Medoro Resources Announces Second Quarter Results

TORONTO, Aug. 13 /CNW/ - Medoro Resources Ltd. (TSX-V/AIM: MRL) announced

today its second quarter and first half results for the three and eight-month

periods ending June 30, 2004. Medoro Resources was formed following the

business combination between Full Riches Investments Limited and a wholly-

owned subsidiary of Gold Mines of Sardinia, plc.

The new entity, Medoro Resources, has elected to report its financial

results on a calendar year basis. Full Riches previously reported its results

for the three months ended January 31, 2004, and, having been identified as

the acquirer for accounting purposes, this release includes results for both

the three and eight-month periods ending June 30, 2004.

For the three and eight-month periods ended June 30, 2004, Medoro

Resources reported a loss of $1.9 million and $3.0 million or $0.02 and $0.05

per share respectively. The loss largely reflects the impact of one-time costs

related to the business combination, as well as ongoing operating costs at its

90%-owned operating subsidiary in Sardegna.

In Sardegna at the Monte Ollasteddu prospect, all remaining issues

related to site access and exploration permits were resolved and exploration

has commenced. Two diamond drill rigs are currently operating, with 3,000

metres of drilling planned to test approximately 2 kilometres of strike length

identified by previous surface sampling. Concurrently, geological mapping and

soil sampling is being conducted on the eastern plateau area in order to

establish drill targets for the second phase of drilling.

On June 7, 2004, the company announced the proposed acquisition of Andina

Minerals Inc. in exchange for 25 million common shares of Medoro, with closing

subsequently extended to August 31, 2004. On the same date, the company

announced a proposed restructuring of its Joint Venture with Sargold Resource

Corporation whereby Sargold would acquire Medoro's entire interest in the

Furtei operations in exchange for (euro) 6 million in cash, the assumption of

(euro) 2 million in liabilities and C$1 million in common shares of Sargold,

with closing expected on or before August 31. Due diligence is continuing by

all parties and further announcements are expected in the near future.

Financial Statements, Notes and Management's Discussion & Analysis

follow.

Medoro Resources Ltd.

Consolidated Balance Sheets

Expressed in Canadian dollars

June 30, October 31,

2004 2003

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Unaudited Audited

Assets

Current assets

Cash and equivalents $ 4,392,545 $ 3,221,339

Accounts receivable 2,087,749 9,468

Promissory note - 50,000

Inventories 646,611 -

Prepaids and deposits 463,021 1,973

-------------------------------------------------------------------------

7,589,926 3,282,780

Loan receivable (Note 2 d) - 662,925

Mineral properties (Notes 2 f and 3) 24,207,498 -

Property, plant and equipment 5,588,745 -

-------------------------------------------------------------------------

Total assets $ 37,386,169 $ 3,945,705

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Liabilities and shareholders' equity

Current liabilities

Accounts payable and accruals $ 3,629,473 $ 97,762

Long-term debt 9,347,144 -

Other long-term liabilities 4,942,709 -

-------------------------------------------------------------------------

17,919,326 97,762

-------------------------------------------------------------------------

Shareholders' equity

Share capital (Note 4) 28,981,977 6,706,001

Contributed surplus (Notes 2 c and f) 179,353 -

Shares to be issued (Note 3) - 15,000

Special warrants (Note 2 b) - 2,490,905

Subscriptions received (Note 2 c) - 1,255,000

Cumulative translation adjustment (41,828) -

Deficit (9,652,659) (6,618,963)

-------------------------------------------------------------------------

19,466,843 3,847,943

-------------------------------------------------------------------------

Total liabilities and shareholders' equity $ 37,386,169 $ 3,945,705

-------------------------------------------------------------------------

-------------------------------------------------------------------------

These unaudited interim consolidated financial statements for the periods

ended June 30, 2004 have not been reviewed by the Company's auditor.

See accompanying notes to unaudited interim consolidated

financial statements.

Medoro Resources Ltd.

