TIDMMSLH

RNS Number : 6703Y

Marshalls PLC

09 May 2023

9 May 2023

Marshalls plc

('Marshalls' or 'Group')

Trading Update

Ahead of its Annual General Meeting tomorrow, Marshalls plc, a

leading manufacturer of products for the built environment,

provides the following trading update for the four months to April

2023.

Group revenue for the four months ended 30 April 2023 was GBP227

million (2022: GBP202 million), which represents year-on-year

growth of 12 per cent including the benefit of the acquisition of

Marley. On a like-for-like basis, Group revenue contracted by 14

per cent reflecting the uncertain macro-economic climate, a

reduction in new house building and continued weakness in private

housing RMI activity.

In the first quarter of the year, National House Building

Council new housing starts were 27 per cent lower than 2022, which

had an impact on the performance of all the Group's reporting

segments. Management have acted quickly to reduce costs in the

business and are accelerating plans to improve production

efficiency, whilst ensuring flexibility to respond when market

demand improves.

Divisional trading performance

Marshalls Landscape Products has continued to experience tough

market conditions due to its exposure to new house building and the

more discretionary elements of private housing RMI. Against this

backdrop, it delivered revenue of GBP110 million (2022: GBP140

million), which represents a reduction of 21 per cent compared to

2022.

Marshalls Building Products delivered revenue of GBP55 million

(2022: GBP61 million), which represents a contraction of nine per

cent. Revenue in the bricks and masonry and mortars businesses was

modestly lower year-on-year, whilst drainage and aggregates were

held back by deferred new housing starts.

Marley Roofing Products delivered revenue of GBP61 million,

which represents a contraction of six per cent compared to the

corresponding period in 2022. Viridian delivered further strong

growth in integrated solar revenues supported by changes in

building regulations, which was offset by a weaker performance in

roofing due to lower volumes of new build housing.

Strategic developments

Following the reduction in the cost base and manufacturing

capacity implemented in the second half of last year in Marshalls

Landscape Products, further actions have been taken to remove

around 70 indirect roles in the Marshalls businesses, which will

result in annualised savings of around GBP3.5 million. The Board

will continue to monitor performance and respond flexibly to

evolving market conditions to ensure that the Group's manufacturing

capacity and cost base are aligned to market demand. In addition,

in order to leverage Marley's excellent commercial strengths, we

are pleased to have promoted Marley's commercial leader to take

responsibility for the trading activities of Marshalls Landscape

and Building Products.

The Group successfully completed the disposal of its former

Belgian subsidiary in April 2023, which simplifies operations and

enhances the Group's focus on the UK construction market. This

business contributed revenue of GBP21 million and an operating loss

of GBP0.7 million in 2022.

Good progress continues to be made with the integration of

Marley. The early successes regarding the reduction of vacancies

have been maintained. The increase in efficiencies has also been

upheld across the concrete tile production lines, which has

resulted in a significant reduction in lead times across several

product lines. This has enabled the business to deliver a much more

targeted approach to asset failures and refurbishment.

Balance sheet and liquidity

The Group's balance sheet continues to be robust, with

pre-IFRS16 net debt of GBP220 million at the end of April. The

increase since December 2022 year end of GBP29 million reflects

seasonal working capital trends and is in-line with the Board's

expectations. The Board's ongoing priority is to reduce leverage

utilising free cash flow generated by the Group, and its net debt

expectations for the full year remain unchanged.

Outlook

The Board remains confident that the Group is well placed to

deliver profitable long-term growth when market conditions improve

and continues to focus on its key strategic initiatives. In the

near-term, the macro-economic climate is expected to remain

challenging and the trading performance in the year to date has

been weaker than originally anticipated.

The Board's expectations for 2023 were set with reference to the

Construction Products Association's ('CPA') Winter forecast that

was published in January 2023. The CPA reduced its 2023

construction output forecast earlier this month. This was

principally driven by a six-percentage point deterioration in new

build housing to a year-on-year contraction of 17 per cent. The CPA

cited reduced demand in the wake of the mini budget, the

consequential sharp rise in mortgage rates and the end of Help to

Buy as contributing factors for the downgrade.

Taking these factors together, the Board now expects to deliver

a result that is lower than its original expectations.

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligations under Article 17 of those

Regulations.

Enquiries:

Chief Executive

Martyn Coffey Chief Financial

Justin Lockwood Officer Marshalls plc +44 (0)1422 314777

+44 (0)20 3128

Tim Rowntree MHP Communications 8540

+44 (0)20 3128

Charlie Barker 8147

Note to the Editor:

About Marshalls plc:

Established in the late 1880s, Marshalls plc is a leading UK

manufacturer of products for the built environment. It operates

through three trading divisions: Marshalls Landscape Products;

Marshalls Building Products; and Marley Roofing Products. Marshalls

Landscape Products is the UK's leading manufacturer of superior

natural stone and innovative concrete hard landscaping products,

supplying the construction, home improvement and landscape markets.

Marshalls Building Products is a supplier of concrete drainage

products, concrete bricks, ready-to-use mortars and aggregates.

Marley Roofing Products is a leader in the manufacture and supply

of pitched roofing systems, including clay and concrete tiles,

timber battens, roof integrated solar solutions and roofing

accessories.

The Group operates a national network of manufacturing and

distribution sites throughout the UK. Marshalls is committed to

quality in everything it does, including the achievement of high

environmental and ethical standards and continual improvement in

health and safety performance. Its strategic goal is to become the

UK's leading manufacturer of products for the built

environment.

Forward-Looking Statements:

Any statements in this release, to the extent that they are

forward-looking, are subject to risk factors associated with,

amongst other things, the economic and business circumstances

occurring from time to time in the markets in which Marshalls

operates. It is believed that the expectations reflected in these

statements are reasonable, but they may be affected by a wide range

of variables, which could cause actual results to differ materially

from those currently anticipated. More information about the

factors that may affect Marshalls' performance is contained in the

Annual Report to shareholders for the year ended 31 December

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTAPMRTMTJMBBJ

(END) Dow Jones Newswires

May 09, 2023 02:00 ET (06:00 GMT)

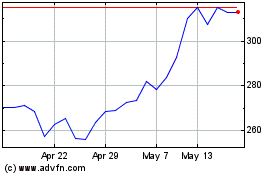

Marshalls (LSE:MSLH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marshalls (LSE:MSLH)

Historical Stock Chart

From Nov 2023 to Nov 2024