlawful. In those jurisdictions where the

securities or other laws require the Offers to be made by a

licensed broker or dealer or similar and any of the Dealer Managers

or any of the Dealer Manager's respective affiliates is such a

licensed broker or dealer in that jurisdiction, the Offers shall be

deemed to be made by such Dealer Manager or affiliate, as the case

may be, on behalf of the relevant Offeror in such jurisdiction.

Each holder participating in the Offers will be deemed to give

certain representations in respect of the jurisdictions referred to

above and generally as set out in the relevant Offer to Purchase.

Any tender of Notes pursuant to an Offer to Purchase from a holder

that is unable to make these representations will be rejected. Each

of the Offerors, the Dealer Managers and Kroll Issuer Services

Limited reserves the right, in its absolute discretion (and without

prejudice to the relevant holder's responsibility for the

representations made by it), to investigate in relation to any

tender of Notes, whether any such representation given by a holder

is correct and, if such investigation is undertaken and as a result

the relevant Offeror determines (for any reason) that such

representation is not correct, such offer to sell will be

rejected.

Each Offeror and their respective affiliates expressly reserve

the right at any time or from time to time following completion or

termination of the Offers made by it, to purchase or exchange or

offer to purchase or exchange Notes or to issue an invitation to

submit offers to sell Notes (including, without limitation, those

tendered pursuant to the relevant Offer(s) but not accepted for

purchase by it) through open market purchases, privately negotiated

transactions, tender offers, exchange offers or otherwise, in each

case on terms that may be more or less favorable than those

contemplated by the relevant Offer(s). In addition, each Offeror

also reserves the right to issue new debt securities from time to

time, including during the term of the Offers made by it.

THIS ANNOUNCEMENT CONTAINS INFORMATION THAT QUALIFIED OR MAY

HAVE QUALIFIED AS INSIDE INFORMATION FOR NATWEST GROUP PLC, FOR THE

PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014

(MAR) AS IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018. THIS ANNOUNCEMENT IS MADE BY ALEXANDER

HOLCROFT, HEAD OF INVESTOR RELATIONS FOR NATWEST GROUP PLC.

THIS ANNOUNCEMENT CONTAINS INFORMATION THAT QUALIFIED OR MAY

HAVE QUALIFIED AS INSIDE INFORMATION FOR NatWest Markets N.V., FOR

THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU)

596/2014 (MAR). FOR THE PURPOSES OF MAR AND ARTICLE 2 OF COMMISSION

IMPLEMENTING REGULATION (EU) 2016/1055, THIS ANNOUNCEMENT IS MADE

BY Vasileios TSAGRIS, TREASURER OF NatWest Markets N.V.

Legal Entity Identifiers

NatWest Group plc 2138005O9XJIJN4JPN90

NatWest Markets N.V. X3CZP3CK64YBHON1LE12

FORWARD-LOOKING STATEMENTS

From time to time, the Offerors may make statements, both

written and oral, regarding our assumptions, projections,

expectations, intentions or beliefs about future events. These

statements constitute "forward-looking statements". The Offerors

caution that these statements may and often do vary materially from

actual results. Accordingly, the Offerors cannot assure you that

actual results will not differ materially from those expressed or

implied by the forward-looking statements. You should read the

sections entitled "Risk Factors" in the relevant Offer to Purchase,

in the Annual Report and H1 2022 Interim Report of the relevant

Offeror which is incorporated by reference therein and

"Forward-Looking Statements" in the Annual Report and H1 2022

Interim Report of the relevant Offeror, which is incorporated by

reference in the relevant Offer to Purchase.

Any forward-looking statements made herein or in the documents

incorporated by reference herein speak only as of the date they are

made. Except as required by the U.K. Financial Conduct Authority

(the "FCA") or the Dutch Authority for the Financial Markets (the

"AFM"), as applicable, any applicable stock exchange or any

applicable law, the Offerors expressly disclaim any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statement contained in the relevant Offer to

Purchase or the documents incorporated by reference herein to

reflect any changes in expectations with regard thereto or any new

information or any changes in events, conditions or circumstances

on which any such statement is based. The reader should, however,

(i) with respect to NatWest Group consult any additional

disclosures that NatWest Group has made or may make in documents

that NatWest Group has filed or may file with the U.S. Securities

and Exchange Commission and (ii) with respect to NWM N.V. consult

any additional disclosures that NWM N.V. has made or may make in

documents that NWM N.V. has filed or may file with the AFM.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENEASPFESAAEFA

(END) Dow Jones Newswires

August 01, 2022 12:02 ET (16:02 GMT)

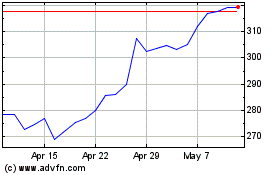

Natwest (LSE:NWG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Natwest (LSE:NWG)

Historical Stock Chart

From Jan 2024 to Jan 2025