Consolidated Statements of Operations and Deficit

Expressed in Canadian dollars, unaudited

Three Months Three Months Eight Months Nine Months

Ended Ended Ended Ended

June 30, July 31, June 30, July 31,

2004 2003 2004 2003

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Interest income $ 13,062 $ (5,995) $ 80,219 $ 224

General and

administrative

expenses (1,182,076) (149,022) (2,297,859) (197,718)

Exploration

expenses (438,202) - (305,870) -

Loss on disposal

of capital assets - - - (1,844)

Amortization (305,870) - (560,341) (97)

Foreign exchange

gains (losses) 33,254 (1,029) 45,428 (8,467)

-------------------------------------------------------------------------

Net loss for

the period (1,879,832) (156,046) (3,033,696) (207,902)

Deficit,

beginning of

period (7,772,827) (6,324,136) (6,618,963) (6,272,280)

-------------------------------------------------------------------------

Deficit,

end of period $(9,652,659) $(6,480,182) $(9,652,659) $(6,480,182)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and

diluted loss

per share $ (0.02) $ (0.01) $ (0.05) $ (0.02)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Weighted average

number of

common shares

outstanding 84,670,649 11,871,849 57,264,086 11,871,851

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying notes to unaudited interim consolidated

financial statements.

Medoro Resources Ltd.

Consolidated Statements of Cash Flows

Expressed in Canadian dollars, unaudited

Three Months Three Months Eight Months Nine Months

Ended Ended Ended Ended

June 30, July 31, June 30, July 31,

2004 2003 2004 2003

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Cash provided

by (used in):

Operating

activities

Net loss for

the period $(1,879,832) $ (156,046) $(3,033,696) $ (207,902)

Items not

affecting cash:

Loss on disposal

of capital

assets - - - 1,844

Amortization 305,870 - 305,870 97

Foreign exchange

(gains) losses (33,254) 1,029 (45,428) 8,467

Changes in

non-cash working

capital items:

Accounts

receivable (58,729) 123,735 (363,938) 118,227

Promissory note - - 50,000 -

Inventories (6,069) - (4,436) -

Prepaids and

deposits (314,191) 2,082 (306,295) -

Accounts payable

and accrued

liabilities (462,809) (22,257) (6,228) (19,538)

Other long-term

liabilities (458,331) - 183,527 -

-------------------------------------------------------------------------

(2,907,345) (51,457) (3,220,624) (98,805)

-------------------------------------------------------------------------

Investing

activities

Acquisition of

Sardinia Gold

Mining SpA,

net of acquired

cash (Note 2) (601,785) - (2,104,279) -

Acquisition of

mineral

properties

(Note 3) (9,752) - (1,008,042) -

Increase in

property,

plant and

equipment, net 4,327 - (11,548) -

-------------------------------------------------------------------------

(607,210) - (3,123,869) -

-------------------------------------------------------------------------

Financing

activities

Issuance of

special warrants - - 295,000 -

Issuance of

subscription

receipts - - 8,015,000 -

Issuance costs - - (781,515) -

-------------------------------------------------------------------------

- - 7,528,485 -

-------------------------------------------------------------------------

Foreign exchange

impact on cash 14,632 - (12,786) -

-------------------------------------------------------------------------

Net increase

(decrease) in

cash and

equivalents (3,499,923) (51,457) 1,171,206 (98,805)

Cash and

equivalents,

beginning of

period 7,892,468 193,131 3,221,339 240,479

-------------------------------------------------------------------------

Cash and

equivalents,

end of period $ 4,392,545 $ 141,674 $ 4,392,545 $ 141,674

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying notes to unaudited interim consolidated

financial statements.

Medoro Resources Ltd.

Notes to Unaudited Interim Consolidated Financial Statements

For the Three and Eight Month Periods Ended June 30, 2004 and the

Three and Nine Month Periods Ended July 31, 2003

All Amounts Expressed in Canadian Dollars

Unaudited

-------------------------------------------------------------------------

1. Basis of Presentation

The interim consolidated financial statements include the accounts of

the amalgamated entity resulting from the Business Combination as

described in Note 2 (the "Company"), Full Riches Investments Ltd.

("FRI") and its wholly owned subsidiaries, principally Gold Mines of

Sardinia Pty. Ltd. ("GMS Australia"), Sardinia Gold Mining SpA

("Sardinia Gold") and Miniere di Pestarena srl. Pursuant to the

Business Combination, the amalgamated company, formed on March 2,

2004, has continued under the name of Medoro Resources Ltd.

The unaudited interim period financial statements have been prepared

by the Company in accordance with Canadian generally accepted

accounting principles ("GAAP"). All financial summaries included are

presented on a comparative and consistent basis showing the figures

for the corresponding period in the preceding year. The preparation

of financial data is based on accounting principles and practices

consistent with those used in the preparation of annual financial

statements. Certain information and footnote disclosure normally

included in financial statements prepared in accordance with GAAP has

been condensed or omitted. These unaudited interim period statements

should be read together with the audited financial statements and the

accompanying notes included in the FRI's latest annual report. In the

opinion of the Company, its unaudited interim financial statements

contain all adjustments necessary in order to present a fair

statement of the results of the interim periods presented.

Certain reclassifications have been made to the prior period

financial statements to conform to the current period presentation.

2. Acquisition of Sardinia Gold Mining SpA

(a) The business combination

On October 3, 2003, FRI entered into an arm's length agreement with

Gold Mines of Sardinia plc, a public company formed under the laws of

England and Wales ("GMS England") pursuant to which FRI and GMS

England agreed to complete a business combination (the "Business

Combination"). GMS England is a gold exploration and development

company with interests on the Italian island of Sardinia through its

operating subsidiary Sardinia Gold, a joint venture with the

Sardinian regional Government, in which GMS England holds a 90%

interest through GMS Australia and the Sardinian regional Government

the remaining 10%.

FRI received approval in February 2004 from the TSX Venture Exchange,

including the amalgamation of FRI with GMS England's wholly owned

subsidiary, Medoro Resources Ltd. ("GMS Canada"), incorporated under

the laws of the Yukon, to create the Company to continue under the

name of Medoro Resources Ltd. The amalgamation was completed February

24, 2004. GMS England transferred all of the issued and outstanding

shares in the capital of GMS Australia from GMS England to GMS Canada

in consideration for an aggregate of 38,726,261 shares of GMS Canada.

Pursuant to the terms of the amalgamation:

(i) GMS England, as the sole shareholder of GMS Canada, received

common shares of the Company, representing approximately 50% of

the Company's issued and outstanding shares as of the date of

the completion of the amalgamation. In conjunction with the

completion of the Business Combination, GMS England distributed

the shares it received of the Company to its shareholders; and

(ii) The shareholders of FRI received common shares of the Company

representing, in aggregate, approximately 50% of the Company's

issued and outstanding shares as of the date of the

amalgamation.

In identifying the acquirer in this Business Combination,

consideration was given to the proposed relative composition of the

Board of Directors and Management of the Company. FRI was identified

as the acquirer.

(b) Initial private placement

Completion of the Business Combination was subject to the successful

completion of $10,000,000 (gross) in equity financings by FRI (the

"Private Placements"). The use of proceeds of the financings is for

future exploration and development expenses and general working

capital. In connection with the Business Combination, FRI announced a

non-brokered private placement of up to 40,500,000 special warrants

(the "Special Warrants") at a price of $0.10 per Special Warrant for

gross proceeds of $4,050,000 (the "Initial Private Placement"). On

October 27, 2003, FRI completed the issue and sale of 25,000,000

Special Warrants for aggregate proceeds of $2,500,000. FRI completed

the issue and sale of the balance of the $1,550,000 on December 11,

2003. The Special Warrants were subsequently exercised for common

shares prior to the completion of the amalgamation and each FRI

common share received on such exercise was exchanged of 0.5 common

shares of the Company pursuant to the amalgamation. Issuance costs

related to the transaction amounted to $43,798.

(c) Agency Private Placement

In connection with the satisfaction of the condition to complete the

balance of the Private Placements, FRI retained an agent ("the

Agent") in connection with the private placement of 22,900,000

subscription receipts (the "Subscription Receipts") at a price of

$0.35 per Subscription Receipt for aggregate proceeds of $8,015,000

(the "Agency Private Placement"). Each Subscription Receipt was

exercisable, for no additional consideration, into one FRI common

share. The private placement was completed on January 16, 2004. The

Subscription Receipts were exercised for FRI common shares prior to

the amalgamation and each FRI common share received on the exercise

was subsequently exchanged for 0.5 common shares of the Company

pursuant to the amalgamation.

In connection with the Agency Private Placement, FRI paid the Agent a

commission of $480,900 equal to 6% of the aggregate proceeds from the

Agency Private Placement and issued 1,374,000 Agent's Warrants. Each

Agent's Warrant entitles the holder to acquire one FRI common share

at a price of $0.35 until January 15, 2006. In addition, each Agent's

Warrant was exchanged for 0.5 replacement warrants of the Company at

$0.70 per warrant pursuant to the amalgamation. The fair value of the

Agent's Warrants of $117,950, included in contributed surplus, was

calculated using the Black-Scholes pricing model assuming a risk-free

interest rate of 2.87%, volatility of 40% and no dividend payments.

Total issuance costs related to the Subscription Receipts were

$864,762 including the commission, warrants and advisory and legal

fees.

(d) Interim financing of GMS England and Sardinia Gold

In conjunction with the Business Combination, FRI arranged interim

financing (the "Interim Financing") for GMS England consisting of US

$1,500,000 advanced by FRI in two tranches pursuant to a loan

agreement between FRI and GMS England dated October 3, 2003 (the "GMS

Loan Agreement"). The loans bore interest at a rate of 10% per annum

from the date of issue and matured following the completion of the

Business Combination such that the obligations of GMS England

thereunder expired on closing of the Business Combination. The loans

were direct obligations of GMS England, secured by a charge over the

shares of GMS Australia. All funds advanced under the Interim

Financing were paid directly to Sardinia Gold. In February 2004,

prior to the Business Combination, FRI advanced ("SGM Advances")

additional funds of $211,968 directly to Sardinia Gold for working

capital purposes. Pursuant to the Business Combination, the

obligations of GMS England under the Interim Financing and SGM

Advances were acquired by the Company.

(e) Joint venture

Pursuant to the terms of the Business Combination, the Company

entered into a binding letter of intent with a wholly-owned

subsidiary of Gold Fields Limited ("Gold Fields"). Under the letter

of intent, the Company will grant Gold Fields an exclusive option

over all of its properties in Sardinia not currently under option to

Bolivar Gold Corp. or Sargold Resource Corporation. Gold Fields will

have a period of 12 months to perform preliminary evaluations on the

properties, during which period Gold Fields will have the right to

acquire up to a 70% interest in specific properties, with 50% to be

earned by sole-funding all expenditures through to completion of a

bankable feasibility study. Upon completion of a bankable feasibility

study, Gold Fields and Sardinia Gold will each be responsible for

funding further exploration, development and other work on the

property in accordance with their respective percentage interests.

(f) Other matters

(i) In consideration for their services, in introducing the

parties, assistance with the Italian authorities, due

diligence, assisting with the financing and continued

services in completing the Business Combination, a total of

10,000,000 FRI common shares were issued, after receiving

TSX Venture Exchange approval, to Next com Italia srl, Jose

Francisco Arata and Endeavour Financial. Pursuant to the

amalgamation, each of these common shares were exchanged for

0.5 common shares of the Company.

(ii) FRI retained McFarlane Gordon Inc. to act as sponsor (the

"Sponsor") in connection with the Business Combination in

accordance with the policies of the TSX Venture Exchange.

As consideration for the services rendered by the Sponsor,

FRI agreed to issue 250,000 FRI common shares which,

pursuant to the amalgamation, were subsequently exchanged

for 0.5 common shares of the Company.

(iii) Post-amalgamation, the Company issued:

- 1,182,888 options to holders of GMS England options;

- 5,793,918 warrants to holders of GMS England warrants as

consideration for the assignment to, and assumption by,

the Company of certain GMS England Agreements; and

- 319,857 common shares to Williams de Broe in consideration

of services performed in connection with the amalgamation.

(iv) On February 24, 2004, the Business Combination was completed

and shares in the Company began trading on March 2, 2004.

The acquisition of 100% of GMS Australia has been accounted

for using the purchase method and the results of operations

have been included in the earnings of the Company from the

date of amalgamation.

The preliminary allocation of the purchase price is

summarized below:

44,171,118 shares issued at $0.20 per share

(Notes 2 a, 2 f (i), 2 f (ii) and 2 f (iii)) $ 8,834,223

Fair value of GMS England options and warrants

exchanged for options and warrants of the

Company (Note 2 f (iii)) 61,403

Acquisition costs 1,450,000

-------------------------------------------------------------

Total consideration $ 10,345,626

-------------------------------------------------------------

-------------------------------------------------------------

Net assets acquired:

Cash $ 467,080

Accounts receivable 1,751,366

Inventories 655,756

Prepaids and deposits 158,821

Mineral interests 21,017,046

Property, plant and equipment 6,197,089

Accounts payable and accrued liabilities (3,001,865)

Interim Financing and SGM Advance

(Note 2 d) (2,203,968)

Long-term debt (9,544,655)

Other long-term liabilities (5,151,044)

-------------------------------------------------------------

$ 10,345,626

-------------------------------------------------------------

-------------------------------------------------------------

The fair value of the options and warrants was determined

using the Black-Scholes option pricing model assuming no

dividends were paid, a volatility of the Company's shares of

40%, an expected life of options and warrants ranging

between 0.5 years and 5 years and annual risk-free interest

rate ranging between 2.15% and 3.48%.

As at June 30, 2004, $405,313 of the acquisition costs was

included in accounts payable and accrued liabilities.

3. Acquisition of Miniere di Pestarena srl

On March 23, 2004, the Company acquired 100% of the share capital in

Miniere di Pestarena srl, an Italian company with exploration rights

covering the Pestarena and Lavanchetto concessions located in the

Piedmont Region in Northern Italy for total consideration amounting

to $3,208,042 represented by a cash payment of $979,835 (600,000

Euros), acquisition costs of $28,207 and the issuance of 4,000,000

common shares of the Company on May 5, 2004. These shares are subject

to a hold period expiring on September 4, 2004, during which they

cannot be traded. The acquisition has been accounted for using the

purchase method and the purchase price has been allocated to mineral

properties.

4. Capital Stock

(a) Common shares

Authorized - Unlimited common shares without par value

Issued and outstanding -

Number

of shares Amount

------------------------------------------------------------------

------------------------------------------------------------------

Opening balance as at

October 31, 2003 11,871,849 $ 6,706,001

Issued prior to amalgamation:

As consideration for bridge

facility (see below) 150,000 15,000

Upon exercise of Special Warrants

(Note 2 b) 40,500,000 4,006,202

Upon exercise of Subscription

Rights (Note 2 c) 22,900,000 7,150,238

As consideration for services in

connection with the Business

Combination (Note 2 f (i)) 10,000,000 1,000,000

As consideration for services

rendered by the Sponsor

(Note 2 f (ii)) 250,000 25,000

------------------------------------------------------------------

Balance as at February 24, 2004,

prior to amalgamation 85,671,849 $ 18,902,441

------------------------------------------------------------------

------------------------------------------------------------------

Number

of shares Amount

------------------------------------------------------------------

------------------------------------------------------------------

Opening balance as at February 24,

2004, post-amalgamation, after

giving effect to exchange of

0.5 common shares of the Company

for each FRI common share 42,835,925 $ 18,902,441

Issued to GMS England pursuant to

the Business Combination (Note 2 a) 38,726,261 7,745,252

Issued as consideration for services

in connection with the amalgamation

(Note 2 f (iii)) 319,857 63,971

Issued in settlement of accrued

liabilities (see below) 140,624 70,313

Issued to acquire Miniere di

Pestarena srl (Note 3) 4,000,000 2,200,000

------------------------------------------------------------------

Closing balance as at June 30, 2004 86,022,667 $ 28,981,977

------------------------------------------------------------------

------------------------------------------------------------------

FRI issued 150,000 common shares to Endeavour Mining Capital

Corp. as part of the consideration for providing it with a bridge

facility of US $500,000 bearing interest at a rate of 10% per

annum that matured on October 31, 2003.

On May 5, 2004, pursuant to the approval of the TSX Venture

Exchange, the Company issued an aggregate of 140,624 common

shares in final payment of $70,313 of accrued liabilities owed to

four consultants to the Company.

(b) Escrow shares

As at June 30, 2004, there were 3,426,000 common shares of the

Company held in escrow.

(c) Stock options

As at June 30, 2004, there are 2,825,000 stock options of the

Company outstanding exercisable at $0.70 per common share,

including 325,000 stock options of the Company granted in

February 2004 to certain officers and consultants of FRI. In

addition, subsequent to the amalgamation, 1,182,888 stock options

of the Company were issued to holders of GMS England options

expiring through mid-2006 at exercise prices ranging from $1.45

to $3.25 per common share.

(d) Stock warrants

As at June 30, 2004, there were 5,793,918 warrants (Note 2 f

(iii)) outstanding with expiry dates ranging up until 2008 and

exercise prices ranging from $0.70 to $3.30 per common share. In

addition, there were 687,000 Agent's Warrants (Note 2 c)

outstanding exercisable at $0.70 per common share expiring on

January 15, 2006.

5. Related Party Transactions

During the eight months period ended June 30, 2004, the Company paid

the following amounts to related parties:

(a) Consulting fees of $23,888 and rent of $4,000 (2003 - Nil) were

paid to a company in which a director of the Company is an

officer.

(b) Consulting fees of $196,289 were paid (2003 - Nil) to Next com

Italia srl, a company in which the President of Sardinia Gold is

managing director.

6. Segmented Information

The Company operates in one principal business segment, gold

exploration and development, principally conducted through its

operating subsidiaries located in Italy.

Management's Discussion and Analysis of Results of Operation and

Financial Condition for the three and eight-month periods ended

June 30, 2004

This Management's Discussion and Analysis should be read in conjunction

with the company's unaudited consolidated financial statements for the periods

ended June 30, 2004 and related notes thereto which have been prepared in

accordance with Canadian generally accepted accounting principles. In

addition, the following should be read in conjunction with the 2003 audited

consolidated financial statements. All figures are expressed in Canadian

dollars unless otherwise noted.

This Management's Discussion and Analysis has been prepared with

reference to National Instrument 51-102 "Continuous Disclosure Obligations" of

the Canadian Securities Administrators. This Management's Discussion and

Analysis has been prepared as of August 13, 2004.

Overview

Medoro Resources Ltd. was created in February 2004 as a result of the

business combination between Full Riches Investments Limited and GMS Canada,

whose principal assets were the exploration and formerly-producing gold assets

belonging to Gold Mines of Sardinia (GMS).

The original focus of GMS was the exploration, development and production

of gold on the island of Sardegna in Italy. GMS was successful in this regard,

having produced, in total, 130,000 ounces of gold during the period 1997 -

2003. This was not a particularly prosperous period for gold producers, large

and small, as the price of gold was hovering around 20-year lows. As a result,

GMS' ability to explore for and develop additional gold resources was

constrained by available cash flow. Having exhausted all readily-available

sources of ore in February 2003, the company suspended operations and pursued

alternatives that would enable GMS shareholders to realize some value for its

extensive portfolio of exploration concessions.

The Full Riches transaction achieved this objective. In addition to

providing badly needed cash resources, a key requirement of the transaction

was that Full Riches secure the participation of a senior partner who would

take on the responsibility of funding an aggressive program of exploration of

GMS' concessions. This commitment was fulfilled by the participation of a

wholly-owned subsidiary of Gold Fields Limited, who have a 12-month exclusive

right to explore any GMS concession not previously optioned to another party

and can earn a 70% interest in any such property by funding all costs through

to the completion of a bankable feasibility study.

In addition to the Gold Fields Joint Venture, GMS had previously

negotiated two exploration joint ventures, one with Sargold Resource

Corporation for exploration in the Furtei area and one with Bolivar Gold Corp.

for the exploration of the Monte Ollasteddu concession. Bolivar Gold Corp. can

earn a 70% interest in the property by funding all expenditures through to the

completion of a bankable feasibility study. A wholly-owned subsidiary of Gold

Fields is currently earning a 60% interest in the property by funding all of

Bolivar Gold's obligations. At Furtei, Sargold Resource Corporation is earning

a 45% interest in the concessions by funding (euro) 15 million over an 8 year

period. As announced on June 7, 2004, the parties have agreed to a

restructuring of this agreement whereby Sargold would acquire Medoro's entire

interest in the Furtei operations in exchange for (euro) 6 million in cash,

the assumption of (euro) 2 million in liabilities and C$1 million in common

shares of Sargold, with closing expected on or before August 31, 2004.

Medoro Resources' vision is to create the pre-eminent European-focused

gold exploration company with a diverse portfolio of gold prospects throughout

the region. To achieve this objective, the company intends to leverage off of

its existing land position in Sardegna. Given the company's current financial

and technical resources, Medoro's strategy will initially be to rely

extensively on joint ventures with highly-qualified, well-financed partners to

fund exploration of both existing concessions as well as newly-acquired

opportunities elsewhere in Italy and throughout Europe.

In order to achieve this strategy, the company must reduce the negative

cash flow associated with the formerly producing GMS assets to a point where

Medoro is organized and operated on a largely 'cash neutral' basis, with all

exploration funding provided by joint venture partners. Failure to achieve

this will limit the company's ability to acquire new properties and may

ultimately require the sale of some assets or additional equity financing, if

available. In the longer term, this strategy is only viable if economic

quantities of gold are discovered and developed on at least one of the

company's properties and thereby generate cash flow operations sufficient to

cover all corporate costs on an ongoing basis. On June 7, 2004, the company

announced the proposed acquisition of Andina Minerals Inc. in exchange for

25 million common shares of Medoro, with closing subsequently extended to

August 31, 2004. Given the regulatory delays experienced in carrying out its

stated strategy in Sardegna, the company believes that it is appropriate to

diversify its geographical focus and that the Andina acquisition would achieve

this objective as well as significantly enhance the management team.

Results of Operations

With the recently completed business combination, comparisons between

current costs and prior periods are not meaningful. However, the following

comments identify various issues related to the results of operations for the

periods ending June 30, 2004 and the company's financial condition as of that

date.

With mining operations in Sardegna suspended as of February 2003, the

only tangible activity in the group was general and administrative costs

related to the business combination as well as ongoing administrative costs,

primarily in Italy and Canada. These costs amounted to $2.3 million in the

eight months ended June 30, 2004, with $1.2 million occurring in the most

recent three months. In addition, a total of $438,000 was expended in the past

three months on exploration that is not recoverable from joint venture

partners. After adjusting for non-cash items and changes in non-cash working

capital, operating activities consumed $2.9 million in the three months ended

June 30, 2004 and a further $0.3 million in the preceding five months.

Investing activities in the three and eight-month periods ended June 30, 2004

consist largely of the acquisition of the Pestarena property in northwestern

Italy at a cash cost of $1.0 million plus the issuance of 4 million shares.

During the eight months ended June 30, 2004 the company raised net proceeds of

$7.5 million through the sale of 22.9 million subscription receipts which were

exercisable, for no additional consideration, into common shares of Full

Riches which, pursuant to the business combination, were exchanged for

0.5 common shares of Medoro Resources.

The following tables provide selected financial information for the three

most recent years and eight most recent quarters. All results from business

activities preceding the GMS acquisition have been treated as discontinued

operations.

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Three most recent years Oct. 31 Oct. 31 Oct. 31

2003 2002 2001

-------------------------------------------------------------------------

a) Revenues $ 0 $ 798,695 $ 979,116

b) Income before

discontinued operations 0 0 0

- per share 0.00 0.00 0.00

c) Net income (346,683) (507,972) (42,559)

- per share (0.03) (0.04) (0.00)

d) Total assets 3,945,705 448,219 258,515

e) Long term debt 0 0 0

f) Dividends per share 0.00 0.00 0.00

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Summary of Jun. 30 Mar. 31 Jan. 31 Oct. 31

Quarterly Results 2004 2004(x) 2004 2003

-------------------------------------------------------------------------

a) Revenues $ 0 $ 0 $ 0 $ 0

b) Income before

discontinued

operations (1,879,832) (1,064,016) 0 0

- per share (0.02) (0.02) 0.00 0.00

c) Net income (1,879,832) (1,064,016) (89,848) (138,781)

- per share (0.02) (0.02) (0.01) (0.01)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(x) two-month period

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Summary of Jul. 31 Apr. 30 Jan. 31 Oct. 31

Quarterly Results 2003 2003 2003 2002

-------------------------------------------------------------------------

a) Revenues $ 0 $ 0 $ 0 $ 0

b) Income before

discontinued

operations 0 0 0 0

- per share 0.00 0.00 0.00 0.00

c) Net income (156,046) (26,289) (25,567) (613,543)

- per share (0.01) (0.00) (0.00) (0.05)

-------------------------------------------------------------------------

Liquidity and Financial Resources

At June 30, 2004, Medoro Resources had $4.4 million in cash and working

capital of $4.0 million. In order to achieve its objectives, the company has

initiated a thorough review of all activities in Sardegna with a view to

reducing ongoing costs not recoverable from exploration partners to a minimal

level. At the same time, there are approximately $3.6 million in trade

payables, many of which are greater than 90 days overdue, which need to be

settled in the coming months.

In addition to reducing ongoing costs, management is actively looking at

a number of possible corporate arrangements which could help ensure that

shareholders ultimately realize the inherent value in the company's exciting

exploration portfolio. In the absence of success in these initiatives, some

combination of asset sales or additional financing would be required to ensure

the company's long-term survival.

Disclosure of Outstanding Share Data

Medoro Resources' outstanding voting or equity securities, or securities

convertible into, or exercisable or exchangeable for, voting or equity

securities of the company, are as follows:

-------------------------------------------------------------------------

Securities Jun 30, 2004 Mar 31, 2004 Oct 31, 2003

-------------------------------------------------------------------------

Common shares 86,022,667 81,882,043 11,871,849

Warrants, with expiry dates

ranging up until 2008 and

exercise prices ranging

from $0.70 to $3.30 5,793,918 5,793,918 Nil

Agent's warrants, exercisable

until January 15, 2006 at $0.70 687,000 687,000 Nil

Stock options, with expiry dates

ranging up until February 2009

and exercise prices ranging

from $0.70 to $3.49 4,007,888 4,007,888 Nil

Transactions with Related Parties

All transactions with related parties have occurred in the normal course

of operations and are measured at the exchange amount, which is the amount of

consideration established and agreed to by the related parties. During the

eight month period ended June 30, 2004, Medoro Resources paid the following

amounts to related parties: (i) consulting fees of $23,888 and rent of $4,000

(2003 - Nil) to a company in which a director of the Company is an officer;

and (ii) consulting fees of $196,289 were paid (2003 - Nil) to Next com Italia

srl, a company in which the President of Sardinia Gold is managing director.

Off-Balance Sheet Arrangements

Medoro Resources has no off-balance sheet arrangements that have, or are

reasonably likely to have, a current or future effect on the results of

operations or financial condition of the company including, without

limitation, such considerations as liquidity and capital resources.

Changes in Accounting Policies Including Initial Adoption

Medoro Resources' unaudited interim financial statements are prepared in

accordance with Canadian generally accepted accounting principles ("GAAP").

They do not include all of the information and disclosures required by

Canadian GAAP for annual financial statements. In the opinion of management,

all adjustments considered necessary for fair presentation have been included

in these financial statements.

Additional information relating to the company is available on SEDAR at

www.sedar.com.

For further information: Peter Volk, Assistant Secretary,

1 (416) 603-4653, info(at)medororesources.com

(MRL.)

END

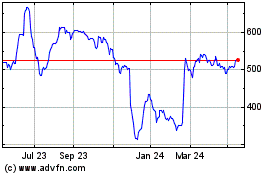

Marlowe (LSE:MRL)

Historical Stock Chart

From Sep 2024 to Oct 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Oct 2023 to Oct 2024